When you fail to plan, you plan to fail

2020 vs 2021 ESOO – what a difference a year has made

The Australian Energy Market Operator (AEMO) provides an annual report known as the Electricity Statement of Opportunities (ESOO) to outline the current state of the energy market, including identifiying any gaps that may affect the reliability of power generation.

A key focus of this year’s ESOO was mananging the accelarated uptake of renewable generation as Australia moves towards a decarbonised energy market.

The ESOO gives market participants a snapshot of current, planned and proposed electricity supply capabilities, the retirement of assets (coal fired generators) and demand forecasts. It also addresses shortfalls of energy supply.

Unserved energy (USE) is the amount of energy demanded, but not supplied due to reliability incidents.

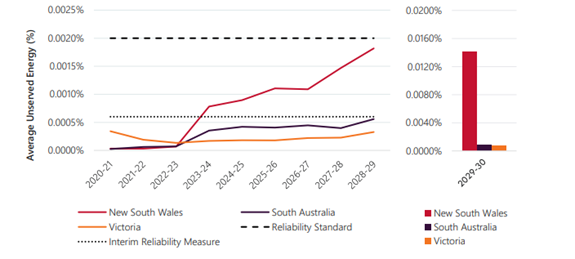

Last year, the expected USE, under AEMO’s ‘central scenario’, indicated that only NSW exceeded the interim reliability target of 0.0006% in 2023/24 and was getting close to the average USE target of 0.002% around 2028/29, see Fig 1.

Fig 1 – Expected Unserved Energy, Central scenario, 2020-21 to 2029-30[1]

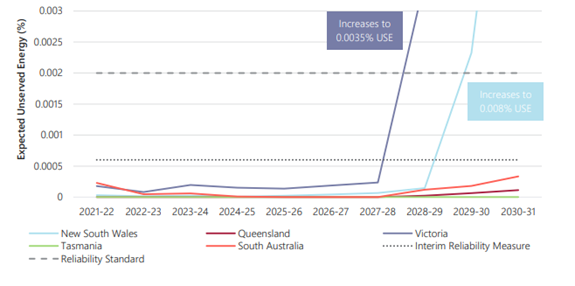

In contrast, in the 2021 ESOO, both Victoria and NSW breach the interim reliability target and the USE around 2027 to 2030, see Fig 2. So what’s changed in the last year?

Fig 2 – Expected Unserved Energy, 2021-22 to 2030-31, Central outlook[2]

It is clear the existing and committed projects for new generation are sufficient for the next five years, with new projects needed to deal with the emerging reliability gap from 2027-28. Both Victoria and NSW are creating separate state policy frameworks to improve their transition to renewables.

Energy Australia has announced an earlier closure date of 2028 for all units at its brown-coal fired Yallourn Power Station in Victoria and in NSW, the closure of two units at Eraring Power Station have been brought forward. Issues such as the Callide C power station incident (where a turbine unit exploded) in Queensland in May 2021 also highlight concerns about generator reliability. This has thrown the spotlight on the growing need for dispatchable energy such as Snowy 2.0 or Tasmania’s Battery of the Nation.

The growth in new variable renewable generation and retirement of coal-fired power stations also means new transmission developments are vitally important to get the new generation to load centres. These developments include HumeLink, VNI West and Marinus Link.

A number of transmission projects have been taken into account in the ESOO;

- Project Energy Connect, a new interconnector between SA and NSW is expected to commence operation in 2023-24, this will allow more resources to be shared across the National Electricity Market (NEM);

- Increased transfer capacity, reducing supply scarcity is also improved by QNI minor (Queensland to NSW interconnector) in 2022;

- The Victorian side of the VNI, the Victorian – NSW interconnector in 2022/23 and the Victorian System Integrity Protection Scheme in 2021 which will use reserve capacity from Victoria’s Big Battery to increase power flow through the VNI; and

- Western Victoria transmission upgrades will be completed in 2025-26 which will allow improved power flows between Victoria and other regions.

Reforming access to the Grid

New generation without the associated transmission to get the power to customers is no help in achieving reliability. Transmission is also crucial to alleviate congestion. The Energy Security Board (ESB) commissioned FTI Consulting to forecast the impact of network congestion in the NEM in 2030 using AEMO’s 2020 ‘Step Change’ scenario – which models high renewable penetrations.

Generation is dispatched in each region in merit order, with the cheapest being dispatched to meet demand, subject to constraints. If higher cost generation needs to be dispatched then overall costs to consumers increase and the generators behind the constraints earn less revenue and hence their profitability is impacted.

Under the step change, wind and solar are expected to increase by more than 200 per cent in the NEM to 31GW by 2030[3]. FTI predicts that even with generation and transmission development as planned in AEMO’s Integrated System Plan (ISP) there will still be congestion. Stability and thermal constraints could lead to about 2.5TWh of solar and about 1TWh of hydro generation being constrained off and additional thermal generation dispatched in its place. Where thermal generation is dispatched instead of cheaper renewables, this will also lead to higher carbon emissions.

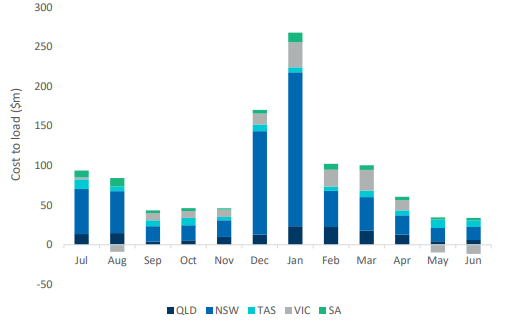

FTI has modelled these constraints will generally lead to higher wholesale prices in each state. The average increase being $5/MWh, with the range being $3-9/MWr in November and January respectively. Consumers are expected to pay an additional $1.05 billion per annum, essentially a wealth transfer from consumers to generators, see Fig 3.

The ESB notes these costs to customers could be worse as current levels of renewable generation are running 27 per cent ahead of the ISP step change scenario. There is a need to reform the way generators access the grid before this gets worse.

Fig 3 – Increase in cost to load customers due to network constraints by region in 2030[4]

FTI compare the current NEM design to two options:

- Congestion management through locational marginal pricing which is used in the US and New Zealand; and

- Congestion management through constrained on and off payments which is used in most of Europe.

In the worked example provided in the report, the LMP model provided the best outcome for consumers.

Where thermal generation is dispatched instead of cheaper renewables, this will also lead to higher carbon emissions. The costs to consumers will also be higher at times of system constraints.

Where additional renewables are connecting (beyond the anticipated level in the ISP) ahead of transmission development this may result in increased congestion for new renewables and incumbent generators and will lead to lower generator revenues.

While state coordinated renewable energy zones can manage immediate term congestion, the ESB considers that longer-term reform is needed to send price signals to energy intensive industries to locate near plentiful supply and to better manage congestion across the NEM. It has recommended an congestion management approach to national energy ministers to manage this.

The National Cabinet is expected to provide a position on the ESBs recommendations in September 2021. This would allow the progression of a rule change to implement a congestion management model.

The ESOO comes but once a year, and as we’ve seen a lot can happen in a few short months.

Overall, the report forecasts a positive outlook for the grid’s ability to allow for more renewable energy generation such as wind and solar while still creating a stable and reliable energy grid.

But we ignore the ESB’s recommendations at our peril and need to ensure we are all singing from the same songbook and consider a long term plan to sure up our energy supply.

Because when we fail to plan, we plan to fail.

[1] AEMO 2020 Electricity Statement of Opportunities, p7

[2] AEMO 2021 Electricity Statement of Opportunities, p6

[3] FTI Forecast Congestion in the NEM, Final Report, 5 Aug 2021

[4] Ibid, p16, Market price cap lowered to $1,000/MWh and lower DSP activation price