Vic transmission development – speed demands strong road rules

Victoria is consulting on a new Victorian Transmission Investment Framework (VTIF) which is a critical step to delivering much needed transmission investment. The consultation paper notes the urgency of ‘just getting on with it’ with Victoria relying on the three remaining coal generators that supplied about 70 per cent of Victoria’s energy in 2020. Yallourn is scheduled to close in 2028 and LoyYang has a possible earlier closure date of 2032. Delivering an appropriate mix of generation and the right level of transmission in anticipation of these closures is critical.

The critical new interconnectors to support reliable and renewable energy into Victoria are not expected to come online until the late 2020s or early 2030s – MarinusLink and VNI West. The consultation paper also highlights an expected 2,000MW of offshore wind capacity by 2032. Current regulatory processes have appropriate checks and balances but are seen as slow. States are seeing a need to move faster and are splintering off from the NEM arrangements to take back control of coordinating transmission and generation.

The Victorian Government has established a new division called VicGrid to take the lead of the planning process.

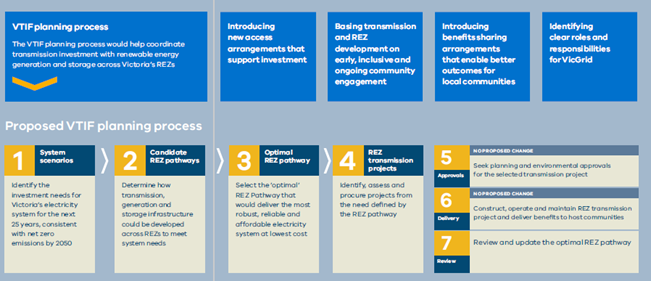

The proposed framework has five key elements and follows a planning process outlined below in Fig 1

- A new planning process for transmission and REZ development

- Introducing new access arrangements that support investment.

- Basing transmission and REZ development on early, inclusive and ongoing community engagement.

- Introducing benefit sharing arrangements that enable better outcomes for local communities.

- Identifying clear roles and responsibilities for VicGrid.

Each of these key elements are covered briefly below.

Fig 1 Proposed Victorian Transmission Investment Framework [1]

VTIF planning process

The framework proposes that VicGrid delivers a 25-year plan for the development of the transmission system in Victoria every four years. This is like a Victorian integrated system plan (ISP) that can consider Renewable Energy Zones (REZ) onshore and offshore and undertake any planning within the state. It essentially takes over the Victorian component of Australian Energy Market Operator’s (AEMO) ISP.

It may be beneficial to consider at least a two-yearly cycle to improve the linkage of state inputs and outputs to/from the ISP.

Scenario planning is a time-consuming and complex exercise. The scenarios should follow the ISP unless there is good reason to vary.

It will be important in the development of the VicGrid plan to consider the cost/risk trade-offs of state self-reliability and the impacts on customer’s bills. It is also essential that candidate REZs and optimal REZ pathways are well understood and have undergone robust public consultation. It is important that stakeholders understand the development of the plan and are clear on why certain projects are required for consumers and investors to have confidence in the plan.

New access arrangements

Victoria is concerned about the timeliness of any Energy Security Board (ESB) access model and intends to continue working on standalone access arrangements.

In the recent Energy Ministers’ Meeting Communique [2], Ministers have asked for the congestion management work to be expedited recognising the critical importance of providing more certainty to renewable investors. Whether this changes the Victorian ‘just do it’ attitude remains to be seen.

Auctioning access rights provides scope for generators to co-finance transmission infrastructure, reducing the costs borne by electricity consumers. The framework is not clear on the allocation of these costs to generators or electricity consumers.

Early, inclusive and ongoing engagement

VicGrid is well placed to ensure end-to-end engagement processes are acceptable for those who are impacted and the many consumers that benefit and pay for electricity. The improved land use tool and appropriate engagement can be used to assess the deliverability of different network options early.

It is critically important that VicGrid is not just leading but is also responsible for overall engagement and community acceptance given it is proposing the infrastructure corridors. While the early generic engagement appears to be led by VicGrid, the landowner engagement and negotiation is left with the winning bidder. The quality of the collective engagement and messaging across these parties will be essential to project acceptability by communities and landowners impacted. It may be useful to consider the handover point after the planning and environmental approvals and land compensation as this may lower the risk for the winning bidders and instil VicGrid as an independent planner.

Clear responsibilities for overall engagement and social licence with appropriate hand-over arrangements to winning bidders will reduce risks and costs to consumers of the transition.

Benefits sharing

Investment in generation and transmission will create employment and training opportunities, benefit local supply chains and services, aid diversification of local economies and potential for co-investment. The framework proposes three models- generation investing, transmission investing or generation and transmission pool funds, all of which could work.

The community and employment costs need to balance the interests of the regional communities and the end use consumers who ultimately fund these costs. The purpose of the benefits cost is clear but who is governing the program costs and funding, in conjunction with local council and communities, is not. There needs to be strong governance that ensures there is long term value for local communities and transparent, fair and equitable arrangements.

The types of projects that can be included in community or local benefits should be articulated in the framework and valued by the regional community.

Upfront and ongoing payments should be clear and supported by a published allocation methodology if some costs are to be allocated to generation connections and others to end use consumers.

Clarify and refine roles

VicGrid will be taking on a role to actively lead transmission and generation coordination and development in Victoria and ensure it is delivered in a timely and efficient manner. It is not clear whether there is a need for the AEMO to continue to have a Victorian transmission planning role. AusNet also plans replacement and maintenance work on its network. The framework should carefully consider the allocation of functions and seek to minimise duplication and cost, VicGrid should be the independent planner.

Additional entities involved in transmission network planning do not necessarily aid confidence and streamlined processes and may add to costs. If VicGrid is the independent planner and decision maker, then there will be a need for good cost governance and transparency of decision-making processes. The costs of any new framework will ultimately be borne by consumers.

Victoria could draw on elements of the national framework to keep arrangements simple and consistent or utilise aspects of the NSW framework that may help facilitate a timely response. Strong governance and robust, transparent decision making and consultation processes will be crucial for investor and consumer confidence.

As was the case for the NSW Roadmap, the costs are not clear. There is opportunity to consider functions and remove duplication to ensure that total system costs are in the long-term interests of consumers. Energy affordability and the rising cost of living means that the burden of government policy shouldn’t necessarily fall entirely on consumers.

[1] Victorian Transmission Investment Framework, Preliminary Design, Consultation Paper, July 2022, p9

[2] https://www.energy.gov.au/government-priorities/energy-ministers/meetings-and-communiques. 12 Aug 2022 Communique