Will customers pay the price for the NSW energy transition?

The Electricity Infrastructure Roadmap (roadmap) is the NSW Government’s plan to transform its electricity system into one that is affordable, clean and reliable. It is a seminal policy that embodies the growing trend for states to go it alone, rather than subscribing to the nationalised infrastructure approach of the National Electricity Market (NEM).

The roadmap is enabled by the Electricity Infrastructure Investment Act (EIIA), aimed at coordinating investment in transmission, generation, storage and firming infrastructure as ageing coal-fired generation plants retire. It also includes actions that will work together to deliver ‘whole-of system’ benefits.

Intent of the roadmap

The intent of the roadmap is to coordinate generation and the development of the NSW Renewable Energy Zone (REZ). By having a clear pathway, the NSW government hopes to provide certainty for investors and business. The roadmap also seeks to bring forward generation and network delivery to avoid price shocks for customers and enable network projects to be developed faster.

However, aspects of the roadmap are light on consultation, and it appears the first customers will know of the costs will be in their retail bills. Transparency should be at the center of arrangements to ensure that NSW consumers and other stakeholders are bought along the journey.

So how is the plan developed?

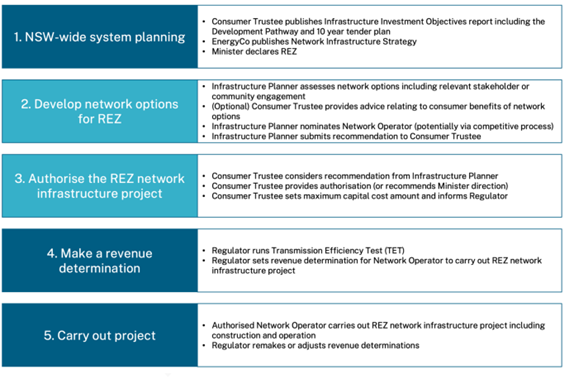

Fig 1: The high level stages relating to identifying, authorising and determining revenue for REZ network infrastructure projects under the NSW EIIA

Source – https://www.energy.nsw.gov.au/sites/default/files/2022-05/govp1634-energyco-aemo.pdf

Oversight for the delivery of the roadmap sits with the newly created Consumer Trustee. This subsidiary of the Australian Energy Market Operator has been established by the NSW Government to “act independently and in the long-term financial interests of NSW electricity customers to improve the affordability, reliability, security and sustainability of electricity supply.” The Consumer Trustee publishes the Infrastructure Investment Objective Report, which includes the NSW development pathway and a ten-year tender plan.

The NSW energy corporation, EnergyCo publishes a Network Infrastructure Strategy. The Infrastructure Planner, also EnergyCo, develops the network options (and non-network options), establishes the tender processes to deliver the project(s) and makes a recommendation(s) to the Consumer Trustee to authorise the project(s).

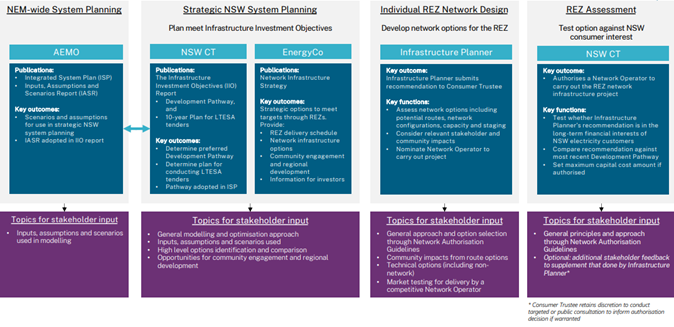

Fig 2. below outlines the process and opportunities for input. Consultation appears to be discretionary, yet it is critical to the longevity and support for the roadmap.

Fig 2: Opportunities for stakeholder input in the recommendation and authorisation of REZ network infrastructure projects

Source https://www.energy.nsw.gov.au/sites/default/files/2022-05/govp1634-energyco-aemo.pdf

It is not clear how the cost, risk and timing trade-offs in the selection of scopes and vendors will be made by the Infrastructure Planner. While supportive of innovation and flexibility of work scopes, it needs to lead to lower total system costs for all consumers.

The REZ network operator role is also still not clear, it may or may not be licenced and registered in the NEM as a Transmission Network Service Provider (TNSP). The network operator also may own, lease or licence, construct, finance, maintain and/or operate the network infrastructure project. It appears that the primary TNSP or jurisdictional planner will operate the transmission system in accordance with the national rules. Where one operator starts and the other one leaves off is not clear. Hopefully the slices and dices come together for a reliable and secure power system every day.

A fair broader benefits test?

The Consumer Trustee will do a benefits assessment of the projects with transmission in the REZ and without new transmission. It may include the capital cost of the project and could include the operating costs across the life of the REZ. This assessment and the development of the counterfactual is key to establishing an upper limit on costs which is provided to the Australian Energy Regulator (AER) for the Transmission Efficiency Test.

These constraints increase the benefits of the project option versus the counterfactual. A fairer net-benefit assessment would consider the benefits of the project proceeding against a counterfactual where that project did not proceed and an alternative project must be built.

There is no transparency of the test or the upper limit of the project cost. There may be benefit in considering whether the Consumer Trustee should have to adhere to a guideline that ensures the test is applied consistently. It is important that the right projects proceed seeking to reduce the total system costs.

Regulating prudent and efficient costs?

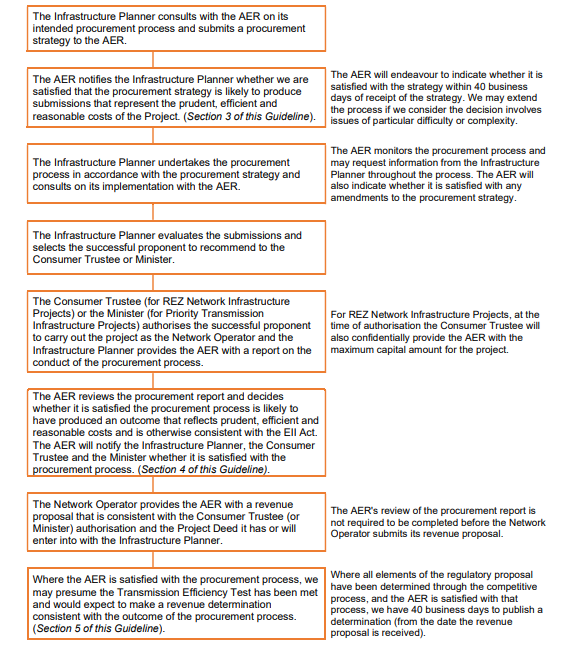

Fig 3. below outlines the interaction between the Infrastructure Planner’s procurement process to select a network operator and the AER’s Transmission Efficiency Test and revenue determination. Development of regulations and guidelines to date have concentrated on the contestable procurement process.

The Infrastructure Planner decides whether the network operator can be selected through a competitive process or not and will consider factors such as the separability of the new infrastructure from the existing network and the capacity and capability of the market to deliver the project in the time required. Where the competitive process is not feasible, the Infrastructure Planner will directly select the network operator to carry out the network infrastructure project.

Where projects are contestable, the Infrastructure Planner will develop a procurement strategy, run the tender process and submit a report to the AER on the procurement process outcomes.

The AER does not have a role in assessing or authorising the network project, this is the responsibility of the Infrastructure Planner and Consumer Trustee. The AER will have to regard the outcomes of the competitive process when applying the transmission efficiency test and making a revenue determination. It is intended that NSW regulations will provide the AER visibility of the procurement process and it will be able to rely on the likely result that the process has resulted in a prudent, efficient and reasonable cost. If this is the case and the total project costs are below the maximum capital advised by the Consumer Trustee, then the AER may presume the costs are efficient.

The Infrastructure Planner is responsible for undertaking preparatory activities and early development and the critical role of gaining social licence for the project through community engagement. The selected network operator will be obliged to pay these costs, so again the AER will be required to accept these costs in a revenue determination.

This is somewhat different from the AER’s role being required to calculate the efficient and prudent costs in a revenue determination in the Act – it is a “presume it’s okay and consumers will pay” approach.

Fig 3: The Transmission Efficiency Test and revenue determination process

How is the roadmap funded – and what do electricity consumers pay for?

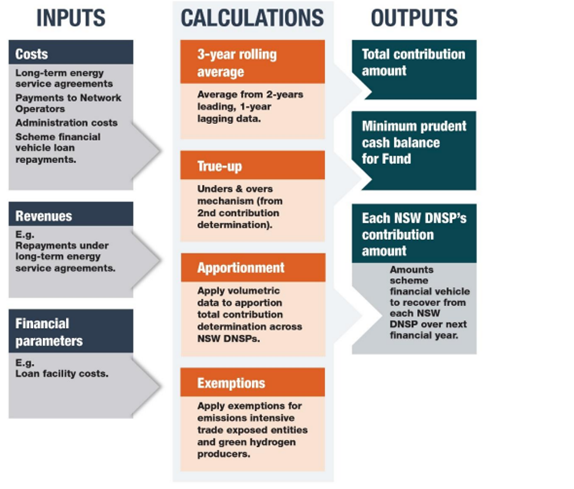

The roadmap will be paid for by customers, with NSW Distribution Network Service Providers (DNSPs) required to raise their share of the funds through network charges. The AER will decide the amount required to be paid by each DNSP by 28 February each year.

As indicated in Fig 4. the scheme financial vehicle that will manage the funds collected will make payments to:

- Proponents with a long-term energy services agreement whether these parties are in the REZ or elsewhere in NSW

- The network operators in accordance with their AER revenue determination

- To cover the administrative costs of the Consumer Trustee, the Financial Trustee and the two regulators involved – AER NSW and IPART (the Infrastructure Planner costs will be funded through the network operator payments).

Each of the DNSPs – Ausgrid, Endeavour Energy and Essential Energy – will be provided a contribution order to make payments to fund the roadmap costs. The NSW DNSPs must then recover their respective contribution amounts by passing the costs through to electricity retailers and onto NSW electricity customers on their retail bill. This is one jurisdictional scheme which will cover the NSW Roadmap costs. Each of the DNSPs submit an annual pricing proposal to the AER in April for approval of network charges which flow through to consumer bills from 1 July each year.

Fig 4 Overview of the Contribution determination method

The roadmap also enables for the exemption of certain costs for both energy intensive trade exposed, entities and green hydrogen producers.

At this point, the total cost of delivering the roadmap is unclear. Nor do we know what proportion of costs will be allocated to REZ proponents vs consumers.

There are however, clear questions about whether loading the costs of a government policy into an essential service is in the best interest of customers – especially given energy affordability and the increasing cost of living. Perhaps there is a role for the NSW government to fund a portion of its policy costs, so the entire burden doesn’t fall on electricity consumers.