Stakeholders reject abolition of merits review of regulatory decisions

Stakeholder submissions to a COAG Energy Council review of the Limited Merits Review regime have overwhelmingly rejected the abolition of the regime.

An option to abolish the regime and rely only on judicial review has not been endorsed at a public forum or in the submissions of diverse stakeholders. The COAG Energy Council initiated the review after its 19 August 2016 meeting and provided stakeholders with four weeks to respond to four potential options, ranging from no change; reform of the current scheme; to its abolition.

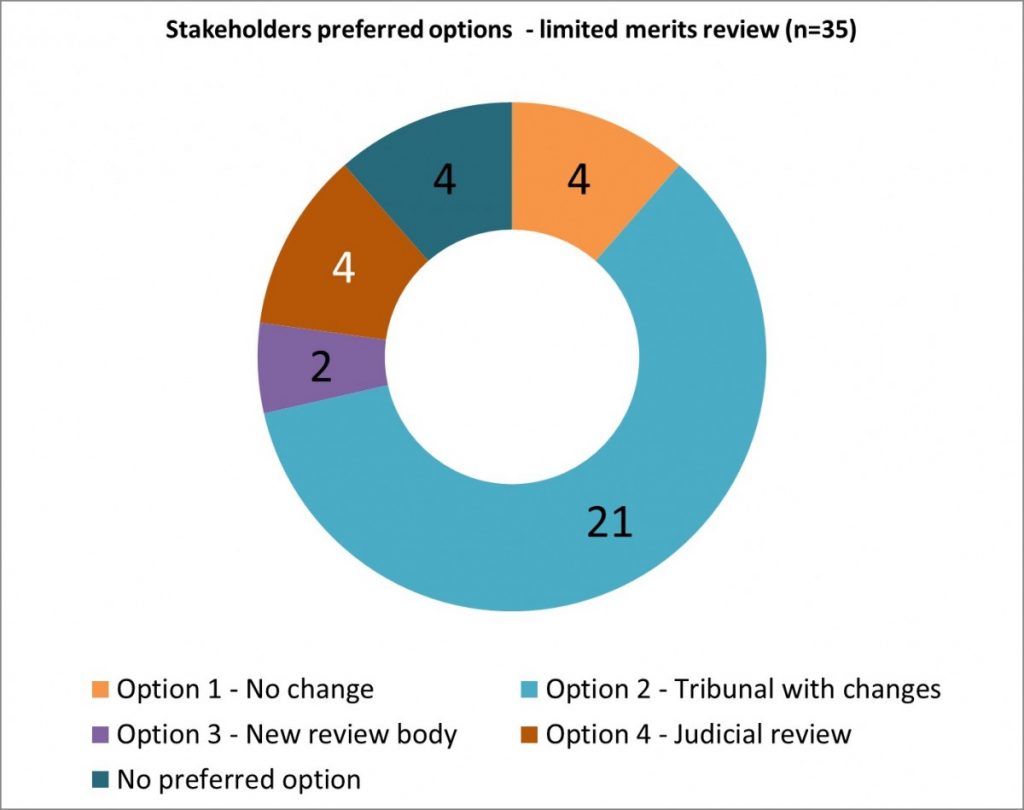

Approximately 35 diverse stakeholders from consumer groups, policy experts, industry participants, investors and regulators made public submissions. Their preferred options are summarised in Figure 1 below.

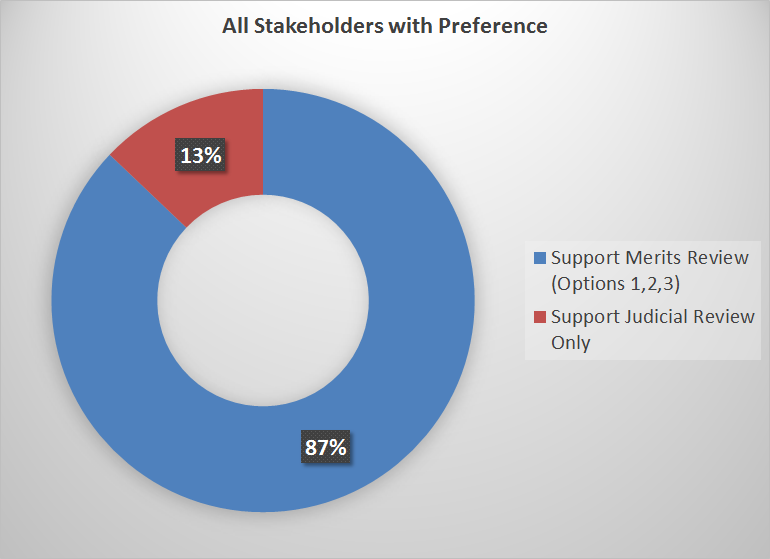

Of the 31 parties who expressed a preference, more than eighty percent supported the retention of Limited Merits Review, with over two-thirds in favour of targeted reforms to the current review process administered by the Australian Competition Tribunal. Only four organisations (or 10%) supported the abolition of merits-based review and reliance on judicial review alone, including the Australian Energy Regulator (AER) itself. In fact, more stakeholders supported no change or expressed no preference, than endorsed the AER’s request to remove merits accountability for its determinations.

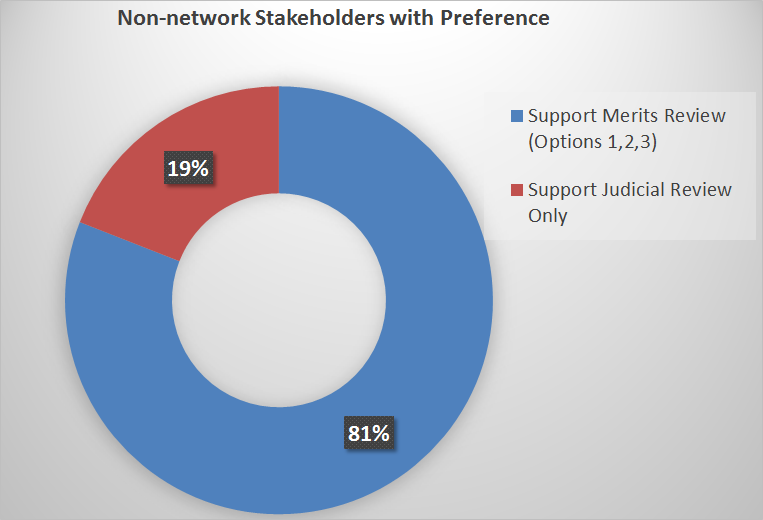

If the submissions of ten network industry representatives are excluded, the picture does not change significantly. In fact, there was more support among non-network stakeholders for “Option 2” (reform to the current regime), than all of the other options combined.

Common ground in evidence on potential reform options

There was also significant common ground across stakeholders on possible reform options:

- A range of consumer, regulator and industry voices supported the greater role of ‘expert peer review’ processes and better use of expert input in decision-making processes.

- A number of groups, including consumer groups and industry, supported further examination of the use of binding industry-wide rate of return determinations as a mechanism to reduce the potential for multiple overlapping appeals. These approaches already apply in New Zealand. Both the network sector and the WA Economic Regulation Authority (WA ERA) emphasised the importance of binding determinations of this kind to be reviewable on the merits, as they are in New Zealand, to ensure accountability and provide for the best possible decision.

- A range of parties, including networks, also pointed to the potential to increase financial thresholds applying to appeals as a workable and proportionate response to any concerns on the frequency and nature of appeals to date.

Long-term interest of consumers in accessible merits review mechanisms

A consistent point of discussion throughout policy debate has been the contribution of availability of merits review to the long-term interest of consumers. Consumers have a direct interest in a workable, efficient and timely merits review regime. It allows correction of material errors and supports the quality of regulatory decision-making. The Public Interest Advocacy Centre and others have pointed out that the abolition of the LMR regime would remove the rights of consumers and their advocates to challenge the merits of AER determinations. Energy Consumers Australia also indicated concerns in this regard, whilst not reaching a definitive landing on reform measures.

Securing investment confidence and low financing costs for lower customer bills

Investors indicated that access to limited merits review was important to confidence in regulatory certainty. For instance, Commonwealth Bank, Westpac, Queensland Investment Corporation, Hastings Funds Management, Magellan Asset Management and Investors Mutual all submitted in favour of retention of the regime. (ANZ and Lazard made confidential submissions.) The advice from investors reinforced findings from a previous Royal Bank of Canada investor survey provided to the review indicating 85 per cent of investors considered merits review to be crucial in ensuring accountable and transparent decision making by the AER.

Analysis by the Energy Networks Association has identified quantifiable risks if the regime causes re-evaluation of capital funding costs in a sector with over $44 billion of existing private investment and annual debt financing requirements of over $7 billion. For instance, a mere 5 basis point (or 0.05%) addition to the existing weighted average cost of capital from increased perceptions of regulatory risk would lead to an increase in financing costs of approximately $250 million over a five-year regulatory period. A rating agency downgrade of the sector could impact debt margins by 20 basis points and increase costs to customers by around $1 billion over a five-year period.

Avoiding poor decisions, made quickly

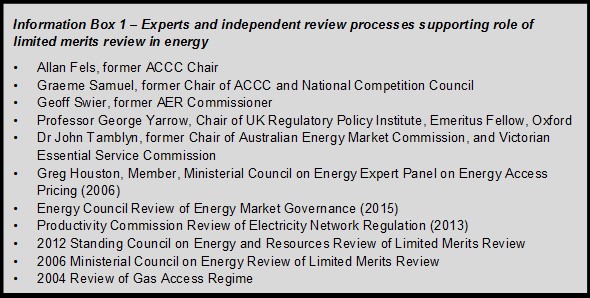

A common thread in a range of voices and perspectives through the review has been the need to make careful decisions based on all the evidence. This was emphasised by a combined opinion – from former AER Commissioner, Mr Geoff Swier, former ACCC Chair, Graeme Samuel, and two members of a previous Ministerial Expert Panel on Energy Access Pricing – that currently no case has been made for removal of Limited Merits Review, or actions beyond targeted reforms. These voices add to an already long list of expert public policy, competition figures, past regulators, who have direct experience with merits review, and independent reviews that have supported the continued availability of merits-based review (See Information Box 1).

International experts have also provided strong views to the COAG Energy Council review, including Sir Derek Morris, former Chair of the UK Competition Commission, the primary appeal body in the United Kingdom. He observed:

Given the critical importance of an effective merits review regime to business and consumer confidence, and economic growth, the proposal to switch off merits reviews entirely is, in my mind, simply untenable from the standpoint of good public policymaking. There are many successful models that could be adopted from around the world, of which the UK is one, none of which impose overly burdensome costs on society.

Many stakeholders expressed concern that the review was being conducted prematurely (before the final outcomes of the remitted AER determinations were made) or expressed concern the timetable for the review was too brief. For instance the ECA submission noted that “[w]hile it is clear to ECA that the LMR regime is not performing as intended, it may be premature to conclude that LMR cannot work.” The combined opinion from Professor Graeme Samuels AC and others stated:

Since the AER is still to remake its determinations in light of the Tribunal’s findings, at this stage it cannot be said that either:

- the outcome of the current process will, or even is likely to, result in ‘cherry picking’; or

- the current process will not give sufficient consideration to whether there is a materially preferable decision that is in the long term interest of consumers. In its still-to-be-remade determination, the question of whether a different decision would indeed be materially preferable remains with the AER, supported by guidance from the Tribunal as to particular linkages that it believes should be considered in that process. (page 4)

It is relatively unusual in Australian energy policy debates to see the consistency of opinion that is present in the submissions to the Review of the Limited Merits Review regime. There is widespread support for reform of the current regime, yet widespread rejection of proposals to abolish the regime in favour of Judicial Review only.

The retention of accessible merits review is important to consumers, industry participants and the providers of debt and equity for long-life infrastructure. All parties have an interest in ensuring robust regulatory decisions, which should ensure that consumers pay no more than necessary for the services they value.

The report of the Limited Merits Review regime is scheduled to be considered by COAG Energy Council Ministers in December. Given this meeting will also discuss the preliminary advice from the Finkel review of energy security, it’s hoped the link between a stable, high quality regulatory regime and affordable, secure energy supply for customers remains front of mind.