Will US tax credits eat Australia’s hydrogen lunch?

The US’ Inflation Reduction Act[1] (IRA) contains $US369 billion worth of tax credits and funding for clean energy and climate change measures. The bill also includes measures for the US health system and for drought resilience, but almost 85 per cent of the investments are related to clean energy and climate change.

President Biden signed the bill on 12 September 2022[2].

The Act is the single largest and most ambitious investment in the ability of the United States to advance clean energy, cut consumer energy costs, confront the climate crisis, promote environmental justice, and strengthen energy security, among other vital provisions that will lower costs for families, reduce the deficit, and grow and strengthen the economy.

Energy Security and Climate Change Actions

The measures announced in the IRA aim to cut an additional 1 billion tons of emissions in 2030, putting America’s 50 to 52 per cent emissions reduction target within reach and making substantial progress toward President Biden’s goal of 100 per cent carbon pollution-free electricity by 2035[3].

Funding[4] has been assigned to the following areas:

- $US196 billion to carbon free energy (focused on renewable and nuclear electricity),

- $US23 billion to transportation (focusing on electric vehicles and infrastructure),

- $US17 billion to clean energy including tax credits and funding for direct air capture and hydrogen, as well as funding for sustainable aviation fuels,

- $US71 billion to manufacturing, and

- $US61 billion to non-energy related emission reduction opportunities (ag agriculture).

Other complementary funding is also assigned from acts such as the Infrastructure Investment and Jobs Act. For hydrogen, the main incentives are the tax credits for renewable electricity and for hydrogen production facilities.

Hydrogen tax credits

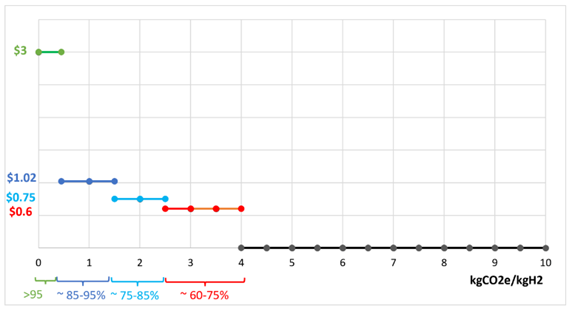

The Act introduces tax credits for clean hydrogen production. The base credit is $US0.60 per kilogram of hydrogen produced, so long as the carbon intensity is within the range of 0 to 0.45 kg CO2-e/ kg H2[5]. This base credit reduces as the emission intensity increases and cuts off when carbon intensity exceeds 4 kg of CO2-e/kg of H2. A well-to-gate approach to measure the lifecycle emissions is mandated.

The credit increases to five times the base credit if Wage and Workforce Requirements are met[6] . To meet these requirements[7], laborers and mechanics must be paid wages at not less than prevailing rates as determined by the Secretary of Labor and apprenticeship requirements need to be met.

What this means is that a tax credit of $US3/ kg hydrogen could be available for hydrogen with low emission intensity meeting local workforce requirements. The adjustment of credit with emission intensity is shown below.

Figure 1: Production tax credit in $ per kilogram of hydrogen produced relative to the carbon intensity of the produced hydrogen (assumes wage requirements are met) (Source: www.nrdc.org[8])

For facilities to be eligible, construction must occur before January 1, 2033, and credits can be claimed during the first 10 years of operation[9].

Green hydrogen cost competitiveness

Separate to the IRA, the US DOE[10] has a $US 1/kg target for clean hydrogen by early 2030s.

Figure 2: The US Department of Energy’s Hydrogen Shot—seeks to reduce the cost of clean hydrogen by 80 per cent to $1 per 1 kilogram in 1 decade (“1 1 1”).

Separate analysis by the Rhodium Group[11] on the impact of the IRA found that green hydrogen produced from utility-scale solar in the United States could cost $0.39 per kilogram in some regions by 2030, while natural gas-produced hydrogen prices could range from $0.99 to $1.54 per kilogram. Clearly, the IRA measures do not consider the innovation leading to further cost reductions as per the DOE research on hydrogen and fuels cells.

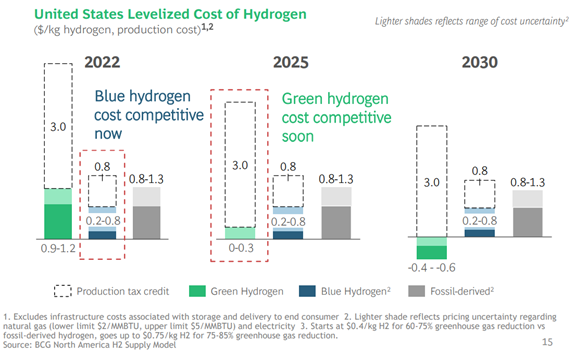

BCG illustrates the impact of the IRA on the cost of green hydrogen, and its immediate competitiveness as a preferred source of hydrogen.

Figure 3: US Levelised cost of hydrogen with IRA tax credits (Source: BCG, 2022[12])

This shows that both green and blue hydrogen become cost competitive with fossil derived hydrogen simply from the introduction of the tax credits. By 2025, the tax credits effectively make fossil derived hydrogen uncompetitive and by 2030, the tax credits outweigh the total production cost of green hydrogen. This by itself is an interesting outcome from a tax credit.

How will this work out

The price trajectory shown in Figure 3 would lead to hydrogen users switching to the greener option as it is lower cost and avoids the greenhouse gas emissions. It also presents a strong signal to fossil fuel hydrogen producers to switch to a lower cost production of hydrogen.

Any tax credit is limited though. If the total $US 17 billion from the IRA to clean energy is allocated to tax credits and if the maximum tax credits were obtained, this would lead to a total of 5.7 million tons of green hydrogen produced[13]. If this was allocated uniformly over the 10-year period of crediting, the IRA would support 570,000 tonnes of green hydrogen a year. The US consumes around 10 million tonnes of hydrogen a year in its oil and gas sectors and for chemicals and manufacturing.

Some switching will occur from the tax credits. However, in the absence of the DOE Hydrogen Shot, the production of green hydrogen in 2030 will still be between $US 2.40 and $US2.60/ kg, once again exceeding the cost of fossil derived hydrogen. It is unclear how the green hydrogen industry would be supported at that stage or if switching back to fossil fuel hydrogen would occur.

Implications for Australia

The US, Australia, the Middle East and other countries are developing their hydrogen industries for both domestic supply and export opportunities. The additional incentives from the IRA may lead to increased investment in new hydrogen production plants in the US. This combined with other major international developments (e.g. the EU installing 6 GW of electrolysers by 2024[14] and the production of 1 million tonnes of hydrogen) places additional pressure on hydrogen electrolyser manufacturers. While this is welcome news for that sector and the hydrogen industry in general, it could disadvantage smaller countries that aren’t able to offer similar sized contracts.

Australia’s largest electrolyser is at 1.25 MW capacity[15] and plans are underway for 10 MW electrolysers with the first one expected to be completed in the Pilbara, WA, in early 2024[16].

For Australia to be an international player, suitable policies need to be introduced to support a rapid scale from 10 MW to a capacity that is competitive with the US and Europe.

While the IRA-supported hydrogen would be cheaper than that produced in Australia, the scale of production limited by the total amount of tax credits would likely see it replace fossil derived hydrogen in the US and make it unlikely to become part of the international market. The role of the IRA in facilitating hydrogen projects in the US may however lead to it gaining a commercial advantage and becoming a preferred international hydrogen producer.

Policy considerations

The tax credits in the IRA provide an immediate incentive that makes green hydrogen commercially competitive. Scaling up production and gaining experience from building and operating hydrogen facilities and markets will reduce overall costs. In parallel, ongoing investment in R&D should commercialise new technologies leading to further cost reductions. While the tax credits create additional benefits through local jobs, they are a blunt instrument and do not directly help green hydrogen production become cost competitive with its fossil fuel incumbent. A technology focused incentive that provides long term support for early market entrants and that can be adjusted with technology improvements may offer a better solution.

Australia has made significant investments in hydrogen research and development and governments around the country are providing grants and/or financial incentives towards hydrogen production facilities. Additional policy will be needed to drive the demand of hydrogen including certification of hydrogen, the development of a renewable gas target and hydrogen purchase agreements from government operations to replace natural gas loads.

[1] https://www.democrats.senate.gov/imo/media/doc/inflation_reduction_act_one_page_summary.pdf

[2] https://www.federalregister.gov/documents/2022/09/16/2022-20210/implementation-of-the-energy-and-infrastructure-provisions-of-the-inflation-reduction-act-of-2022

[3] https://www.wri.org/insights/inflation-reduction-act-benefits

[4] BCG (2022), US Inflation Reduction Act: Climate & Energy Features and Potential Implications, https://media-publications.bcg.com/BCG-Executive-Perspectives-US-Inflation-Reduction-Act-16August2022.pdf

[5] https://www.weforum.org/agenda/2022/08/why-the-u-s-inflation-reduction-act-is-an-important-step-in-the-transition-to-clean-energy/

[6] https://www.mossadams.com/articles/2022/08/inflation-reduction-act-clean-energy-credits#section-45v

[7] https://www.kslaw.com/news-and-insights/hydrogen-related-provisions-of-the-inflation-reduction-act-of-2022

[8] https://www.nrdc.org/experts/rachel-fakhry/ira-hydrogen-incentives-climate-hit-or-miss-tbd

[9] https://www.mossadams.com/articles/2022/08/inflation-reduction-act-clean-energy-credits#section-45v – note that facilities under construction before 1 January 2023 may also be eligible based on when the production of hydrogen commences.

[10] https://www.energy.gov/eere/fuelcells/hydrogen-shot

[11] https://www.atlanticcouncil.org/blogs/energysource/the-inflation-reduction-act-will-accelerate-clean-hydrogen-adoption/

[12] BCG (2022), US Inflation Reduction Act: Climate & Energy Features and Potential Implications, https://media-publications.bcg.com/BCG-Executive-Perspectives-US-Inflation-Reduction-Act-16August2022.pdf

[13] $US17 billion divided by $US3 leads to 5.7 billion kg of hydrogen, which equals 5.7 million tons

[14] https://ec.europa.eu/energy/sites/ener/files/hydrogen_strategy.pdf

[15] https://www.australiangasnetworks.com.au/hyp-sa

[16] https://arena.gov.au/news/australias-first-large-scale-hydrogen-plant-to-be-built-in-pilbara/