Will COVID kill nuclear?

As we’ve analysed previously, since lockdown measures were introduced in the United Kingdom (UK), total energy use has fallen by up to 20 per cent[i].

To meet the new demand profile, the National Grid Electricity System Operator (ESO) has used existing markets and balancing mechanisms and paid generators to reduce output. Under these new conditions, grid stability has been maintained.

One prominent generator under contract with the ESO is Sizewell B, a 1.2GW nuclear power plant. As the youngest nuclear power plant in the UK fleet, this facility is able to offer some flexibility.

Typically, nuclear power plant operation is considered baseload – operating at full capacity for as long as maintenance and fuel stocks allow[ii].

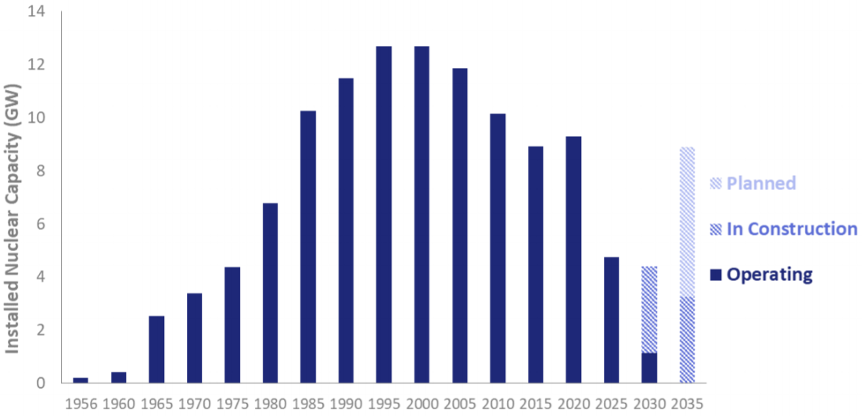

The UK’s history of nuclear power plants started in 1956, and new plants were built steadily through to the mid-1990s, when installed capacity peaked, as seen in Figure 1. Despite this early growth, no new capacity has come online since Sizewell B’s 1995 commission.

Figure 1: Nuclear Power Station Capacity in the UK[iii]

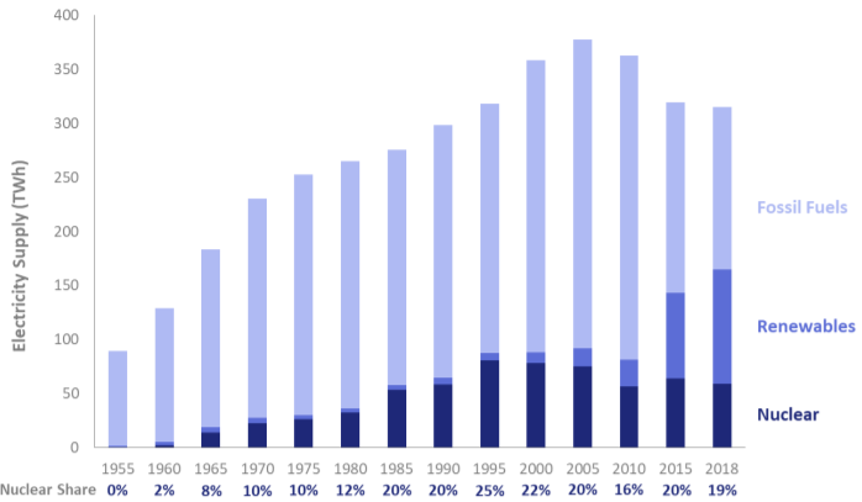

Nuclear power in the UK reached peak output in 1997iii. Since then, the volume of electricity it has produced has declined, due in part to plant closures. Unplanned outages and maintenance outages have also caused reductions in annual output.

Figure 2 shows the declining contribution of nuclear and fossil fuels to the electricity mix (from 2000) as renewable sources have grown.

Figure 2: Electricity Sources in the UKiii

As Figure 1 shows, new nuclear power plants are planned for the UK. However, their development is an ongoing saga.

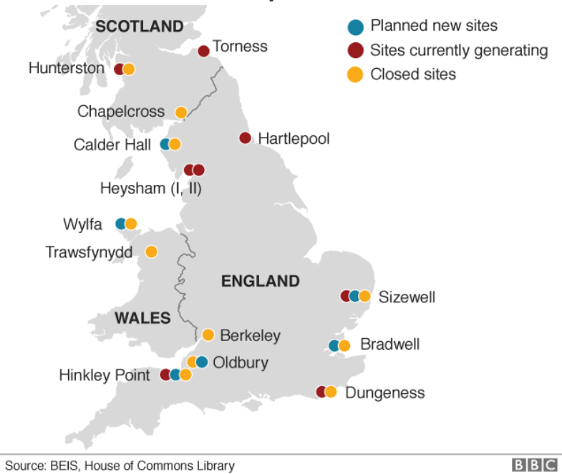

The most prominent and progressed of these is Hinkley Point C, a 3.2GW facility with two nuclear reactors. It was approved for construction in 2013. While eight projects have been selected as suitable sites by the government[iv], Hinkley Point C is the only one to start construction.

Three projects have been cancelled due to financing issues[v]. A planning proposal for Sizewell C was submitted in May this year, which is expected to take 18 months to complete.

Figure 3 provides an overview of nuclear power stations in the UK.

Figure 3: Sites of nuclear power stations[vi]

With an original £18.5b ($AUD33.6b) budget, Hinkley Point C was to be a flagship project for the French-utility EDF as the first of its type built outside of France. The project was helped to financial close by a 2016 contract for difference (CfD) with the UK government that provides £92.5 ($AUD168) per MWh for all output for 35 years[vii]. This strike-price is almost double the current market rate and was indexed to inflationvii.

Since then, the project has experienced significant delays and budget increases. The cost is now closer to £22.5b and while civil works have started, completion at best is now flagged for late 2025vi.

The saga of Hinkley Point C does not bode well for future nuclear projects – indeed its owner EDF has recorded similar blowouts for other developments.

One plant in France modelled on the same technology is ten years overdue and has quadrupled in cost[viii]. This delay has also cast significant doubts on EDF’s ability to deliver its Sizewell C project.

In spite of the troubled economics and challenging environmental impacts of nuclear power, it is still considered part of future UK energy scenarios[ix].

However, looking at the strike price for offshore wind and the economics of renewable sources, it is unclear if this future stacks up. For example, the 2019 CfD value in wind projects to be delivered by 2025 was about £40 ($AUD73) per MWhvi. Wind, unlike nuclear, has shown significant potential for cost reduction as the CfD price has fallen from £120 ($AUD219) per MWh in 2015[x].

One proposed option to fund future nuclear power projects was to include them in a Regulated-Asset-Base (RAB) testv.

Consultation was open in 2019, and under this model electricity consumers would pay in advance, through electricity tariffs, to fund future nuclear projects. No announcement on the outcome has been made given that the high locked-in strike-price for Hinkley Point C, which will already add between £10-15 per bill per year[xi], it is hard to see how this new proposal will work.

The UK is considering new nuclear power technologies, including small modular reactors. A funding decision model, as well as a technology direction, is expected to be in the UK government’s energy white paper, which has been delayed since 2019.

The ongoing cost blowouts and uncertainty in novel nuclear technology in the UK suggest caution in how warmly Australia’s Technology Investment Roadmap should embrace nuclear power plants as a long-term option.

There is no doubt nuclear power will have an ongoing role in the global energy mix. However, any analysis about whether Australia should go down the same path must consider whether the significant infrastructure and environmental costs can play a part in our low-emission future generation mix.

References

[i] International Energy Agency. (2020, July). Covid-19 Impact on Electricity. Retrieved from iea.org/reports/covid-19-impact-on-electricity

[ii] Patel, S. (2019, March 31). Flexible Operation of Nuclear Power Plants Ramps Up. Retrieved from Power: powermag.com/flexible-operation-of-nuclear-power-plants-ramps-up/

[iii] Roberts, T., & Clark, H. (2019, March 28). Special feature article – Nuclear electricity in the UK. Retrieved August 2020, from Department of Business, Energy & Industrial Strategy, Energy Trends: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/789655/Nuclear_electricity_in_the_UK.pdf

[iv] BBC News. (2020, May 27). Sizewell C: Nuclear power station plans for Suffolk submitted. Retrieved from BBC News: bbc.com/news/uk-england-suffolk-52813171

[v] Vaughan, A. (2019, January 18). What role does nuclear power play in UK and what are alternatives? Retrieved from The Guardian: theguardian.com/business/2019/jan/17/what-role-does-nuclear-power-play-in-uk-and-what-are-alternatives

[vi] BBC News. (2019, September 25). Hinkley Point C nuclear plant to run £2.9bn over budget. Retrieved from BBC News: https://www.bbc.com/news/business-49823305

[vii] Watt, H. (2017, December 21). Hinkley Point: the ‘dreadful deal’ behind the world’s most expensive power plant. Retrieved from The Guardian: theguardian.com/news/2017/dec/21/hinkley-point-c-dreadful-deal-behind-worlds-most-expensive-power-plant

[viii] White, S. (2019, October 28). France orders EDF to tackle nuclear project failings. Retrieved from Reuters: reuters.com/article/us-edf-flamanville/france-orders-edf-to-tackle-nuclear-project-failings-idUSKBN1X710S

[ix] National Grid ESO. (2020, July). Future Energy Scenarios. Retrieved from nationalgrideso.com/document/173821/download

[x] Lidbetter, H. (2020, July 20). Viewpoint: The nuclear option in the UK’s clean energy transition. Retrieved from Worlds Nuclear News: world-nuclear-news.org/Articles/Viewpoint-The-nuclear-option-in-the-UKs-clean-ener

[xi] Twidale, S. (2017, June 23). UK Hinkley plant could cost $38 bln in electricity payment top-ups: watchdog. Retrieved from Reuters: reuters.com/article/us-britain-nuclear-costs/uk-hinkley-plant-could-cost-38-bln-in-electricity-payment-top-ups-watchdog-idUSKBN19D2WP