EVs and the grid: International insights for Australia

There has been huge growth internationally in the uptake of electric vehicles (EVs). In countries like Sweden and Norway where there are supportive policy settings, the EV market share has almost tripled in just a few years. While Australia is something of a laggard in uptake, adoption is increasing and as more supply of vehicles becomes available, we could see an explosion of growth. The challenge is we don’t yet have the policy settings in place to ensure the electricity grid can cope and we need to get moving before the EV wave hits. We look at what can be learned from international experience.

With many countries around the world introducing policies banning petrol cars and regulations to incentivise consumers to switch to electric vehicles (EVs), the EV market share is rapidly increasing. In Sweden, there has been a more than 200 per cent jump in just two years – in 2019 just 20 per cent of cars sold were EVs. By 2021, this figure had exploded to 65 per cent of all cars sold. In Norway, the leading nation for EV adoption, the sale of EVs jumped from about 22 per cent to 75 per cent in just six years [1].

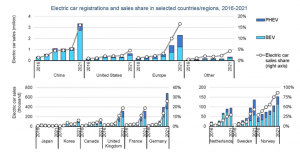

The figure below shows the EV sales share in selected countries and regions.

Figure 1: EV sales share in selected countries and regions from 2016 to 2021 [1]

But what does that mean for electricity networks in Australia?

The mass adoption of unmanaged EVs will mean significantly more power is needed from the electricity grid. Significant increases in peak demand also create voltage and thermal issues which grid operators must manage. It also means more investment in generation to cope with the increase in the load and more investment in network companies resulting in an overall higher cost of electricity to customers.

Read Energy Network Australia’s recent opinion piece on EV integration and the challenges and opportunities for the grid.

How can we avoid this double whammy of costs and is there a win-win solution that mitigates EV charging impacts to the grid and accommodates customer’s charging needs? The answer is yes.

EV managed charging

Managed charging or “smart charging”, combined with time of use tariffs (ToU), is likely to be a key solution. “Smart charging” can be broadly grouped into two types: supplier-enabled (provided by aggregators or grid operators) and/or user-enabled (users responding to ToU rates).

In our previous article Are we ready for the EV revolution?, we summarised the key findings of the University of Melbourne’s analysis on the use of EV management strategies including ToU tariffs for a sample of Australia’s distribution networks.

In this article we also take a look at some of the insights from EY’s Norway EV Exploration Tour [2] and the EY Mobility Consumer Index (MCI) report [3]. Some key points:

- The Norwegian grid was built to handle high electricity demand for winter heating and the “headroom” this provided has allowed high volumes of EVs without constraining the network.

- But this isn’t sustainable in the long term and managed charging is likely to become one of the key solutions for grid operators to mitigate the impact of EV charging on the grid.

- Global EY analysis has found that managed charging can mitigate the peak load by up to 21 per cent[3]

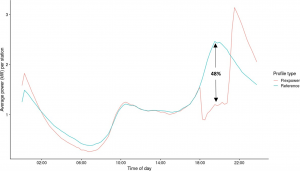

In the Netherlands, a pilot project between the City of Amsterdam and Flexpower was conducted to examine the effectiveness of managed EV charging in mitigating peak demand. It was found that the EV managed charging supressed the EV peak demand by 48 per cent (Figure 2) [3] [4].

| 48% |

Figure 2: The average power per station over the day for Flexpower and reference stations. The plotted value represents the total grid load contribution of EV charging [4]

The key take-aways from these international projects demonstrate how critical the right policy settings are to managing the impact of EVs on the electricity grid and deliver customers cheaper bills and more control over their energy. The report shows:

- The impact of the overall load increase due to EVs is much less disruptive compared with the impact on the peak loads – but peak loads drive system investment

- Smart charging is one of the key, long-term solutions to mitigate the unwanted side effects caused by EV-charging demand

- Time of use tariffs are critical to influence customer charging behaviour

- Given that most EV owners prefer to charge at home, there is a need for coordinated home charging infrastructure policy at the federal level to fully unlock the benefits of EVs to customers

- Smart chargers will provide even more benefits to customers when V2G (Vehicle-to-grid) and V2X (Vehicle-to-anything) EVs are rolled out giving customers the ability to sell excess electricity back to the grid from the batteries inside their EV or to power their homes during an outage

- As Australia is still an early adopter with EV market share of less than two per cent, we have an opportunity now to design and coordinate policy that ensures our power system delivers for customers when the future EV tsunami hits. We need to get moving.

References

| [1] | “Global EV Outlook 2022,” INTERNATIONAL ENERGY AGENCY, 2022. [Online]. Available: https://iea.blob.core.windows.net/assets/e0d2081d-487d-4818-8c59-69b638969f9e/GlobalElectricVehicleOutlook2022.pdf. |

| [2] | EY, “DEIP EV Grid Integration Reference Group Meeting,” Online, 2022. |

| [3] | “EY Mobility Consumer Index 2022 study,” EY, May 2022. [Online]. Available: https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/automotive-and-transportation/automotive-transportation-pdfs/ey-mobility-consumer-index-2022-study.pdf. |

| [4] | P. Bons, A. Buatois, G. Ligthart, R. v. d. Hoed and J. Warmerdam, “Final report – Amsterdam Flexpower Operational Pilot,” Interreg, North Sea Region, 2020. [Online]. Available: https://www.seev4-city.eu/wp-content/uploads/2020/07/SEEV4-City-Flexpower-Operational-Pilot-Final-Report.pdf. |