Could the solar boom bust the grid?

Solar Generation

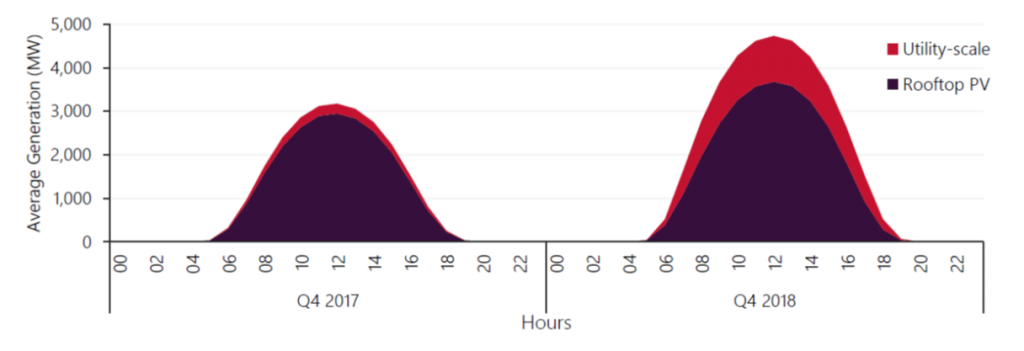

According to AEMO’s Quarterly Energy Dynamics Report [1], the average daily peak generation of rooftop photovoltaic (PV) increased 25 per cent from 3110 MW to 3878 MW between Q4 2017 and Q4 2018, which can be attributed to a record amount of installed rooftop solar capacity over 2018, as shown in Figure 1. Rooftop solar provided most solar generation – making up 74 per cent of total solar generation in Q4 2018. The Clean Energy Regulator estimated that 1.6 GW of solar capacity was installed across Australia over 2018, with more than 1 GW of this capacity expected in the NEM [2]. The speed and magnitude of our solar PV uptake is skyrocketing.

Figure 1: Average NEM hourly large-scale solar and rooftop PV generation profile across Q4 2017 and Q4 2018

In Victoria and NSW, political parties offered rooftop solar rebate and battery storage subsidies, and last week, the NSW Labor Opposition promised to deliver the biggest renewables roll-out of 7 GW of renewable energy. All this is positive news for Australia in terms of reaching our Paris agreement target to support renewable energy generation to combat climate change. Networks commend the emerging renewable energy promises, however, these raise some imminent challenges for the grid and its customers.

Network Challenges

Original electricity infrastructure did not intend for electricity to move in two directions. While it is not impossible for electricity to flow backwards, it is tricky for networks to manage the grid on a technological level, especially when there is a lot of distributed electricity feeding back into the grid in the same area. Transformers may become saturated due to increased voltage from exportation. So what challenges do networks face when the local part of the grid is full?

Maintaining Grid Stability

Networks will face new technical and operational challenges in managing the future grid. The two main technical issues caused by large amounts of solar being fed back into the grid include [3]:

- Voltage spikes on low voltage lines which could damage network and consumer equipment and result in networks needing to temporarily shut down solar inverters to restore voltage to normal limits. Presently, because of limited visibility of data, there is little ability of low voltage networks to manage distributed energy resource (DER) export and the constraints in their networks that lead to high levels of DER causing them to breach technical obligations, such as voltage limits.

- Thermal overloading of substation transformers or fault currents caused by net reverse (upstream) flows.

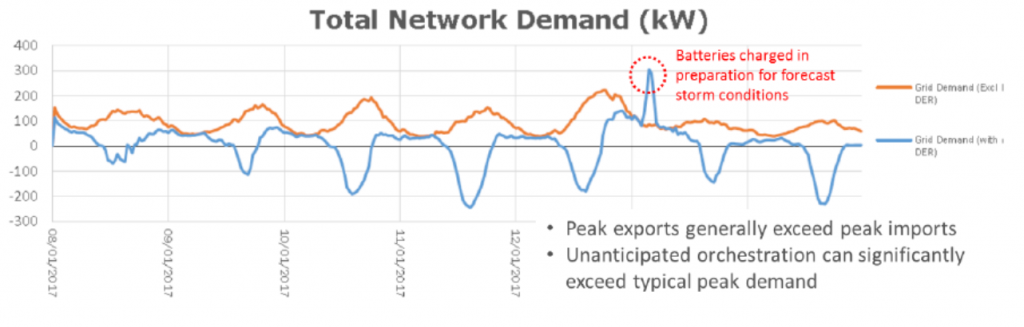

Figure 2: SAPN’s Salisbury battery trial – aggregate customer load profile

Based on South Australia Power Networks’ (SAPNs) Salisbury battery trial, a key learning was that for customers installing solar systems of 5kW or more, even with batteries, exports are still typically significantly exceeding imports as most customers’ batteries are fully charged by about midday. According to SAPN’s annual report [4], it is expected that zone substation reverse flows will be emerging across South Australia by 2020, and by 2050, distributed solar load flows on high voltage feeders could potentially exceed asset ratings at times of minimum demand. Network impacts will arise first in the low voltage network, where the effect of increasing penetration of solar and other DER is to increase the dynamic range of power flows between peak demand and peak export and the rate with which the system can swing from one end of this range to the other. These effects are already visible in data from the Salisbury battery trial, as seen in Figure 2.

Hence, investments such as changes to network configurations or equipment become necessary to maintain grid stability and reduce risks. But, who should pay for these investments?

New connections

According to AS/NSZ 4777, most networks will allow system sizes as per the below:

- Single phase connection (most homes): Up to 5kW,

- Three-phase connection (some homes and many businesses): Up to 30kW

Network Service Providers (NSPs) are challenged with facilitating and integrating customer driven DER into their networks. Another important implication of size limitations is solar feed-in tariff eligibility. ‘First in best dressed’ access policy applies – so once certain (very localised) saturation levels are reached, new customer connections within the same area may not be allowed to export into the grid due to technical network constraints. New solar customers will naturally expect to be able to get connected to the grid and take advantage of feed-in tariffs to the same extent as their neighbours. But this is not always possible and it is raising questions of ‘solar equity’. Questions like ‘why should my neighbours be able to export up to 5kW but I am restricted at 0 kW because I connected after them?’ and ‘do they pay more than me for this privilege’? The governing National Electricity Rule 6.1.4 states that ‘a distribution NSP must not charge a distribution network user, distribution use of system charges for the export of electricity generated by the user into the distribution network’. This leads to significant constraints as it bans export charging.

Legitimate questions are being raised about the local access regime and whether it remains fit for purpose. The reality is, the ‘first in best dressed’ approach needs assessment and innovative approaches considered – for example, sharing of export capacity among all customers, with energy potentially tradeable or auctioned.

Customers applying to install solar should always contact their local distributor to check network capacity before they make the decision to invest and solar companies with an interest in their business should be advising them to do so.

Curtailment

Curtailment is the restriction of a customer’s generation capacity because of weakness in the grid in an area – a growing issue in Germany and China. It becomes essential to protect whole-of-system security, safety and power reliability. In Germany, grid operators are being forced to dramatically increase operating costs to stabilise a centralised grid that was never built for fragmented renewable production. While in China, the Government has been trying to adjust the timing of construction and has set up an early warning system forcing regions suffering from excess capacity growth to slow down the pace of new approvals.

Hawaii has had its own share of problems as concerns over system reliability led network operators or regulators to limit or pause rooftop solar programs. Considering these international scenarios, curtailment could become an issue in Australia, particularly as DER uptake accelerates as solar and battery subsidy policies take full effect.

In Australia, the Australian Energy Market Operator (AEMO) manages curtailment in large-scale generation in the National Electricity Market. While you would think new solar customers in Australia would prefer occasional curtailment to blanket export restrictions, distribution businesses do not have capacity to curtail at the local level. This poses the question of how curtailment in small-scale generation will be managed in future in order to ensure power system security and fairness for customers.

Promises versus Challenges

It is essential that Australia establishes an effective mechanism to properly integrate solar and storage into the grid so customer exports aren’t restricted and they are able to get full benefit from their DER. Energy Networks Australia’s Energy Network Transformation Roadmap has facilitated the development of a pathway forward for network businesses to accommodate distributed energy throughout their networks and our Open Energy Networks Project with AEMO is an important extension of this work. In addition, Energy Networks Australia is soon to launch DER connection guidelines, which will provide technical guidance for standardising rooftop solar connections for all Australian network businesses.

At a political and government level, policies and programs must consider network and whole-of-system challenges. If they don’t, not only will customer expectations not be met, the system simply won’t cope. The solar boom could go bust.

References

[1] AEMO Quarterly Energy Dynamics Report Q4 2018

https://www.aemo.com.au/-/media/Files/Media_Centre/2019/QED-Q4-2018.pdf

[2] Small-scale technology certificate market update – December 2018

[3] Cross about subsidies: the equity implications of rooftop solar in Australia

[4] SA Power Networks Distribution Annual Report Planning Report 2018/19 to 2022/23

https://www.sapowernetworks.com.au/public/download.jsp?id=9716