‘Think as You Go’: Getting regulatory taxation right

Albert Einstein famously declared the hardest thing in the world to understand was tax, and the recent release of the Australian Energy Regulator’s early findings in its review of regulatory tax approaches only reinforces his view.

The review was triggered to look at current approaches for setting the cost of tax allowances that typically make up around 3 to 5 per cent of total network revenues set by the AER.

The review commenced with claims of potential ‘price gouging’ by networks, and highlighting of a discrepancy between regulatory allowances and an ATO report of tax paid. As with most such debates, the more information is available, the harder it is to tell a headline grabbing story. Networks cooperated in a voluntary information provision process to help shed light on some of the facts, and the AER has released its first review report based on this fuller business-specific information.

The shrinking gap and its drivers

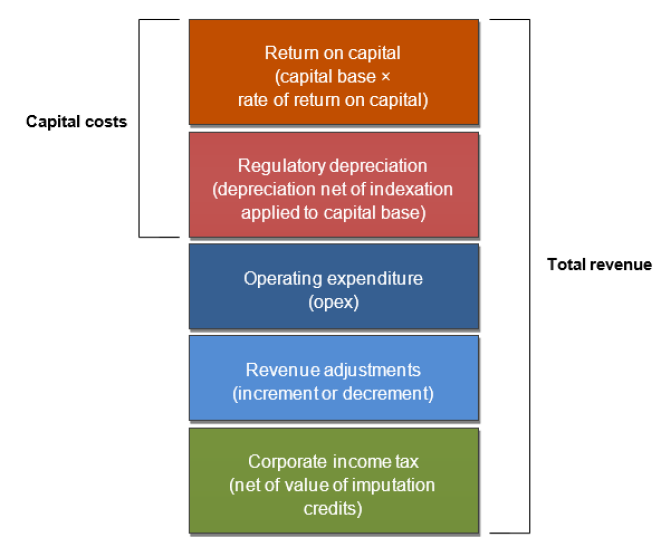

The report has found that the difference between the so-called ‘building block’ corporate tax allowances (see Figure 1 below) and actual tax paid is smaller than initially published ATO data. Critically, it also finds there are valid and expected reasons for the difference, as highlighted by networks at the time.

Figure 1 – Corporate income tax as part of the ‘building block’ revenue decision

Source: AER

These include previously accrued tax losses, the fact that around a third of networks are not the ultimate tax paying entity (i.e. tax is still paid but by a different owner or investor), and due to the tax paying firm having a range of other business activities that means tax is still paid, but the component linked to the regulated network is not actually disaggregated.

All of these are known and designed features of the broader tax system applying to all corporations, rather than being related to the AER’s regulatory approach. In fact, as the AER observes, whatever regulatory approach to recovery of tax costs had applied in the recent past, it would have made little difference to the initial differences ATO observed, because of previous tax losses.

Costs to customers of poorly considered alternatives

The Australian Energy Regulator and its experts have clearly identified the potential cost of poorly considered regulatory policy – for example, finding that changing to a simplistic ‘pass-through’ arrangement of actual taxes could drive up prices for all consumers over time compared to the current approach. The regulator notes this is a pervasive problem under cost-plus regulation, and that there are also risks of any switch leading to customers paying a double penalty of higher costs in the future.

A critical strength of the current incentive-based or ‘benchmark’ approach is it avoids customers in different suburbs and different sides of the street paying different network charges on the basis of the actual tax positions of individual businesses. It also avoids the risk of sudden price rises when there is a change of ownership, and promotes competition for network management that can lead to the uncovering of new business efficiencies for customers.

Updating the benchmark – findings of the review

The review has identified possible changes to update the AER’s benchmark and assumption to better reflect efficient tax approaches. Reviewing benchmarks regularly to ensure they align with actual observed practice is a normal step, and setting new benchmarks is part of the way incentive based regulation passes any efficiency benefits to customers.

Caution, application of principle and careful thought is warranted, however.

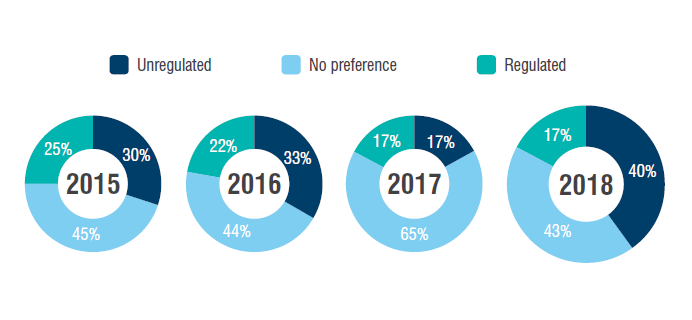

The recent release of Infrastructure Partnerships Australia’s Infrastructure Investment Report has highlighted increased concerns by surveyed global investors about the level of Australian regulatory risk. Investors have identified regulatory uncertainty as the critical factor limiting investment, and signalled an increased preference for investment in unregulated infrastructure compared to regulated infrastructure.

Figure 2 – Preferred regulatory models for investments

Source: Australian Infrastructure Investment Report 2018, p.8

In this context it will be important for the AER to ensure decisions it takes are prospectively applied, and protect regulatory confidence by being consistent with Australian’s incentive regulatory approach and evidence-based.

Calibrating and assessing proposals for change

The review is considering four potential changes to its benchmark approach.

These relate to updating its assumptions on the form of tax depreciation used by some businesses, consistently integrating asset life assumptions for gas pipelines into AER models, and changing how refurbishments are treated in tax allowances. Careful analysis is needed on each of these significant changes, particularly to ensure that incentives are maintained for cost-saving refurbishment projects that deliver savings to current and future customers.

A further change still being assessed is making adjustments to assumed interest expenses in the tax building block, in a way that appears complex and on its face to undermine the logic of using benchmark approach. The review has yet to fully assess all of the data provided by networks under further information collection process ahead of an expect December final report.

This reinforces the importance of focusing on the smooth delivery of a set of pragmatic, practical and well-considered changes, rather than measures that would reinforce rising and potentially damaging external judgements of regulatory risk.