Changing the 100m Track: Rate of Return Decision Falls Short

The next Australian Energy Regulator rate of return ruling will set investment incentives out to the Brisbane Olympics in 2032, and potentially beyond. The draft released last week overturned twenty years of precedent on a major setting, on the basis that the regulator’s main task was just to focus on looking just five years ahead in its decisions. Such an approach creates new risks, unwarranted regulatory uncertainty and reduces incentives for investments to underpin the energy transition

Like the Olympics, the Rate of Return Instrument review occurs every four years and sets important benchmarks for the future. It determines the allowed rate of return on more than $100 billion of existing and new investments supporting safe, reliable network services to customers.

It would be a surprising development if athletes in the Brisbane Olympics turned up to find the 100-metre running track to be 93 metres long. Yet the draft rate of return proposals introduce a similarly disruptive move to established past practice.

The draft ruling proposes to fundamentally change the long-standing ‘benchmark term’ for how to measure the base cost of equity: arguably the most critical single setting of the entire framework. The regulator has proposed switching from the near universally adopted 10-year government bond term, to a new approach of matching the regulatory period (most often, five years).

Changing the length of the track – real-world consequences

The impact of this change is to reduce the offered return on equity and investment incentives for required energy network infrastructure projects at a time when the energy transition must accelerate.

This risks crimping grid investments that could bring to a market under strain diverse new renewable and distributed energy sources that will reduce wholesale energy prices and improve system security for customers.

With network investment near decade lows, and an identified need to build about 10,000 km of new transmission lines to connect growing renewables sources, the reduction in the benchmark term adds an extra hurdle to what needs to be a sprint race to meet agreed emissions goals.

Governments and rule-making bodies are already grappling with the acknowledged challenges of making multiple simultaneous major transmission projects financeable under current low return settings.

Lowering possible returns still further has the potential to unintentionally derail the new Commonwealth Government’s Rewiring the Nation goal of leveraging greater private sector investment to support the energy transition – shifting more of the load to taxpayer support. The AER’s proposed approach also reduces the scope for this funding to support other innovative technologies such as large-scale storage.

The change is based on a theoretical view that the regulatory task should be focused on the five-year regulatory period, and that the observed practice of real-world investors who overwhelmingly use longer term government bonds as a benchmark is irrelevant.

Moving the finishing line mid-race

The problem with this view is three-fold:

- It is not the standard applied elsewhere in the draft ruling

- The community relies on real-world investors and not mathematical formulas in decisions to make investments, and

- Most other regulators do not agree with a five-year approach.

In setting the large return on debt element of the rate of return, no such focus on a five-year period is present. Instead, the regulator correctly uses a 10-year trailing average on the basis that this is efficient observed commercial practice. Logic would suggest at least the same approach should apply to equity, which by definition is perpetual.

Such a radical departure in approach and switch to 20 years of regulatory precedent is likely to give pause to actual investors considering making investments in network assets with lives of 50-80 years. Some will inevitably ask: what other parts of real-world investment decision-making may be ignored or overturned in future decisions, and why has there been a change now?

The answer so far offered by the AER is that its attempt to fix a broken inflation forecasting approach in 2020 has led to this outcome. Yet the AER asserted that the inflation forecasting outcome was an independent decision that could lead to different outcomes.

Breaking from the pack – but in which direction?

Currently the AER is the only Australian regulatory body proposing to use a five-year government bond to set a cost of equity estimate. Over the past several years three state-based regulators trialled and then abandoned the approach now being proposed by the AER.

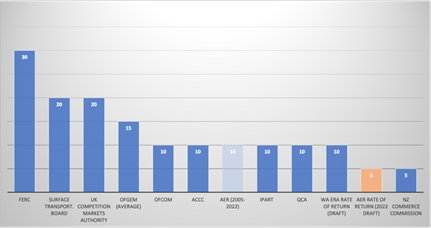

The only other energy network regulator previously using the five year approach – the WA Economic Regulation Authority – announced its intention to abandon the approach a single day after the AER’s decision. In fact, other regulatory bodies overseas typically employ a much longer-term benchmark bond, reflecting the long-lived nature of the investments and cashflows.

Figure 1 – Moving from the mainstream – Regulatory practice on the benchmark term of equity

The single exception is New Zealand, which adopts other safety mechanisms the AER does not to avoid underinvestment risks.

Best regulatory practice is not determined by votes, but it is unclear on what basis the AER considers it is correct to adopt an approach which all other Australian, UK and US regulators have systematically rejected.

Underlying performance issues not addressed – adding volatility

Movement to a term of five years risks being the unasked-for solution to a problem that doesn’t exist.

For good measure, it also creates some new problems of its own.

One is that, looking back through history, the five-year approach would have delivered higher prices, compared with the current approach, during the 1990s recession and the Global Financial Crisis. This means a change in approach may lead to higher prices for customers, at the very time their incomes face greatest risk and challenge.

Further, the solution doesn’t address the actual challenges and problems identified in the ‘Pathway’ process leading up to the current AER review – which looked at the issue of the impact of low interest rates on rate of return estimates.

A movement to a five-year approach would have delivered even lower rates of return at the historic bond rate lows recently experienced. Currently, government bond yields have risen, but future adverse conditions, or changes in monetary policy could easily see bond rates fall back to their recent lows.

In rate of return terms, making the lows lower, and potentially delivering customers higher prices in bad economic times for a hoped-for saving on average does not improve the performance of the system – it weakens it.

There is further to run in this race – but to get the best performance out of the grid and assist the energy transition, we need to avoid putting new hurdles in our own way.

Further details on the AER Rate of Return decision and process can be accessed here.