In an uncertain future, hydrogen is a common element

Hydrogen is one of the transformational technologies of Gas Vision 2050. While it has enormous potential to complement natural gas for home heating, hot water and cooking, it also has possible uses replacing petrol and diesel in vehicles and supporting the electricity sector as a flexible energy source to help manage peak demand.

Hydrogen reduces gas demand

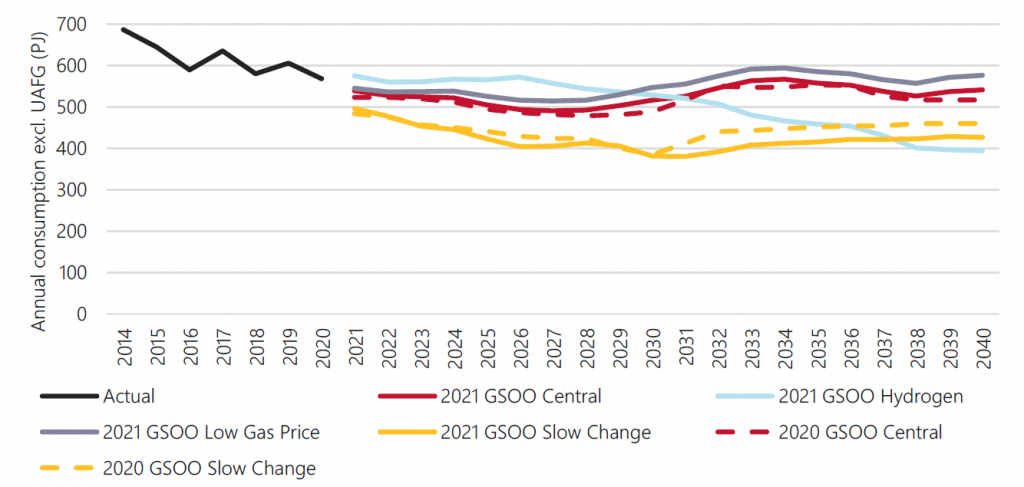

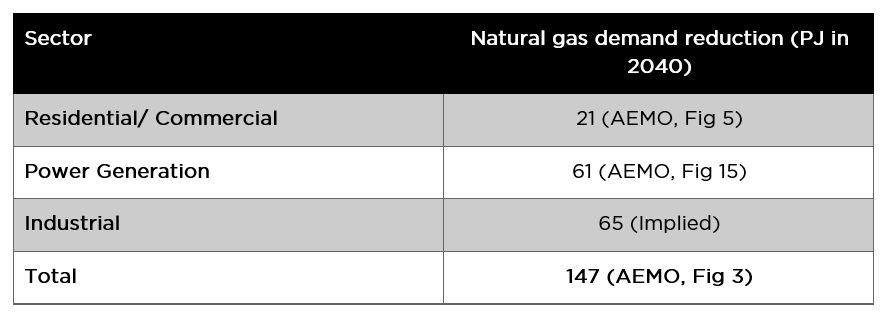

The Gas Statement of Opportunities (GSOO) is a yearly publication by the Australian Energy Markey Operator (AEMO) that investigates the supply and demand for natural gas on Australia’s east coast[i]. AEMO included a hydrogen scenario in the 2021 edition of GSOO. This scenario shows that gas consumption for domestic use could decline by almost 30 per cent by 2040 compared with its central scenario (a reduction of 147 PJ).

Figure 1: Comparison of GSOO scenarios – showing domestic gas consumption below 400 PJ in 2040 (Source: AEMO (2021), Gas Statement of Opportunities – Figure 3).

This requires a future world where economic production of hydrogen is strong. A hydrogen cost path has not been provided in the report, but it appears that economic production requires:

- hydrogen consumption to start with the domestic market and then transition to export markets;

- hydrogen production driven by electrolysis; and

- a high level of electrolyser utilisation that favours grid-connected electrolysers.

The assumptions in the report show that hydrogen production grows from 2.2 kt production in 2022 to 2.8Mt (an increase of 127,000 per cent over eight years) in 2030 and then to 13 Mt in 2040 (an increase of 464 per cent from 2030). Those are massive growth rates.

The domestic demand for hydrogen will mainly be from the industrial sector. Blending into distribution networks is assumed to start at very low levels in 2021 and then ramp up to 10 per cent energy by 2038 (or an equivalent of 21 PJ). AEMO notes that this does not require a uniform 10 per cent blend and that some sections of the network could be sectioned off to provide 100 per cent hydrogen to customers. This implies that gas consumption for the industrial and power generation sector reduces by 126 PJ compared with the central scenario.

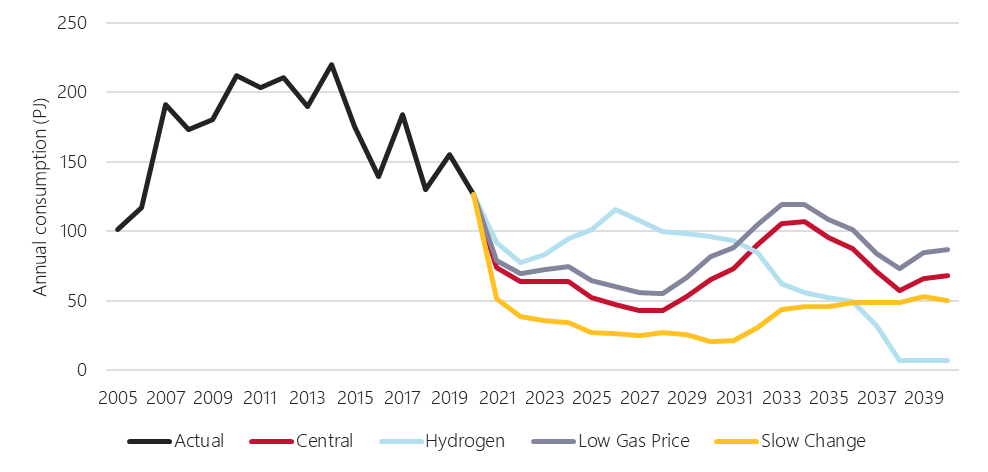

In the AEMO scenarios, natural gas for power generation appears to be declining compared with the past decade. This is mainly driven by a smaller role of gas to support variable renewable generation. When hydrogen is included in the scenario, the amount of gas used for power generation declines even further by 61 PJ.

Figure 2: Annual gas consumption for power generation (Source: AEMO (2021)).

Producing hydrogen through electrolysis will increase the demand for electricity. But this load is assumed to be flexible so that the electrolysers can provide balancing services for the electricity grid, which reduces the demand for gas power generation.

Domestic or international supply

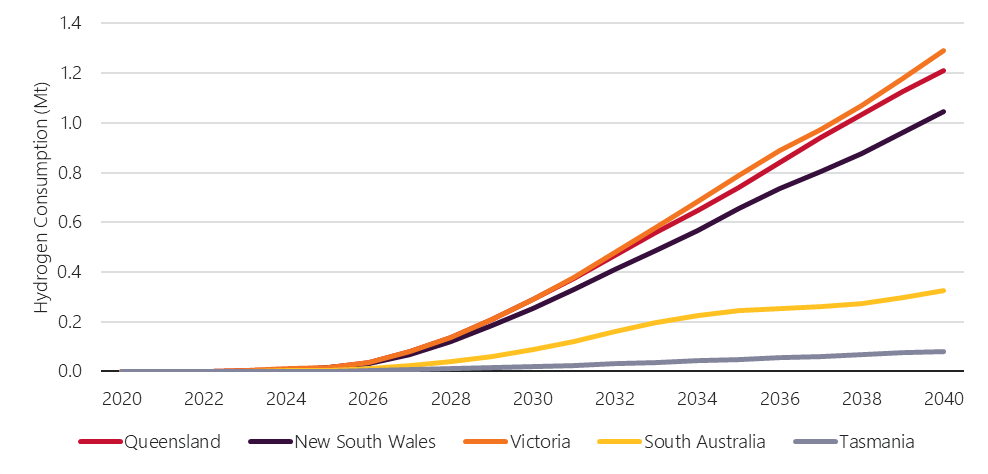

An estimate of domestic hydrogen consumption is provided by AEMO for National Electricity Market (NEM) states. This suggests that just under three million tonnes will be consumed in those states by 2040, compared with an overall production level of 13 million tonnes. Clearly, hydrogen exports account for most of the local production.

Figure n: Hydrogen consumption in NEM states (Source: AEMO (2021)).

Impacts on electricity demand

The hydrogen scenario is based on producing hydrogen from electrolysis. This requires additional renewable electricity demand. An additional 585 TWh[ii] of renewable electricity generation will be required to provide 13 million tonnes of hydrogen for the domestic and international market.

In comparison, the 2020 Electricity Statement of Opportunity showed that the NEM currently delivers around 180 TWh.

This means that under the hydrogen scenario, by 2040, more than three additional NEM equivalents of renewable electricity will be required, along with the continued conversion of the market to renewables. This illustrates the sheer scale of energy supplied through gas infrastructure and that converting this will need a systems approach. These demands will increase even further as gas networks become fully decarbonised with hydrogen.

AEMO is planning to do further modelling on the impacts on the electricity sector for the hydrogen scenario in its next round of the Integrated System Plan.

Do we need a Hydrogen Statement of Opportunity?

AEMO already produces electricity and gas statement of opportunities reports. The interaction between the sectors will become much stronger with the introduction of hydrogen as an energy carrier for domestic heat, industrial supply, a flexible load for electricity generation and energy exports. Taking a systems approach to energy planning should also consider:

- the seasonal nature of natural gas consumption to provide heating services;

- the storage potential of gas infrastructure that can be repurposed with hydrogen;

- how hydrogen can help support the electricity grid in a renewable drought;

- the level of hydrogen exports that can be suitably sustained.

Perhaps there is an opportunity for a new publication that addresses these energy sector links and also considers the role of hydrogen in mobility.

[i] AEMO publishes a separate document for the west coast of Australia – The Western Australian Gas Statement of Opportunities

[ii] CSIRO (2018) – National Hydrogen Roadmap shows that the most efficient production of hydrogen would require 45 kWh per kg hydrogen. For 13 million tonnes hydrogen, this requires 585 TWh.