Brexit – Will the lights go out?

The UK exiting the European energy market would be like Victoria withdrawing from the NEM (National Electricity Market). This could be the result of a no-deal Brexit.

Much like Victoria is to Tasmania, the UK is the transmission hub between Ireland and Europe.

Currently, the UK’s electricity market is integrated with the EU, with common rules governing operations.[i]

As the UK is relatively self-sufficient when it comes to electricity, a no-deal Brexit doesn’t look to be a question of whether the lights will go off, but how much it will cost to keep them on.

While the UK only imports 5.4 per cent of its total electricity supply[ii], it gains many efficiencies through interconnection and free trade of electricity.

If the UK exits the EU energy market, if interconnectors can no longer operate as efficiently or without tariffs and if Ireland is forced to somehow split the island‘s energy market, then operating costs will go up.

What is a no-deal Brexit?A no-deal scenario would result in the UK immediately leaving the European Union (EU) with no agreement about the “divorce” process. The UK would lose all rights and reciprocal arrangements with the EU and would revert fully to ‘third country’ status.[iii] Overnight, the UK would leave the single market and customs union, which were designed to facilitate trade between EU members by eliminating checks and tariffs (taxes on imports).[iv] |

Interconnection and Transmission

According to leaked UK Government documents on Operation Yellowhammer, outlining the worst-case scenario for Brexit, there would be no immediate disruption to interconnectors on day one.[v]

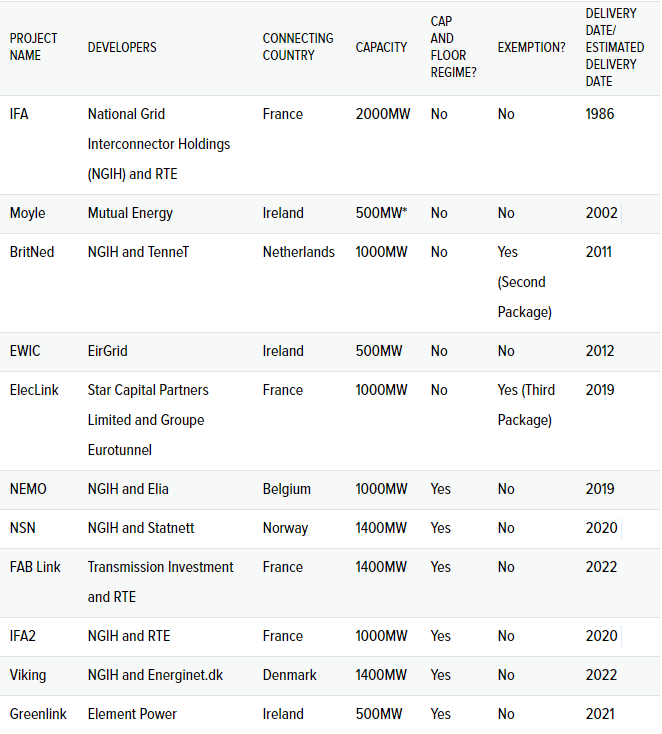

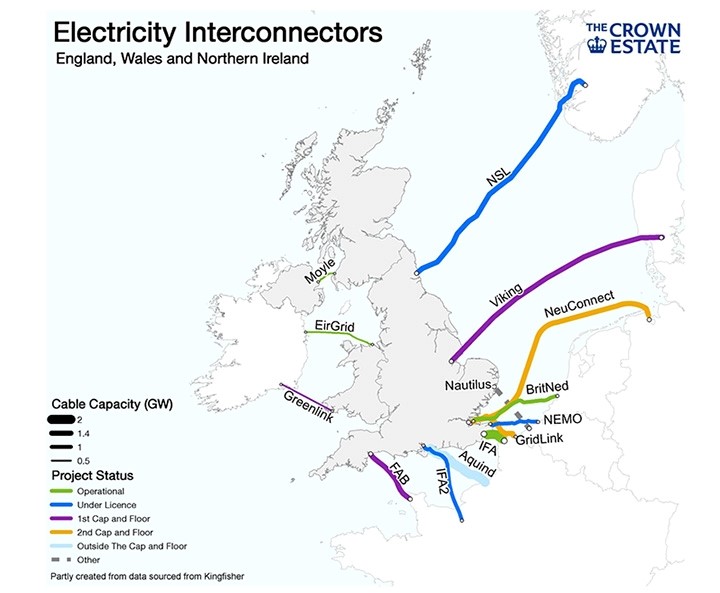

The UK currently operates five interconnectors with a total capacity of 5GW[vi]:

- 2GW to France (IFA)

- 1GW to the Netherlands (BritNed)

- 500MW to Northern Ireland (Moyle)

- 500MW to the Republic of Ireland (East West)

- 1000MW to Belgium (Nemo)

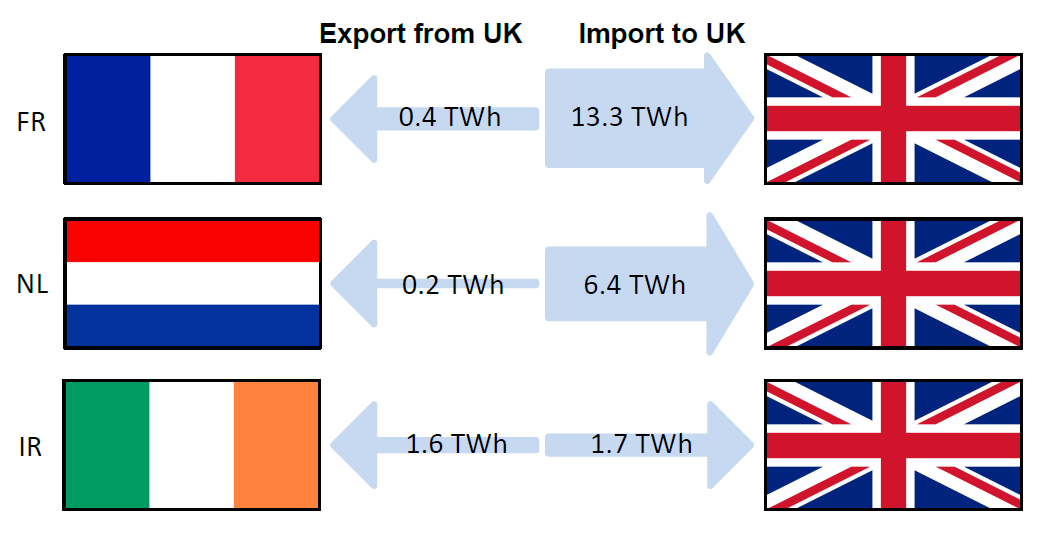

Since 2004, the UK has been a net importer of energy[vii]. Net imports made up 36 per cent of UK energy needs in 2017.

These imports have mostly been in the form of gas and oil (90 per cent). Only 5.4 per cent of the total electricity supply was from imported electricity.

Though the UK has been a net electricity importer since the interconnector with France opened, at its peak in 2015, this only accounted for 6.6 per cent of the UK electricity supply. This is significantly lower than the EU average of more than 20 per cent.[viii]

There are seven interconnector projects under construction or planned, and it is not clear how Brexit will affect their operation.

Though these interconnectors are highly unlikely to cease operation, if tariffs are imposed or restrictions are placed on trades (such as limiting forward trading), then this will drive up costs.

A less efficient system is a more expensive system. This means higher power bills.

Figure 1: Electricity imports and exports in 2018 (Source: Digest of UK Energy Statistics 2019)

Table 1: UK to EU interconnector projects past and future (Source: Ofgem)

What’s been said about tariffs?

The UK has said it will provide exemptions for 12 months on electricity imports and exports, while the EU has said it wouldn’t.

What the EU says[ix]: Regarding third country imports and exports of electricity, Commission Regulation (EU) No 838/20107 provides that a transmission system use fee is to be paid on all scheduled imports and exports of electricity from all third countries which have not adopted an agreement whereby it is applying Union law. As of the withdrawal date this provision will apply to imports of electricity from and exports of electricity to the United Kingdom.

What the UK says[x]: If the UK leaves the EU without a deal, a temporary tariff regime will be implemented. This would apply for up to 12 months while a full consultation, and review on a permanent approach, is undertaken. Under the temporary tariff regime, imports of electrical energy into the UK would be eligible for tariff free access.

Transmission system operators

The EU could refuse to certify any UK owned Transmission System Operators (TSOs) following a no-deal Brexit. The EU Directorate-General Energy makes that very clear:

TSOs controlled on the withdrawal date by investors from the United Kingdom are TSOs controlled by persons from a third country. For these TSOs to continue their activity in the EU, they require a certification in accordance with Article 11 of Directive (EU) 2009/72/EC and Directive (EU) 2009/73/EC. Member States may refuse certification where granting certification poses a threat to security of supply of the Member State.

If not certified, this could impact on the UK’s ability to tap into the EU’s transmission network or add additional complexity or regulation to its operation.

Figure 2: Map of existing and planned interconnectors between the UK and EU (Source: The Crown Estate)

Ireland – Single Electricity Market

Northern Ireland and Ireland operate as the all-island Single Electricity Market (SEM) for wholesale electricity.

The UK Government has warned that as a result of Brexit, EU rules will cease to apply in Northern Ireland, leaving key elements of SEM without any legal basis.[xi]

Any disruption in this market or changes to export tariffs could have a significant impact on the cost of electricity in Ireland and the UK.

Net exports – excess wind

Ireland has been a net exporter of electricity since 2016[xii].

As Ireland has significant wind generation, exporting this excess helps to maintain the stability of the grid since Ireland has limited storage ability. It also helps avoid the need to turn off these wind turbines, which would be counterproductive to Ireland meeting its emissions targets.

Interconnections also help avoid unnecessary and expensive investment in storage such as batteries or pumped hydro.

If this wind can’t be exported and wind generators need to turn down output, then this may end up driving up the cost of electricity as generators raise prices to make up the shortfall.

The UK, being a net importer, will at times rely on Ireland for extra supply so any changes that make it less efficient to export to the UK will result in higher prices for UK consumers.

Will it split?

The UK Government has warned: there is a risk that the Single Electricity Market will be unable to continue, and the Northern Ireland market would become separated from that of Ireland. Separate Ireland and Northern Ireland markets will be less efficient, with potential effects for producers and consumers on both sides of the border.[xiii]

The Utility Regulator of Ireland has said there would be some immediate impacts on its operation following Brexit.

The regulator warns that as Ireland is connected through Great Britain to the pan-EU market, the SEM will become isolated and this market will “almost certainly be less efficient than today”.[xiv]

Forward trading via the interconnectors will cease, and day-ahead trading will become local to the SEM.[xv]

So what does all this mean?

There are a lot of unknowns.

The EU and the UK seem to interpret the situation very differently.

While most of this is likely posturing from their respective media spin machines to push their respective agendas, there are so many moving parts to this situation that could go wrong.

Hopefully, regardless of the Brexit outcome, there will continue to be free trade agreements in place for electricity as well as agreed standards and terms for TSOs.

Any of this is possible, and without it, prices will go up.

References

[i] https://www.gov.uk/government/publications/trading-electricity-if-theres-no-brexit-deal/trading-electricity-if-theres-no-brexit-deal

[ii] https://www.gov.uk/government/statistics/digest-of-uk-energy-statistics-dukes-2019

[iii] https://static.rasset.ie/documents/news/operation-yellowhammer.pdf

[iv] https://www.bbc.com/news/uk-politics-48511379

[v] https://static.rasset.ie/documents/news/operation-yellowhammer.pdf

[vi] https://www.ofgem.gov.uk/electricity/transmission-networks/electricity-interconnectors

[vii] https://researchbriefings.parliament.uk/ResearchBriefing/Summary/SN04046

[viii] https://www.cer.eu/sites/default/files/pbrief_energy_lowe_25.9.17.pdf

[ix] https://ec.europa.eu/info/sites/info/files/file_import/energy_market_en_0.pdf

[x] https://www.gov.uk/government/publications/trading-electricity-if-theres-no-brexit-deal/trading-electricity-if-theres-no-brexit-deal

[xi] https://www.gov.uk/government/publications/trading-electricity-if-theres-no-brexit-deal/trading-electricity-if-theres-no-brexit-deal

[xii] https://www.seai.ie/data-and-insights/seai-statistics/key-statistics/electricity/

[xiii] https://www.gov.uk/government/publications/trading-electricity-if-theres-no-brexit-deal/trading-electricity-if-theres-no-brexit-deal

[xiv] https://www.uregni.gov.uk/news-centre/electricity-and-gas-trading-arrangements-event-no-deal-brexit

[xv] https://www.uregni.gov.uk/sites/uregni/files/media-files/Market%20readiness%20update%20-%20TSO%20slides%20180219.pdf