Qld sets demand record again…and again…and again

New peaks, great peaks, three peaks, late peaks. Valentine’s Day saw the Queensland electricity sector hit record limits for the third day in a row. We take a look at a remarkable week.

Not one, but three peak demand records were broken in Queensland mid-February during the extreme hot spell that swept the state virtually unbroken for days. The highest demand recorded was 9796MW on Wednesday 14 February – well above the 2017 record of 9412MW.

Source: Powerlink Queensland

Brisbane sweltered, with temperatures barely dropping below 30 degrees the entire day, and unsurprisingly, demand on the grid increased as homes and businesses turned to their air-conditioning to stay cool.

While records were broken, the other interesting feature is the times that the peaks were reached – with Powerlink records showing that the peak on 12 February hit at 7:30pm and those on 13 and 14 of February were reached at 5:00pm.

As though extreme heat wasn’t in itself testing, the weather provided more challenges, as storms moving across the south east caused damage to the distribution network.

Sustained periods of heat in an Australian summer are expected– but the science tells us that extreme weather is becoming more prevalent. So are reports of the death of peak demand grossly exaggerated?

Demanding times

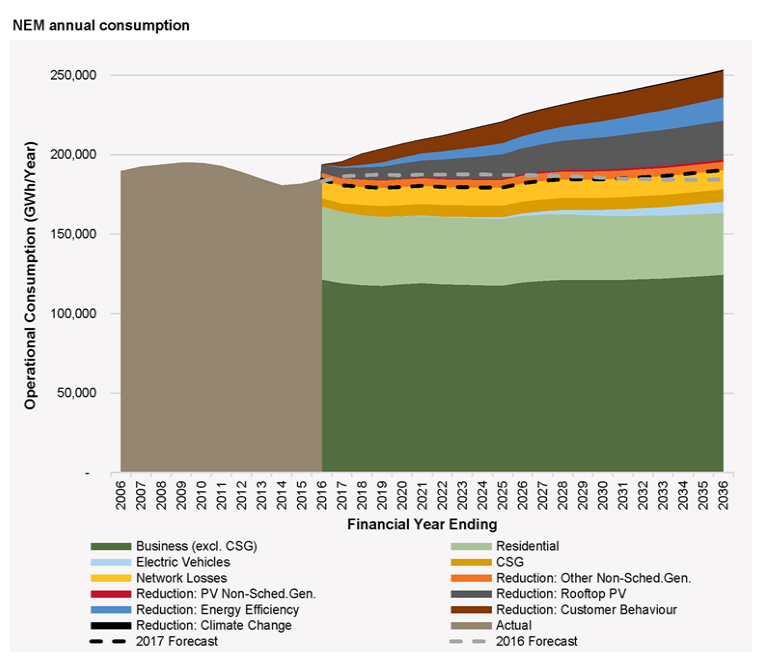

It is widely recognised that the relationship between economic growth and energy consumption has significantly changed in the past 10 years. AEMO’s 2017 Electricity Forecasting Insights suggests that

Consumption met by grid-supplied electricity is forecast to remain flat for the next 20 years, despite projected 30% growth in population and assumed average growth in the Australian economy.[1]

AEMO suggests that initially forecast consumption is flat as uptake of rooftop PV and energy efficiency measures offset growth from forecast increases in population and economic activity. However from the mid-2020s, consumption growth is projected to resume, as growth drivers are complemented by consumption from the projected increase in electric vehicles (EVs), and growth in rooftop PV slows down.[2]

Source: AEMO, Annual Consumption Overview

AEMO predicts that in Queensland, consumption is projected to grow 9.0% in the 20-year forecast period, from 50,484 GWh in 2016–17 to 55,004 GWh in 2036–37. Coal Seam Gas (CSG) production growth is a strong driver behind consumption growth and is expected to counter the reduction in demand from aluminium smelting consumption in Queensland.[3]

While annual operational electricity consumption is forecast to remain flat, peak demand remains difficult to forecast and ‘patchy’ between jurisdictions and grid locations over time. It also continues to be a significant pressure on future network capacity requirements.

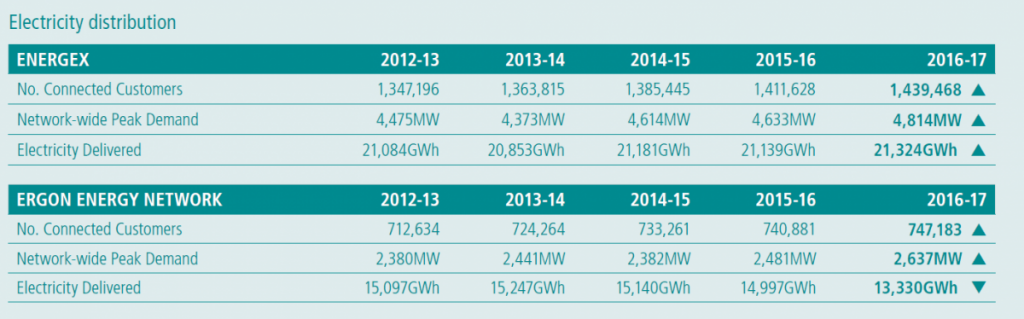

Energy Queensland’s most recent Annual Report confirms that with sustained warmer temperatures across Queensland over the summer, networks experienced record peaks in demand.[4]

Demand in the South East on Energex’s network hit an all-time high of 4,814MW in January 2017. This was followed in regional Queensland by a record system-wide peak on Ergon Energy’s network of 2,637MW in February. The highest peak in demand to occur across the two distribution networks simultaneously reached 7,145MW at 5.50pm on 12 February 2017.

Source: Energy Queensland Annual Report – Performance Review 2016-17,

What is notable about peak events across Australia in 2017 and 2018 is that many of the demand peaks occurred on the weekend. Households using air conditioners to escape the heat is a big factor.

Seventy-six per cent of homes in South East Queensland now have air conditioning compared with forty five percent in 2004. AEMO confirmed that Victoria recently experienced its highest operational demand for a Sunday ever, recording 9,144 MW of demand at 7:30 PM AEDT, and unlike typical peak days during the week, demand was particularly strong from households, rather than spread across commercial and industrial areas. Because of the prolonged, intense heat, residential customers were using air-conditioners for longer periods of time, putting localised pressure on electricity networks.

It’s warm

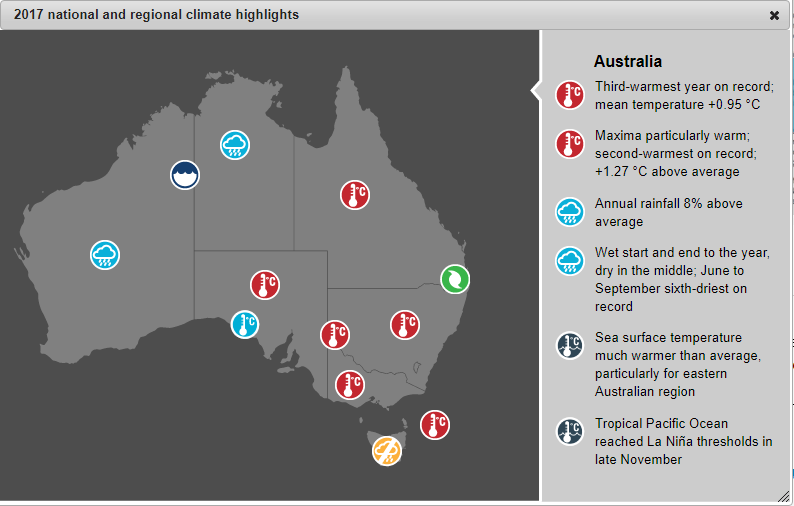

The Australian Bureau of Meteorology’s 2017 Annual Climate Statement shows that last year was Australia’s third-warmest on record, with the annual mean temperature 0.95 °C above average.

Source: Australian Bureau of Meteorology 2017 Annual Climate Statement

Maximum and minimum temperatures were warmer than average; particularly maxima, which were the second-warmest on record (1.27 °C above average). March, July, August, October, and December were amongst the ten warmest on record. However it’s not just the heat that’s rising. Winter nights were cooler than average for the southern mainland.

2017 was not an anomaly. If we consider the Bureau’s 2016 annual report, we see that year too being one of extreme weather events. 2016 was our fourth warmest year on record, 0.87 °C higher than average. Annual rainfall was 17 per cent above average, but regional outcomes were variable.

Smart responses

With the heat, comes increased demand and networks carefully consider how to respond.

Energy Queensland businesses – Ergon Energy and Energex – carried out comprehensive summer preparation activities in the lead-up to the 2017-2018 season which included upgrading and uprating “at risk” and aging network assets, testing response capabilities and reviewing emergency management plans.

While the electricity delivered across South East Queensland for 2016-17 increased with the summer conditions, the uptake of solar energy systems helped to suppress energy growth – one in every three detached houses in the South East now has solar. This lowers demand during the day, however, without battery storage, the peak shifts to later in the day in residential areas.

New technology and smart services to help us “beat the peak” are critical and analysis for the Electricity Network Transformation Roadmap highlights the benefits of tariff reform and DER orchestration to avoid network expenditure.

AEMO identifies that consumers will become more active in controlling their energy use, both with energy efficiency and ‘behind the meter’ generation – supported by projected falling costs for PV systems, battery storage, and energy-efficient appliances. Opportunities exist for the energy sector to support customer choice through more targeted products and services and in managing energy use.

Consistent with this, over summer 2017-2108 Energy Queensland, prepared a range of contingencies to manage the network during peak demand, including:

- Off-peak tariff switching (for example electric hot water systems, pool pumps, and other appliances such as air conditioning);

- PeakSmart air-conditioning signalling;

- Public energy efficiency messaging through traditional news and social media.

Ergon’s response to peak demand included off-peak tariff switching of hot water, pool pumps, and air-conditioners. Approximately 70MW of controlled load was removed from the network and gradually restored as the network load reduced through the early evening at specified time intervals (4pm to 8pm).

Energex network customers owning PeakSmart air conditioners were signalled to cap their energy use at 50-75 per cent at specified times over the five day heatwave, alleviating approximately 15MW of daily demand. Consumers would have noticed little to no impact as air-conditioners continued to cycle and cool but at a reduced capacity due to the PeakSmart signal.

Yurika’s Virtual Power Plant also formed part of the peak demand response. When demand spiked for air-conditioners, the plant drew 44 megawatts from a supplier in the south-east corner to help meet record peak demand.

The Virtual Power Plant helps take pressure off the network and can also reduce the volatility of wholesale prices in the National Electricity Market – a major driver of power prices.

Smart investments for the future

While many network requirements are driven by ‘non-coincident’, localised demand, peak events in 2017 and 2018 indicate that electricity networks experienced significant demand pressures. This requires smart future investments.

AEMO’s analysis suggests that forecast growth in maximum demand in the medium to longer term may require investments in generation, network, or demand-side solutions to ensure reliability and security of supply. Uncertainty across these scenarios pose investment challenges.

They highlight that the transition the energy sector is experiencing represents,

“…an important opportunity for new market and regulatory arrangements, improved system planning, and new market, network, and non-network solutions, to support an orderly transition and deliver consumers secure, reliable, and affordable energy to meet their demand.”[5]

Arguably, Australia’s regulatory policy is yet to fully realise the benefits of the innovation undertaken by network businesses and third parties that is valued by customers.

There is still work to do to ensure customers can make the most of the opportunities to integrate new technologies that could improve the quality and reliability of electricity network services, and allow better responsiveness to customer choice in technology and service.

[1] AEMO, Electricity Forecasting Insights for the National Electricity Market, June 2017, p 3.

[4] Energy Queensland Annual Report – Performance Review 2016-17, Sep 2017, p 21.

[5] AEMO, Electricity Forecasting Insights for the National Electricity Market, June 2017, p 3.