Unpacking the Price Stack

The AEMC recently released its electricity price trends report, which contains some new data that allows for a far more detailed investigation of the bill ‘price stack’.

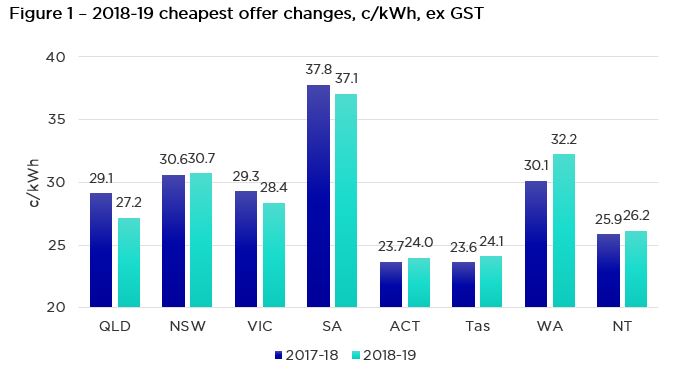

The good news is that overall, electricity prices are expected to fall slightly this year. The customer-weighted price of the cheapest offers available around the country is falling from 31.3 c/kWh to 31.1 c/kWh. Figure 1 shows 2017/18 and 2018/19 prices and how they vary across states and territories.

While wholesale prices have risen in recent years, they are forecast to fall in the next few years. An expected 9,732 MW of generation and battery storage is looking to enter the market before 2022, while 3663 MW is expected to enter this year.

While network prices remain materially lower than they were in 2014/15, they are flat or slightly rising in 2018/19 and beyond. New transmission infrastructure is expected to draw efficiencies from better linking new generators to wholesale markets, bringing with it slightly higher transmission costs. Solar penetration is continuing its rise, with Australians contributing to this in their electricity bills through the Small Scale Renewable Energy Scheme.

Once wholesale, environmental and network costs are accounted for, the remaining cost components of a bill are retail costs, retail margins and any ‘truing up’ errors in the AEMC’s assessment of other supply chain cost components. These components are collectively referred to as the ‘residual’.

More offers, more information

In previous reports, the AEMC’s pricing benchmark used in each state has been an average of each retailer’s minimum market offer, weighted by customer numbers. This was the only pricing information that the AEMC provided.

This year, the AEMC has released a data book which contains additional pricing information, including the:

- median retail market offer,

- minimum standing offer,

- median standing offer, and the

- weighted median of the market and standing offer.

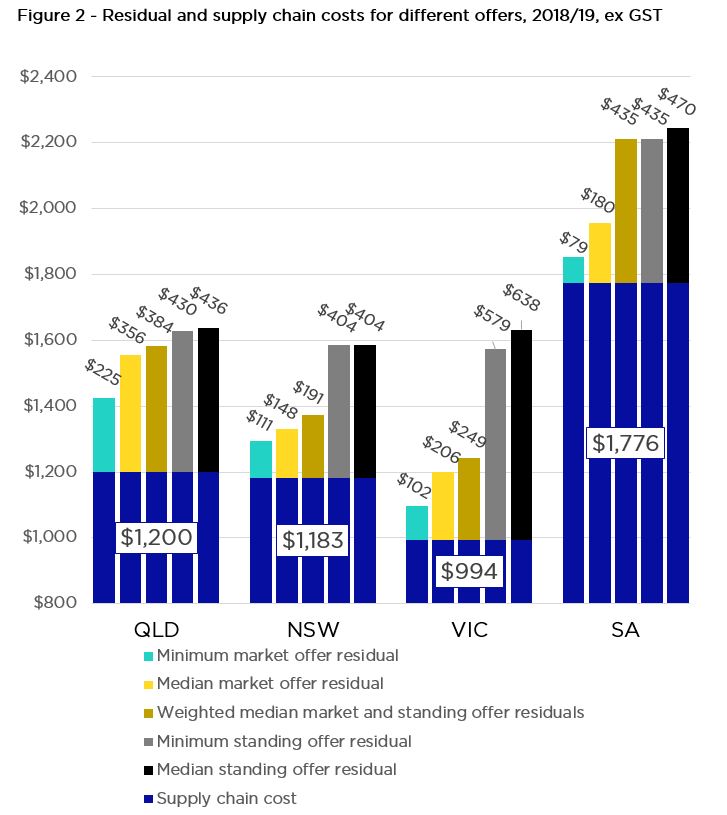

The prices of each offer are provided in each state if they are applicable, for example in Tasmania prices are regulated so only one standing offer price is presented, while in Victoria there are prices for all five types of offers. In NEM states where prices are not regulated, the retail offers are presented in Figure 2.

For each type of offer, the supply chain cost which consists of wholesale costs, environmental costs and network charges (represented in dark blue) are the same. The only part of a customer’s bill that varies is the residual cost. The different residual costs for each type of offer are shown by the other bars on the graph, with the total cost of an offer being the sum of supply chain and residual costs.

What does this mean for customers?

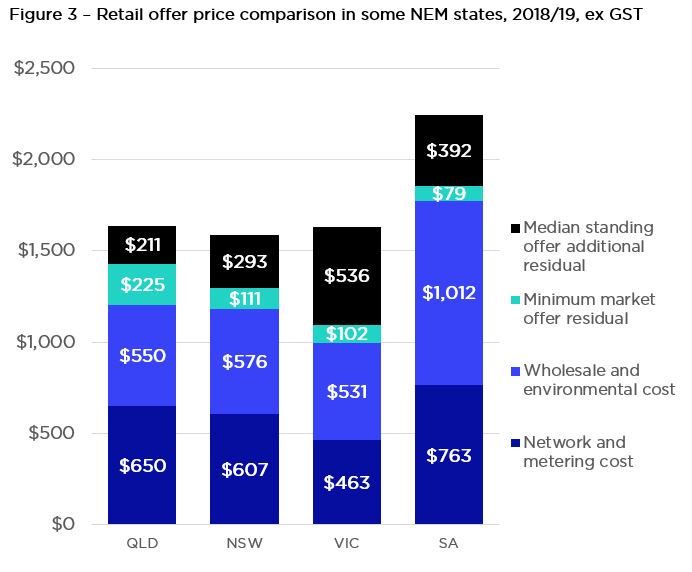

There is a large difference between the price of a minimum market offer and a median standing offer. Figure 3 shows network and metering cost, wholesale and environmental cost, the minimum market offer residual and the extra additional cost that customers pay under the median standing offer (the black bar).

The additional residual that customers are paying under the median standing offer is delivering them no extra value, nor is it contributing towards providing additional supply chain services. That’s an extra charge to customers of between 13 to 49 per cent that they are paying for no reason.

Victorian customers are paying additional charges larger than the entire network and metering portion of the bill.

The good news is that most customers are on market offers where they are available, but some customers are still paying standing offer rates, including:

- 19 per cent of Queensland customers,

- 17 per cent of New South Wales customers,

- 6 per cent of Victorian customers, and

- 11 per cent of South Australian customers.

That’s hundreds of thousands of customers who aren’t getting value on their electricity offers because they haven’t spoken to their retailer or shopped around – a behavioural economist might say this is not surprising.

Power prices remain a sensitive issue

Australians on the most expensive offers could still be paying much less for their electricity, conclusions which have been echoed by the ACCC in its Retail Electricity Pricing Inquiry.

Retailers and governments alike have recognised the call to action and are well on the way to implementing a reference price which customers can use to get a better deal. Along with the 16 other recommendations which the COAG Energy Council has approved, customers should soon have a much easier time finding more suitable, cheaper offers.

The more we can do to put fair, reasonable and understandable prices in front of customers, the more they can feel confident that they are making informed choices, taking control and lowering their energy costs.