Lowering the limbo bar: the impact of record low inflation and interest rates

Last week, Commonwealth 10-year bond yields hit historic lows of less than 1.3 per cent. With more than $10 trillion of global government debt trading at negative yields, there is every possibility they could head lower into the future. This is especially the case since inflation in the March quarter was recorded at precisely 0 per cent, bringing annual inflation to just 1.3 per cent.

Australia’s system of setting network charges was designed during very different conditions than the ‘New Normal’ of the post-Global Financial Crisis period.

How does the combination of historically low bond rates and near zero inflation test and flow through key parts of this system?

Look out below – falling yields and contribution to lower network charges

A major part of energy network charges reflects the need to provide an appropriate cost of funds for investments in existing poles, wires and distribution pipelines that provide energy and critical grid access to customers.

Regulators such as the Australian Energy Regulator typically build these regulatory return estimates on a “base” of what is called the ‘risk-free’ rate – and have used the 10-year government bond rate in setting this risk-free rate.

The logic is that investors will require a premium over the risk-free rate to attract investment compared with the safe alternative of investing in a government bond, which is backed by all the taxation and monetary powers available to sovereign governments through time.

Under the AER’s current approach, the regulatory return on equity for investors is set in each five-year network pricing decision by adding a risk premium of 3.66 per cent to an average of recent yields of 10-year government bonds. In the past this risk premium has been higher.

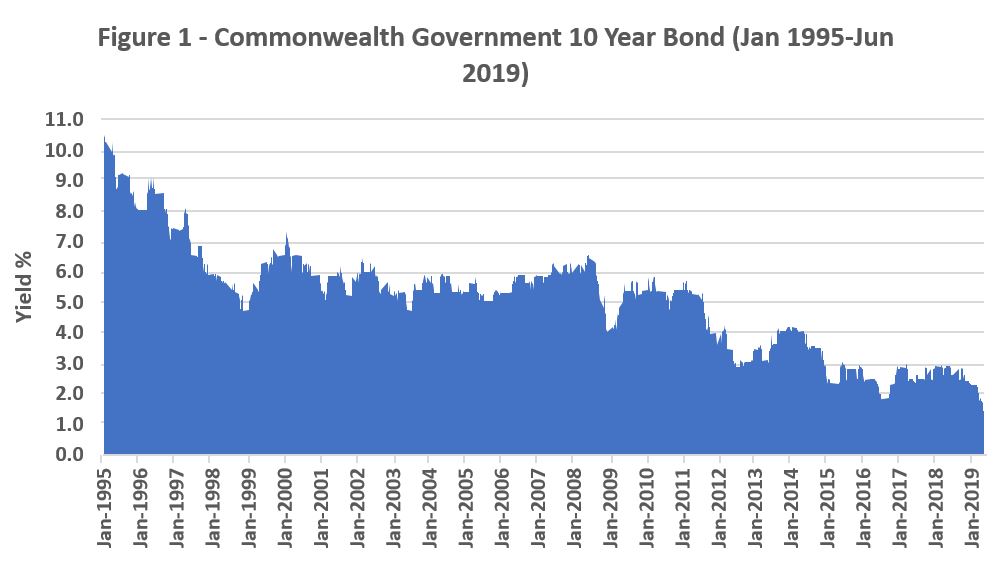

What is evident from Figure 1 below is that for much of the past 25 years, government bond yields have been systematically falling and in the post-Global Financial Crisis period, have decisively broken downwards.

Source: RBA

Through decisions over the past several decades this trend has meant a significant downward pressure on network charges, to the direct benefit of current customers.

Commonwealth 10-year bonds hitting 1.3 per cent means that expected regulated equity returns on existing and future network investments would be less than five per cent, about half the level of a decade ago. As a point of comparison, five per cent is about the same return that a government-guaranteed term deposit yielded in 2012.

This combined movement to lower regulated equity returns and low bond rates produces some counterintuitive effects. These include allowed returns on equity falling just below allowed returns on debt in the AER’s recent final determination for New South Wales electricity distributor Ausgrid. That is, the current approach effectively assumes shareholders, with only an uncertain residual claim to any profits, require lower ongoing returns than debt providers, who possess all the certainty of legally enforceable and secured debt contracts.

Lower bond rates in the future could well see this situation occur more frequently, posing ongoing challenges to efficient investment and the basis of the current model.

Mind the gap – low inflation, targets and expectations

Meanwhile, low inflation has also emerged as a significant new factor for consideration.

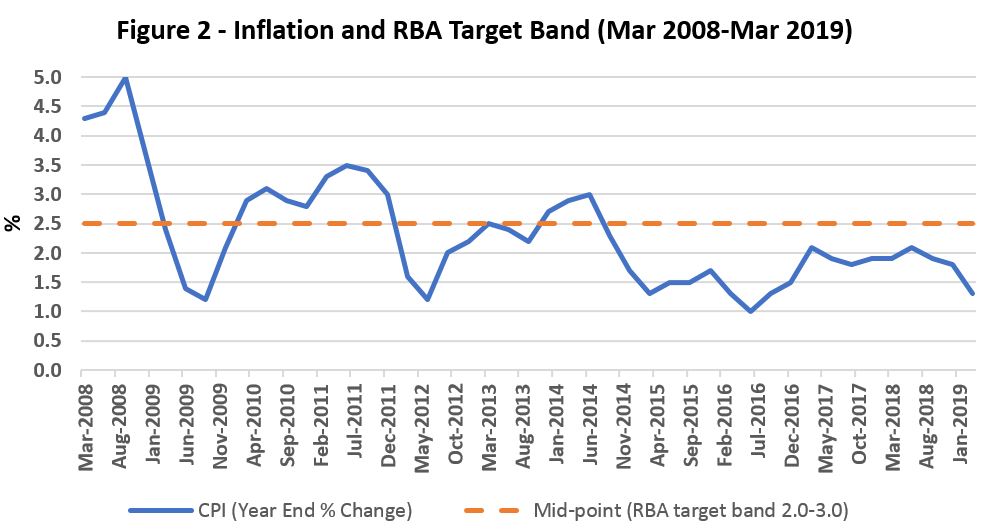

Recent weak inflation data for the Reserve Bank has led to an active policy debate about the effectiveness of the current ‘inflation targeting approach’. The Reserve Bank of Australia presently seeks to achieve a medium-term target range of 2-3 per cent over time.

The existing regulatory approach adopted by the AER for forecasting future inflation relies heavily on an assumption of the RBA achieving, on average, the mid-point of this range over time. While up to relatively recently this matched what had actually happened, this is no longer necessarily the case (See Figure 2). In fact, inflation (or the Consumer Price Index) has averaged below 2 per cent for the past decade.

Source: ABS

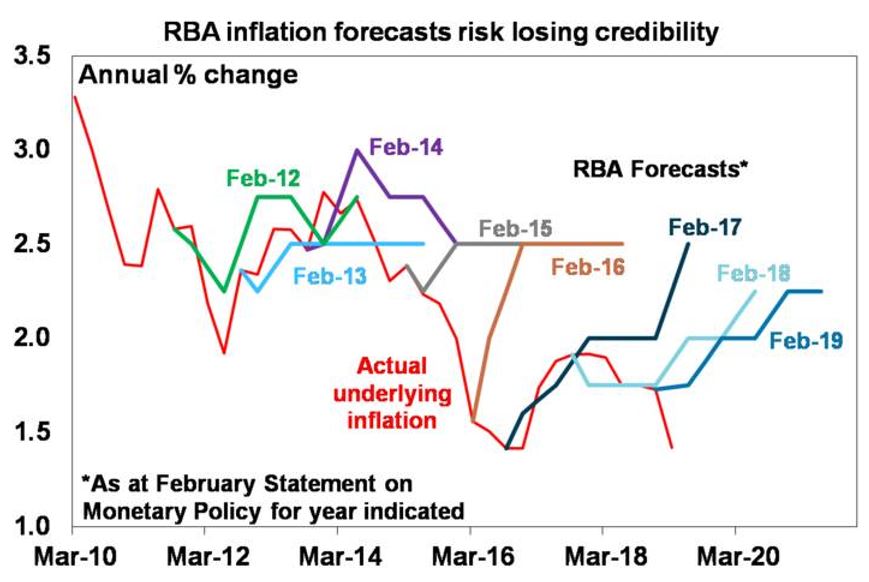

As Figure 3 shows, Reserve Bank forecasts have consistently projected a return to the two to three per cent inflation target band, while actual inflation has continued to track to decade lows. The RBA has recently been reviewing the performance of its forecasts and has highlighted the underestimation over recent years.

Figure 3 – The Way Back to Normal?

Source: AMP Capital

One of the impacts of the AER’s approach of heavy reliance on RBA estimates is that a significant gap has emerged between the level of inflation assumed in regulatory decisions and that actually occurring.

A perverse result of this flowing through the current regulatory models is that networks undertaking capital investments today cannot count on receiving even the recently lowered levels of regulated returns set by the AER in its December 2018 binding guideline.

In effect, the risk is that the RBA’s lack of capacity to return underlying inflation to its target band for much of the past five years is now unintentionally creating the wrong investment signals.

Adjusting to a ‘New Normal’ financial world?

The AER reviewed its approach in 2017, at a time in which the RBA expected a rapid bounce-back in inflation towards the target band.

Recent RBA forecasts now project further delays in reaching the very bottom of the inflation target band and markets now expect a further lowering of cash rates. This is occurring amid open discussion about the potential introduction of extreme forms of monetary policy easing.

The identified danger for central banks around the world is that it may be far easier to curb inflation than to create it. If true, this suggests the risks of perverse investment signals may be persistent, just at a time when major new network investments to support new renewable generation and more interconnected markets is critical.

If current conditions are signalling a ‘new normal’ then it may be that regulatory settings will need to reconsidered, to avoid distorting future investment outcomes in a way that has the potential to harm customers.