Safeguarding against energy shortages

Australia’s Safeguard Mechanism reforms will require new gas developments to offset their emissions, possibly putting more pressure on gas prices. This is at a time when customers are concerned about the cost of living and there is a critical need for more gas supply to prevent shortages and support the energy transition. The Australian Energy Market Operator’s (AEMO’s) recently released 2023 Gas Statement of Opportunities highlights supply issues, however it did not consider the impact of the Safeguard Mechanism on these.

AEMO produces annual reports, usually at the end of March, to forecast the adequacy of gas supplies. For Australia’s east coast, this is the Gas Statement of Opportunities[1] and for the west, it is the WA Gas Statement of Opportunities[2]. These reports are based on information from gas industry participants and forecast changing customer gas needs for the next 20 years.

This year, the GSOO was released earlier than expected and made a big media impact with its warnings of potential shortages in coming years and for highlighting the need for more gas supply. However the Commonwealth’s Safeguard Mechanism, which is welcomed for providing certainty and supporting emissions reduction, has a possible unintended consequence of increasing the costs of new gas supply. The reforms are expected to pass through the Senate this week.

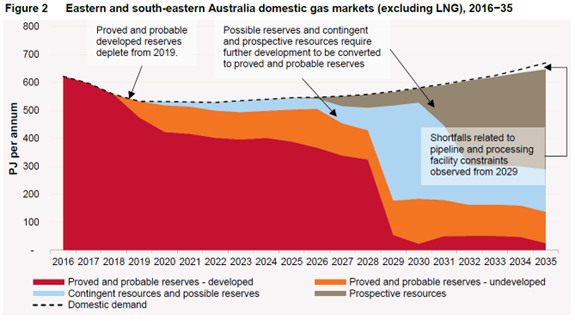

Gas shortages have been forecast by AEMO since the first GSOO in 2016[3], which showed a potential shortfall under a medium scenario from 2019. As noted in the executive summary:

As proved and probable reserves are projected to decline from 2019, currently undeveloped gas reserves and contingent and prospective resources will be required to meet forecast demand (AEMO, 2016 GSOO, pg 2).

Figure 1: Projected shortfalls in 2019 from the 2016 GSOO (Source: AEMO)

Of course, the 2019 shortfall did not occur as the gas businesses mobilised to produce adequate gas supply to meet demand.

Solving the near-term shortfall

The near-term shortfall forecast in the most recent report is predicted to occur in winter this year.

In particular, the risk of peak day shortfalls continues to be forecast under very high demand conditions in the southern states from winter 2023 (AEMO, 2023 GSOO, pg 4).

The annual physical gas supply is expected to be adequate until 2027 when additional investments will be needed to secure additional supply. Calling out a gas shortage three to four years from the publication date is common in the GSOO series of documents.

The shortfall predicted during very high demand conditions is a real risk. This can occur when several events happen at the same time, for example:

- Extreme cold weather across the southern regions.

- The unavailability or inadequacy of deep gas storage.

- The reliance of gas use for electricity generation at the same time.

- Gas transmission constraints from infrastructure developments not proceeding as planned.

- Whether spot cargoes in excess of LNG export contracts are made available to the southern market.

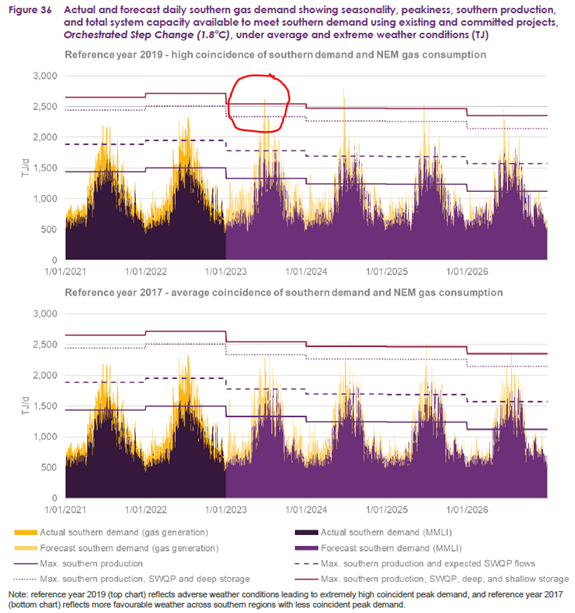

When all these factors combine, the impact is shown in the figure below in the red circle. This is based on 2019 when there was a high level of coincidence of the above events. A key driver to that potential shortfall is the reduced gas production in the southern states. Using an alternate reference year of 2017 provides the results in the bottom of the chart, i.e., no near-term supply shortage.

Figure 2: The impact of different reference year weather conditions on potential short term supply shortages (AEMO, 2023 GSOO, pg 71)

In the report, AEMO outlines a range of potential actions to ensure the gas system has maximum resilience and production capability. These actions may be required to address the potential shortfall. There are three broad actions related to infrastructure:

- Ensuring all planned gas infrastructure projects are completed on schedule.

- Develop new (committed but not yet developed) gas supply projects on time.

- Ensuring southern gas storage is at full capacity before the start of winter.

However, flexible operation of gas consumption is also available to manage supply risks. These actions can include:

- Reducing gas generation at times of peak gas demand, with greater potential use of secondary liquid fuels (if available), or the use of alternative electricity generation (such as batteries or pumped hydro).

- Reducing electricity demand by deploying demand response measures in the electricity market to reduce electricity demand, thereby lowering the need for gas generation.

- Voluntary reductions in consumption from gas consumers during extreme peak day events may also be available, however incentives and processes to deliver these are less mature in the gas market than in the National Electricity Market.

Flexible operation of the gas and electricity system combined provides AEMO with several tools to manage projected near-term gas supply shortages. This demonstrates the value of being able to have a variety of fuels and storage options that can be used to meet changing demand and varying external conditions.

Renewable gas for long term shortages

Projected gas shortage in the longer term will require new gas supplies. AEMO expects gas shortages from 2026/ 2027.

These shortages can be met with additional supply including increased drilling in Queensland, potential gas imports and renewable gases, such as hydrogen and biomethane.

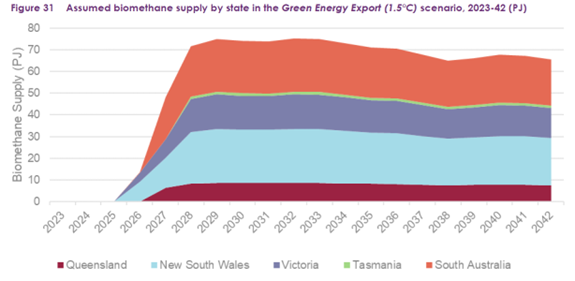

AEMO assumes that more than 70 PJ of biomethane could be available by 2027 to help address the projected gas shortage.

Figure 3: Assumed biomethane supply for Australia’s east coast (Source: AEMO, 2023 GSOO).

Renewable gas is not currently considered as an alternative gas supply in the GSOO. It could help plug the gap from declining production of natural gas from the southern states and the increased pressure on new gas projects from the safeguard reforms. Biomethane and hydrogen projects are well underway across Australia and are already providing renewable gas blends to customers. A supportive policy environment would accelerate these projects and help decarbonise gas networks at the same time.

Summary

Gas is used by many millions of homes and businesses and is a critical fuel source for industry and on-demand power generation. Forecasting its demand needs to consider potential extreme weather conditions and coincident need for gas for heating and power generation.

While the focus has been on gas shortages, the GSOO also documents practical actions that can be undertaken to minimise the impact of potential near-term or longer-term shortages. An important addition to these is the development of renewable gas like green hydrogen and biomethane. This will help us meet our emissions objectives and deliver a reliable, secure energy transition.

[1] https://aemo.com.au/-/media/files/gas/national_planning_and_forecasting/gsoo/2023/2023-gas-statement-of-opportunities.pdf?la=en

[2] https://aemo.com.au/-/media/files/gas/national_planning_and_forecasting/wa_gsoo/2022/2022-wa-gas-statement-of-opportunities.pdf?la=en

[3] The GSOO replaced the national gas forecasting report.