Renewable gas target is a zero emissions bullseye

Many residential and commercial customers have been actively pursuing options to reduce emissions from their energy use. Common responses include:

- improving energy efficiency of homes or businesses;

- installing solar panels, or

- offsetting those emissions through carbon offset schemes.

Most energy retailers offer customers options to offset the emissions from their electricity and gas use. However, achieving a target of net-zero emissions by 2050 will require more than offsets, and all energy sources will need to switch to renewable alternatives if we are to be successful.

For gas used in the home, this means a move towards renewable hydrogen or biomethane. Renewable hydrogen can be generated from renewable electricity and biomethane can be produced from organic waste at landfills or wastewater treatment plants.

Figure 1: Transformational technologies to reach net-zero emissions from gas (Source: Gas Vision 2050)

A few weeks ago, we saw the first renewable hydrogen delivered to residential customers in Adelaide’s gas network and this week marked the start of a certification pilot to enable biomethane blending into the Sydney gas network from 2022.

Customers who want to purchase renewable gas should soon be able to do so

Building a renewable gas market

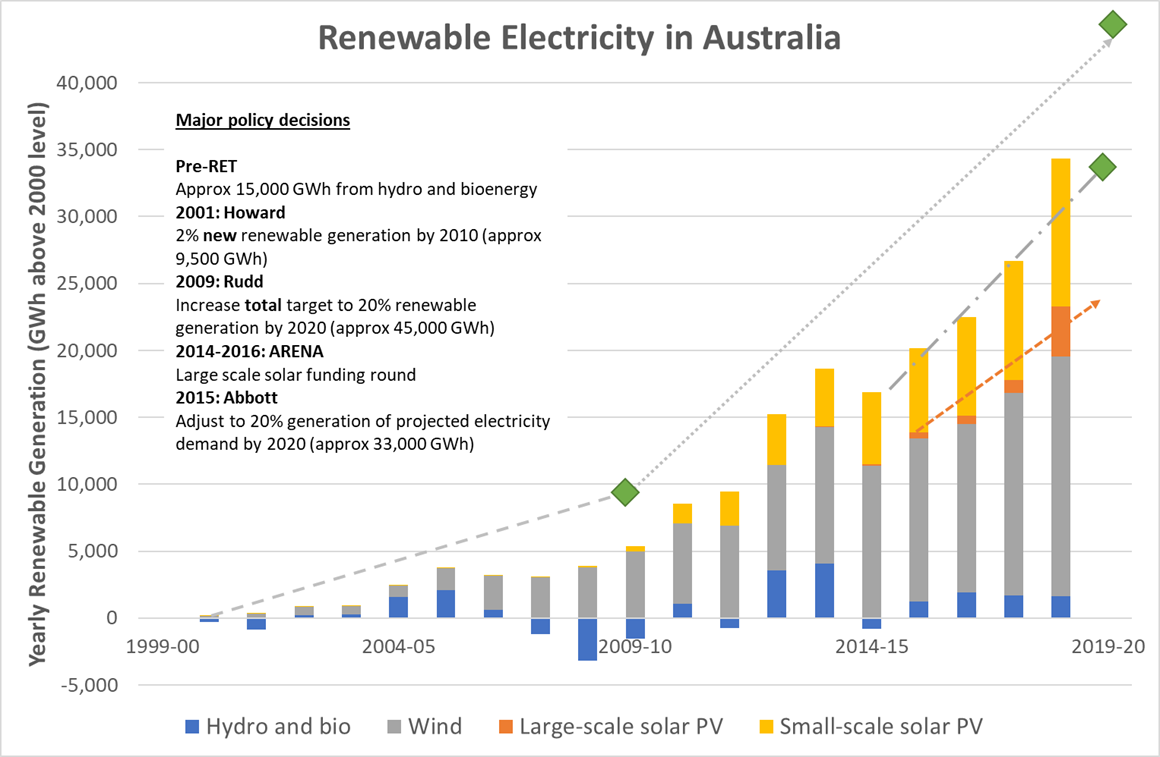

One way to drive the uptake of renewable gas is a renewable gas target (RGT). Electricity and gas distributer Jemena[i] recently called for this policy shift – and it makes sense. We have seen from Australia’s renewable energy target (RET) just how effective targets can be at encouraging technology development. The RET has resulted in an increase in renewable generation in response to the associated obligations on energy retailers and additional financial incentives for household customers.

Figure 2: How the renewable energy target has driven renewable electricity generation (Source: Australian Energy Statistics, Energy Networks Australia analysis)

A RGT should cover all types of renewable gas but also recognise the differences between hydrogen or biomethane.

Setting a modest RGT would create a large amount of demand due to the sheer scale of energy provided by gas networks. Reaching such a target could be achieved through blends of hydrogen or biomethane in the network, or through dedicated conversions of individual parts of the network. For example, a 10 per cent blend (by vol) of hydrogen for all residential gas customers in Australia will require 5.6 PJ of hydrogen and between 250 and 700 MW of electrolysers[ii] to be installed. This is a massive increase in scale and will create localised experience of building the hydrogen supply chain and reduce costs.

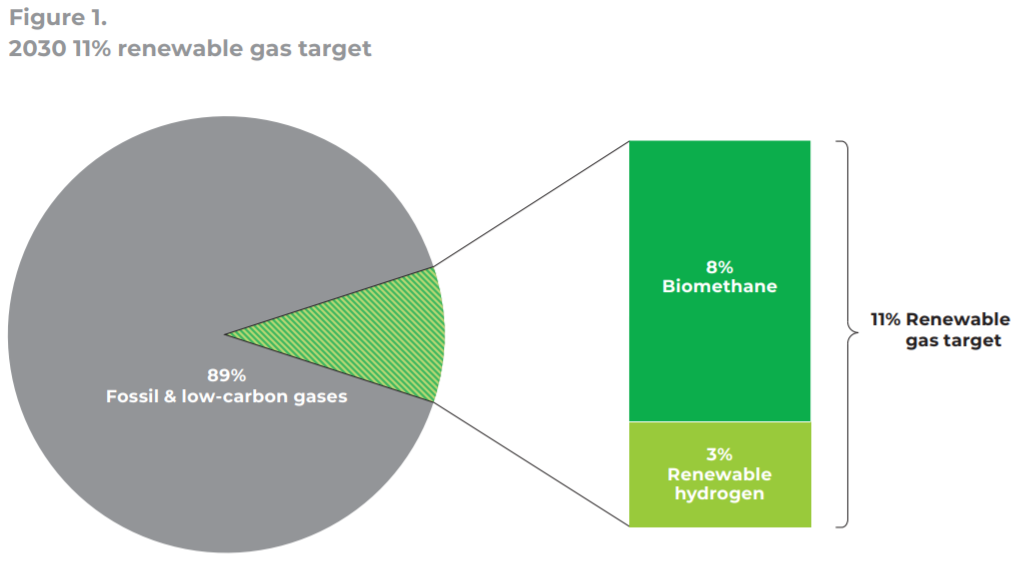

A RGT should also be supported by other incentives to address structural issues in the renewable gas market, for example technical and commercial differences between hydrogen and biomethane. The European Gas for Climate program is suggesting an 11 per cent renewable gas target by 2030 and includes sub-targets for both hydrogen and biomethane pathways.

Figure 3: Technology targets within a renewable gas targets (Source: Gas for Climate (2021), Setting a binding target for 11% renewable gas, https://www.europeanbiogas.eu/wp-content/uploads/2021/01/20210122_FINAL_policy_proposal_designed.pdf)

Another form of incentive is a certification scheme to accompany a RGT. This is the mechanism for customers to purchase renewable gas and provides them with the confidence that they are buying a product without the emissions. A certification scheme could cover many things such as:

- the type of gas being provided,

- how and where this gas was made,

- the source of initial energy used, and

- the lifecycle carbon intensity.

Within Australia, a hydrogen certification scheme is being developed as part of the National Hydrogen Strategy[iii] and a new pilot for renewable gas certification[iv] involving Energy Networks Australia, Jemena, Greenpower and the NSW Government will enable customers to purchase renewable gas with confidence. Successfully implementing such schemes will make renewable gas more accessible to customers.

International biomethane success

Biomethane targets have been successful at increasing the renewable gas blend in countries such as France, Denmark and the UK. While the schemes are slightly different between countries, the main features include incentives to produce biomethane and blend it into the gas network. This can be combined with avoidance of “gate-fees” for waste to create commercial opportunities for biomethane blending into the network.

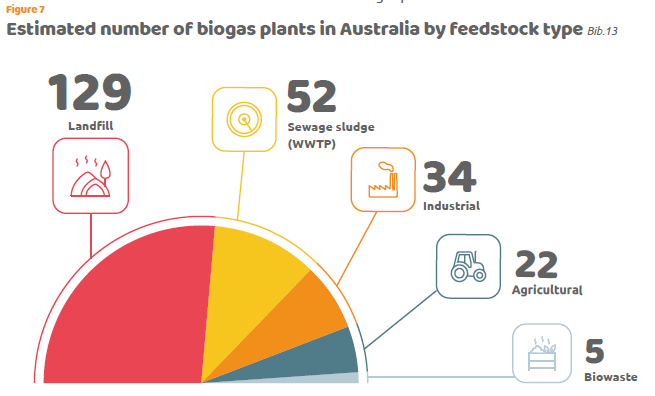

Do we have enough biogas to heat Australia?

Biogas is already produced in Australia but it is generally used for renewable electricity generation – driven by the incentives of the Renewable Energy Target. An alternate option is to use this gas to provide a renewable gas option for customers. That requires the biogas to upgraded to meet the quality specification of natural gas. In 2016/17 1,200 GWh of electricity were generated from biogas, representing about 0.5 per cent of national electricity generation. This consumed 4,320 TJ of biogas. If this biogas was used in the network directly, it would be able to provide a 10 per cent renewable gas blend to 1.3 million homes.

Figure 4: Biogas plant in Australia (Source: Bioenergy Opportunities in Australia)

Some estimates[v] of the biogas potential in Australia indicate that it could replace all the natural gas currently used by homes, businesses and industry. These estimates are likely optimistic but do illustrate that a vast volume of renewable gas could be unlocked with the right policy settings including a RGT.

Getting the target right

There are a range of different renewable gas options under development. These are complementary solutions to decarbonise gas. To build the market requires the correct policies, targets and incentives to be designed. As a minimum, a renewable gas target with a suitable certification program is required to allow customers to be able to purchase renewable gas.

[i] https://jemena.com.au/about/newsroom/media-release/2021/jemena-calls-for-renewable-gas-target

[ii] The wide range of installed electrolysers reflects whether they are powered via the grid or dedicated renewable.

[iii] Australia’s National Hydrogen Strategy – actions 4.16 to 4.19

[iv] https://www.energynetworks.com.au/news/media-releases/2021-media-release/pilot-lights-the-way-to-green-gas-certification/

[v] Deloitte Access Economics, https://www.energynetworks.com.au/resources/reports/decarbonising-australias-gas-distribution-networks-deloitte/