They said what? AEMO’s Integrated System Plan submissions

While the National Energy Guarantee dominates media coverage, AEMO’s Integrated System Plan could have a greater impact on the long-term structure of our energy supplies. We take a look at what the sector is saying in submissions to the consultation paper.

As the month of April speeds along, the development of the Australian Energy Market Operator’s (AEMO) inaugural Integrated System Plan[1] (“the Plan”) continues full steam ahead.

AEMO’s objective is to deliver a first-best strategic infrastructure plan by the end of June 2018[2]. This Plan, based on sound engineering and economics, aims to facilitate an orderly energy system transition under a range of future scenarios. Particular emphasis is being placed on: (a) What makes a successful renewable energy zone[3] (REZ) and, if REZs are identified[4], how to develop them, and (b) transmission development options in applying ‘a least regrets’ approach.

The background

A key priority in the development of AEMO’s June 2018 Plan is its engagement with and consideration of input from stakeholders. AEMO last week published most stakeholder submissions (about 70), having commenced a two-phased consultation process in December 2017.

This article examines some[5] of those submissions to provide insights, draw key themes and identify other stakeholder perspectives in what is potentially a game-changing document for the National Electricity Market (NEM).

High-level AEMO Precis

There was overwhelming support in the submissions for the development of the Plan as a long-term strategic approach to co-ordinate generation and network planning for the NEM. A number of important themes identified by AEMO include:

- The need for future power system resilience to impending transformational changes in supply, consumer choices, technology, and (more-extreme) climate.

- A strong desire for transparent and robust planning that considers total end-to-end requirements, with consumer interests[6]a priority.

- Strategic planning that builds operational resilience with strong consideration of system security, reliability, and the total bill for consumers.

- Managing potential early retirement of coal-fired generation[7].

- A polarised view on network development and the role of the Australian Energy Regulator’s (AER) Regulatory Investment Test – Transmission (RIT-T) (see below).

- Opportunities and incentives for, and the role of, Distributed Energy Resources (DER).

The renewables and generation connections challenge

As the energy transformation evolves, the challenge for the NEM is how to optimally connect, forecast, and develop an integrated power system that can facilitate affordable, variable and dispatchable[8] forms of generation in non-traditional areas without compromising system reliability and system security.

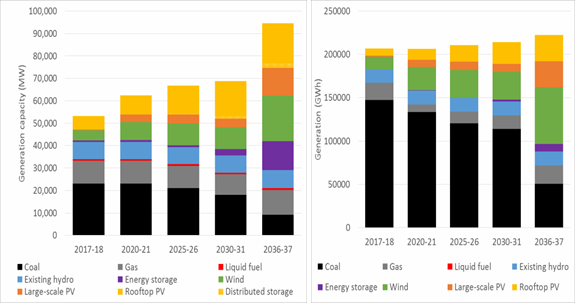

Below is an extract from AEMO’s Consultation Paper (Figure 9, page 29), that provides preliminary sub-period projections of NEM generation capacity (left) and generation output (right), under a neutral scenario over 20 years.

The challenge to achieve optimal outcomes in the intervening decades to 2037 requires an examination of the following issues:

The existing regulatory framework

While it’s the enactment of a Finkel Review recommendation, at this stage, AEMO’s Plan has no clear regulatory status. This is an opportunity to embed a ‘circuit breaker’ to re-evaluate the capability of the RIT-T (a cost-benefit economic test constrained to assessing the electricity market[9]) and facilitate flexible, agile systems.

The AER’s submission sees the plan as “an extension rather than a substitute for the RIT-T” process and “should be complemented by joint planning between AEMO, the TNSPs, DNSPs, and where applicable, non-network service providers”.

There are, as to be expected, multiple views. The likes of AGL, ACA Low Emissions Technology, Delta Electricity and Engie suggest that new technologies, flattening demand and policy uncertainty may challenge the need for long-lived (network) assets. They want to retain the RIT-T as is, ostensibly shielding consumers from uneconomic network investments as consumers ultimately underwrite regulated investments. The Australian Energy Council (AEC) agrees, suggesting the Plan “should foreshadow not mandate transmission investment of a national character”. The lack of a consumer benefit test in the RIT-T (it’s a net market benefit test) led others such as the NSW Government to offer a different perspective. Advocating for a streamlined RIT-T process, which can assist to unlock the generation project pipeline gridlock and put downward pressure on retail prices. It also identifies three important energy zones.

The Clean Energy Council[10] (CEC) is squarely in this camp, stating:

“[The] RIT-T is ill-suited to large, strategic, co-ordinated investments … It is not suggested for the RIT-T to be abolished. However, an alternative model should be established for when the RIT-T does not deliver, as is the current experience … The RIT-T should not interfere with the strategic transmission investments for the implementation of REZs or the scope of the ISP”.

Snowy Hydro’s position is interesting. It argues that a ‘strategic’ transmission Investment may not require a RIT-T to be undertaken, but have the TNSP competitively source the delivery of the project. UPC Renewables Australia argues, “doing nothing is a significant risk to consumers”.

AEMO’s challenge is to take into account: (1) The development of the concurrent National Energy Guarantee and (2) The Australian Energy Market Commission’s (AEMC) Coordination of Generation and Transmission Investment Review. The latter is likely to examine whether generation investment or transmission investment through REZs should take precedence r going forward. Unsurprisingly, advocates for generation include the AEC and AGL, while AusNet Services and the CEC are pushing for a more transmission-led investment framework.

The free-market versus centralised planning ‘balance’

Since its inception in 1998, the NEM’s most important features are the basic tenets of competition, de-centralised decision-making and network monopoly regulation.

Fans of Milton the Monster will recall the importance of proportion to getting a formula exactly right; too much of one thing and not enough of the other makes for a rather ineffective, imbalanced beast.

The challenge for the Plan is to get a practical and optimal balance between collaborative and coordinated approaches among NEM participants and profit driven imperatives.

Will the Plan’s balance be right?

“Six drops of the essence of terror. Five drops of sinister sauce …

Now for the tincture of tenderness,

But I must use only a touch …”

Getting generators to co-operate … crucial to the Plan’s success?

To date, getting prospective generators, which are driven by natural profit tendencies, to cooperate within confidentiality constraints has been a fraught process. This was exemplified during the AEMC’s deliberations and findings on the minimalist Scale Efficient Network Extensions rule change proposal during 2010 and 2011.

AusNet Services suggests that a facilitation of generators is required. The AER similarly argues the “attractiveness [of REZ’s] is contingent on multiple parties making investment decisions [and] there will be benefits in coordinating private investment”. Origin Energy’s Stage 2 submission proposes AEMO facilitating:

“working groups between generation and transmission businesses to examine the identified REZs. It is difficult to justify the development of a Renewable Energy Zone without the backing of renewable energy proponents and this process could provide the economic justification with which to seek a RiT-T. Organising multiple generators to connect within a zone has the potential to lower connection costs and reduce the risk of stranded assets which would result in better financial outcomes for consumers”.

However, this will remain a high hurdle. AGL states that

“The drivers of new generation build will continue to be wholesale market price signals and settings that are exposed to investment risk”.

An important issue that most stakeholders agree on is the need to get an optimal sequencing of potential projects, from a whole-of system perspective. Diverse, varied stakeholders, including the Clean Energy Finance Corporation, the South Australian Council of Social Service (SACOSS) and the CEC, agree.

Entrepreneurial opportunities

A number of entrepreneurial opportunities were outlined in various technologies including: High Voltage Direct Current (HVDC) (UNSW, and Siemens (potentially for QNI)), as well as better utilisation of transmission lines and alternate solutions (Smart Wires and Melbourne Energy Institute (including Distributed Energy Resources), and endeavouring to potentially utilise existing network infrastructure (TransGrid).

For the strategic types

A number of important questions need answering.

- Will there be sufficient dispatchable generation for commercial & industrial load?

- Are there any new dispatachable generation facilities (not including Snowy 2.0) in the pipeline, with a clear process for an orderly transition?

- Are the current (national) transmission planning arrangements across the NEM still suitable?[11]

Energy Networks Australia and its members look forward to continued collaboration with AEMO and all interested stakeholders in providing input to AEMO’s on-going development of its inaugural Integrated System Plan and its evolution going forward.

[1] AEMO is calling this an Integrated System Plan (ISP), rather than an integrated grid plan [as originally termed in the Finkel Report] to reflect that over time, the ISP will by necessity consider a wide spectrum of interconnected infrastructure and energy developments including transmission, generation, gas pipelines, and distributed energy resources.

[2] AEMO is preparing an inaugural Integrated System Plan (ISP) for the National Electricity Market (NEM). The Plan was recommended (Recommendation 5.1) by the Independent Review into the Future Security of the NEM (Finkel Review) in June 2017.

[3] This was considered too narrow a focus by ACA Low Emissions Technology, and that AEMO should be technologically broader.

[4] In their respective jurisdictions, AusNet Services (Victoria), Risen Energy (Qld) and Central NSW Councils suggested additional REZs could be considered to those identified by AEMO.

[5] Just over half of those submissions were reviewed.

[6] Adani Renewables seek a “globally competitive energy price” goal, while Business South Australia argues for a better understanding of cost impacts for consumers in each jurisdiction.

[7] This may require a closer examination of a centralised backstop/reserves approach.

[8] AEMO’s Power System requirements Reference Paper (March 2018) explains Dispatchability as “[the] Extent to which the output of an energy resource or portfolio of resources can be relied on to “follow a target” and adhere to a dispatch schedule at some time in the future”.

[9] Siemens supports the need for valuing the additional security, reliability [and] national interests that greater transmission and interconnection brings. Deakin (University) Energy argues that the current transmission investment framework may compromise optimal outcomes.

[10] S&C Electric have raised a similar issue.

[11] AusNet Services canvasses the idea in its Stage 2 submission in response to AEMO’s question 4.2 that ‘This national planning role should be truly independent. As has been discussed in many reviews, the different approach in Victoria may need to be addressed to ensure it is truly independent and consistently applied across the NEM”.