The value of cost reflective pricing in a disrupted energy sector

The transformation of Australia’s electricity sector will require pricing that rewards smarter energy use and new technologies. Will recent Australian Energy Regulator decisions enable progress on electricity tariffs which are fairer and more efficient?

Progressing consensus

Pricing reform has been easy to agree on in principle but hard to progress in practice.

The COAG Energy Council in 2014 saw tariff reform as the essential next step in a process of providing better price signals to consumers[1]. The AEMC’s Approach Paper on the Electricity Network Regulatory Framework Review noted that cost-reflective network tariffs can result in significant savings for consumers and creates an essential foundation for future reforms.

The Electricity Network Transformation Roadmap found better pricing and incentives were essential for a ‘co-optimised’ energy system that avoids duplicative investments. It could help to reduce average network costs by 30% below 2016 levels by 2050 and contribute to total system savings of over $100 billion by 2050. AGL’s recent report on Australia’s Economic Transformation noted that moving towards more cost-reflective pricing, particularly for networks, will improve energy productivity and ensure that all customers contribute equally to the provision of shared energy services.

Despite the value of reform to customers, the potential benefits are yet to be realised. While most networks now offer small customers cost-reflective network tariffs with robust methodologies, there are a range of barriers from metering, to industry structure, to behavioural preferences which severely limit customer take-up. These are well documented in the 2016 publication, the Electricity Network Tariff Reform Handbook.

This month, the Australian Energy Regulator (AER) fired a warning shot on the need for reform. Its recent decisions on Tariff Structure Statements indicate positive impacts won’t be achieved just by offering tariffs, without a more proactive strategy to migrate small customers to these tariffs. The AER recognises that more work needs to be done:

“it is vital that we see a substantial effort to accelerate the pace of network tariff reform in the next tariff structure statement period for all distributors.”

Many electricity distribution businesses already have some form of cost-reflective tariff available for small customers but these tariffs are usually only applied if a customer ‘opts in’ and assigned by the retailer. In Victoria, a State Government Order in Council was introduced last year preventing the assignment of customers to the cost reflective prices which COAG Energy Council has advocated, even where the customer retained the opportunity to ‘opt out’ to current tariff structures.

Under Opt In frameworks, the level of take-up by customers, reliant on enabling meters and subject to jurisdictional regulation, has been virtually non-existent.

The lack of take-up of more cost reflective tariffs is to the disadvantage of the community given evidence that suggests more cost reflectivity benefits customers over the medium to long term. In 2014, the AEMC estimated that 70-80% of all customers will have lower network charges as a result of cost-reflective network pricing, over the medium term[2]. AGL concluded that vulnerable customers are in fact more likely than other customers to benefit from cost reflective pricing once demand response is accounted for[3].

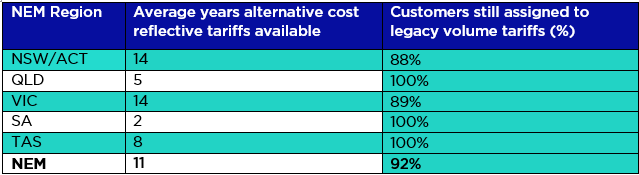

The result of the current arrangements are that virtually all residential customers continue to be assigned to network tariffs that all stakeholders agree are inefficient, even though the option to migrate customers to more cost reflective tariffs has been available for years. Unless more direct action is undertaken, most residential customers are likely to be assigned to legacy tariffs for many years to come.

The impact of doing nothing

This lack of signal in the network tariff may partly explain why customers remain dissatisfied with the value for money proposition offered by energy services. Research undertaken by Energy Consumers Australia suggests that while there is broad satisfaction with the reliability of the service delivered, current pricing structures are masking cross-subsidies and adding unnecessarily to network costs. In its submission to the Finkel Review, Energy Consumers Australia noted:

“Consumers are increasingly becoming interactive participants in the energy market and are investing in technology to generate, store and ultimately trade electricity to manage their consumption and bills….While this disruption is very real, the defining experience for most residential and small business consumers in the energy market over the last decade has not been about technology or advances in service. The retail products in the market are mainly differentiated by discounts and payment options… Consumers continue to be charged for their electricity on a shared-use basis, masking cross-subsidies and in the long-term adding unnecessarily to the size of the electricity network…. What has changed is the price consumers are paying.”

Breaking the stalemate – a new approach to tariff assignment

It was also significant that Federal Minister for Environment and Energy, Josh Frydenberg, told a recent consumer forum that Australian Governments:

“…need to ensure the market settings provide consumers with the right price signals and allow consumers choice… and collaboration will be critical if we are to remove barriers to consumer access to data and achieve effective roll‑out of cost‑reflective pricing. Industry should be able to address these issues without the heavy hand of government coming into play.”[4]

The only examples of successful assignment of customers to cost reflective tariffs have occurred where the network has made a mandatory assignment of the customer to the tariff, rather than relying on the customer to opt-in through the retailer. ActewAGL recently observed that an opt-in tariff assignment framework for time of use pricing resulted in only 30 customers being assigned to the tariff. However, when ActewAGL introduced mandatory assignment with opt out for time of use tariffs to new customers, the number of customers who chose to opt out had been negligible[5].

The AER has put out the challenge to overcome the inactivity in pricing reform:

“The Network Pricing Objective states that the tariffs a distributor charges should reflect the distributor’s efficient costs of providing its direct control services to the retail customer.[6] … Our view is the price signals faced by the retailer should be cost reflective in order to meet this objective….In the long run, we consider this should be facilitated by assigning all customers to cost reflective network tariffs. We consider the best method to transition to this objective is through an opt-out approach in the next round of tariff structure statements…”

The AER has effectively highlighted that Governments do not need to be intermediaries between networks and retailers.

Bundling cost-reflective services to customers is the core business of energy retailers and has been their long standing role for wholesale energy, ancillary service and retail costs. Governments do not, for instance, mandate that customers must ‘Opt In’ to the structure of a wholesale energy contract or a new billing system which allows the retailer to serve them.

As the AEMC has noted:

The role of the networks is to provide cost-reflective [network] pricing. The retailers’ role is to take wholesale costs, network charges and other potential energy services such as distributed generation or energy management systems, and package these up for consumers. In many ways, their job is to be the consumers’ agent for dealing with the rest of the system… Consumers choose between fixed and variable mortgages with different terms in the financial sector; and they choose from a range of mobile phone packages in the telecommunications sector.[7]

The lessons from the telecommunications sector show us that there is the capacity to present a menu of options, minimising layers of complexity that may paralyse customer decision making. For some customers this may include bundling new services that work with batteries and solar, for others it may be simpler product offerings that manage the price signals for them.

There are already signs of the industry taking on the challenge. Retailers like AGL, Origin and Horizon have developed innovative products which are simple for the consumer but overlay more complicated network charging mechanisms.

In its recent response to the Finkel Review, the Australian Energy Council indicated that the retail sector is ready to play its part in this future transition:

Competition is more likely to drive innovation and facilitate the deployment of energy services to consumers at the lowest possible cost. A point that is often overlooked is that cost-reflective network tariffs do not have to be passed through in full to be effective. Retail competition will drive retailers to design value propositions for customers that are easy to understand. It is too early to be definitive about the forms these may take, but they could include rebates for load control (to be used in a way that does not affect amenity, such as off peak pool pumps and air conditioner cycling) or fixed price contracts where the retailer manages the underlying risks arising from the customers’ load profile.

As Minister Frydenberg argues, effective progress on pricing reform is likely to require less heavy handed intervention by Governments. It will also need to be supported by a genuine commitment from all participants in the energy supply chain to enable customers to make informed decisions and share in the benefits of fairer and more efficient pricing.

[1] COAG Energy Council, Communique, December 2014

[2] AEMC: New rules for cost-reflective distribution network prices, News Release November 2014

[3] Paul Simshauser and David Downer, On the inequity of flat-rate electricity tariffs, AGL Applied Economic and Policy Research, Working Paper 41 http://aglblog.com.au/wp-content/uploads/No.41-On-the-inequity-of-tariffs.pdf

[4] Speech to the Energy Consumers Australia Foresighting Forum

[5] ActewAGL, Re: Issues paper—Tariff structure statement proposal, ActewAGL, Submission to AER, 28 April 2016, p.5.

[6] NER, cl. 6.18.5(a).

[7] AEMC, Ensuring the regulatory framework facilitates competitive and efficient energy markets in a time of technological change: Address at Australian Energy Week 2016, 21 June 2016, p. 4.