Natural gas, available, accessible and affordable

A few weeks ago, 12,000 global gas leaders met in Washington DC for the World Gas Conference and we were there. This week we look at the role of gas from a North American perspective and how it compares with Australia’s gas outlook. What lessons can we learn and how do we make the most of our abundant natural resources?

On 27 June this year, the COAG Energy Council released a report[1] addressing frequently asked questions about the supply of natural gas. On the other side of the planet, gas experts were discussing the future of gas and maximising its potential. While the meeting and the COAG report address a lot of common issues such as unconventional gas, the major difference between the North American and Australian perspectives is price and availability.

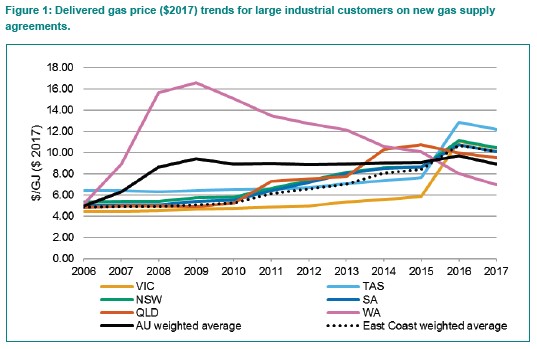

The COAG report doesn’t mention gas price, but the increase in the wholesale Australian gas price is a major concern to gas consumers in Australia. East coast wholesale gas prices have been rising since the beginning of this decade in Queensland, but rapidly in New South Wales and Victoria in the last couple of years. It appears, for now, that prices have peaked and are expected to be $8 to $10/ per gigajoule (GJ) for the time being. Australia’s west coast tells a different story with gas prices steadily declining since 2009 to around $7/ GJ.

Source: Oakley Greenwood (2018), Gas price trends review – 2017

In Australia, there have been concerns about gas availability, so governments agreed to intervene in the market if required. Fortunately, gas suppliers have been able to improve gas supply to reduce the risk of gas shortages for domestic use.

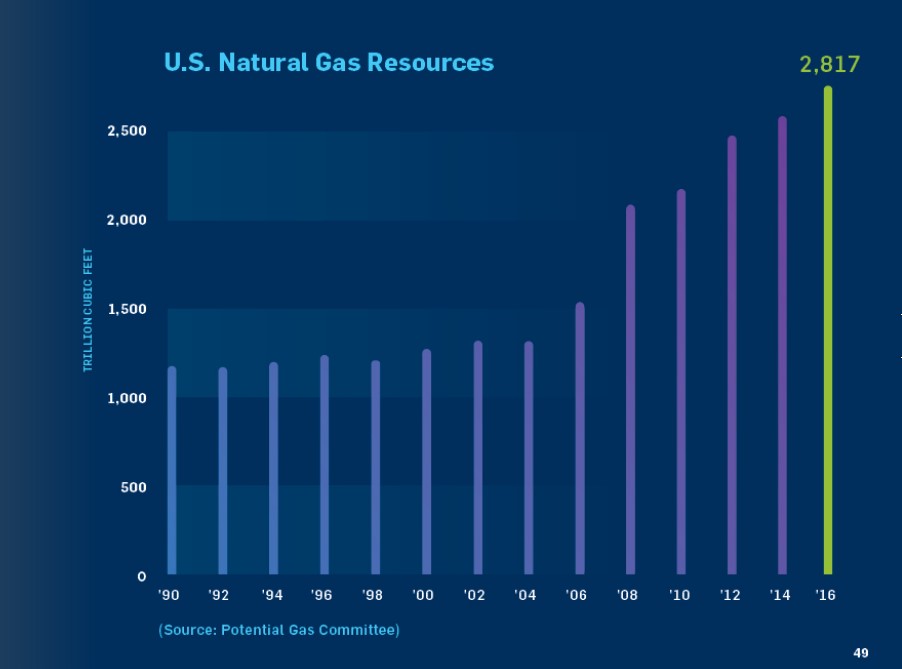

The US gas outlook is starkly different and this was a common message at the World Gas Conference. Since the commercial development of shale gas, the US has been able to produce vast volumes of gas at low cost. The potential natural gas resource in the US has doubled between 1990 and 2016. It is currently estimated that the US has enough recoverable gas to meet America’s requirements for 100 years. Some speakers indicated that this could be as much as 300 to 600 years.

Source: American Gas Association (2018), AGA Playbook, https://www.aga.org/news/aga-playbook/

Moreover, the US has been the largest producer of natural gas since 2011 and produced 20 per cent of the world’s gas in 2017[2]. Australia produced 3.1 per cent of the world’s gas in 2017 and that is growing.

This US gas has become available through innovation such as hydraulic fracturing and extending the length of horizontal drilling. Cost for drilling wells through these technologies has greatly reduced and further cost reductions are possible by extending the length of horizontal drilling further. Effective use of resources is also a key factor in reducing costs. One of the case studies described at the conference included drilling engineers being located in a centralised drilling data centre instead of out in the field. Instead of each well requiring a group of drilling engineers, the data centre was able to manage 10 wells being drilled using 24 engineers rather than 70. Innovation such as this has driven down costs of US gas to levels of around $US3/ one million British thermal untils (Mmbtu[3]).

This equates to about AUD $3.84/GJ. So the price of gas in the US is between one third to half the wholesale price in Australia. With that in mind, it is clear that gas can be affordable if the policy settings are right.Similarly, gas exports through LNG in Australia have largely become available through innovation. Producing gas from coal seams in Queensland to drive exports has required significant innovation.

So what is next for the US?

This resource is widely spread across the US making it accessible. The expectation is that gas prices will be maintained for at least the next five years The US is also expanding its export of LNG to take advantage of its abundance of natural gas. Before the shale gas revolution in Louisiana industry moved offshore due to high costs of energy. In the last few years, industry has returned onshore responding to low gas prices and long term supply.

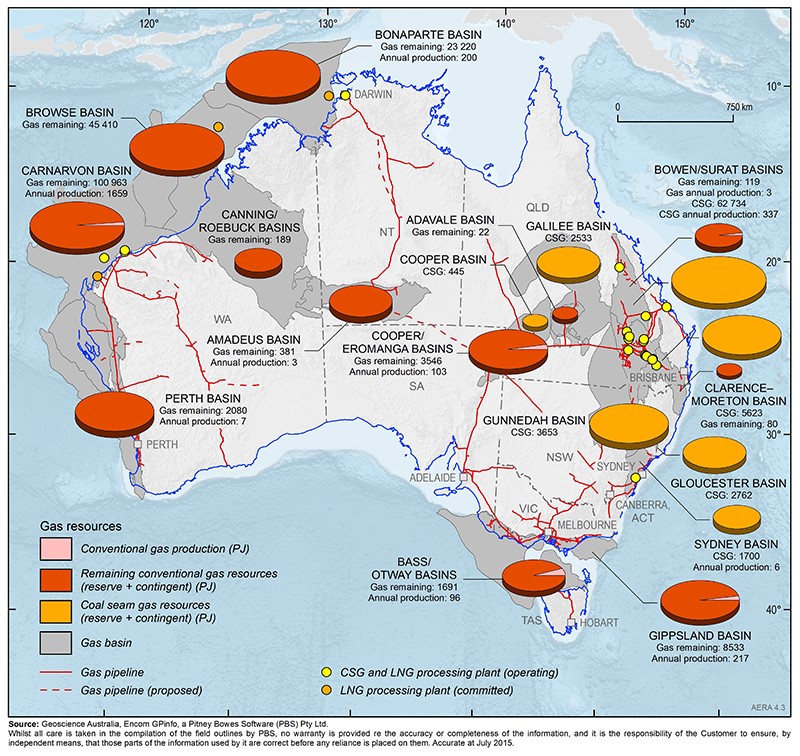

Natural gas in Australia is also wide spread and there are vast amounts of resources that could be developed. It is s also supported by a system of transmission pipelines connecting many of these basins to the major consumer markets, including exports.

Source: COAG (2018), Gas Supply Strategy Collaborative Action 7

However, this resource development needs to occur within a global market where the US is supplying cheap gas and countries in Asia and Africa are becoming larger importers of gas. Developing these gas resources would allow Australia to continue being a leader in LNG exports, while also using the gas to support domestic industries.

In terms of policy and any future editions of the FAQ report by COAG, an obvious question is “how do we reduce the cost of gas production in Australia?”

The author would like to acknowledge the Australian Gas Industry Trust for financial support to attend World Gas Conference 2018.

[1] COAG (2018), Gas Supply Strategy – Collaborative Action 7 – Frequently Asked Questions.

[2] BP – Statistical Review of World Energy 2018 (Natural gas), https://www.bp.com/content/dam/bp/en/corporate/pdf/energy-economics/statistical-review/bp-stats-review-2018-natural-gas.pdf

[3] The conversion assumes that 1AUD equals 0.74 $US and that 1 Mmbtu equals 1.055 GJ.