A Hard Day’s Night for inflation

Australia recently recorded its largest quarterly fall in headline inflation in 72 years, taking the annual inflation rate to June 2020 to -0.3 per cent – the first negative annual rate since 1962.

COVID-19 impacts have exacerbated and reinforced powerful deflationary trends which have meant actual inflation consistently falling below the RBA target band over the past decade.

Like a return to bell-bottom jeans or a Beatles revival, this would have little impact on the regulatory framework underpinning investment and network charges, except for a small quirk of fate.

This quirk is that the existing regulatory approach adopted by the AER and some other regulators for forecasting future inflation relies on an assumption of the Reserve Bank of Australia achieving, on average, the mid-point of its target range of 2-3 per cent over time.

The accuracy of the assumption can impact on risks for both investors and customers under the regime, depending on actual outcomes.

A long and winding road away from the official inflation target

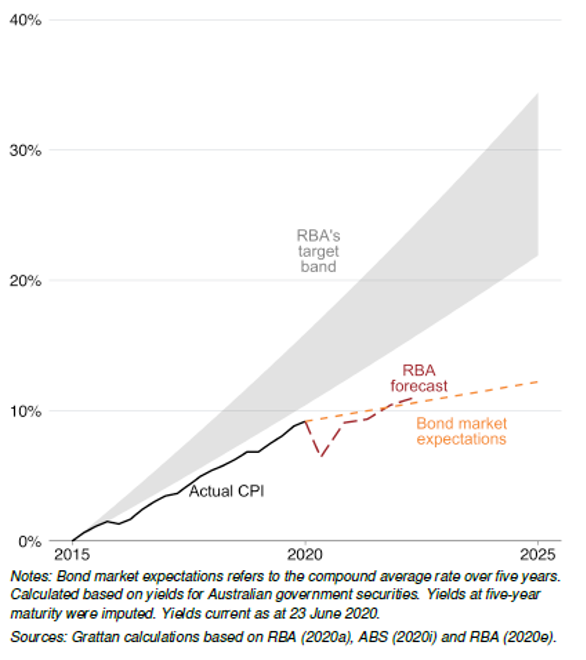

Whilst up to relatively recently, the assumption of achieving the mid-point of the inflation target had more or less matched what had happened, increasingly this has not been true. Recently the Grattan Institute highlighted this issue, as illustrated in Figure 1 below.

Figure 1 – Inflation slipping further below the target band (Source: Grattan Institute, The Recovery Book, June 2020, Figure 3.10)

In a world in which inflation has been described by commentators as ‘dead as a doornail’ current approaches are under scrutiny through the AER review of regulatory inflation.

Under current regulatory approaches, below forecast outcomes translate to perverse real-world regulatory effects, such as an artificially lowering or deferring regulatory returns on equity and failing to provide for efficient debt costs – impacting investment incentives and funding.

Even before COVID-19, persistently weak inflation data for the Reserve Bank was resulting in a significant policy debate about the effectiveness of the current method. The RBA’s recently published economic outlook includes three scenarios, and under all inflation is likely to remain very low.

Things we said today: perspectives from the review

The AER’s review process is looking at how the issues can be managed. Both within Australia and overseas other regulators have shifted their approaches to recognise some of the same issues.

ENA has suggested a two-pronged approach of giving weight to forward-looking market-based estimates of inflation, and movement to a ‘hybrid’ approach which would reduce some of the impacts of the current circumstances and reduce risk for networks and consumers.

This approach would ensure that unexpected variations in actual inflation don’t result in funding shortfalls or customers paying more than is necessary at some times, and less at others.

Other stakeholder responses have suggested alternative ways of seeking to neutralise the risks posed through designing new mechanisms and adjustments to regulatory models.

Avoiding a magical mystery tour in the future

The AER’s consideration of these issues in its re-examination of its current approaches to regulatory inflation is welcome.

The review is due to reach a decision by the end of the year. This provides an opportunity to start to address a critical area where evolving market conditions risk – through no fault of anybody – breaking current models.

The emergence of deflation, negative interest rates globally and extreme events such as negative oil prices are a reminder that markets are not predictable. The best regulatory systems will recognise evolving conditions – and enable a stepping back to ask the key question: do the results being produced still make sense?

The review is an opportunity to put in place enduring solutions that are robust to a wider set of possible futures than previously envisaged. This can help protect customers and networks from unnecessary risks and volatility.

Just as our energy grids need be resilient to possible futures, there is a strong benefit in ensuring frameworks that underpin the delivery of customer outcomes for decades into the future are themselves resilient to potential tests and surprises that could easily lay ahead.