Behind the news: network reliability

The holiday is definitely over.

As families returned to work and school after the summer break, Australian politicians have again turned their attention to energy. With the Australian Parliament resuming for 2018, and three state elections due over the next twelve months, the pitch for hearts and minds through batteries big and small is a likely feature of the landscape for months to come.

Simultaneously, the spotlight has been on electricity distribution network reliability as the Australian Energy Market Operator (AEMO) confirmed that on 28 January Victoria experienced its highest operational demand for a Sunday ever, recording 9,144 MW of demand at 7:30 PM AEDT. This unprecedenteddemand had subsequent impacts on loclaised parts of the Victorian distribution network.

In the maelstrom, a bipartisan federal report on Grid Modernisation was released on Monday with some big things to say. Headlines have twisted sensible recommendations on metering, but the report is worthy of a deep dive into the 23 recommendations; with considered recommendations on interconnection, making sure regulation keeps pace with technology and fairer pricing.

Further, what the Powering our future report has to say about reliability is contextually important, while the numbers on reliability nationally tell a different story beyond the headlines.

Powering our Future

For their Grid Modernisation inquiry, the House of Representatives Standing Committee on the Environment and Energy undertook an online questionnaire of households and businesses. In the questionnaire, 81.5 per cent of respondents rated their electricity service either reliable or very reliable. By comparison, during hearings the AEMO gave evidence that Australia’s power system operates extremely effectively, with a reliability standard of 99.998 per cent.[1]

The Committee also heard that while electricity costs had increased in the past 10 years, reliability had improved and that excluding major weather events, customers who previously experienced an average of two interruptions a year now experience one interruption each year. The report also identified the role of AEMO in setting reliability standards assessed against the customer value of compared to different process in each NEM jurisdiction (p 261). In addition, the Committee recommends

Recommendation 9: The Committee recommends that the Minister for the Environment and Energy take to the Council of Australian Governments Energy Council a proposal that all of the National Electricity Market states refer reliability regulation to the Australian Energy Market Operator, in keeping with the Victorian approach, and operate under the customer value of reliability model.[2]

What do the numbers say?

Reliability is a combination of the service provided by generators, transmission networks and distribution networks.

As it relates to the distribution networks, comparisons of reliability across jurisdictions must be made with care as geographic conditions, population density and historical investment differ across the networks.

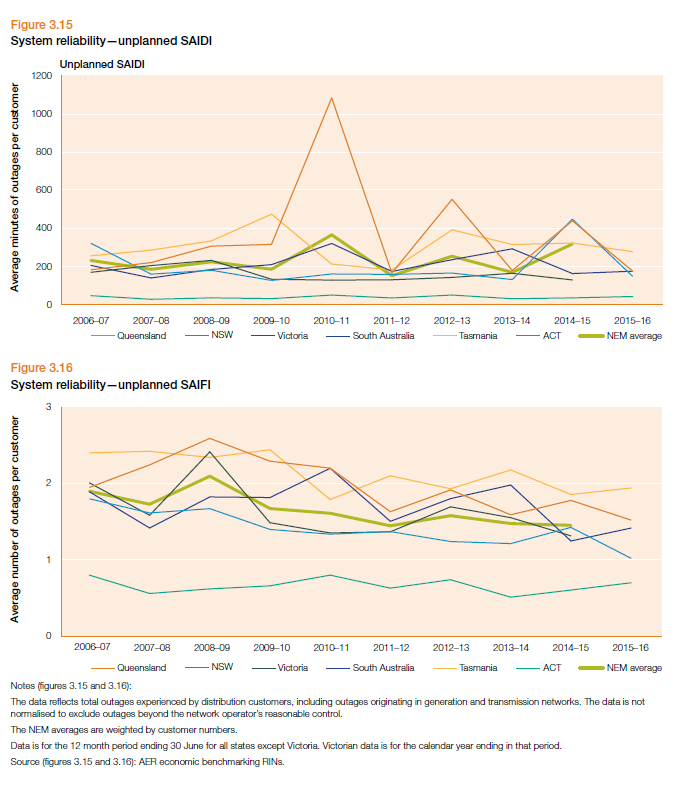

Reliability of electricity distribution networks is measured by a number of indicators; the system average interruption duration index (SAIDI) and the system average interruption frequency index (SAIFI)

With regard to SAIDI, the Australian Energy Regulator (AER) has found that a typical customer experiences around 200 minutes of outages per year – including planned and unplanned outages. Regional conditions affect this, as do major weather events – for example Tropical Cyclones in Northern Queensland.

To put this into perspective, there are 525,600 minutes in one year. For the average customer, interruptions of any kind will only occur 0.03 percent of the time during the entire year. For networks with the highest minutes off supply per customer, averages in the reporting period for those networks can be attributed to major storm events of Tropical Cyclone Larry, Monica, Lam, Yasi and Marcia.

The average number of unplanned outages per year (or SAIFI) has generally declined over the past decade. NEM Customers have experienced on average around 1.5 outages each year. In 2015–16, this fell in Tasmania, Victoria, Queensland and NSW. In Queensland and NSW this fell to near the lowest levels of the past decade, with NSW recording the largest fall. It rose in South Australia and the ACT (up 8 per cent and 22 per cent respectively), however the ACT continues to have the lowest frequency of unplanned outage time.

Source: Australian Energy Regulator, State of the Energy Market, May 2017, p122

Comparing distribution networks to other service providers target indicators, there’s no question networks are held to a particularly high standard, for good reason.

Trains NSW has a target of 92 per cent when it comes to trains running – anything more is considered a “big win for customers”.

Complaints about the NBN network surged 117.5 per cent in 2016, compared to the previous year when Telstra admitted that a whole one per cent of its NBN customers – about 7,900 people – had been sold network speeds that were completely unattainable 100% of the time.

Valuing reliability

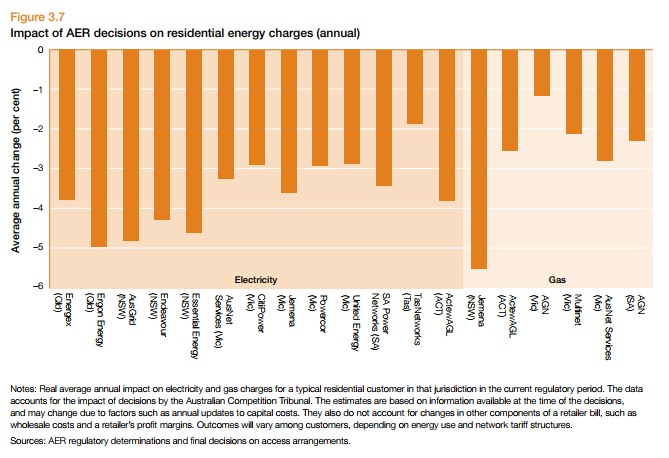

Investment in network infrastructure so networks could meet reliability standards was a key driver of rising network costs for several years in previous regulatory periods. Concerns about the impact of this investment on customer bills led the CoAG Energy Council in 2014 to endorse a new approach to setting distribution reliability targets. The approach accounts for the value that customers place on reliability and the likelihood of interruptions.[3] Accordingly, several jurisdictions, particularly Queensland and New South Wales reformed their distribution reliability standards.

The AER has indicated that previous regulatory determinations were made at a time when network costs were on the rise to replace ageing assets, meet stricter reliability and bushfire safety standards, and respond to forecasts made at the time of rising peak demand but that these cost pressures have now eased and regulated network revenues are now forecast to fall by an average 13.5 per cent in electricity.[4]

Source: Australian Energy Regulator, State of the Energy Market, May 2017, p109.

Most outages in the NEM originate in distribution networks, however, notwithstanding natural disaster, accidents and faults, investing in sufficient capacity to avoid all outages, 100 per cent of the time is not realistic and it would come at a huge cost to customers.

The Grid Modernisation report recognises this,

The Committee considers the reliable supply of electricity to be of the utmost importance as part of the service delivery of a modern grid. However, the Committee is aware that reliability carries implications for price. The Committee considers it essential that the energy market and policy makers are innovative in pursuing cost effective methods of achieving reliability (pp83-84)

We need to be smart about investment, we need to build network where we need to but not more than we need to. The Powering our Future report is another review that directs us to the opportunities available to deliver a safe, reliable and affordable energy, but it is only by industry, governments and regulators working together with customers that we will unlock the full benefits of a modern power grid.

[1] House of Representatives Standing Committee on the Environment and Energy, Powering our future, Inquiry into modernising Australiaʹs electricity grid, p 74.

[2] House of Representatives Standing Committee on the Environment and Energy, Powering our future, Inquiry into modernising Australiaʹs electricity grid, p 85.

[3] Australian Energy Regulator, State of the Energy Market May 2017, p121.

[4] Australian Energy Regulator, State of the Energy Market May 2017, p 107