Energy demand – flattening the curve?

As governments implement stricter rules for everyone to self-isolate and restrict activities to essential activities in response to the COVID-19 pandemic, the home is becoming our only refuge. It is also becoming the new office, schoolroom, gym or what-ever is needed for people to stay safe and healthy.

Routines have been disrupted. For many companies, business as usual has disappeared and across the country, new trends in the use of essential resources are emerging.

In the energy industry, the priority is to ensure customers’ access to essential electricity and gas services is uninterrupted.

As people stay at home, residential energy usage through the distribution network is expected to increase and early indications show that this is occurring.

The full extent of change in demand from businesses, small to medium enterprises (SMEs) and industry, is yet to be seen. However, international experience suggests that overall demand will reduce as the cumulative growth in residential sector demand will be less than the drop in commercial demand.[i]

Given the current social distancing measures and lockdowns are expected for the next six months, it is timely to contemplate what it means for the energy system if overall demand does continue to reduce.

The impact of changing demands may impact the balance of the energy system by shifting load or exacerbate existing issues with inflexible and low demand. There may also be future ramifications from this pandemic on demand, for example if working from home policies become more common, and commercial businesses cannot to recover, it may lead to significant deviations for future energy growth forecasts by the Australian Energy Market Operator (AEMO).[ii]

Considering Minimum Demand

An area of the National Electricity Market (NEM) that may be significantly affected by COVID-19 is minimum demand.

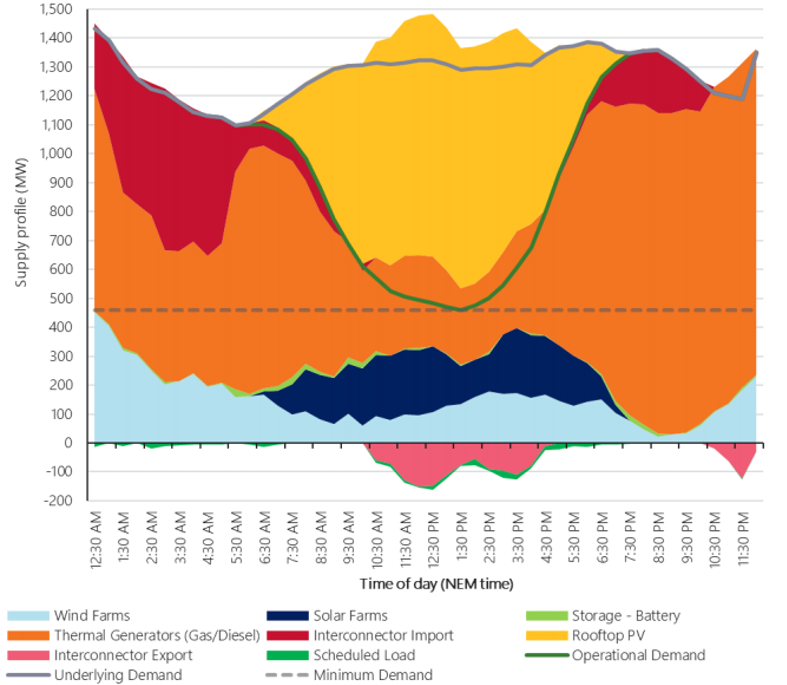

| Minimum demand is the period of time that NEM operational demand is at its lowest within a day, traditionally this has occurred overnight and has been manageable. However, parts of Australia are now experiencing severe midday minimum demand values. Seen as troughs in demand graphs, the new lows stretch through the daylight hours and are the result of rooftop solar PV output outstripping demand. |

These daytime troughs have been occurring with increasing regularity in South Australia (SA) and in Western Australia (WA). In addition, the depth of minimum demand events has been increasing.

SA experienced its latest record low demand day on 10 November 2019. Figure 1 shows what this looks like. It can be seen that uncontrolled rooftop PV generation is causing a significant reduction in operational demand and, for almost six hours of the day, rooftop PV is driving export through the interconnector.

Figure 1: Example of minimum demand occurring midday (SA, 10 November 2019) – AEMO[iii]

Seasonally low demand and this increasingly high penetration of rooftop PV, which reduces daytime operational demand, are two factors that lead to negative pricing events in the NEM.[iv]

Negative pricing events have occurred more regularly in Queensland, SA and WA and are significantly affecting market participants.[v] In addition to changing market conditions, minimum demand is leading to system security concerns.[vi]

In the next few months it will be interesting to see how shutdowns related to COVID-19 and shifting of load from business to residential areas exacerbates minimum demand. There is potential that a mild winter with no slowdown in rooftop PV installations could contribute to further minimum demand records being set leading to significant impact on the market and potentially system inertia and voltage.

Rebalancing the Energy System

There is also the possibility that the increasing demand in residential areas may help to rebalance the grid, with households acting as local solar sponges during the day in neighborhoods with high PV penetration.

Given the prevalence of people at home, and a potential new interest in electricity bills, there may be an opportunity to educate customers on demand-side participation opportunities to influence usage patterns. For example, if you have solar installed on your rooftop you may want to consider scheduling your dishwasher, washing machine and heating to occur throughout the day to take advantage of any non-peak tariffs. We’ve previously written about how changing household battery use behaviours could help stablise the grid.

When will we know?

The final impacts of COVID-19 are yet to be seen and for now, while you can keep safe at home, you may want to consider ways using local solar output at time of generation could subsidise your Netflix subscription.

As the data begins to roll in and customer habits stablise, it will be interesting to compare seasonal trends.

References

[i]Wood, E. (2020, March 24). Could COVID-19 Give Rise to the Home Microgrid? Retrieved from Microgrid Knowledge: https://microgridknowledge.com/residential-microgrids-covid19

[ii] AEMO. (2019). 2019 Electricity Statement of Opportunities – A report for the National Electricity Market. Australian Energy Market Operator Limited.

[iii] AEMO. (2019). South Australian Electricity Report. Australian Energy Market Operator Limited. Retrieved from online.

[iv] AEMO. (2019). Quarterly Energy Dynamics Q3 2019 – Market Insights and WA Market Operations. Australian Energy Market Operator. Australian Energy Market Operator Limited. Retrieved from online.

[v] AEMO. (2019). Quarterly Energy Dynamics Q4 2019. Australian Energy Market Operator Limited. Retrieved from online.

[vi] AEMO. (2019). 2019 Electricity Statement of Opportunities – A report for the National Electricity Market. Australian Energy Market Operator Limited.