Midday: the new off-peak time for electricity

Everyone’s heard of time-of-use tariffs. We write about them regularly in our Energy Insider articles. They’re intended to price services (typically utility-type or publicly funded/subsidised) to manage demand and congestion – and are therefore more expensive during high-use periods and cheaper in lower-use periods. This incentivises more efficient consumption patterns from customers.

For energy customers, this type of pricing offers significant potential benefits.

The rapid growth of household solar means far more electricity is now generated in the middle of the day and supply often exceeds demand. This is called a solar trough or the back of the ‘duck curve’. It can cause grid instability and reliability issues. In the evening, when the sun goes down but everyone gets home from work, demand spikes – again putting pressure on the grid – and wholesale prices rise so all customers are impacted by higher bills. Managing these shifting sands by simply investing more in infrastructure is one way of dealing with this, but that also results in all customers paying more.

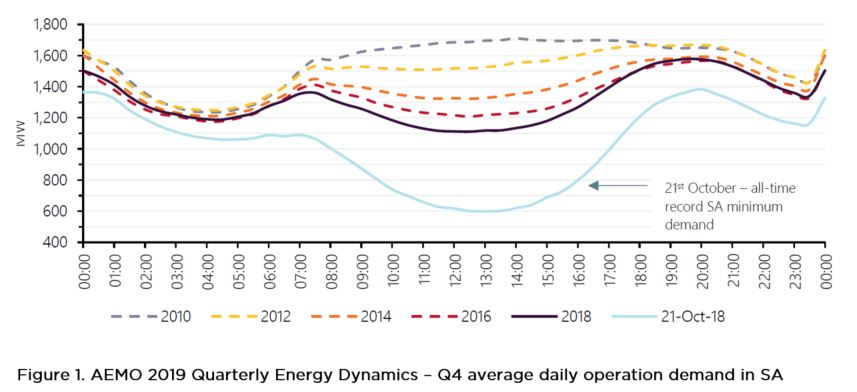

Figure 1 above illustrates the middle-day slump in demand. While this is significant, the duck curve is even more pronounced in SAPN’s residential network.

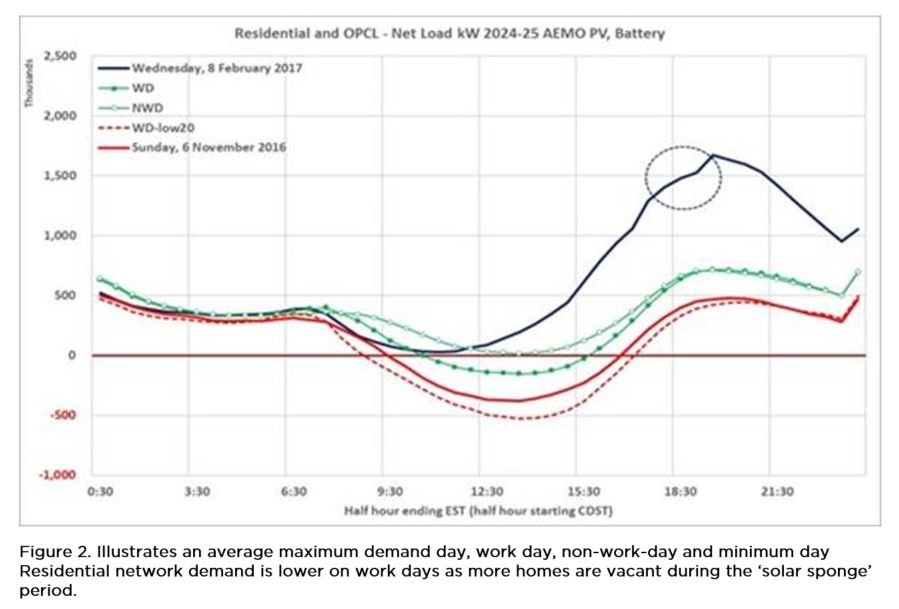

Figure 2 (below) demonstrates SAPN’s average residential load profile for 2016-2017 and predicted load for 2024-25, based on AEMO’s forecast for PV and batteries. Even without the impact of increased solar and storage, demand is well into negative territory in the middle of the day.

It makes far more sense to implement pricing signals to smooth out the ever-growing trough and peak periods, encouraging less electricity use at peak demand times and more at lower demand times. If enough customers use less energy at peak periods by shifting their consumption to other times of the day or by simply using less, network augmentation can be delayed or prevented. This means cheaper prices for customers.

Historically, the defining assumption of network tariff reform is that end-use customers are exposed to the time-of-use price signals. But what happens when a retailer chooses not to pass through a network’s time-of-use prices to customers and instead gives customers flat tariffs?

Our electricity market includes network businesses, retailers and end-use customers. A network sets its tariffs which are passed on to retailers. These can be flat, time-of-use or something else. Retailers pay the network company for their use of the network. Retailers then provide retail offers to end-use customers and customers pay the prices of the retail offer they are on. So for network pricing purposes, end-use consumers do not directly pay network tariffs, retailers do.

When customers use more energy during high-use, peak periods, retailers have to pay the network company more under time-of-use network tariffs. The retailers then have an incentive to offer tariffs to customers that reward them for using less energy during peak periods, as this is the most expensive time for retailers to use the network. Competition theory says that the competitive market will innovate and retailers will present different options to customers. Retailers can present any sort of offer to customers, such as time-of-use, a flat tariff or even an offer which is cheaper during peak periods. But the innovation from retailers could go well beyond simple pricing options. By combining technology options with retail offers, customers can receive options to use smart load management to automatically shift load from peak to off peak times.

If customers can easily shift their consumption away from peak periods then they can take advantage of a retailer’s time-of-use offer and save on their electricity bills. SAPN estimates a customer with an EV on a time-of-use tariff and charging the EV in the middle of the day could save as much as $500 per annum compared with a flat retail price.

What if customers prefer flat prices?

Let’s assume that customers either can’t easily shift their consumption from peak to off peak, or simply don’t want to engage with more complex pricing signals. In that instance, they will prefer flat retail tariffs. While this may initially be a problem for retailers, a competitive retail market will quickly see the development of retail offers that continue to have flat pricing structures, but utilise smart technology and other incentives to help move load from peak to off peak times. Much of this load shifting is likely to be done automatically without the customer needing to lift a finger.

So, should we have time-of-use network tariffs if some customers want flat prices?

In very uncharacteristic fashion for energy dilemmas, the answer is simple, yes. In the reality of an increasingly distributed energy landscape, these types of pricing structures are essential not only to avoid the network infrastructure investment that would otherwise be needed, but to improve pricing equity for all end-use customers.

The ACCC echoed this sentiment in recommendation 14 of its Retail Electricity Pricing Inquiry, advocating for accelerated take up of cost-reflective network pricing and going as far as recommending mandatory cost-reflective network tariffs for retailers. Similarly it also concluded that retailers should be free to innovate in the packaging of the network tariff as part of their retail offer.

This approach clearly strengthens the retailers’ incentive to innovate in the competitive market and offer customers plans which work for the retailer and that customers want. It’s a great initiative because networks are putting price signals out there for retailers to take advantage of. Customers will demonstrate their preferences to retailers. Successful retailers will find smart ways to marry the two together.