Evolving Faster

This week’s Energy Insider is an edited version of the speech delivered by Chief Executive Officer John Bradley at Evolving Faster, the Energy Networks Australia 2017 regulation seminar.

This week Energy Networks Australia held its annual energy regulation seminar, Evolving Faster – Regulating Transformed Energy Markets’. Evolving quickly might seem like a contradiction – but it is the essential challenge for an energy system supporting our economy, communities and our need for security, affordability, fairness, and sustainability.

The transformation is a given. It is as global as the battery storage production capacity being installed in China, which Bloomberg forecasts to be 121 Gwh per annum in 4 years, or four times the size of Tesla’s Gigafactory. It’s as local as the White Gum Valley housing project in Perth now trialling Power Ledger’s peer to peer trading platform based on the blockchain.

What is at question is whether the energy system can evolve quickly enough to get in front of this wave. It will require more than the Finkel Review’s 50 recommendations or new power system security frameworks by the Australian Energy Market Commission (AEMC) and Australian Energy Market Operator (AEMO) – although all those things will be vital.

Consumer outcomes will also rely on:

- a regulatory framework which fosters innovation – and not only in new energy markets but within network services also;

- Regulation that not only enables new choices for active customers but which also avoids leaving passive customers high and dry;

- Customer protection frameworks focussed on the reality of new energy services, the potential uptake of micro-grids and the rapid rise of embedded networks.

Fresh Thinking in Regulatory Approaches

These challenges are likely to require just as much fresh thinking in regulatory policy – as in energy businesses themselves. That analysis should be based on the real outcomes for customers in our energy markets. It should be led by market evidence.

A few years ago, Australia’s ‘hands off’ approach to energy markets looked like a good one – with a well-run gross pool energy market, an unbundled industry structure and some of the highest levels of retail customer churn in the world.

Looking at competitive energy markets today, the evidence indicates:

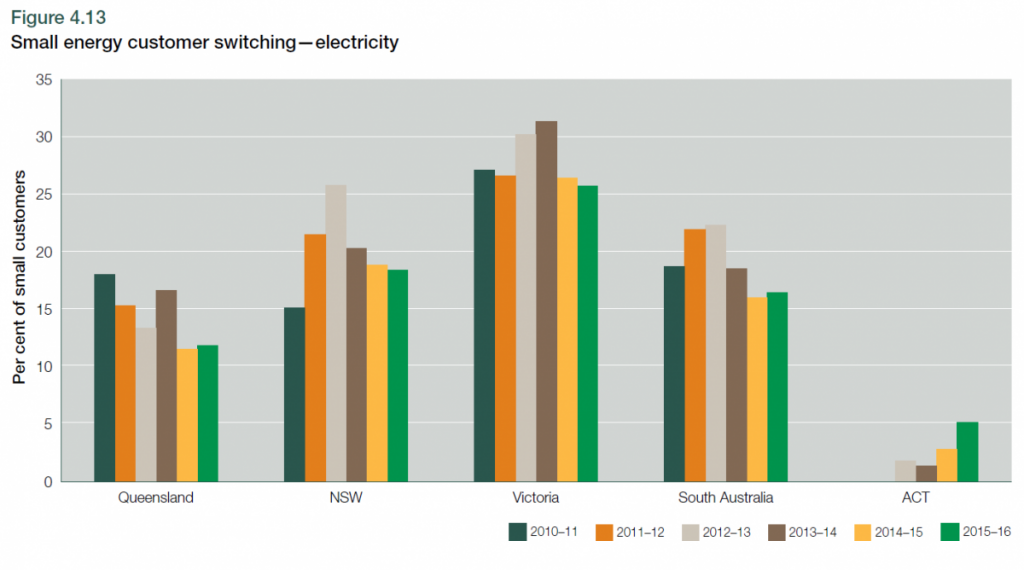

- a significant cohort of customers are not active – about half have not switched in the last 5 years and many of those have never switched supplier;

- switching rates have generally been flat or declining among small customers;

- an increased concentration of generation market share by the largest retailers at a time of significant wholesale price volatility.

- the breadth of retail offers are widening, along with the use of time-limited discounts.

The AEMC report on Tuesday appeared to welcome greater price dispersion as consistent with more competitive markets. It appears to us to be consistent with retailers taking a highly segmented approach to customer pricing.

There is sufficient evidence that these markets are punishing customers who don’t shop around or who allow their discount period to lapse. We know that two thirds of electricity and gas customers did not consider an alternative offer in the last 12 months[1].

We know that awareness of the AER’s excellent price comparison website Energy Made Easy website remains very low at 9%[2]. As recognised by customer advocates and Consumer Action’s Power Transformed project, behavioural economics also tells us that just providing more information and expecting customers to ‘work it out’ is not a solution in itself.

Source: AER State of the Energy Market Report, 2017, p. 145

The Need for Agile Networks

Why is the network industry concerned about whether competitive energy markets are effective? In short, because the capacity to transform energy networks in time to meet the needs of customers has been made vulnerable to what happens in competitive markets.

The Electricity Network Transformation Roadmap confirms networks can be the platform to unlock new energy services markets worth over $2 billion per year and more efficient network service delivery. Approximately $16 billion in network costs can be avoided by 2050, reducing network charges by 30%, but it will require both:

- foundational pricing reforms and incentives; and

- the ability to acquire firm ‘grid services’ from fleets of distributed energy resources being connected to the system.

The ‘lived’ market experience should inform regulatory policy being developed for a transformed energy system. Take two examples:

- Fair and efficient network tariffs hostage to imperfect retail marketsPolicy makers are currently relying on the benefits of network pricing reform being achieved by retailers marketing products based on new network tariffs to relatively inactive customers who are expected to ‘opt in’. This assumption needs a reality check based on the real world behaviour of retailers and customers.Despite the acceptance by COAG Energy Council, the AEMC, AER and diverse stakeholders of the benefits and desirability of cost-reflective network tariffs, they will not be delivered by relying on market actors in the current regulatory context. Many electricity distribution businesses provide some form of cost-reflective tariff, however take-up has been virtually non-existent in most jurisdictions. In its submission to the ACCC Retail Markets inquiry, energy networks have proposed potential solutions that recognise this reality.

- Outsourcing does not equate to efficiencyAustralian regulatory policy should be wary of freezing out networks from direct customer relationships to achieve network support outcomes in the Australian Energy Market Commission’s current contestability review. After all, networks have been using load control relays “behind the meter” for decades to manage network peaks through off-peak hot water energy storage. They have been incentivised to do this to save network customers money.As new fleets of demand response, battery storage, smart inverters or electric vehicles emerge, network service providers will have every reason to contract with an aggregator or intermediary where that’s cheaper or better for network customers. Where outsourcing is not cheaper or sufficiently reliable, why would policy makers want to compel a higher cost model that undermines the use of non-network solutions? Competition policy experts such as Euan Morton, Principal of Synergies Economic Consulting have previously warned the AEMC to avoid imposing higher costs on network customers based on a “bet” on future benefits for energy markets.Everyone agrees that networks, as regulated monopolies, should not be traders in energy markets nor should they be able to prevent customers – or their agents – using those same distributed energy resources (DER ) resources in competitive energy markets. That’s a given. However, those issues can be dealt with in ring-fencing and shared asset guidelines. They hardly require mandating the ‘contracting out’ of network use of DER services.In this world of UBER and disintermediation it seems odd that policy makers are considering forcing in an intermediary, such that networks would only be permitted to contract for DER services via an aggregator.In an energy market in which customers can be passive or prefer simplicity, it seems risky to require networks to contract through an energy services market which is not highly competitive.All procurement options should be left on the table, along with strong incentives to meet network customer needs at least cost.

Network Innovation Discussion Paper

The customer driven energy revolution which is currently underway will require electricity networks to become as agile as the technologies they connect. This week, it released a Discussion Paper on Network Innovation authored by Irina Umback.

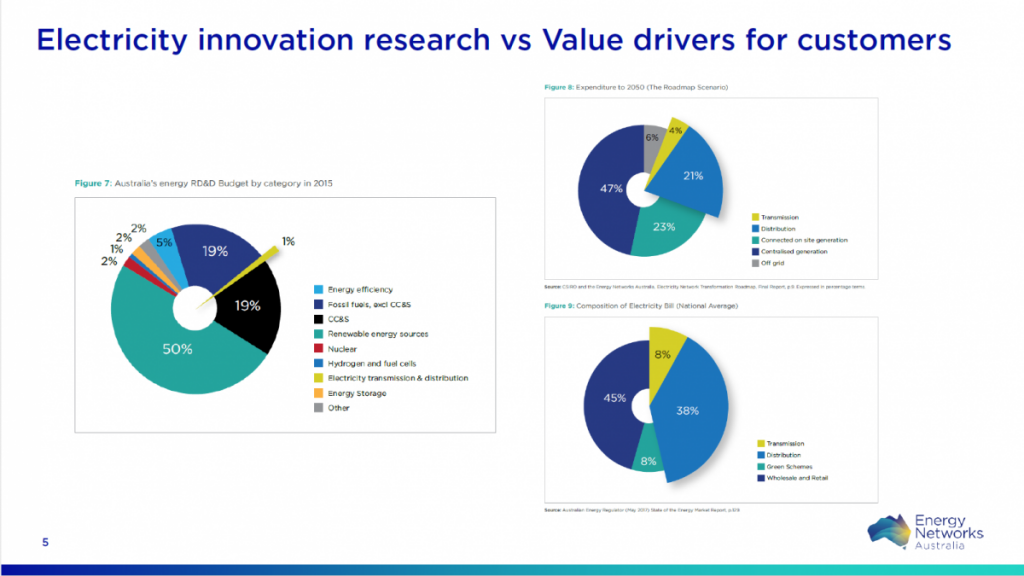

Australia’s research focus does not line up with the best international experience. For instance, the UK invests three times more on energy network innovation per capita despite being much more densely populated.

About 1% of Australia’s energy research budget goes into electricity grids, despite the grid representing up to half the cost of an average electricity bill and a quarter of future electricity system expenditure to 2050.

Australia has the opportunity to learn from international experience in fostering network innovation. In the UK, an independent evaluation of the Ofgem’s Low Carbon Networks Fund found the net benefits of the program were over 6 times the cost of the scheme. The UK energy regulator estimated that its network innovation scheme could achieve net benefits for customers of between £800 million and £1.2 billion when projects are rolled out by trialing companies and up to £8.1 billion if rolled out across Great Britain.

Continuing innovation in energy networks, through the integration of new technologies, smart grid applications, machine learning and ‘big data’ analytics can reduce long-term energy costs and provide a more stable, reliable energy system.

The Discussion Paper canvasses options for Australia to get on the front foot in network innovation and is part of a wider discussion our sector is pursuing focussed on innovation in energy networks.

Stakeholder feedback is sought on key questions in the Discussion Paper until September 26, 2017.