Riding the energy transition roller-coaster

There’s a point on any great theme park ride where anticipation turns into exhilaration – equal parts fear and excitement. The ride gets underway with a jolt and a slow clanking climb to the top of the mountain. A long pause. Then freefall. In those first few moments of weightlessness, it dawns – there is no going back – there is only the wild ride ahead.

We can debate where we are in the rollercoaster of the energy transition, but a good place to look for data to help us gain this perspective is The Australian Energy Market Operator’s (AEMO) quarterly energy dynamics (QED) reports. The latest one, QED Q1 2022, shows we’re well and truly in freefall. Just look at how much has changed in the dispatch of capacity across the National Energy Market (NEM) in the past 12 months.

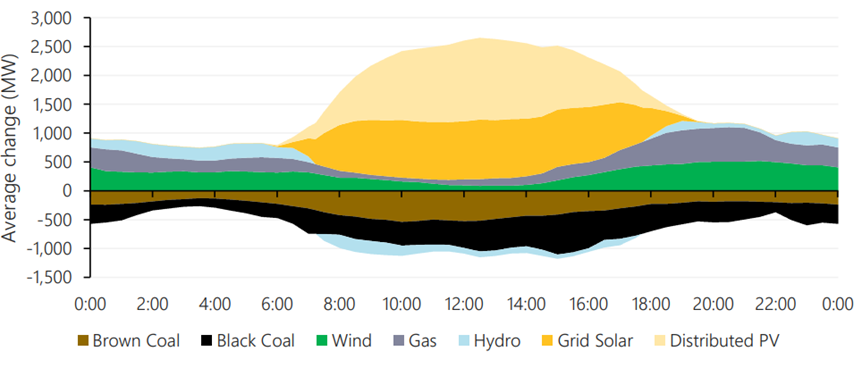

Figure 1: change in supply – Q1 2022 vs. Q1 2021 by time of day

Source: AEMO

Solar and wind have increased significantly while gas and hydro are filling in the gaps. Coal is coming out across the board, but particularly during the daylight hours. And there’s plenty of time left on this ride. Black coal was still at 44 per cent of NEM generation in Q1 2022 (down 3.2 per cent from the previous year) and brown coal at 16.3 per cent (down 1.9 per cent). While this is driven in part by high levels of coal outages across the NEM (planned and unplanned), the longer-term driver is the continued entry of renewables and its impact on balance sheets. Each announcement bringing forward coal closures is less surprising than the last.

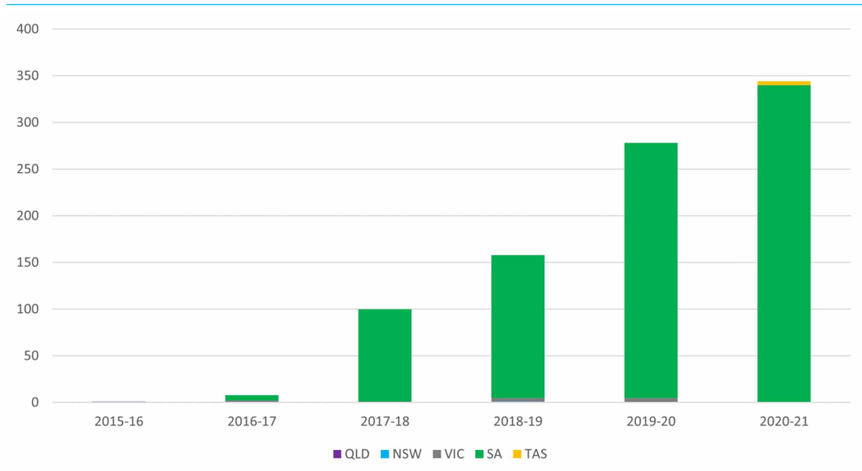

The QED Q1 2022 also allows us to look ahead a little. South Australia sits in the front carriage of the energy transition roller-coaster, and it’s already been through the first loop-the-loop. In South Australia energy security concerns resulted in a significant increase in AEMO directions until 2021 to keep the system within technical limits. Directions in that region have made up the bulk of security directions across the NEM.

Figure 2: number of directions for security by region

Source: AEMC Reliability Panel, 2021 Annual market performance review, p66.

Following the 2016 system black in South Australia, the Australian Energy Market Commission (AEMC) conducted an emergency review of system security frameworks. One measure subsequently implemented was a requirement for transmission businesses to procure minimum levels of system strength when asked to do so by AEMO. Immediately after those arrangements came into force AEMO issued Electranet (the local transmission network business in South Australia) notice of a system strength shortfall in its backyard.

Electranet then went through a cost benefit analysis to determine the best way to meet that shortfall. The options included contracting with existing synchronous generators on an ongoing basis or installing synchronous condensers. Electranet’s analysis showed the second option would have greater net benefit, and so four synchronous condensers were procured and ultimately commissioned in late November 2021.

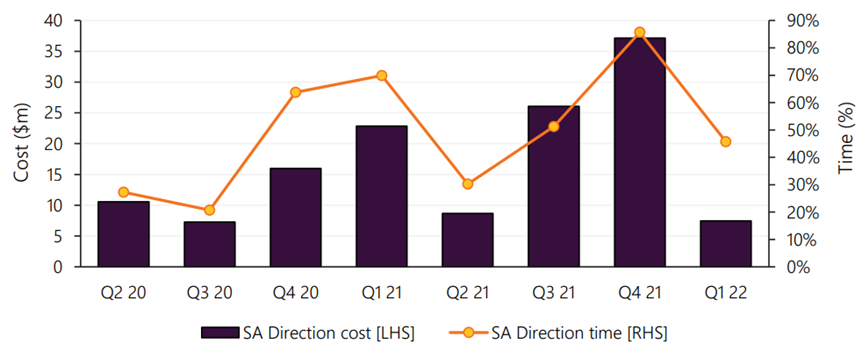

AEMO’s QED Q1 2022 provides the first real opportunity to check on the impact of these. The starkest impact has been on the cost of directions. Directions costs that increased over time to a peak of around $37 million in Q4 2021 have dropped significantly to $7.5 million in Q1 2022. The commissioning of synchronous condensers has been a major factor in this reduction, as well as increased wholesale prices keeping gas generators in the dispatch merit order more often (although this impact is debatable given the wholesale prices are largely driven by gas costs).

Figure 3: time and cost of system security directions (energy only) in South Australia

Let’s go back in time to when the decision was made to invest in the synchronous condensers. The cost benefit assessment conservatively assumed a net reduction in annual directions costs of about $22 million a year. It would be simplistic to assume that the reduction in directions costs between Q4 2021 and Q1 2022 represents the ongoing quarterly value of the synchronous condensers from reduced market intervention. However, it does provide a reference point showing that the assumed benefit from reduced intervention was well and truly conservative. The energy market and environmental benefits may also be significant, with the commissioned synchronous condensers allowing a raising of the limit on variable renewable energy (VRE) generation in the region from 1,100 MW to 2,500 MW (a limit that hasn’t constrained VRE output since). All things being equal, this should reduce the cost of energy in South Australia, albeit while other factors (such as gas prices) are pushing wholesale energy prices higher.

Mid roller-coaster ride it can be difficult to make major decisions. The level of uncertainty in a transforming energy system is higher than it historically has been. Amidst this uncertainty we’re asked to place ourselves in a range of potential futures and look backwards to assess the relative benefits of options. The easier decisions have no future regrets and the more difficult decisions have a few. The industry and customers have many tough decisions to make together to navigate the energy transition. This will hopefully involve many constructive and pragmatic discussions standing together in those hypothetical futures, talking about the nature of the risks we face and regrets we may have. Data from sources like the QED shedding light on the value of some of the big decisions made in the past should help us to ground difficult discussions with real-world reference points and navigate some of the complexity together.