Rate of Return: The signal and the noise

In his book The Signal and The Noise statistician and author Nate Silver seeks to analyse the qualities of successful forecasts and estimates across a set of different areas, including baseball, elections, and finance.

As a challenging domain for prediction, nothing quite matches the task set of the Australian Energy Regulator (AER) and WA Economic Regulation Authority under the current national rate of return framework. The task is to estimate a rate of return and design an approach that will meet and reflect market conditions up to nine years into a highly uncertain future.

To increase the difficultly, the rate of return set under these processes flows on to impact investment and usage signals for network infrastructure valued at around $110 billion, as well as new required, but as yet unbuilt, infrastructure.

Making irreversible, high consequence decisions through the energy transition

And while those mounting challenges are considered – mix in a once in a generation planned expansion and strengthening of the national transmission grid identified in the recent Integrated System Plan process, involving a staged and sequenced investment task in scale unlike anything since the original establishment of the National Electricity Market (NEM).

Significant customer benefits hang on timely delivery of the planned investments – market benefits of about $29 billion according to the Australian Energy Market Operator (AEMO) – in the form of lower wholesale prices and improved network reliability.

Developments since the 2018 Rate of Return Instrument

Since the last Rate of Return Instrument was made in 2018, much of the world has experienced record low or negative real interest rates, monetary authorities purchasing of government bonds, negative oil prices, and the financial fall-out from the COVID-19 pandemic. Falling interest rates have been reflected in significant reductions across many network charges nationally.

The extreme conditions have tested existing rate of return approaches – designed in different conditions – in ways that were completely unanticipated.

In particular, they have pushed regulatory return on equity allowances for many Australian energy networks to their lowest ever levels, with risk premiums below that of other comparable international regulatory regimes.

Building a predictable and stable framework: retaining what works

Despite those pressures, some areas of the current AER Rate of Return Instrument appear to be performing largely as intended, with AER cost of debt estimates closely matching actual network debt costs.

The Rate of Return Instrument is arguably the single largest decision the AER makes on a regular basis, with its impacts stretching over irreversible investment and consumption decisions across electricity and gas, and its effective life of up to nine years.

Given this, the need for predictability and stability where existing approaches are sound is at a premium. For this and other reasons, networks have questioned initial reconsideration of the AER of the so-called ‘benchmark term’ to apply to the cost of equity.

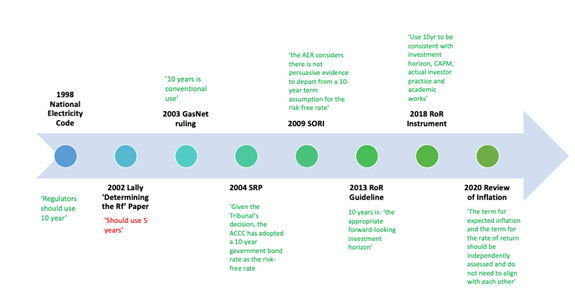

This has been set at ten years for the past twenty years, and consistently reaffirmed to date (See Figure 1).

Figure 1 – Timeline of Regulatory Reviews of Term of Equity: 20 Years of Consideration

Networks’ perspectives are that there are sufficient challenging issues for the process still to consider, without also redebating past settled issues or re-opening highly theoretical debates on which the AER has ruled many times before.

Sufficient new challenges exist to focus on

An example of these looming challenges are findings from the AER’s expert consultants that there is room for improvement in cost of equity estimation approaches, and recommendations to consider adopting a greater weighting to forward-looking data, models and evidence in setting future risk premiums.

Another urgent issue which has arisen is building a future-proof approach to assessing the assumed ‘riskiness’ of network firms, following the recent takeover and delisting of two companies (Spark Infrastructure and AusNet) previously used for benchmarking by the AER. With these two sources of comparison now absent, a new approach will need to be developed.

Applying the wisdom of the fox and the hedgehog

Each of these are complex issues, but ones that other regulators have successfully tackled as well, meaning there are viable solutions.

The Signal and Noise highlights that cautious approaches, viewing issues from multiple perspectives using different data and evidence can produce better forecasts – the ‘foxes’ approach in the so called ‘hedgehog versus foxes’ observation of the poet Archilochus.

Such approaches argue against over-reliance on a single model, and for the careful observation of what other decision-makers do, as well as other available ‘cross-checks’ capable of informing regulatory judgement.

Among these cross-checks, ensuring Australian regulators’ approaches have regard to the methods and outcomes of international regulators is essential to inform and shape future practice.

An alternative narrow – or hedgehog-like – approach of applying a single model and just explaining away sharp differences in practice and estimates risks poor outcomes for consumers and networks alike over the medium term.

Progressing the Instrument

Zoological advice aside, ahead of the expected June draft Rate of Return Instrument, all energy stakeholders will be interested in how the Australian regulators have weighed and interpreted the signal against the noise.

Picking the right signals will be critical to future customer outcomes.