Brits are on board – should we go to RIIO two?

For almost 40 years, the UK energy framework has been a bell weather for policy-makers and regulators around the world. UK regulator Ofgem recently commenced a review of its RIIO (Revenue = Incentives + Innovation + Output) regulatory framework. What might this mean for the Australian landscape?

Since its original privatisation phase and reforms going back 40 years, the UK energy framework has traditionally been a bell weather for policy-makers and regulators around the world.

The UK energy regulator – the Office of Gas and Electricity Markets (Ofgem) recently commenced a review of its RIIO (Revenue = Incentives + Innovation + Output) regulatory framework, which has been in use since 2013.

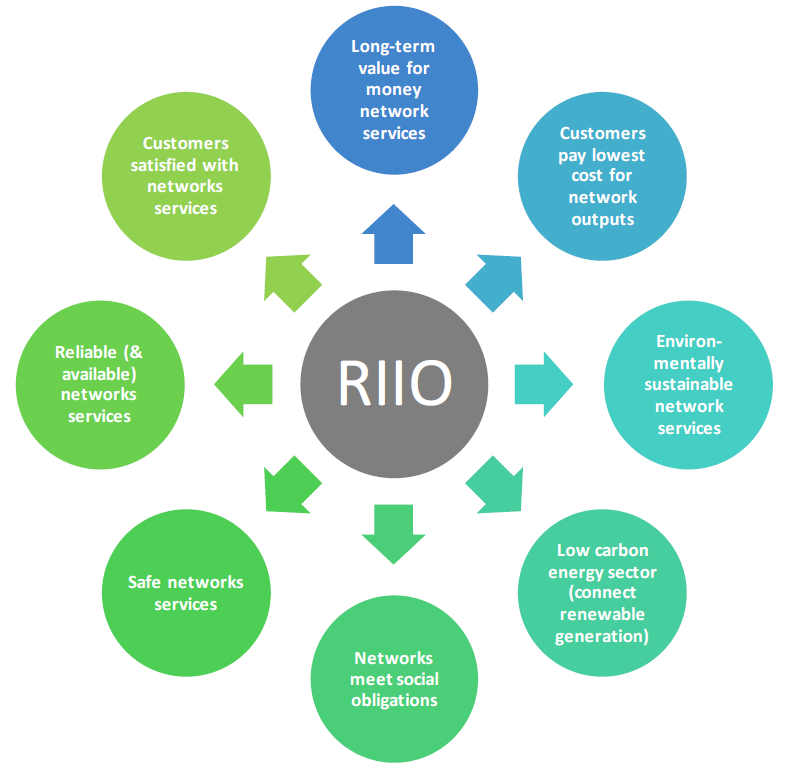

Figure 1 Illustration of the RIIO framework’s intended impacts[i]

Ofgem is of the view that overall, the RIIO framework has worked well and is still appropriate for the next round of energy price controls, although some evolution in order to meet the challenges that lie ahead is needed. Ofgem is on the lookout for opportunities to further enhance elements of the framework based on what it has learned from RIIO-1. Recognising the important role of public legitimacy underpinning sustainable regulatory frameworks, Ofgem has also been investing heavily in community engagement and utilising new platforms, such as social media, to communicate with the community.

An independent evaluation of RIIO-1 concluded that networks have become more reliable and customer satisfaction has improved.[ii] The Innovation Stimulus Package has been successful in embedding change and innovation within the operations of networks.

Although networks’ performance has been higher than expected, Ofgem is concerned that network firms benefited from wider economic conditions and forecast errors, rather than from efficiencies over the course of the price control. Dermot Nolan, Ofgem’s CEO, has publicly warned that RIIO-2 “will be a tougher price control for network companies”.[iii]

Length of the price control period

Ofgem has proposed to reduce the price control period from eight years to five. There will be flexibility to set some allowances for a longer period if this could deliver customer benefits.

Ofgem considers that the scale and pace of change in the energy sector makes it challenging to forecast costs over a longer timeframe. A shorter period means that Ofgem will be able to address issues arising from forecast errors or changes in economic conditions sooner.

The alternative is an eight-year price control with a more extensive mid-period review. It is no surprise that of the two options, networks generally prefer a shorter five-year period.[iv] The prospect of reopening the regulatory settlement is harmful to the regulatory certainty and stability valued by investors. Indeed, Ofgem recently confirmed that despite concerns about network outperformance during the 2015-2023 electricity price control, opening a mid-year review would be too risky. Instead, reliance on the efficiency incentives and other mechanisms is preferable.[v]

Driving innovation and efficiency

RIIO-2 will be more focused on driving competition. Ofgem is to apply a set of criteria to identify projects suitable for competition to all network sectors (this currently applies only to electricity transmission). An expenditure threshold for these projects is set at £100m.[vi] This is comparable to Australia’s Regulatory Investment Test; a cost-benefit economic test requiring networks to engage with market providers to identify non-network options as alternatives to traditional network investments.

The Network Innovation Competition and Network Innovation Allowance will continue to apply. Ofgem has emphasised the need to dedicate innovation funding towards critical issues associated with the energy transition. Projects related to system operability, whole system co-ordination and decarbonisation, for example. It has also proposed to coordinate with other public sector innovation schemes and enable increased third party engagement for effective, collaborative outcomes.[vii]

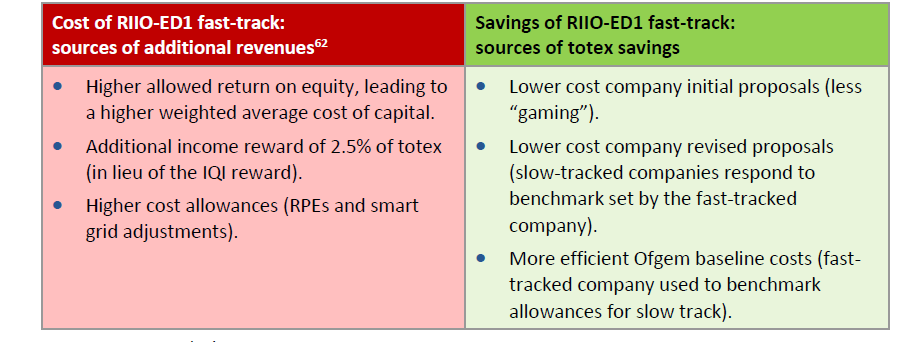

Ofgem is also seeking to promote competition between network companies by using fast-tracking and comparative benchmarking. Fast-tracking processes was one regulatory innovation under the RIIO framework. It is designed to encourage firms to submit well-justified proposals that do not include inflated forecast costs. It effectively promotes a competitive dynamic between networks to submit the best business plan for its customers.

Under RIIO–1, fast-tracked companies received a direct financial reward of 2.5 per cent of total expenditure allowance, higher incentive rates, and further benefits. Ofgem‘s estimation put the financial benefits of fast-tracking at around £250m. The actual benefits were closer to £510m.[viii]

There is talk of not including fast-tracking in RIIO-2 and substituting it with alternative measures, but Ofgem has not yet made a decision. At this stage, Ofgem considers that the benefits, such as the information gained through fast-tracking, on balance, probably outweigh the costs.[ix]

Figure 2 Sources of totex savings and additional revenues that may be attributed to fast-track[x]

Giving consumers a stronger voice

While Ofgem considers that RIIO-1 was successful in improving networks’ engagement with stakeholders, it has proposed new models for enhanced stakeholder engagement in electricity transmission and distribution.

Going forward, networks will be required to set up a Customer Engagement Group (a User Group in transmission) to ensure that it is the customers priorities driving energy networks’ business plans. This group will scrutinise different elements of the network’s proposals, with the exception of topics that relate to the rate of return and financeability.

Ofgem will also set up an independently-chaired RIIO-2 “Challenge Group”. This group will assess companies’ proposals and reports provided by the Customer Engagement Group and report back to Ofgem on its findings. Open hearings will follow to resolve areas of contention identified during the process.

Elements of these approaches already exist in Australia.

For example, the Australian Energy Regulator’s (AER) Consumer Challenge Panel assists the AER in making better regulatory decisions by bringing in input on issues of importance to consumers in each regulatory determination.

The AER, Energy Networks Australia and Energy Consumers Australia recently launched a joint initiative to explore ways to improve sector engagement – the “New Reg” project. The project will run a ‘live’ public engagement process in parallel with a ‘live’ trial’ by AusNet Services, an electricity distribution business in Victoria. The trial involves AusNet Services negotiating its regulatory proposal with a Customer Forum that has been established to represent the perspectives of AusNet Services’ customers.

This process will enable stakeholders to assess the effectiveness of the new approach that aims to deliver network revenue proposals where consumer preferences drive network decision-making about investment and operations. Results will inform discussions about possible future changes to the National Electricity Rules.

This highlights that where once Australia was almost solely an ‘importer’ of regulatory designs and innovation, that dynamic may be changing. Over-time, there may be greater opportunities for both UK and Australian policy makers, regulators, consumers and network to identify useful lessons about what does and does not work.

[i] CEPA, Review of the RIIO Framework and RIIO-1 Performance, Report for Ofgem, March 2018, p.16.

[ii] Ibid. p.21.

[iii] Addleshaw Goddard website: https://www.addleshawgoddard.com/en/insights/insights-briefings/2018/energy/riio-2-framework-published/

[iv] Ofgem, RIIO-2 Framework Consultation, March 2018, p.28.

[v] Ofgem website: https://www.ofgem.gov.uk/publications-and-updates/ofgem-welcomes-western-power-distribution-s-contribution-consumers

[vi] Ofgem, RIIO-2 Framework Consultation, March 2018, p.55.

[vii] Ibid. p.49-49.

[viii] Ibid. p.69.

[ix] Ibid. p.69-70.

[x] CEPA, Review of the RIIO Framework and RIIO-1 Performance, Report for Ofgem, March 2018, p.63.