Reclaiming our gas advantage

The Victorian Parliament this week passed new bans on unconventional gas supply, days before the release of the Australian Energy Market Operator’s Gas Statement of Opportunities (GSOO).

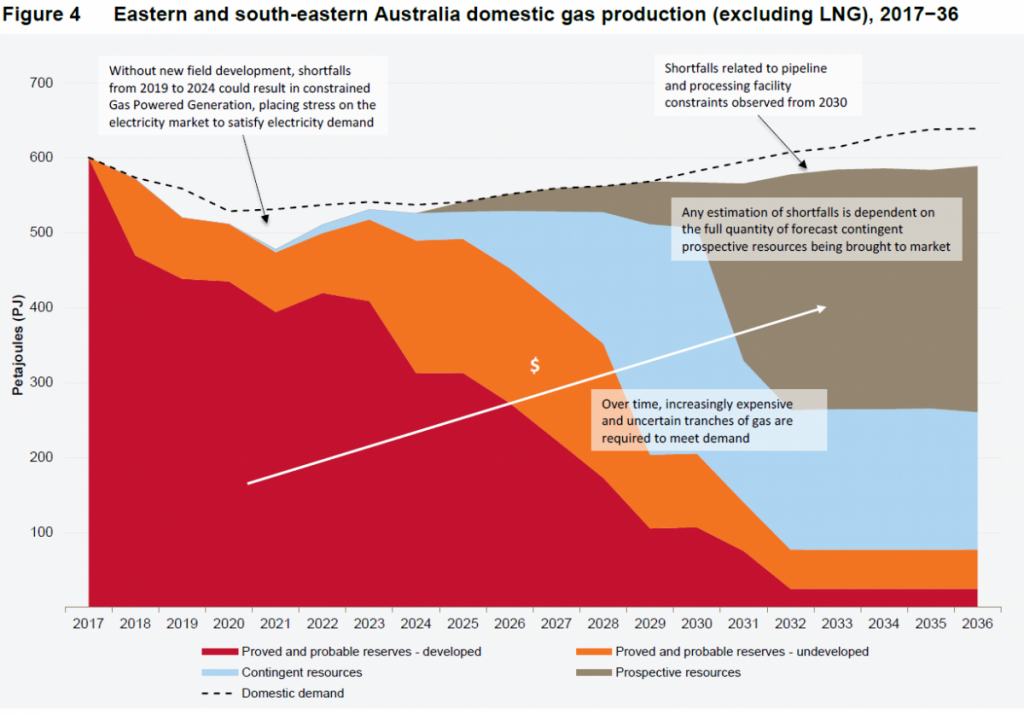

AEMO predicts gas supply shortfalls within two years in southern states. In its ‘Neutral’ Scenario, the shortfall could exceed 156 Petajoules (PJ) between 2019 and 2024 and result in either power outages or gas supply cuts, unless action is taken. In a scenario where the NEM were more reliant on gas powered generation, AEMO projects a shortfall of 245 PJ over the same period. A key driver is falling gas production, which AEMO expects to decline by 20% in eastern and south-eastern Australia by 2021, including a 155 PJ (or 38%) reduction in Victoria[1].

AEMO notes the National Electricity Market is highly dependent on gas powered generation to balance intermittent renewable generation output and for system stability particularly in South Australia. It warns of increasing power outages when gas powered generation cannot respond fast enough to meet demand.

“AEMO projects that declining gas supplies could result in electricity supply shortfalls between 2019 and 2021 of approximately 80 GWh to 363 GWh across SA, NSW, and Victoria.”[2]

Source: AEMO Gas Statement of Opportunities 2017

The Victorian bans this week come despite the State having the largest manufacturing sector dependent on gas, the biggest gas consuming households and a generation sector which will soon lose 14% of its firm capacity in Hazelwood Power Station. Nearly 2 million Victorian households rely on natural gas for hot water, heating and cooking.

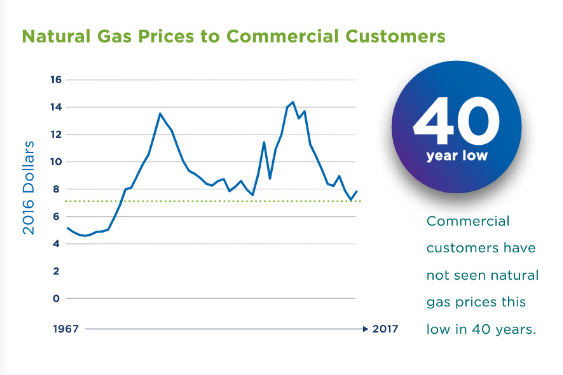

Internationally, it’s a very different story. Gas is a powerhouse in the United States where commercial customers are experiencing the lowest natural gas prices in decades.

Policy-driven Gas Shortages

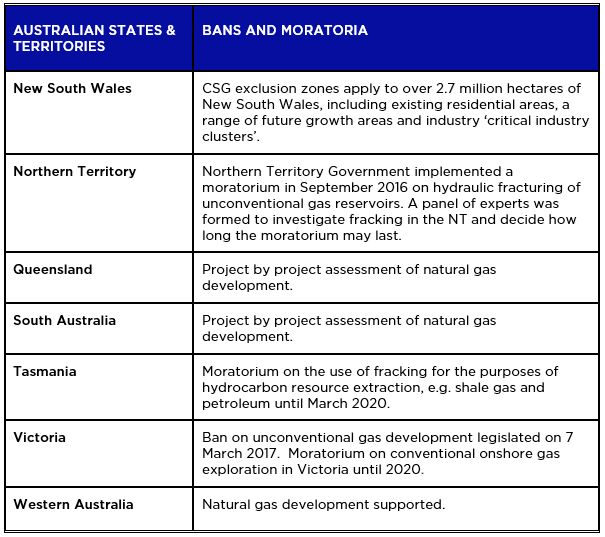

Barriers to gas exploration and development has reduced new gas supplies entering the domestic market resulting in upward pressure on domestic gas prices. The risk of state government intervention has also reduced appetite for investment.

The Victorian intervention is the most stringent of all states in its treatment of gas development. This week the Victorian Government passed legislation to permanently ban all onshore unconventional gas exploration and development, including fracking and coal seam gas. It also extended the moratorium on conventional onshore gas exploration and development to 2020.

Unnecessary restrictions on gas explorations and development by state governments including Victoria and Northern Territory place upward pressure on gas prices. An evidence-based national approach to gas exploration and production, such as that provided by the Academy of Technological Science and Engineering[3], could provide incentives for industry to recommence exploration activities, placing downward pressure on long-term gas supply and prices.

The constraints on supply have clear consequences for the Australian economy, as ACCC Chair Rod Sims warned in Senate estimates this week:

“The Australian gas market is short of gas—on the east coast, we are talking about, not the west coast—and does not have enough competing gas suppliers. So we really do have a problem…. There are a lot of manufacturing companies, particularly—industrial companies—that are dependent on gas, either because they use it as a feedstock or because they use it as a source of energy and it is hard to change. I think the current issues in the gas industry, particularly the very high prices and the difficulty of getting gas, are going to cause manufacturing a very big problem.” Rod Sims[4] (page 107)

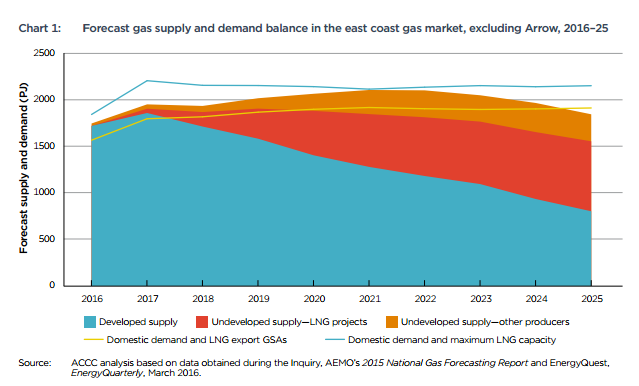

The ACCC highlighted the significant supply development required in east coast gas markets in its 2016 Report[5] “Inquiry into the east coast gas market”.

The ACCC warned of the potential for Government bans to exacerbate tight markets and recommended explicitly in 2016:

Governments should consider adopting regulatory regimes to manage the risks of individual gas supply projects on a case by case basis rather than using blanket moratoria. Governments should take into consideration the significant effects that moratoria and other restrictions on gas development may have on gas users.

The Australian Energy Market Operator (AEMO)[6]predicts that the retirement of Hazelwood will cause a spike in gas consumption for 2017-19 due to additional demand for gas for power generation. The greatest challenge is expected to occur between 2018 and 2024. Gas supply may be stretched further if additional gas is required for power generation as highlighted in Jacobs modelling for Energy Networks Australia.[7] This study found that, under all scenarios, the contribution of gas-fired power generation in 2030 would need to increase by at least 280% to 73,000 GWh per year, to enable Australia to reach its 2030 abatement target.

The US experience

During the past 10 years the United States has witnessed the resurgence of its gas industry, through the development of shale gas reserves keeping natural gas prices low.

The US Energy Information Administration has recently reported that energy-related CO2 emissions for first six months of 2016 were lowest since 1991. This was the lowest emissions level for the first six months of the year since 1991, as mild weather and changes in generation type contributed to the decline in energy-related emissions.

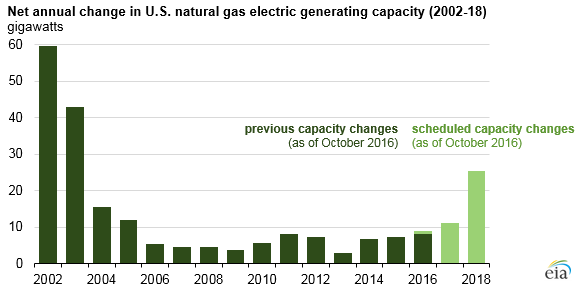

The EIA predicts that natural gas-fired generating capacity is likely to increase over the next two years. Many of the natural gas-fired power plants currently under construction are located in Mid-Atlantic states and Texas, where the nation’s major natural gas shale plays are located.

Source: U.S. Energy Information Administration, Electric Power Annual and Preliminary Monthly Electric Generator Inventory

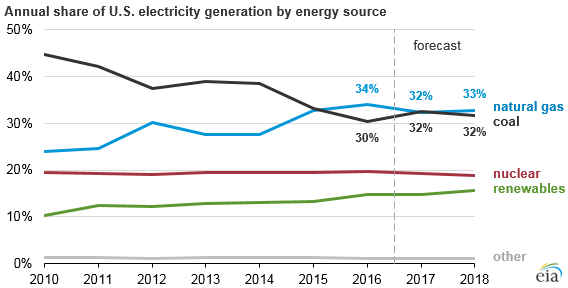

Natural gas was the primary source of U.S. electricity generation (when measured on an annual basis) in 2016 for the first time. The amount of electricity generation fuelled by natural gas between January and October 2016 was 6% higher than generation during the same period in 2015. In contrast, coal-fired electricity generation during the first 10 months of 2016 was down 12% compared with the same period in 2015.

Natural gas was the leading source of electricity for nearly every month of 2016, accounting for an estimated 34% of total annual utility-scale power generation, compared with a 30% share for coal-fired generation.[8]

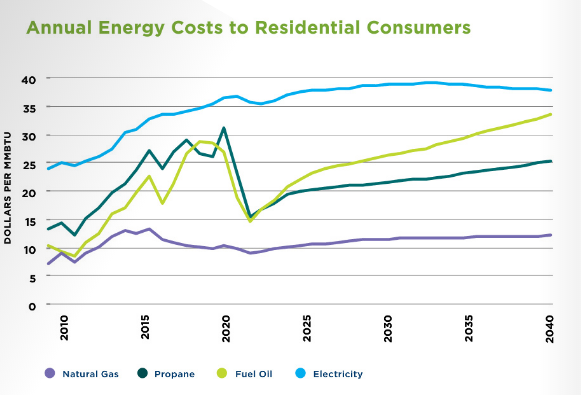

The American Gas Association 2017 Playbook[9] Natural Gas: Moving our Nation Forward indicates low domestic gas prices have led to savings of almost $50 billion for energy customers and that commercial customers are experiencing a 40 year low in natural gas prices.

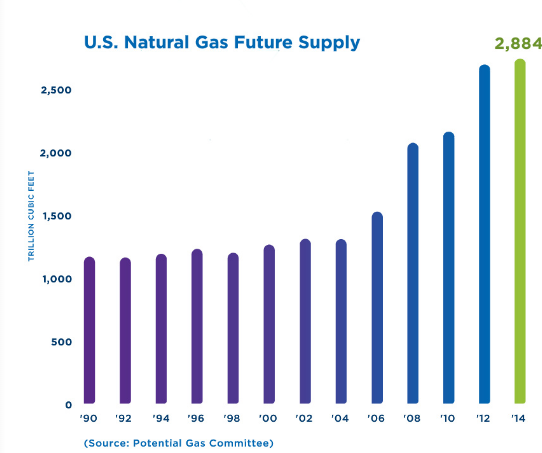

At the end of 2014, estimated future supply of natural gas (reserves plus resources) was enough to meet America’s energy needs for more than 100 years.

The outlook for Australia

Gas contributes significantly to Australia’s electricity generation sector. In 2014-15, gas provided 18% of total generation. Gas is a low emission fuel with significant capacity to support Australia achieve its carbon abatement targets.

Gas used in efficient new gas-fired power generation has approximately half the emissions of the current electricity grid[10]. As a flexible generation technology, gas fired power stations can provide a critical balancing service, enabling higher penetration of variable renewable energy. This requires market participants to have sufficient commercial confidence to underwrite plant availability and gas contracting.

Gas can also positively contribute to the security and supply of electricity and energy more widely:

- Reliability: gas networks are largely underground and as such are very reliable. On average, customers experience only one hour off supply every forty years[11].

- Security of supply: diversifying the energy mix is key to energy security.

- Affordability: reduced distribution gas prices have been placing downward pressure on residential gas prices[12].

In its submission to the Finkel Review, Energy Networks Australia has recommended the Review consider the longer term future of gas and gas infrastructure. There is increasing Australian and international recognition of opportunities to further reduce the relatively low carbon footprint of gas with innovation in, for instance, the use of biomethane and hydrogen applications.

Broadening the supply of natural gas for the South Eastern Australia market will put downward pressure on prices. Removing unnecessary regulatory burdens and lifting restrictions on exploration may provide the right set of conditions for industry to explore and develop new gas resources.

The economic role of gas will remain dependent on its competitive position as a fuel of choice, competing on price, sustainability, security and amenity.

[1] AEMO (2017) Gas Statement of Opportunities, p.3

[2] AEMO (2017) Gas Statement of Opportunities, p.1.

[3] http://www.atse.org.au/atse/content/publications/focus/issue/193-unconventional-gas-is-here.aspx

[4] Senate Economics Legislation Committee Estimates (Public) Wednesday, 1 March 2017 Canberra, Page 107

[5] ACCC (2016), Inquiry into the east coast gas market, April 2016, available from: https://www.accc.gov.au/publications/inquiry-into-the-east-coast-gas-market

[6] AEMO (2016), National Gas Forecasting Report, December 2016

[7] Jacobs (2016), Australia’s climate policy options – modelling of alternate policy scenarios, report completed for Energy Networks Australia, accessed from www.energynetworks.com.au

[10] Department of the Environment (2014), National Greenhouse Accounts Factors.

[11] Australian Gas Networks (AGN) Victoria and Albury Final Plan. December 2016.

[12] For example, in South Australia, AGN’s distribution tariff fell by 23 % on 1 July 2016.