What could customers save with standalone systems & microgrids?

New analysis identifies the ability for grid companies to save billions of dollars for Australian customers – by using alternatives to traditional grid infrastructure.

In news from Western Australia this week, Carnegie Wave announced plans to develop the world’s first solar, battery and wave integrated microgrid, with the company securing $3.69 million in debt funding for the project, in addition to support from ARENA. The project is being developed in collaboration with Western Power and will be able to function both “on-grid” and in island mode.

The Carnegie wave project highlights how new technologies and operating platforms can be substituted for traditional service delivery infrastructure. The economic benefits can deliver cost savings that can be passed onto customers through lower prices.

For example, over the last year Horizon Power built stand alone power systems for several customers around Esperance as a cheaper alternative to restoring grid infrastructure after bushfires hit the region in 2015.

However, current regulations require customers to be connected to “poles and wires” even where a stand alone power system is the lower cost option. Networks may be able to meet their “obligation to connect” in smarter ways. In a recent rule change request to the Australian Energy Market Commission, Western Power estimates lower network costs of over $380 million could be achieved over the next 10 years if stand alone power systems could be installed as an alternative to replacing network assets.

In addition to lower costs, Western Power estimates that smarter alternatives to replacing poles and wires in these areas of the network would also provide more reliable and safer outcomes for over 2,700 customers.

Making way for innovation

Stand alone power systems use a mix of different technologies to allow individual customers continuous energy supply without the need for grid connection. Microgrids use similar technologies to provide continuous energy supply to a group or community of customers.

The analysis, released by ENA and CSIRO, as part of the Electricity Network Transformation Roadmap, highlights the need for regulatory arrangements to adapt to innovative delivery of services through microgrids and stand alone power systems. The report by Energeia found that almost $700 million could be saved by supplying a proportion of future rural connections with a stand alone power system between now and 2050. Up to 27,000 new rural farm connections required between now and 2050 would be more efficiently supplied via a Stand Alone Power System rather than being connected to traditional grid infrastructure under current regulations.

In addition to avoiding network expenditure, off-grid stand alone power system arrangements are likely to encourage additional investment in over 2GW of solar PV and over 7.5GWh of battery storage across Australia between now and 2050.

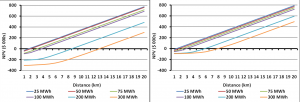

Energeia’s report explored the timing and scope of stand alone power systems for new connections. The high upfront cost of grid connection in remote areas means that alternative stand alone power systems are cost competitive, with a clear relationship between the cost effectiveness of a stand alone power system and the size of the connection and distance from the grid. The NPV analysis of different connection sizes and connection distances in 2016 (left) and 2020 (right) are shown below:

The results show that in 2016, stand alone power systems do not become NPV positive for many farms unless they are than more than 4km away from the grid. However, by 2020 (Right) most small-size connections more than 3km from the grid are NPV positive if supplied from a stand alone power system. Even larger farm connections of 300Mwh per annum are NPV positive with stand alone power systems when they are more than 8km from the grid.

Benefits may not be realised under current regulation

Despite the benefits, current regulatory arrangements mandate networks to provide a conventional and more expensive ‘grid connected’ service. This is likely to inhibit customers establishing a standard network connection through a Network Service Provider using a Stand Alone Power System. As a result, unless the customer is willing to use a market solution, the network will be forced to implement the higher cost solution in these circumstances.

Barriers in the National Electricity Rules (NER) that may prevent electricity networks being able to adopt the lowest cost provision of electricity services has been the subject of a recent Rule change proposal to the AEMC. Western Power has recently lodged a rule change request with the Australian Energy Market Commission (AEMC) seeking to ensure that a lack of clarity in the National Electricity Rules does not preclude distribution network service providers from utilising stand alone power systems to meet their regulatory obligations and licence requirements to facilitate the supply of electricity to customers at least cost. Wester Power notes

Irrespective of the technology used to provide a service, the Rules should be sufficiently flexible to allow DNSPs, as well as customers, to identify and invest in the most efficient option to deliver a reliable, safe and secure supply of electricity. Technology advances mean that the market has entered a new era and the Rules need to be agile and flexible to support the necessary industry transformation

The COAG Energy Council has also recently been considering whether regulatory amendments are necessary for stand alone power systems in the electricity market. As the COAG Energy Council Energy Market Transformation Project Team stated in their August 2016 consultation paper:

The current economic regulatory framework is based around the presumption of a network infrastructure conveying a centralised supply of generation. If microgrid and distributed generation technology develops and presents a more cost effective solution to supplying energy, the regulatory framework needs to develop to accommodate the investment decisions required for stand-alone energy to compete[1].

Unlocking the value of standalone power systems with grid connection

In the case of the 27,000 rural connections outlined above, Energeia demonstrates that adopting the lowest cost option when connecting the customer results in lower network costs and therefore benefits all customers connected to the grid.

However, Energeia’s analysis found that where existing grid connected customers respond to incentives to go off-grid, this may result in higher network bills. Energeia’s analysis indicated that under current tariff and incentive arrangements, up to 10% of grid-connected customers could choose to go off-grid with a stand alone power system by 2050, accepting some implications for their reliability or quality of service.

As the cost of stand alone Power systems continue to fall, Energeia analysed the value of providing ‘win win’ incentives to customers who could leave the grid to say connected. These customers who make significant onsite technology investments can be compensated for their ability to operate in island mode from the grid at peak demand periods where this reduces costs for them and other customers.

Energeia modelled a new network tariff – the Stand Alone Power Systems tariff – which allows the consumer to import or export from the grid during off peak times, but restricted consumption during network system peak events.

This would require the customer to have sufficient distributed energy resources installed to enable them to be fully self-sufficient during these times. However, in return, this tariff included:

- no peak demand charge, as the customer agrees to operate in island mode during the peak period; and

- a notional discount compared to other cost reflective tariffs, which Energeia assumed at 5%. (This is consistent with the concept of a prudent discount, which transmission companies are allowed to offer where economic bypass occurs in order to keep other customer’s costs as low as possible.)

Energeia found that the introduction of the stand alone power systems tariff provided a lower cost and better value to customers with stand alone power systems than operating a stand alone power system on an off-grid arrangement.

In addition, Energeia found that keeping more customers connected to the grid is likely to save other customers over $1 billion in network charges between 2030-2050, equivalent to 4% per annum on average network bills with additional benefits for the distribution energy market. The analysis indicates that the impact of 1 in 10 customers disconnecting from the grid by 2050 would increase average bills to other customers by $132 per year.

Further details and information on the Energeia modelling and Unlocking Value:Unlocking Value: Microgrids and Stand Alone Systems can be accessed here

[1] COAG Energy Council Energy Market Transformation Project Team, Stand-alone energy systems in the Electricity Market – Consultation on regulatory implications, p. 11.