Opportunities for networks to integrate renewables and assess battery storage: AEMO

The Australian Energy Market Operator’s (AEMO) Victorian Annual Planning Report, published this month, outlines a number of new perspectives on Victorian transmission network opportunities for the next decade.

AEMO, like most industry planning bodies, has identified that key drivers of potential network augmentation are shifting away from managing peak demand to facilitating higher levels of renewable generation and inter-regional energy transfer.[1]

The AEMO report is highlighted by renewables’ integration and economic consideration of large-scale battery storage.

An industry in transition

AEMO sees the energy industry transformation as one that will continue and involve:

- slowing demand growth;

- generation decentralisation (including higher levels of renewable generation);

- asset replacement as a key commercial and regulatory issue; and

- circumstances where “major network augmentations to increase capacity might in fact be cost effective for consumers” for transporting cleaner power to demand centres.[2] (This particularly comes to the fore where older, more carbon-emitting generation, particularly from brown coal, is either reduced or ultimately closed.)

Identified connection opportunities in Victoria

North Western Victoria – a key opportunity

This region of Victoria is home to a number of wind farms, namely Waubra and Ararat (expected to connect in July 2016).

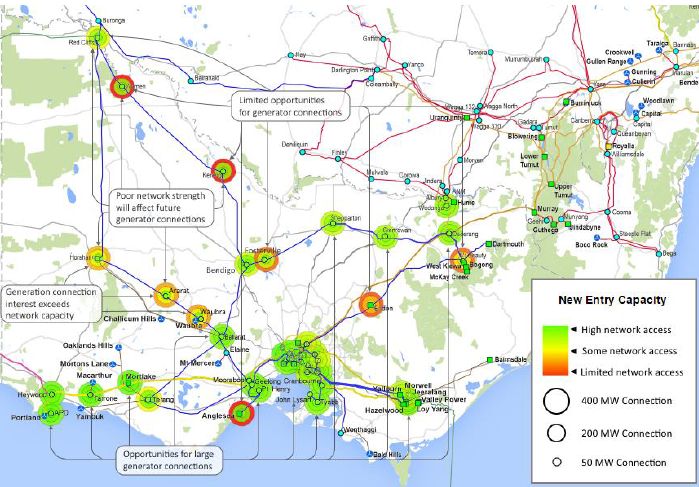

AEMO has received in excess of 1,500MW of connection interest in this wind and solar rich region. [3] (See Figure 1 below.) Most of these proposals are along the 220 kV network between Ballarat and Horsham. Only some of these will be progressed, as there is currently insufficient network strength and capacity to accommodate this volume of connection.

At this stage, AEMO considers that with firm generator investment commitment (of a minimum threshold of around 400MW), it could economically justify a major network augmentation (i.e. transmission lines). These augmentations would need to successfully pass the Australian Energy Regulator’s (AER) full Regulatory Investment Test – Transmission (RIT-T), which AEMO indicates it will commence late in 2016. A key benefit AEMO will evaluate is the displacement of higher-priced fuel generation.

AEMO considers however, that if only 200MW of new connection progresses, then minor line upgrades and the utilisation of control schemes to manage overload on the transmission network, including agreements for automatic load shedding and, in one case, an automatic ‘bus’ splitting control scheme, should be sufficient to accommodate the new and existing generators in the Victorian network.

Figure 1: Generation connection opportunities and risks[4]

Battery storage integration – an ongoing learning curve

AEMO argues that battery storage might be a credible alternative to network augmentation in any attempt to alleviate congestion. AEMO notes that parties wishing to connect to areas with low network capacity might consider battery storage installation to moderate their peak generation.

The report highlights that AEMO has undertaken an economic assessment of the merits or otherwise of large scale (10 to 50 megawatt hours) (MWh) battery storage as a way to reduce wind curtailment in North West Victoria. In doing so, AEMO considered benefits as including[5]:

- reduced generator fuel costs by storing and releasing renewable energy; and

- reduced wind curtailment that can avoid possible penalty payments if the Large Scale Renewable Energy Target cannot be met from other sources.

Based on assumptions that a grid-connected battery will charge when wind generation is curtailed and discharge during daily price peaks, AEMO found that[6]:

- Battery storage was not currently justified in lieu of network augmentation. The assumed cost of a battery ($500,000/MWh) to alleviate congestion in North West Victoria is approximately 250 per cent of the market benefits returned, given a 20-year battery lifespan. Benefits are expected to improve as battery costs decrease and lifespan increases; and

- Generator proponents could consider the additional benefits of price arbitrage, contracting, and ancillary service provision if they chose to integrate battery storage into a renewable generation project.

It is important to note that AEMO concluded that the value of large grid-connected battery storage is unique to each location, due to issues involving network capacity and generation intermittency. AEMO acknowledges that the outcomes of the study are site specific to network congestion emerging in North West Victoria and cannot be applied more broadly[7].

Network Service Provider examples

A number of national electricity market (NEM) Network Service Providers have undertaken battery storage trial projects including, amongst others:

- AusNet Services’ trial of a one megawatt (MW) ‘network’ battery to support the Victorian electricity grid during ‘peak demand’ periods, typically during the afternoon on hot summer days – its Grid Energy Storage System (GESS);

- ElectraNet, AGL Energy and Worley Parsons’ joint Energy Storage for Commercial Renewable Integration in South Australia (ESCRI-SA) study; and

- NSW’s TransGrid’s hybrid idemand (battery, solar panels and energy efficient lights) demand management project.

A number of electricity distribution businesses have similar battery-related projects and trials in their respective franchise areas and regions.

Other AEMO developments[8]

AEMO also announced that it recently changed its Victorian electricity planning criteria to consider the use of five-minute short-term ratings to manage thermal overloads to defer potential augmentations, especially in areas of low demand growth.

Another initiative being utilised by AEMO, in a similar way to that utilised by other TNSPs across the NEM, is the use of low-risk and economically feasible switching control schemes to defer non-urgent network augmentation.

Conclusions

The NEM and the wider energy industry sector continue to face dynamic times. The challenges of integrating and accurately predicting the impact and penetration of renewable energy sources, and the various forms of new technologies in a market environment, highlights the increased complexity confronted by forecasters, energy infrastructure planners and policy makers alike.

[1] AEMO (June 2016) Victorian Annual Planning Report, p. 1

[2] AEMO (9 June 2016) New generation in North West Victoria will require investment

[3] AEMO (June 2016) p. 19

[4] AEMO (June 2016) p. 3

[5] AEMO (June 2016) p. 26

[6] AEMO (June 2016) p. 27

[7] See section 4.2.2 of the Report (pp. 26 -27).

[8] AEMO (June 2016) p. 17