Regulating for the sun

The Australian Energy Regulator (AER) has released draft determinations for distributor South Australian Power Networks (SAPN) and Queensland distributors Ergon Energy and Energex. Determinations occur every five years for each regulated business and set the level of revenue and expenditures each business can recover.

As these two states experience some of the highest levels of solar PV penetration in the world, this process will serve as a test-bed for how Australia’s regulatory framework can adapt to a changing environment.

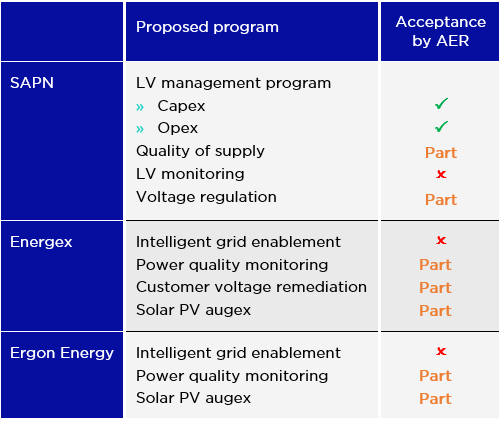

As an example, all three businesses put forward specific expenditure for managing the impacts of rooftop solar on their network, as well as significant amounts for replacement and growth of the network. The regulator did not accept all the proposed expenditure, and the AER’s decisions make it clear that it didn’t consider the networks’ current proposals to be adequately justified, supported by robust businesses cases in all cases.

The three networks now have the opportunity to address the AER’s concerns and provide additional information with their revised proposals.

Embracing the evolving future

The draft determinations show that the AER recognises that solar PV creates voltage issues in the low voltage (LV) network and appreciates that networks need to develop new systems to engage with distributed energy resources (DER), to serve the evolving needs of customers.

As South Australian and Queensland customers lead the nation in the number of solar PV installations, this is a particularly urgent priority for the networks in those states.

This was demonstrated through the AER’s acceptance of SAPNs $34.1 million of expenditure (both capital and operating expenditure) to:

- develop a new LV management program to allow the use of new technologies;

- harness data to manage energy flows; and

- optimise generation across the network.

The AER also saw SAPNs development of new ‘solar sponge’ tariffs, to alleviate voltage problems by promoting consumption during the middle of the day, as a positive step.

However, the AER did not accept Energex and Ergon Energy’s proposed spend for an intelligent Grid Enablement Program that would provide a framework to manage the data needs of its LV network, as it said there was a lack of sufficient supporting documentation.

A summary of the networks proposed programs (the bulk of which is capital expenditure), related to increasing the ability of the LV network to accommodate DER or evolving to meet customer needs is shown below. It highlights that the AER did not accept a number of significant programs and proposed expenditures.

Capex

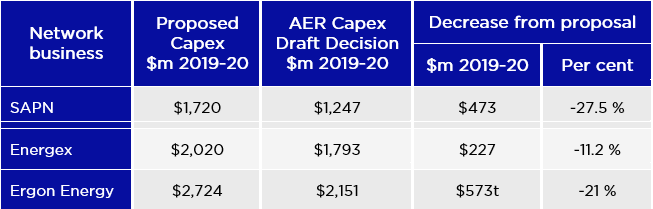

Replacing aged network assets and expanding (augmenting) the network for growth in demand (capacity) and size (length) requires investment, known as capital expenditure (capex). This investment helps keep the network safe, efficient and reliable for customers.

The AER’s draft determinations have disallowed a large proportion of the capex proposed by the three networks (a subset of which is shown in the section above), largely due to the regulator’s claim that there had been a lack of detailed information justifying the prudency and efficiency of the spend.

While the cuts look high, the AER notes that it expects and encourages the businesses to provide additional detail in their revised proposals.

In a surprising move, the AER seems to have changed its historic approach of substituting its own ‘placeholder value’ where spend can be expected, but the network’s supporting materials were found to be lacking. For example, SAPN received nil property-related capex in the draft determination, which on its face appears both unrealistic and contrary to the capex criteria[i].

Prices – falling by how much?

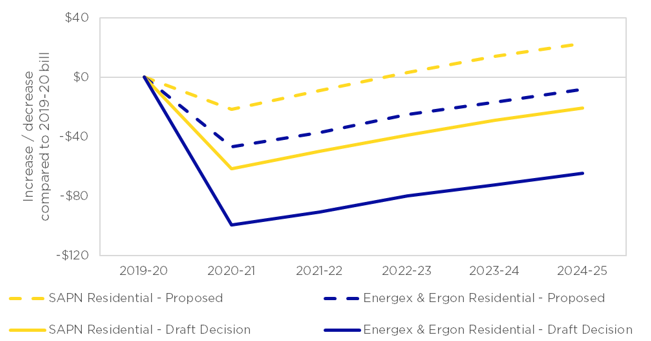

Affordability (keeping prices down) was a key stakeholder concern for all three networks. Queensland distributors even elected to hand back their share of incentive scheme benefits from the current period to customers. All three networks’ proposals put forward initial reductions in distribution prices, followed by small annual increases, but the AER’s draft determinations go even further.

- The biggest contributor to the difference is a reduction to the rate of return. The current risk-free rate and cost of debt is lower than at the time of the proposals.

- The new regulatory tax approach following the recent AER tax review, along with the 2018 rate of return instrument has also reduced the tax allowances.

- Clearly, the reductions to capex in the draft determinations, as well as the cut to SAPNs opex have also had impacts.

Estimated impact of proposals and draft decisions on annual residential electricity bills relative to 2019-20 ($2019-20)[ii]

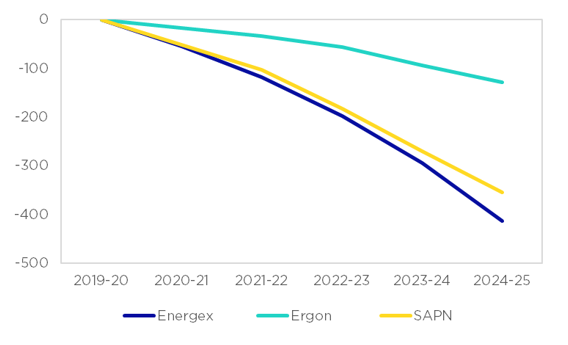

Bending the curve – Regulatory Asset Bases decline

The Regulated Asset Base (RAB) is the current value of assets which network companies have invested in over time. Generally speaking, the size of the RAB and the number of customers in a network are responsible for about 50 per cent of the distribution price customers pay. In real terms, all three networks’ RABs will decline over the next five years.

In Queensland, declining RABs will hopefully stop calls to arbitrarily write-down RAB values, a move which could increase risk (and power prices) across the country.

Closing RAB under Draft Determinations relative to 2019-20 ($ million 2019-20)

Where to next?

SAPN, Energex and Ergon Energy now have the opportunity to address the AER’s concerns and provide further justification and supporting material to demonstrate the prudency and efficiency of their forecasts in their revised proposals. This information will be considered by the AER in making their final determinations, due to be published in April next year.

The determinations before the AER’s Board are some of the most critical in the past decade, as they will set signals and the boundaries for how networks adapt to the street by street solar and battery revolution playing out on the distribution network.

Getting these decisions right will allow customers to maximise value from their investment, enable smarter monitoring and better hosting for the influx of tomorrow’s solar, battery and EV customers.

The game is changing before networks’, regulators’ and customers’ eyes:

- Networks need to develop and to ensure communities understand and support robust plans;

- Customers need to consider the requirements they want from today and tomorrow’s grid, such as the optimal level of solar hosting capacity; and

- Regulators need to consider how all these pieces fit together in a revenue and pricing package.

It is an open question whether these processes will arrive at this destination.

References:

[i] Per 6.5.7(c)(1) of the National Electricity Rules, the capital expenditure criteria are:

- the efficient costs of achieving the capital expenditure objectives;

- the costs that a prudent operator would require to achieve the capital expenditure objectives; and

- a realistic expectation of the demand forecast and cost inputs required to achieve the capital expenditure objectives.

[ii] The impact of distribution charges on the retail bill is dependent on how retailers structure their standing or market offers to customers. The numbers modelled assume all other bill impacts remain constant.

Under the Queensland Government’s uniform tariff policy, the price of electricity in regional Queensland (Ergon’s network) is regulated and is set at the price of electricity in the south-east Queensland market (Energex’s network). The south-east Queensland market is open to private sector competition and the Queensland Government subsidises the difference between regional and south-east prices.