SA interconnector could be delivered 18 months after approvals

A key feature of discussions leading up to last weeks’ COAG Energy Council meeting was the need to strengthen the reliability and security of the energy system and ensure investment in National Electricity Market interconnection is responsive to a rapidly changing energy environment. It is clear that electricity transmission businesses have a pivotal role to play in connecting customers with renewables and delivering a cleaner energy future.

At the COAG meeting on Friday, Federal, State and Territory Energy Ministers noted the important role interconnectors play in a transitioning energy sector[1] and agreed to review the regulatory test for investment in new transmission assets (RIT-T) to ensure it is effective in the current environment. The COAG Energy Council instructed the Australian Energy Regulator and Australian Energy Market Operator to act in this regard and report back to Council by December.[2]

In its June 2016 South Australian Transmission Annual Planning Report, ElectraNet stated its intension to commence a RIT-T consultation in September 2016, with the process to consider a range of potential interconnector options to either New South Wales or Victoria, and also seek alternative solutions that might deliver similar market benefits. The options would be subject to extensive consultation with electricity consumers and industry stakeholders.[3]

Of course, there are potentially a range of options for ensuring the three fundamentals of the electricity market – reliability, affordability and sustainability. The regulatory investment test is intended to ensure that transmission investment is efficient, that networks charges are no higher than necessary, and that non-network solutions, including generation, are not crowded out. Each energy solution needs to be assessed on its merits, and the COAG Energy Council decision last Friday could help to ensure the regulatory test for new transmission assets is timely and effective in the current market environment.

One of the options TransGrid and ElectraNet have proposed is the construction of an interconnector between New South Wales (NSW) and South Australia – an option involving a 275kV single circuit transmission line between Buronga in south west NSW and Robertson in South Australia, with the project to provide for two-way power flows between the states.[4] The new interconnector has been proposed in consideration of the three fundamentals of the electricity market – reliability, affordability and sustainability, which are increasingly at risk in South Australia.

Prior to the COAG Energy Council meeting, Paul Italiano, Chief Executive Officer of TransGrid said the new interconnector could be up and running within 18 months depending on the pace of regulatory, planning and environmental approval processes.[5]

Early analysis detailed in a PwC report prepared for TransGrid, Electricity market issues in South Australia: Analysis of an interconnector between New South Wales and South Australia, assessed wholesale electricity prices, price volatility and the incidence of price spikes, along with whether there was potential future capacity in the NSW generation market to facilitate an interconnector to South Australia, and the economic impacts of constructing the proposed interconnector.

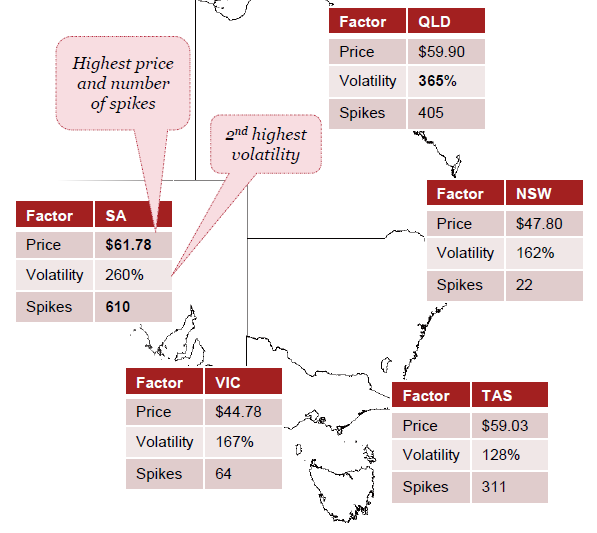

In terms of pricing, PwC observed that South Australia and Queensland are experiencing challenges in the three areas of price, volatility and spikes. Figure 1[6] below details the outcome of PwC’s pricing analysis for the period January 2013 to August 2016.

Figure 1

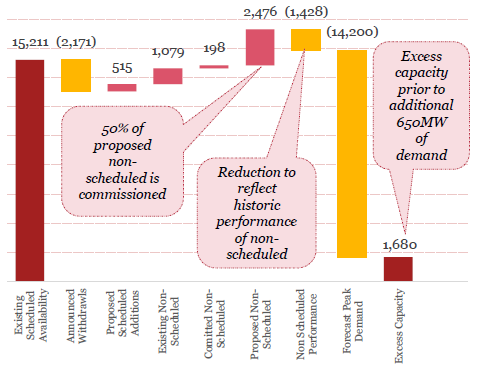

PwC also concluded[7], as demonstrated in Figure 2 below, that NSW has excess generation capacity that will support the additional 650MW demand of the proposed South Australian interconnector until at least 2022.

Figure 2: NSW excess capacity post 2021 (MW)

PwC indicates that an interconnector between NSW and SA could provide benefits to electricity customers including an annual reduction in electricity costs of $106 for an average home in South Australia.[8]

“The provision of excess capacity in New South Wales, a region with low volatility and the lowest number of price spikes historically, to South Australia, a region with high volatility and the highest level of price spikes historically, could be an efficient mechanism for neutralising negative market characteristics such as higher prices.”[9]

PwC also examined the immediate and shorter term economic impacts of constructing the proposed interconnector and concluded:

“…we estimate the additional investment in the network will lead to SA’s Gross State Product (‘GSP’) being at least $190 million higher and Australia’s Gross Domestic Product (‘GDP’) to be at least $310 million higher(in present value terms over a ten year period).”[10]

Noting that they expect the actual impact on the electricity market, South Australia and Australia more broadly to be significantly higher than these initial estimates, PwC recommends further analysis of economic benefits.

In its contribution to the discussion, TransGrid suggests that a NSW-SA interconnector will:

“help deliver affordable, reliable electricity to consumers as well as facilitate the development of [a] renewable energy corridor along the route we’ve identified. New transmission infrastructure in south-west NSW will encourage development in this prime region for renewable resources.”[11]

Preceding the COAG meeting and the PwC report, ElectraNet’s pre-feasibility work also showed that a new interconnector between South Australia and either New South Wales or Victoria may be economically and technically feasible.

Internationally, options for greater interconnection are being assessed to take advantage of price differentials between markets and help manage intermittent supply from renewables and facilitate the growth of renewable energy.

The European Council has adopted an objective to see all member states meet the target of achieving interconnection of at least 10 % of their installed electricity production capacity.

In its Low carbon network infrastructure report[12], the UK House of Commons Energy and Climate Change Select Committee sets out the need for energy networks, governments and regulators to work together to deliver aggressive carbon reduction targets, and the need for agile and flexible energy policy reforms in a period of significant technological change. It also indicated its support for “anticipatory investment”, where the existing network is reinforced in advance of expected connection requests, given it is likely to improve networks’ speed at connecting distributed generation.

The Committee recognised the need for anticipatory investment to be based on robust, up to date modelling to maximise future efficient utilisation of the investment.

In Australia, the RIT-T assessment process needs to allow deeper consideration of renewable energy opportunities, power system security and wider economic benefits. Greater interconnection in the NEM can improve wholesale market competition, and allow access to lower cost generation at times of high demand and customers to connect with new technology and cleaner sources of generation, while benefiting from the back-up provided by a reliable grid.

A co-operative approach by industry and key Australian energy institutions and policy makers is a priority for establishing best-practice thinking on economic assessment of new energy interconnectors.

[1] COAG Energy Council, 19 August 2016, Meeting Communique, p. 2

[2] https://twitter.com/tkoutsantonismp/status/766475065521086464?refsrc=email&s=11 and COAG Energy Council, 19 August 2016, Meeting Communique, p. 2

[3] ElectraNet, June 2016, South Australian Transmission Annual Planning Report, p. 24

[4] PricewaterhouseCoopers, August 2016, Electricity market issues in South Australia: Analysis of an interconnector between New South Wales and South Australia, p. 4

[5] TransGrid, https://www.transgrid.com.au/news-views/news/2016/Pages/SA-NSW-Interconnector-the-missing-link-for-power-grid.aspx

[6] PricewaterhouseCoopers, p. 13

[7] PricewaterhouseCoopers, p. 17

[8] PricewaterhouseCoopers, p. 18

[9] PricewaterhouseCoopers, p. 18

[10] PricewaterhouseCoopers, p. 6

[11] TransGrid, https://www.transgrid.com.au/news-views/news/2016/Pages/SA-NSW-Interconnector-the-missing-link-for-power-grid.aspx

[12] House of Commons, Energy and Climate Change Committee Low carbon network infrastructure: First report of session 2016-17, 17 June 2016, p. 12