EU ‘greener’ hydrogen plan a red herring

A recent European Union draft regulation[1] outlines detailed rules to govern the production of green hydrogen. This places additional burdens on using renewable electricity for hydrogen production compared with other sectors and risks stifling the development of the industry.

The proposal states that for hydrogen to be considered green it must meet these criteria:

- The renewable electricity used must be produced from additional new renewable generation (paragraphs 6 and 7 of [1]);

- This operation of the electrolyser (to produce the hydrogen) must be matched by generation on an hourly basis (paragraph 10 and 11);

- There should not be any transmission line constraints between the new generation and the electrolyser (paragraph 12); and

- Both the new generation and the electrolyser must be in the same “zone” (paragraph 13).

The intent of the regulation is to ensure hydrogen electrolysers do not utilise existing contracted renewable electricity and to incentivise the growth of the renewable electricity sector.

The logic behind this is questionable, however.

If the purpose of the regulation is to increase renewable generation, then it should apply to all industries and organisations seeking to use renewable electricity. Why single out hydrogen production?

Other businesses are not subjected to the same onerous requirements – as evidenced by the many organisations entering into Power Purchase Agreements for 100 per cent renewable electricity. An Australian example of this can be seen in the ACT where its government has contracts to purchase renewable generation to offset the electricity (mostly provided by NSW coal) that the territory actually consumes. This offset arrangement would not comply with the EU’s definition of green because there is no direct connection between the contracted renewable electricity (produced by wind farms in South Australia for example) and the territory.

Hydrogen cost drivers

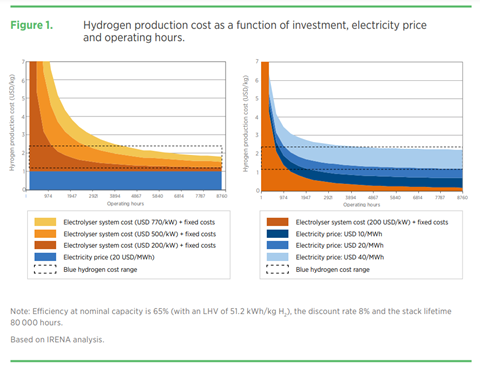

To better understand the potential impact of this new regulation on hydrogen development in the EU let’s have a look at the cost drivers of hydrogen production, which is based on three input costs[2]:

- The capital cost of the electrolyser and the associated balance of plant.

- The utilisation of the electrolyser facilty – with higher utilisation reducing the pay-back period and reducing overall hydrogen costs.

- The cost of the electricity used by the electrolyser. Electricity is the main operating cost of electrolysers. Lower electricity costs lead to cheaper hydrogen.

Figure 1: Hydrogen production cost as a function of capital cost, electricity costs and level of utilisation (Source: IRENA (2020), Green hydrogen cost reductions)

The regulation won’t directly impact the capital cost of the electrolyser, although indirectly it could reduce the rate at which hydrogen electrolysers are built and hence reduce the rate at which the cost declines. The regulation will impact the cost of electricity and the level of utilisation.

There are other likely impacts from the new regulation.

On one hand, if hydrogen electrolysers were being deployed at the gigawatt scale, then it is most likely that they would be connected to dedicated renewables. This lowers tilization but avoids network costs. Overall, this will create lower costs of hydrogen compared to connecting those facilities to the grid. But the gigawatt scenario is still many years off and it doesn’t need regulation as the business case lends itself to dedicated generation.

On the other hand, green hydrogen production is at the one to 10 MW scale around the world. This is scaling up quickly but there are many projects around the 10MW scale being developed. These facilities have high capital cost (on a $/ kg hydrogen basis) so increasing the utilisation lowers the hydrogen cost. This utilisation can be improved by grid connections, albeit at a higher price than dedicated renewables. Putting additional constraints on these projects has the potential to slow down the development pathway for hydrogen.

While there are many plans for GW scale hydrogen export projects in Australia[3], the early projects will most likely be at a much smaller scale and the regulations being put forward in the EU should be a red flag to hydrogen exporters.

Summary

Poorly designed policies or regulations can have unintended consequences. The recent EU policy proposal will result in higher hydrogen production costs for an emerging sector and if copied globally will stifle an industry before it can become competitive.

[1] https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=PI_COM:Ares(2022)3836651 – NOTE that this is not finalised.

[2] For example see Table 1 of https://www.hydrogen.energy.gov/pdfs/20004-cost-electrolytic-hydrogen-production.pdf

[3] https://research.csiro.au/hyresource/projects/facilities/