The ESOO call to action

When you hang up a piñata at a children’s birthday party you get an immediate market response. A crowd swarms the area, often a little too close to the action, eager pick it apart. The electricity market has similar elements to its design. Once a year the market operator, AEMO, issues its Electricity Statement of Opportunities, the ESOO. The document forecasts, over ten years, whether the system is likely to meet or miss its ‘goalposts’ for reliability. The intended market reaction is investment in the generation and network capacity to fill any identified gaps – less fun than a handful of lollies.

Just like a piñata, commentators have come out swinging, picking apart the various responses to what the 2023 ESOO is forecasting.

The ESOO considers, over its ten-year forecast horizon, the entry and exit of generation, the ability of interconnectors to get that generation to customers, and the contributions of demand side participation in the market. The forecast considers how much of the time customers will not get energy. It is measured in unserved energy (USE) and it is used to set the standard for how reliable a system we should be aiming for. The Reliability Standard is 0.002% of USE.[1] This implies we can expect to have enough supply to meet demand 99.998 per cent of the time, in every region of the NEM, every year. We don’t aim for 100% because that would necessitate a market that can incur infinite expense to achieve that outcome.

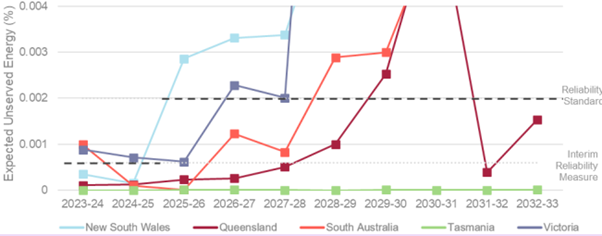

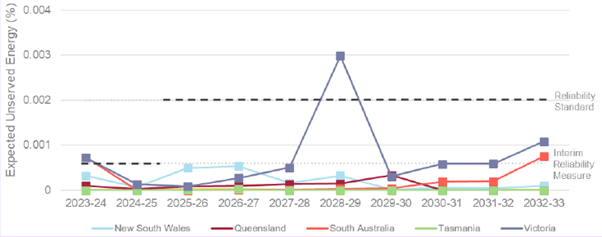

Continuing the trend from recent years, and despite an interim update to the ESOO in February 2023, this year’s ESOO indicates larger gaps in reliability. Figure 1 shows the central scenario forecast that the reliability standard could be breached in 2024/25 in NSW, followed soon after by Victoria, South Australia and Queensland.

Figure 1: 2023 ESOO, Expected USE, Central Scenario[2]

A forecast showing USE rising above the Reliability Standard is generally considered to be undesirable, and requiring something to change in the real world to make sure the forecast world doesn’t eventuate. For this reason, most of the commentary over the past week has opined on what should change in the real world to address the forecast gaps. These changes vary between generation, network or demand.

Much has been made of the real-world changes in generation to fill the gaps. These could include either the earlier entry of new generation, such as firmed wind and solar, or the delayed exit of existing generation, such as coal. Indeed, the light blue line in Figure 1 heads north in 2024/25 in NSW due to the planned closure of the giant Eraring power station. This has prompted significant debate over the need to delay that generator’s exit, bring forward replacement firmed renewable generation, or both.

Highlighting the role of the ESOO to provide information designed to prompt decisions that make the forecast out of date, the NSW Government response to the NSW Electricity Supply and Reliability Check-up suggests it will work with Origin Energy on the extension of Eraring’s operation beyond 2025.[3] Indeed, the public posturing for what will be a very challenging commercial negotiation has begun, with the NSW Government noting in its response that it considers Eraring to be a profitable asset with a decade left in its technical life.[4]

Put in context, this ESOO is a starker and more immediate warning than previous forecasts. In the good old days (say five to ten years ago), an ESOO would highlight a benign gap in a future year in a NEM region, and this would prompt a market (or at times non-market) response. The following year would roll around and the ESOO forecasts would have new information, new plans and committed investments. This would result in a forecast that essentially had fixed, in the real world, the problem faced in the previous year’s modelled world.

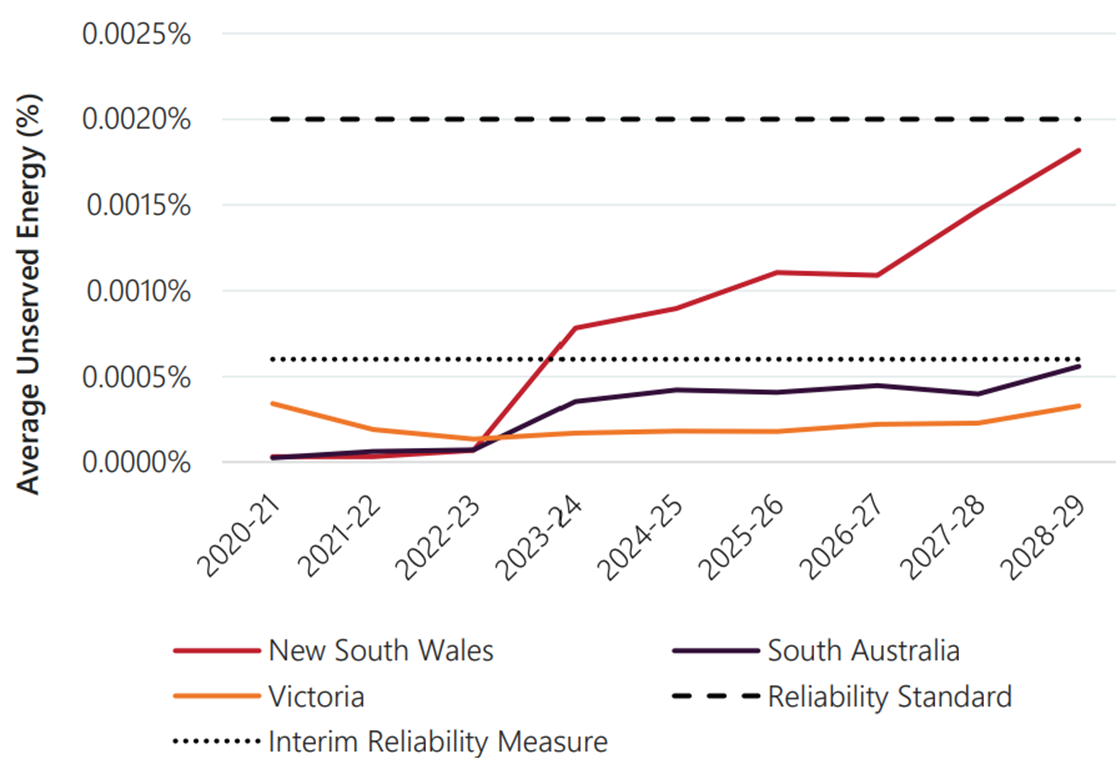

We are now in materially different real-world circumstances, with a tighter supply/demand balance and a constrained network. The most recent ESOO that showed no significant breach of the Reliability Standard under the central case was in 2020. This is shown in Figure 2.

Figure 2: 2020 ESOO, Expected USE, Central scenario[5]

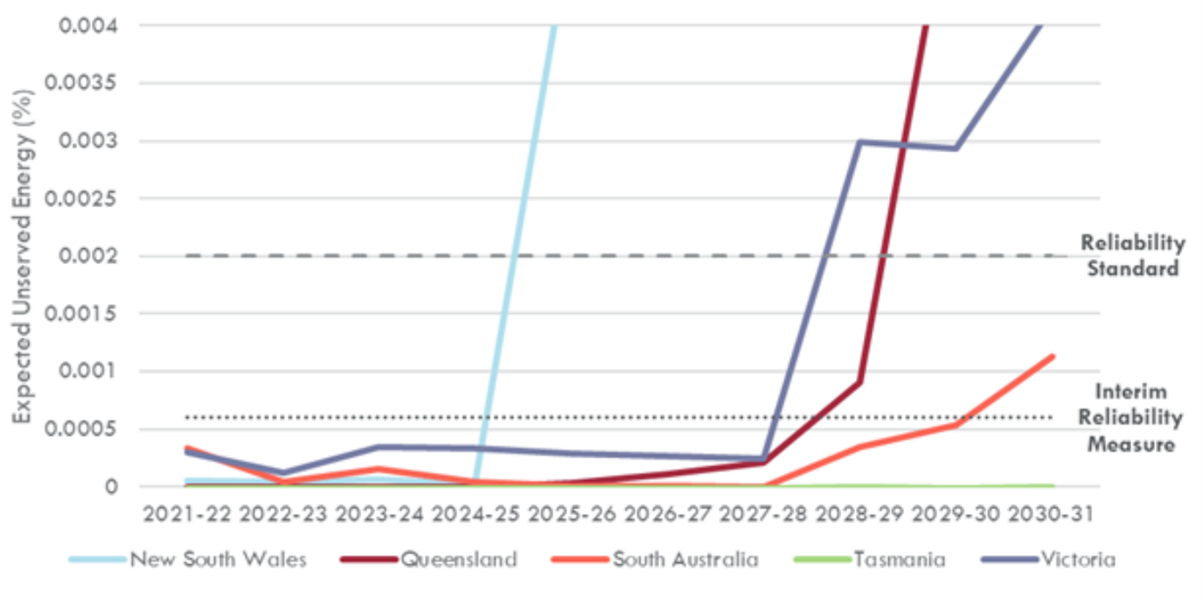

Since 2020, a succession of announced early coal generator retirements proceeded to bring forward the ESOO’s forecast gaps in USE across regions. This started in the 2020 ESOO, in Figure 3.

Figure 3: 2021 ESOO, Expected USE, Central Scenario[6]

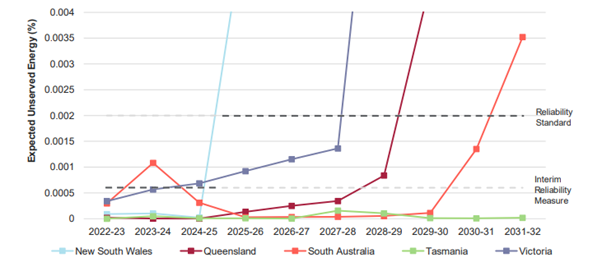

And continued in the 2022 ESOO, shown in Figure 4 below.

Figure 4: 2022 ESOO, Expected USE, Central Scenario[7]

As we can see, the cliff face of USE is moving closer to the present, and the precipitating factor is the closure of existing coal, gas and diesel generation. Some 6,730MW of this generation is expected to retire over the next decade.

Let’s take a look at what needs to happen in the real world to address these significant challenges forecasted in the ESOO modelled world.

Generation and storage

A significant pipeline of committed generation and storage investment is expected to progressively come on-line over the next decade, totalling more than 20 GW of capacity. This includes:

- Tallawarra B (320 MW) in New South Wales from November 2023

- Kurri Kurri Power Station (750 MW) in New South Wales from December 2024

- Kidston Pumped Hydro Energy Storage (250 MW/2,000 megawatt-hours [MWh]) in Queensland from February 2025

- Snowy 2.0 (2,040 MW/350,000 MWh) in New South Wales by December 2029

- Borumba Pumped Hydro (1,998 MW/48,000 MWh) in Queensland from June 2030

- More than 5,241 MW/11,054 MWh of utility-scale batteries, including Eraring Big Battery, Hazelwood Battery Energy Storage System (BESS), Orana BESS, Swanbank BESS, Torrens Island BESS, and Wooreen BESS

- Numerous renewable energy developments across the NEM, including 4,918 MW of wind generation and 5,212 MW of utility-scale solar generation

These changes that we ‘know’ are happening are considered in the central case. Reflecting state governments taking a more active role over recent years, jurisdictional schemes are likely to incentivise further new generation and storage. These schemes include the federal Capacity Investment Scheme, New South Wales Electricity Infrastructure Roadmap, Victorian Renewable Energy Target Auction 2, Queensland Energy and Jobs Plan, and the South Australian Hydrogen and Jobs Plan.

Connecting all this new generation and storage, and getting this new capacity to market, requires new transmission.

Transmission

Transmission is an important enabler of the transition to renewables. It facilitates generation being shared across states and into load centres. This is increasingly important as we shift to more weather dependent generation, where renewable resources may be greater or lesser at any given time across different parts of the NEM. The committed transmission developments considered in the central case in the ESOO include:

- Project Energy Connect linking South Australia to NSW and Victoria. The first stage of this project will start its transmission commissioning in early 2024

- The Waratah Super Battery and associated transmission upgrades in NSW will help meet the reliability requirements in NSW

- Western renewables Link in Victoria will better connect renewables in north west Victoria to the Melbourne Load centre

- Central West Orana renewable Energy Zone will deliver transmission to connect more renewables in NSW

These transmission projects will play a critical role in facilitating the connection of new generation and the delivery of that capacity to load centres. If they are delayed the ability of new generation to fill forecast reliability gaps is also delayed. If that occurs, there will be few options to keep the lights on other than to extend the life of coal and gas generation. With the electricity sector playing a leading role in the decarbonisation of the economy, this should be seen as a last resort.

There is also a range of further actionable ISP transmission projects not considered in the central case that could improve the reliability outlook. These include:

- New Interconnector projects – Marinus Link, HumeLink and VNI West that will allow more generation to be shared across states

- New England REZ and Hunter Transmission project that will allow more renewable generation to get to customers in NSW

Assuming the relevant planning and regulatory processes result in the commitment of these projects, and that they are delivered on time, the reliability outlook is vastly improved. Figure 5 shows the impact of these projects coming online and the additional energy that can be shared across regions.

Figure 5: 2023 ESOO, Expected USE, Additional actionable and anticipated developments[8]

New transmission plays a critical role in the reliability of a transforming power system. While planning and regulatory processes rightly focus on the net benefits of projects, it is also important to consider these projects in the broader context of system reliability and the decarbonisation of our economy.

[1] We also currently have an Interim Reliability Measure (0.0006% of USE) that guides some actions in the market, such as buying reserves to fill any shorter term gaps. For this article we will keep it simple and just refer to the Reliability Standard.

[2] AEMO, 2023 Electricity Statement of Opportunities, p7.

[3] NSW Government, Electricity Supply and Reliability Check Up: NSW Government response, p12.

[4] Ibid at p7.

[5] AEMO, 2020 Electricity Statement of Opportunities, p7.

[7] AEMO 2022 Electricity Statement of Opportunities, p8

[8] AEMO 2023 Electricity Statement of Opportunities, p11