Transmission framework – more strands than a bowl of spaghetti

There is recognition across the energy industry that transmission investment is critical to support the energy system transition at lowest cost to consumers, but it is difficult to keep track of the proliferating regulatory and investment processes projects must follow. This article highlights the splintering frameworks that support transmission investment in the national electricity market, and what this means for timely investment in much needed transmission capacity.

Relevance of the NER framework

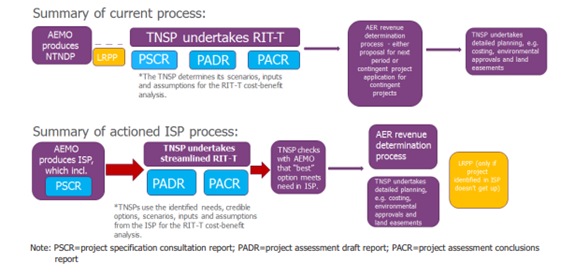

In the final report reviewing coordination of generation and transmission development in 2018, the The Australian Energy Market Commission (AEMC) proposed a more streamlined planning and investment framework. Under the leadership of the Energy Security Board (ESB), with Energy Ministers and all three market bodies on board, a national actionable Integrated System Plan (ISP) framework was created in the national rules and commenced on 1 July 2020. Later in 2020, the Australian Energy Regulator (AER) finalised the guidelines and in 2022 issued a guidance note to articulate expectations for procurement strategy and engagement between the Regulatory Investment Test for Transmission (RIT-T) and Contingent Project Application (CPA) stage. The proposed framework at the time had overwhelming support for the checks and balances it contained. This included appropriate segregation of duties between the planning and investment decision making. The 2022 ISP is the first ISP to be completed under the new framework.

Fig 1 – Comparison of the pre-ISP transmission planning framework and the proposed Actionable ISP framework[1]

Some projects recognised in the 2018 and 2020 ISPs are already completed (e.g., synchronous condensers and minor interconnector upgrades) while the major greenfield projects are well underway in the case of Project Energy Connect. Current target dates for these projects and other REZs are around the second half of this decade. The ageing synchronous generation fleet is not getting any younger and new transmission and generation are needed urgently. This a significant infrastructure delivery program, the scale of which we haven’t seen before.

Transmission planning under constant review

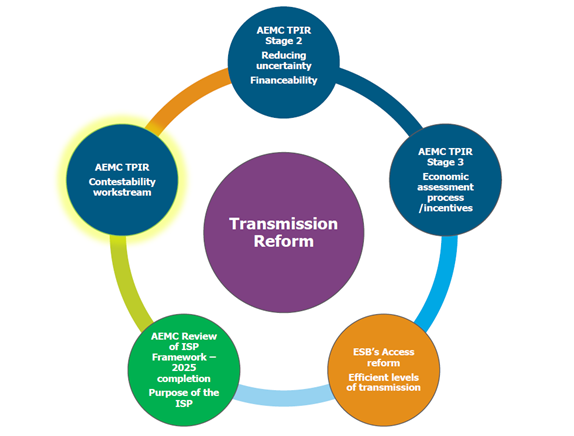

The original actionable ISP rules have had a few fix-up rule changes[2], despite this the AEMC has a number of stages in its current transmission planning review – incremental changes (Stage 2) and longer term improvements (Stage 3) and whether there may be benefits in considering other models for planning and investment e.g. earlier contestability, see Fig 2. These review stages are in addition to the ESB’s transmission access reform and also the review of the actionable ISP rules framework due to be completed by mid 2025. That’s some seven to eight reviews or rule changes in the space of five years. This creates a great deal of uncertainty for what is long lived infrastructure and its cost will be reflected in consumers’ electricity bills for decades.

Fig 2 – Transmission reviews to support the efficient use of transmission infrastructure and timely and efficient investment

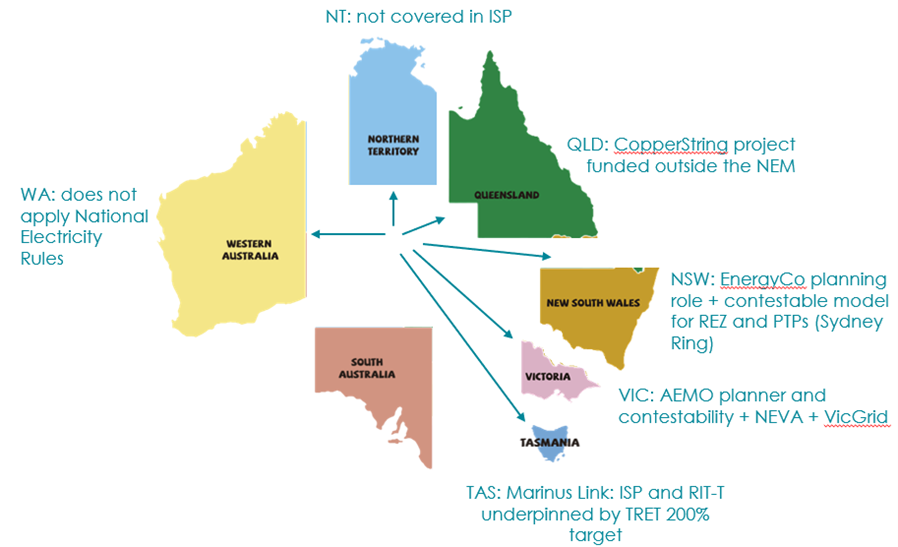

Regulatory processes that afford consumer protections are seen as too slow, the investment settings may be seen as not able to support the levels of investment involved and retirement of needed synchronous generation is moving more rapidly. To tackle this, some state governments have sought to bypass the rules and take matters into their own hands, a high level view is shown in Fig 3.

Fig 3 – State governments are pursuing their own approaches, can the NER regain relevance

Source – Houston Kemp

Improving state planning and environmental approvals and costs would be helpful. Creating a spaghetti bolognese of models and processes is not.

VicGrid and the Consumer Trustee (Victoria and NSW) are both developing state-based plans for state agendas in a power system that is interconnected. There are now bits of national and bits of state processes with varying connection standards and processes that need to be navigated. The transition is gaining pace and the complexity of operating a stable and secure power system is challenging without adding additional coordination and complexity.

The NSW model for the delivery of Renewable Energy Zones (REZs) remains under development two years after the model was first mooted and is yet to be tested in practice. This is time we just don’t have to deliver commissioned generation and transmission infrastructure if reliability is to be maintained. Victoria is considering its framework but is still at a high level and there is a time imperative with the looming generation retirements.

Bypassing the transparency and robustness of the national planning and investment framework, enabling the planner to implement its own plan with consumers paying, is like a move back to the quasi-state electricity commission approach – but does it resolve the issues of the significant construction work program required?

The external factors currently impacting the cost and timeliness of major transmission projects, such as cost escalation, supply chain and labour bottlenecks, environmental approvals and landholder concerns around development, and challenges of establishing social licence – won’t be addressed by contestability or by changing the party responsible.

Increasing the complexity of navigating the state and national processes and the parties involved in delivering and commissioning infrastructure at a time when timeliness is key may not reduce total system costs to consumers. These splintered frameworks are looking to be set to stay. It is not just the state-based planning bodies – there are a range of additional activities and ongoing coordination costs for existing networks and the market bodies.

The 2022 ESOO released yesterday highlights the importance of VNI (minor), QNI (minor) and PEC to meet reliability in the near term. With the expected closure of Yallourn and Vales Point power station towards the end of the decade, there is a reliance on the anticipated transmission, generation and storage projects in the pipeline being delivered on time. Timely transmission development is needed to improve the reliability forecast later this decade. Rather than further fragmentation of the framework, adding coordination complexity and risks, it is time to work together to improve the resilience of the NEM as the economy seeks to electrify. Supporting the current pipeline of projects to commissioning and keeping the pipeline of projects manageable is what is needed to ensure the smooth transition to net zero.

[1] AEMC, Final report COGATI, 21 Dec 2018

[2] https://www.aemc.gov.au/rule-changes/minor-changes-3-2020 and https://www.aemc.gov.au/rule-changes/reallocation-national-transmission-planner-costs