How will COAG enable a more connected future?

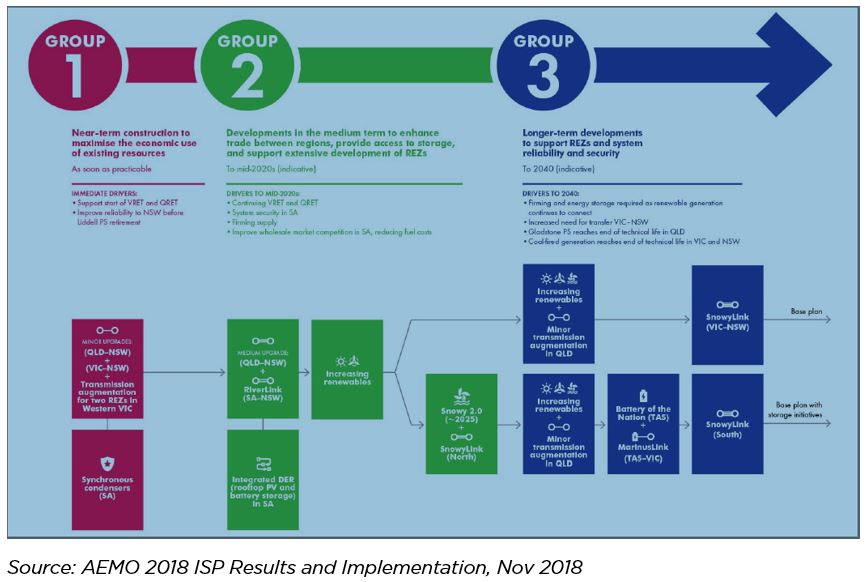

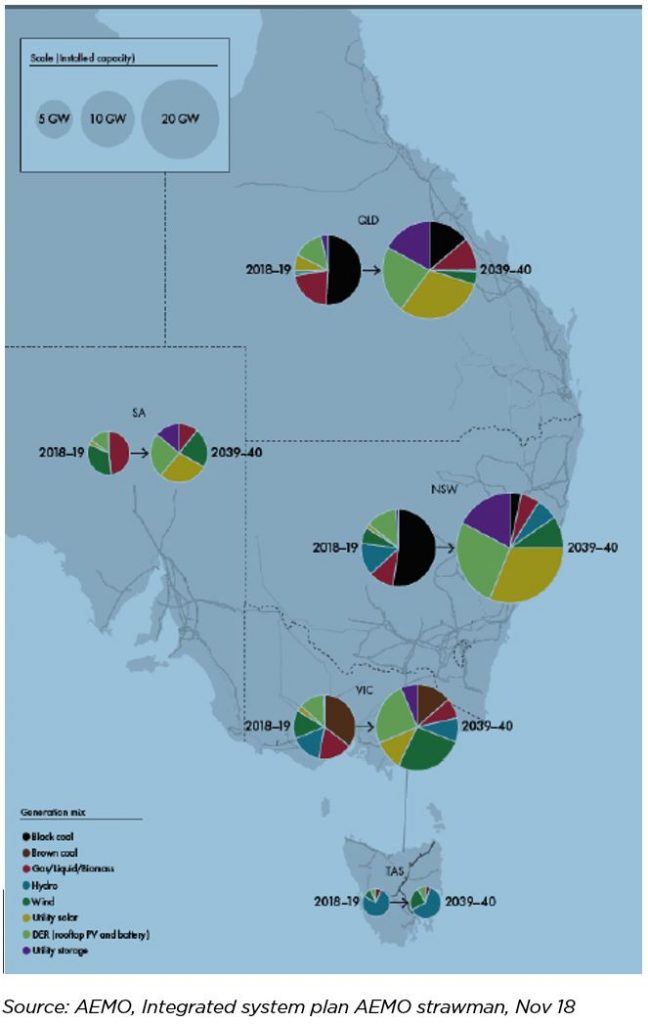

In July this year, AEMO released an Integrated System Plan (ISP) designed to better connect energy customers with the new generation and energy storage that will enter the system as coal-fired plant ages and is retired.

The market is undergoing enormous transformation. Coal generation plant that supplies the equivalent of all NSW demand is due to retire by 2035. An integrated system wide plan provides benefits of considering the economic impacts, but also the technical engineering challenges the power system will face with the changing generation mix.

Transmission is a critical enabler to transport new generation to the load centres and to ensure generation can be better shared across jurisdictions. South Australian experience highlights the need to anticipate the future power system needs to maintain reliability and system security.

In August, the COAG Energy Council asked the Energy Security Board (ESB) to consider how the ISP could be turned into an “actionable strategic plan”.

Further to instructions from its August meeting, in October the COAG Energy Council progressed the following:

- AEMO highlighted that additional measures are required to support future reliability including further transmission and interconnections;

- It was agreed there needs to be a focus on the ISP, with the ESB to develop an implementation plan and clear recommendations for actions, including any rule changes required for the December COAG meeting;

- theESB will further the draft Strategic Energy Plan presented on the overarching guidance on the operation and evolution of energy markets in Australia.

The ESB held workshops with a broad range of stakeholders in November to progress these issues and recommendations about how the current transmission planning and investment framework should be amended.

Ageing generation waits for no one and policy direction is needed out of next week’s COAG Energy Council meeting to facilitate the investment in transmission and generation that is required.

Governments need to be mindful that notice of generator closure rules do not guarantee that the generator is physically able to generate reliably at capacity, nor does it guarantee that the generator is commercially viable up to the expected closure date. Policy vacuums cannot continue, COAG should support the inclusion of an actionable ISP framework into the National Electricity Rules, preferably so that the next ISP, which AEMO is already working on, is under an appropriate rule governance framework.

We cannot risk the investment uncertainty that has resulted from the on again-off again National Energy Guarantee and proposed forced divestiture of energy generation assets. There just isn’t time for such indulgences.

Key Features of integrated system planning in the National Electricity Rules

It is important that the December COAG meeting provides direction to ensure that the integrated system plan is regularly updated and has an appropriate governance framework in the National Electricity Rules.

Network businesses support a planning framework that leverages AEMO’s national planning expertise, while ensuring that Transmission Network Service Providers’ (TNSPs) local knowledge, regional planning expertise and skills are leveraged to optimise project scoping and delivery and maintain clear accountability for regional transmission service outcomes. AEMO is well placed to develop an integrated co-optimised system-wide plan that considers the trade-offs in generation and transmission within the National Electricity Market.

The arrangements described below apply only to ISP projects, while the existing planning and investment framework continues to apply to all remaining network investments.

There are opportunities to streamline current projects so that stakeholder focus is on the national transmission and not on the business as usual safety and replacement projects. This could be done by increasing Regulatory Investment Test for Transmission (RIT-T) thresholds for certain projects without compromising efficient development and management of the transmission system.

Develop the Plan

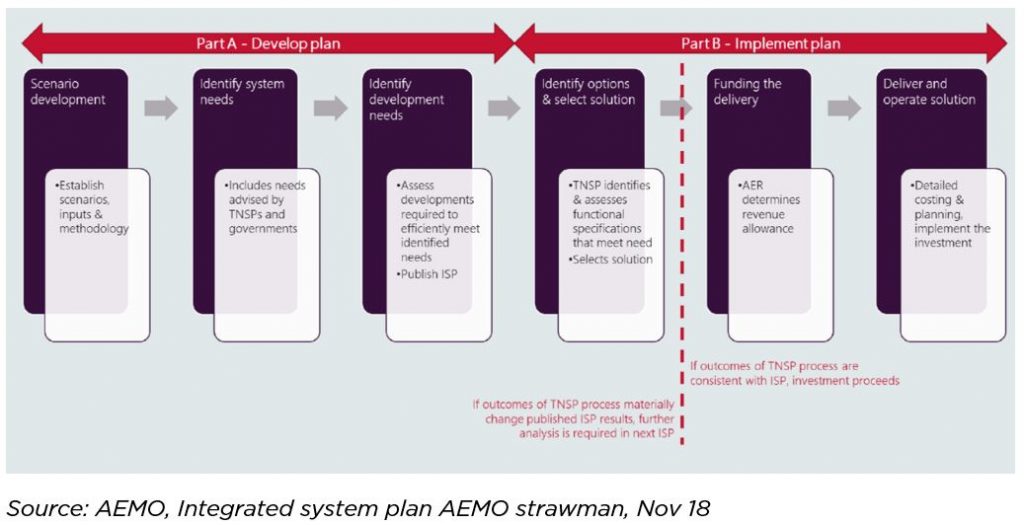

The framework must seek to co-optimise transmission network planning with both supply-side and demand-side. ISP projects are those that increase power transfer capability along national transmission flow paths and deliver material benefits across regions, or are otherwise nationally significant.

The aim is to provide a framework for genuine engagement with stakeholders, including TNSPs, non-network proponents and the AER, built on a collaborative approach to deliver an accepted transmission development pathway that will most efficiently support the ongoing transformation of the integrated electricity supply system.

A rules based ISP would provide a framework for AEMO to consider both network and non-network solutions to ensure they are in the long interests of consumers, with appropriate cost-benefit testing.

Rules consultation on all scenarios and inputs and on a draft ISP will also ensure transparency of the processes and how feedback is taken into account.

We also recommend:

- Requiring the ISP to be updated at least bi-annually to ensure that assumptions are updated as the market evolves and the plan has flexibility to deal with the transforming market.

- A transparent and comprehensive analysis in the ISP would result in identified actionable projects, so there is benefit in streamlining the RIT process for these projects to avoid duplication. For the avoidance of doubt, the RIT process would start at the project assessment draft report stage and still undergo public consultation and assessment of responses. Any disputes on the RIT process should be limited to matters progressed in the RIT and not revisit the project need identified by AEMO.

- More broadly, some ISP investments may require funding from multiple sources. Where there is external funding, then the ISP analysis needs to treat external funding in the same way as the RIT-T, so that these projects get included in the ISP (which is selecting projects based on maximising net benefits).

Implement the plan

- TNSPs undertake detailed options analysis on actionable projects based on the high-level specification set out in the ISP to determine the optimal solution to meet each of the identified needs set out in the ISP. Detailed options analysis should include consideration of alternate technology, sizing, routing and staging solutions for actionable projects, including any non-network options if identified in the ISP and incremental enhancements to existing plant.

- On completion of the regulatory investment process, AEMO confirms whether the outcome of the TNSP process is consistent with ISP identified need, the overall national network development and the assumed costs and benefits in the ISP. If the outcomes of the TNSP process are materially different, but AEMO considers the differences acceptable due to changes in circumstances or the TNSPs subsequent analysis, AEMO confirms that the outcome of the TNSP process is required.

- Once AEMO confirms the alignment with the ISP, TNSPs can proceed to seek a revenue adjustment from the AER. The AER approves the revenue adjustment for the projects and the TNSP contracts for a non-network solution and also can contract for components of a network solution.

Group 1 Projects

The 2018 ISP shows that there is a need for the Group 1 projects in the plan to be delivered in time for the Liddell closure and to manage risks of reducing generator reliability. Several Group 1 projects are progressing well through the existing regulatory investment processes, while other projects are not as well progressed and will deliver beyond the 2018 ISP’s preferred dates. Late delivery of projects could impact customer reliability and increase market costs. Using existing regulatory processes which are lengthy and sequential will not deliver the projects in time.

The 2018 ISP currently has no standing within the regulatory framework, meaning at this stage the ISP cannot be used to streamline these Group 1 projects under the existing framework without COAG support.

If COAG, with Energy Security Board (ESB) support, agrees the required project delivery dates precede what is possible under current regulatory processes, they may wish to act to streamline processes, on a case by case basis, to deliver projects in a timely manner.

This could allow the regulatory investment process to rely on the identified development need of the project in the 2018 ISP, allowing the regulatory investment process to start part way through. To be clear – TNSPs support effective stakeholder consultation and the completion of a robust cost-benefit test, even for projects that may need to be streamlined, to ensure investments deliver long-term benefits to consumers.

Procurement, design and delivery processes usually follow successful completion of the Regulatory Investment Test and approval of the contingent project application. These detailed planning processes could be bought forward with part government funding and state governments could also facilitate more timely planning approvals processes. Earlier engagement of the AER in the regulatory investment process could allow more timely assessment of compliance with the process and the subsequent revenue determination for the project.

The reality is that the current incremental transmission planning process is not well suited for the transformation of the energy market to renewables.

The effective planning of our energy system requires decisions by the COAG Energy Council. Hopefully politics can get out of the way and talk can become action.