Regulating for customer outcomes or competition?

Emerging battery and stand-alone power technologies are propelling the energy transition offering better outcomes for customers across and at the edge of the grid.

As technology redraws the map on the delivery of network services, how do we keep focus on real-world customer outcomes while also fostering competitive markets for customers where viable?

The Australian Energy Regulator (AER) is looking at these issues in its current ring-fencing review, with a particular focus on the role of stand-alone power systems and batteries. Networks have advocated for a clear focus on positive customer outcomes, and a framework that ensures consumers can benefit from networks’ adoption and use of technologies. This is best served by ensuring networks can bring to bear any technology that efficiently serves customer needs, rather than the pursuit of complex and inflexible asset-based regulation.

We take a look here at the AER’s draft decision and whether it will facilitate the rollout of innovative solutions that are in the long-term interests of customers.

Stand-alone power systems

The benefits of stand-alone power systems (SAPS) are well known – they can provide a cost-efficient alternative to traditional poles and wires investment, increasing reliability and safety for SAPS connected customers and lowering costs for all customers over time.

The AER’s draft position is to introduce a broad-based exemption to enable a distributor-led SAPS rollout. This positive move will improve customer outcomes, kickstart market development and incentivise more entry by third parties over time. Without it, integrated SAPS would require a ring-fencing waiver, which imposes costs and delays delivering SAPS’ benefits to customers.

This approach, however, does not automatically provide the distributor with exclusivity over service provision. Distributors will still respond to the incentive regime in practice, and if it emerges that some component of the SAPS service may be efficiently provided through a third party, distributors will pursue this (as they do currently).

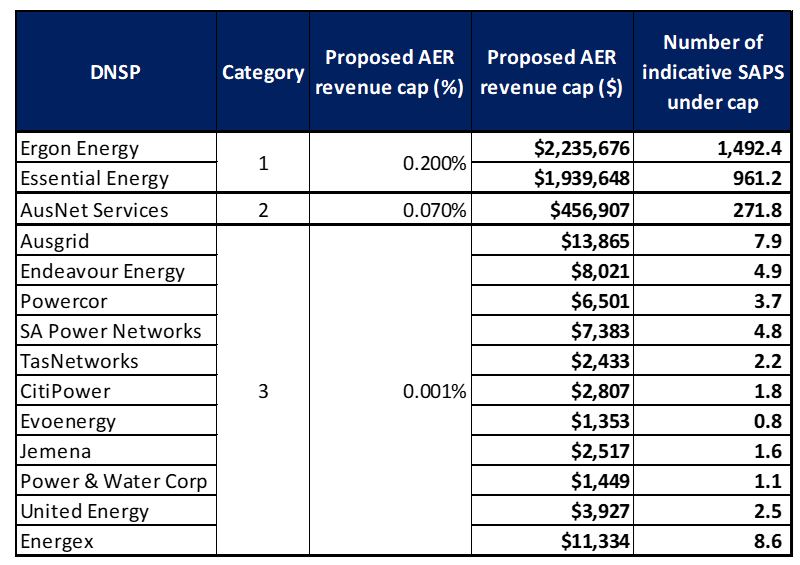

Energy Networks Australia (ENA) has raised a need to review and adjust the calibration of the proposed generation revenue cap thresholds to ensure that the framework accommodates the timely and efficient deployment of SAPS by networks.

As shown in the table below, the proposed threshold for Category 3 distributors appears to allow for distributor-led SAPS indicative roll outs of between 0.8 to 8.6 SAPS in total without having to go through the AER’s waiver process.

Under the proposed thresholds, for example, TasNetworks could roll out only 2.2 SAPS (of a 20kW size) that earn a total of $2,433 in SAPS generation revenue without having to go through the AER’s waiver process. Given the number of potential opportunities to lower network costs and improve customer outcomes across Australian networks, such a constraint on any single network serving many regional and remote areas appears too low by several orders of magnitude.

Figure 1: AER proposed generation revenue caps & indicative distributor-led SAPS[i]

ENA is hoping to work with the AER and other stakeholders to propose alternate fit- for-purpose thresholds that reflect different network circumstances around Australia.

Batteries

Energy storage devices such as batteries represent an increasingly efficient option to address local network issues. “Value-stacking” of these batteries allows for the same battery to be used for multiple purposes (for both distribution and other services).

Enabling value-stacking of batteries reduces the cost to all customers of networks providing distribution services and would foster the energy storage market and provide incentives for third parties to enter.

In submissions to the AER’s Issues Paper, stakeholders including consumer advocates supported a ring‑fencing framework that accommodates batteries, including value stacking, when it results in consumer benefits.

As an example, the Public Interest Advocacy Centre and Simply Energy made a combined submission with Ausgrid that supported the indirect use of storage systems by third parties with appropriate control measures in place, highlighting that it would allow consumer benefits to be realised while ensuring competition in storage services is protected. The submission noted that ring-fencing waivers would add time, cost and uncertainty to community scale storage projects.

When there is a combination of stakeholder voices – consumers and networks – each identifying a case for flexibility and enabling good customer outcomes and warning of the risks of regulation not supporting these outcomes, this should warrant careful review.

As shown below, networks such as Ausgrid and United Energy are undertaking innovative trials that ensure that consumers realise the full benefits of value stacking.

Figure 2: Energy storage device – value stacking trials

Reforms that equate the creation and promotion of competition, without sufficient reflection on maximising customer benefit under real-world constrains, have an unhappy record. The reforms introduced under the competition in metering rule change have not met expectations and have been widely recognised as resulting in sub‑optimal customer outcomes. We need to avoid these same risks being played out in ring-fencing reforms.

ENA supports practical amendments to enable networks’ indirect use of batteries to provide non‑distribution services while also providing transparency to the market about the services that are being offered. This will ensure that customer benefits are not delayed or eroded by a lengthy and costly waiver process.

While we appreciate the challenges in updating the framework, the possibility of any harms arising from networks investing in batteries can and should be addressed directly rather than simply preventing the realisation of consumer benefits from networks using energy storage devices to provide distribution and non-distribution services.

Supporting innovative solutions

Distributors have an important role to play in facilitating the customer-driven transition to distributed energy, which is supporting Australia’s move to a low carbon future. The ring-fencing framework should not place unnecessary constraints that inhibit innovation but rather must be sufficiently adaptable to ensure the optimisation of consumer value from the introduction of new technologies.

[i] Inputs sourced from Appendix C (SAPS Generation revenue cap calculation) of the AER’s Draft electricity distribution ring-fencing guideline – Explanatory Statement, May 2021.