A green recovery needs more than energy

There are many economic recovery plans being launched. Within Australia, the clean energy sector is pushing for further investment in clean energy jobs as a way of creating much-needed employment in regional areas. The one million jobs plan by Beyond Zero Emissions[i] says that:

“In just five-years renewables and low emissions projects can deliver 1.8 million new jobs in regions and communities these are needed the most.”

That’s a lot of jobs!

The plan doesn’t really explain how these jobs will be paid for, but it does suggest there has never been a better time to attract private investment (hundreds of billions) in low-carbon initiatives. This could be a win-win.

A more in-depth analysis titled Carbonomics by Goldman Sachs[ii] looks at the larger task and broader issues of reducing emissions to reach full decarbonisation.

Green energy projects are job intensive

Carbonomics indicates that investing in green infrastructure is more capital and job intensive than investment in traditional energy. The report estimates green infrastructure is 1.5 to three times more capital and job intensive per unit of energy produced. While the savings in operating costs (the sun and the wind are free) are significant, technologies that are more capital and job intensive could put upwards pressure on power prices. Nonetheless, it is anticipated that investments in green technologies, especially renewable electricity generation, will be the largest area of spending in the energy industry for three reasons:

- Shareholder action: there is growing support from shareholders to vote in favour of climate-related proposals.

- Cost of capital: renewable generation projects have a cost of capital between three and five per cent while climate risks mean hydrocarbon projects may have much higher costs of up to 20 per cent.

- Carbon price: the average global carbon price is US$3/ton CO2. Implied carbon costs for new oil projects averages $80/ton CO2 and $40/ton CO2 for LNG projects.

The combination of being job intensive, but also benefitting from lower cost of capital, means that more jobs could be created without necessarily increasing costs for customers. So, a green led recovery may lead to better environmental outcomes and increased jobs. Goldman Sachs indicates it could create an additional 15 to 20 million jobs globally by 2030.

Focusing investment on a green recovery will impact on the role of hydrocarbons.

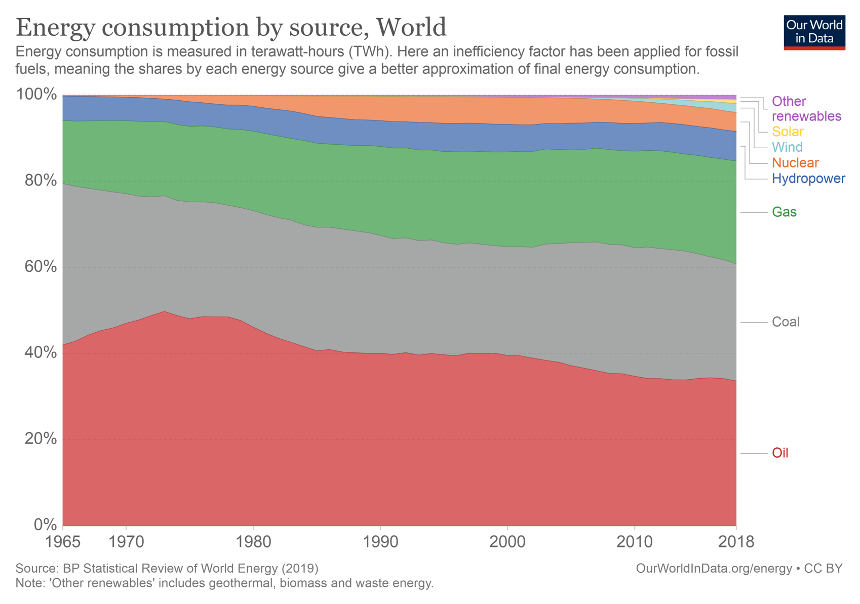

Hydrocarbon projects are at risk of being stranded, not due to lack of demand for fossil fuels but due to the cost of capital. The amount of energy supplied by these traditional energy sources still represents almost 85 per cent of global energy consumption (in 2018) and stranding these energy assets quickly could create energy supply and security risks. More work needs to be done to balance the role of hydrocarbons with a green recovery.

Figure 1: Global Energy Consumptions (Source: Our World in Data (2020))

Two-speed recovery

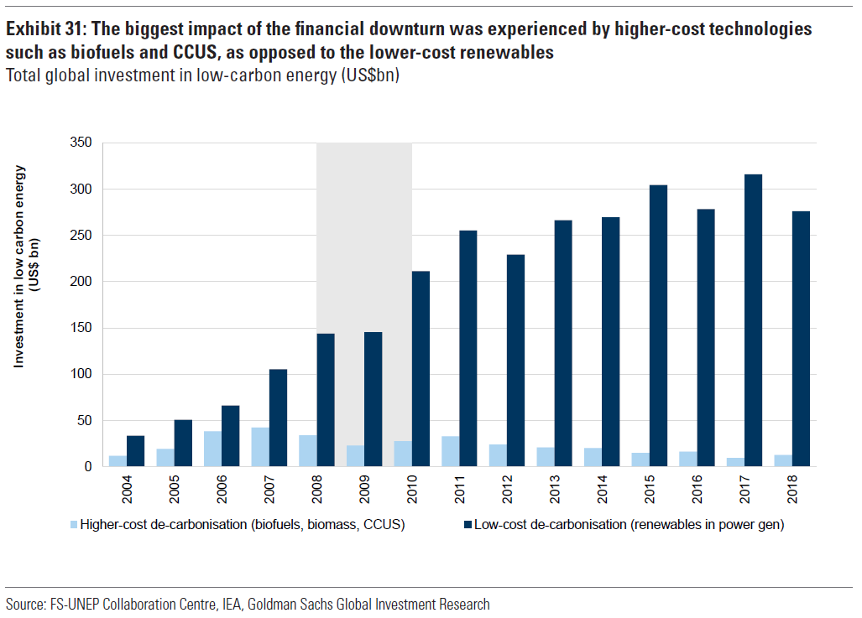

Previous recessions have put green recoveries under pressure. This clearly happened during the Global Financial Crisis of 2008 when investment in green technology and emissions reductions was severely hampered.

Goldman Sachs identifies a risk with stimulus packages that focus on near term technologies. For example, investing in renewables for power generation instead of investing in longer-term options, such as carbon capture and storage. From a decarbonisation perspective, it is important to keep in mind that the whole economy needs to decarbonise and that many different technologies will be required. The report notes:

… that low-cost technologies such as renewable power were significantly less affected and returned to growth, compared to other higher-cost technologies such as biofuels and carbon capture, which did not recover for many years (pg 18).

The implication is that focussing a green recovery based on low-cost options presents a material risk to technological innovation on the higher-cost end of the decarbonisation cost curve.

Figure 2: Reduced investment in higher-cost abatement technologies during the Global Financial Crisis (Source Goldman Sachs (2020), Carbonomics, pg 19)

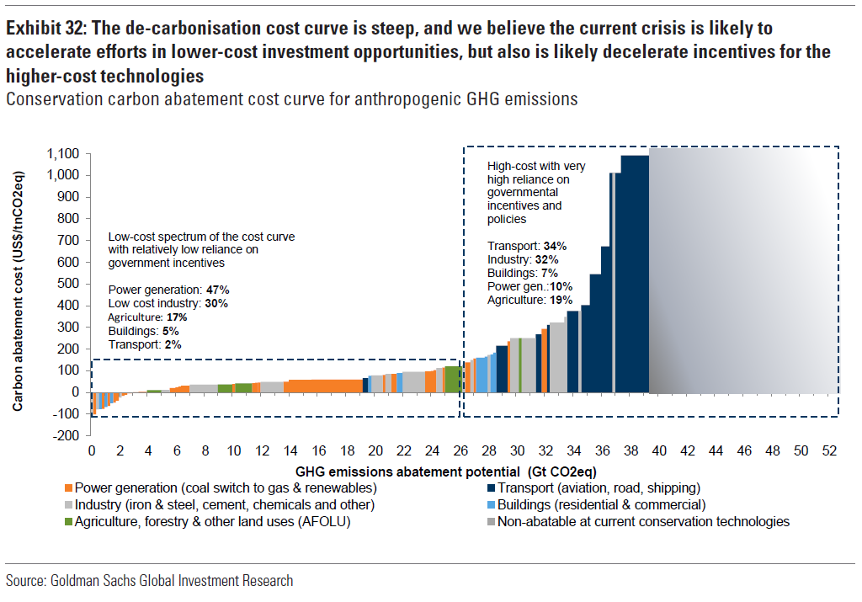

The marginal cost of abatement curve (below) shows that there is a steep increase in abatement costs above 50 per cent and that about one-quarter of the emissions do not have a suitable abatement technology at present. This includes buildings, industry and transport. More research and investment are needed to find and develop abatement technologies for these sectors.

Decarbonising heat for buildings is challenging due to the scale of energy required and the retrofit and systems challenges with electrification. For example, gas provides more energy – as heat – to homes in Victoria compared with electricity. Decarbonising this heat can be achieved through fuel switching, energy efficiency or decarbonising the gas. Across the economy, a mix of these options will need to be deployed.

Figure 3: Marginal abatement curve (Source: Goldman Sachs (2020), Carbonomics, pg 20)

Hydrogen and biomethane are both options that are being tested at pilot scale, and more effort will be required to increase the efficiency of these processes and reduce the costs. This requires ongoing support for R&D, pilot-scale plants and demonstrations to be directed to this area. A green energy recovery focussing only on the low-cost opportunities may risk the necessary investment required to develop the technologies for the higher cost abatement.

Focussing the green recovery

Any recovery that aims to help deliver on the Paris Agreement on climate change should focus on outcomes and on the goals outlined in the Agreement. A green recovery will create jobs, and the cost of finance is low, so, overall, we may achieve new jobs without increasing costs to customers. However, we should not lose sight of the fact that we also need to progress the difficult-to-abate energy sectors (such as heat and aviation) and also the non-energy sector (such as chemicals and agriculture).

We don’t want to focus too much on the near-term options, that may jeopardise our long-term abatement goals in the Paris Agreement.

[i] https://bze.org.au/wp-content/uploads/BZE-Million-Jobs-Plan_FINAL_web.pdf

[ii] https://www.goldmansachs.com/insights/pages/gs-research/carbonomics-green-engine-of-economic-recovery-f/report.pdf