Does size matter? The economics of the grid-scale storage

From the Big Banana to the Big Lawnmower, Australia is a country that prides itself on big installations. Competition is fierce for the title of Australia’s “biggest battery” – but can batteries compete against traditional energy solutions?

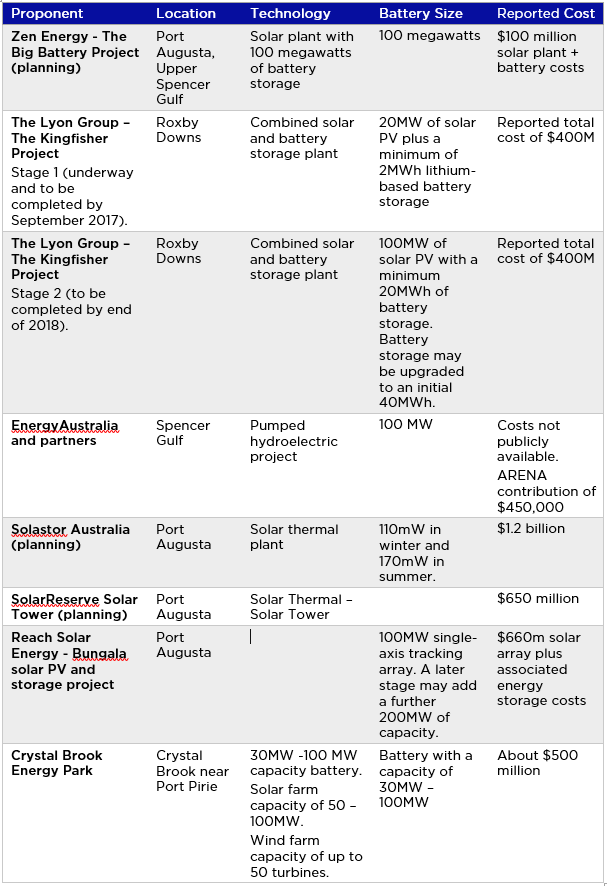

On Friday expressions of interest close for the South Australian Government’s invitation to build Australia’s largest battery – a 100 MW battery to be operational in time for the 2017-2018 summer. The call came less than a month after the Victorian Andrews Government called for Expressions of Interest for what they claimed would be Australia’s largest battery – a new 20MW battery to be constructed in the north-west or south-west of Victoria, in partnership with ARENA. While in September 2016 headlines claimed that Australia’s largest battery storage project had been given the green light – with a a 100-megawatt solar power plant and a 100-megawatt battery storage unit to be developed by Lyons group for their Roxby Downs Kingfisher project.

The ultimate role of large scale battery storage in future energy markets will depend on its economic potential – and that is changing on a daily basis.

Plummeting prices

In December 2015, ARENA published the results of its Energy Storage for Commercial Renewable Integration (ESCRI) project which was undertaken in a collaboration between AGL, ElectraNet, and WorleyParsons, and part funded by ARENA[1]. The project examined the role of medium to large scale (5-30MW) energy storage in the integration of renewable energy into the South Australian electricity system. At that stage, the energy storage device asset was found to be significantly net present value (NPV) negative. To be commercially viable, this project would have required an approximately 63% capital contribution from ARENA or other funding sources (in NPV terms). The paper commented that “while this was a disappointing result, the future price curves and potential for additional revenue yet to be quantified may make such an asset a commercial proposition within the next 5 to 10 years”.

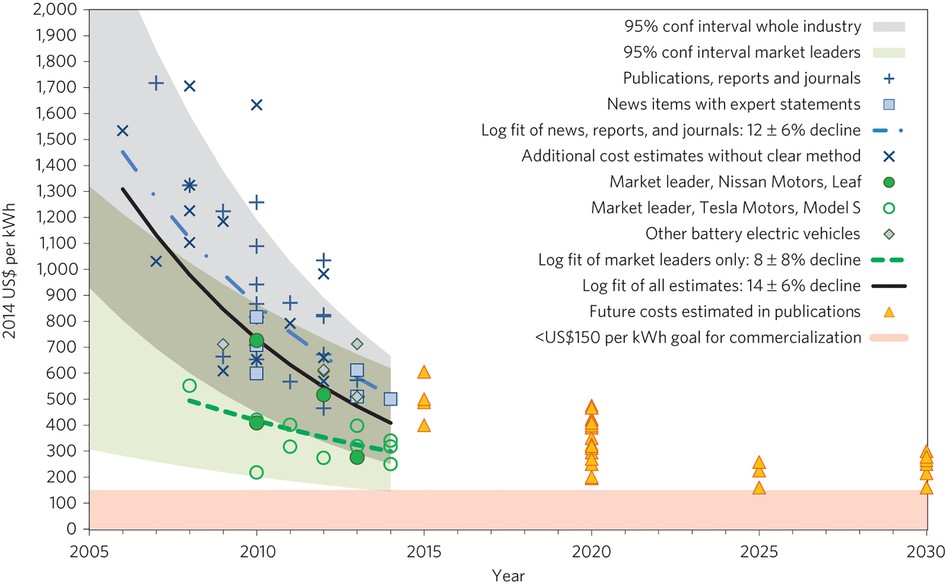

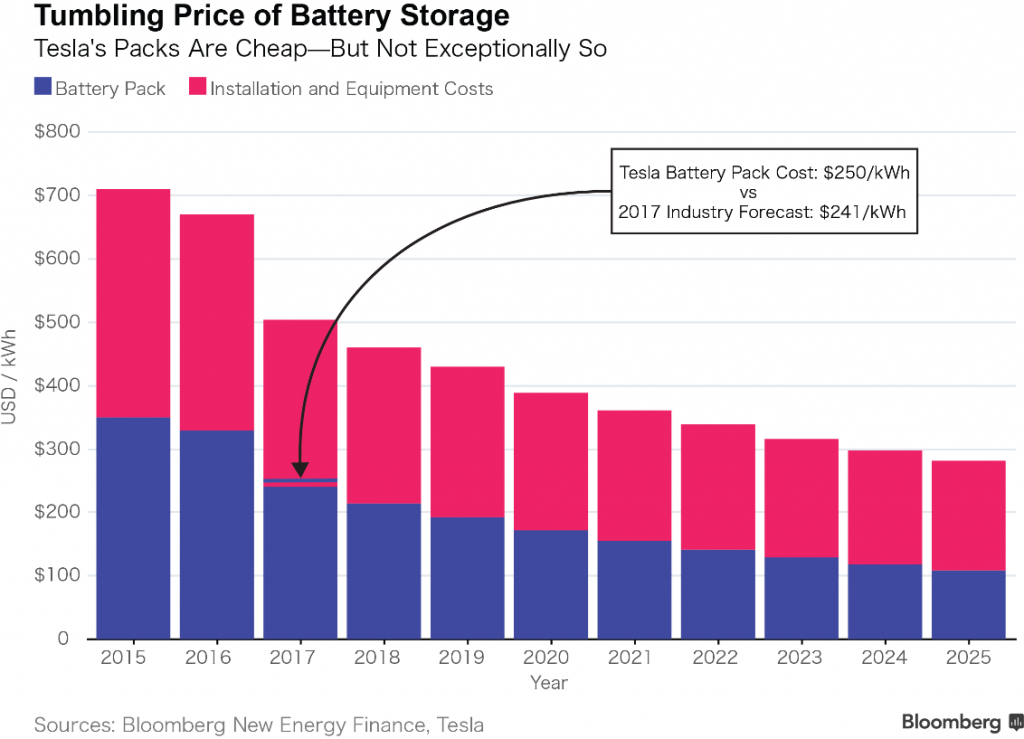

But today, just 15 months later, battery costs are falling rapidly. In his now famous tweet, Elon Musk offered South Australia large scale batteries at just $250 per kWh. Falling battery costs continue a trend identified in a study by Björn Nykvist & Måns Nilsson in March 2015. This study showed that industry-wide cost estimates declined by approximately 14 per cent annually between 2007 and 2014, from above US$1,000 per kWh. The ‘Learning Rate’, or percentage cost reduction following a cumulative doubling of production, was found to be between 6 and 9 per cent, in line with earlier studies on vehicle battery technology. The study showed continuing declines in the cost of Lithium-ion battery packs and that the costs among market leaders are much lower than previously reported.

Rapidly falling costs of battery packs for electric vehicles[2].

A 2016 study by the IEA[3] found that since 2010, Lithium-ion battery costs have followed a similar trend to those experienced by PV a decade earlier, with learning rates averaging 22 per cent.

This year Bloomberg New Energy Finance[4] reported that a 100 MW project (which would entail a 400-megawatt-hour (MWh) battery installation) could cost around $169 million (A$220 million).

When considering the price of the batteries, one must also include the costs of shipping, installation, and associated necessary hardware. These costs are significant and can amount to more than half the total cost. According to the BNEF analysis the total price, would come to about $422/kWh, or $169 million (or A$220 million).

Can Storage compete on price as an Energy Balancing Solution ?

The Australian Energy Market Operator’s (AEMO’s) South Australian Fuel and Technology Report[5] published earlier this month shows that battery storage is now competitive with other large scale solutions for energy balancing.

- Gas peaking plants $218/MWh

- Solar thermal $137/MWh

- Pumped hydro $161/MWh[6]

- Lithium Ion batteries $216/MWh.

As Reputex has noted recently:

“Traditionally, gas-fired generators have been the least cost technology that could provide energy security, such as load-following and peaking services. Analysis indicates, however, that new renewables with energy storage are now competitive with new gas in providing flexible generation services. This is because of recent declines in capital costs of both wind and solar, coupled with rises in electricity and gas prices, resulting in a rebalancing of the least-cost technologies”[7].

Who will win the battle for South Australian Storage?

The potential for large-scale battery storage to meet South Australia’s energy security needs gained traction earlier this month when Tesla CEO Elon Musk made a bold declaration on social media. On 9 March 2017, Musk tweeted that “Tesla will get the system installed and working 100 days from contract signature or it is free”. It follows eye-opening completion times in three US battery projects in California. Earlier this year, Tesla, Greensmith Energy and AES Energy Storage celebrated the completion of three large-scale lithium-ion battery projects totalling 70 megawatts — consisting of 20 megawatts, 20 megawatts and 30 megawatts, respectively. The installations were brought on-line to address projected energy shortages due to the Aliso Canyon gas leak, just six months since regulators issued the emergency storage tender[8].

Less than a week after Musk’s tweet, the South Australian Government opened Expressions of Interest to build Australia’s largest battery.

This isn’t the only big storage development proposed for the state, with a range of medium and large scale storage projects planned or discussed.

Restricted by regulation

In Australia, a potential barrier to the widespread adoption of battery technology by energy suppliers is that current regulation and market mechanisms are geared towards generation and transmission, not power storage.

As Lyon Group partner David Green commented recently, “One of the impediments to batteries being fully deployed in the market is that they can’t capture all the revenue that should be available to them, simply because of the way in which the regulations for the market are established”[9].

The Australian Energy Market Commission is currently considering a Five-Minute Settlement Rule and will make a Draft Determination by 6 July 2017. Reforms in this area, as well as the timely introduction of a market based emissions reduction policy would have the potential to transform the sector.

Who will win the battle of the Gigafactories?

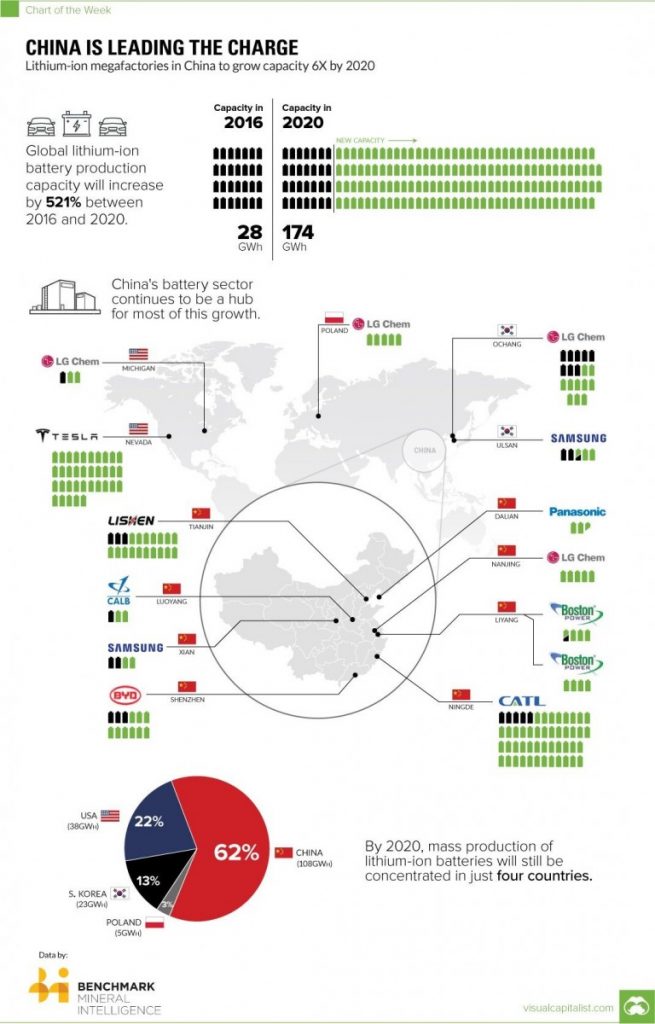

Further reductions in the cost of lithium-ion batteries are likely. In January 2017, Tesla began battery cell and pack production at its massive Gigafactory near Reno, Nevada. By 2018, the Gigafactory will reach full capacity and produce more lithium ion batteries annually than were produced worldwide in 2013[10].

While Tesla’s Nevada factory may capture the headlines, China is likely to dominate lithium-ion battery production, producing an estimated 62% of global production in 2020. One Chinese company, Contemporary Amperex Technology Co. Limited (CATL) is reported to have tripled its lithium-ion battery production last year and plans to reach 50 GWh by 2020. This would make it the world’s second largest producer of li-ion batteries behind Tesla/Panasonic.

Source: https://electrek.co/01/chinese-battery-maker-catl-nevs-gigafactory/

If an integrated suite of bipartisan market-based energy and carbon policies function together then investors will have clarity and be able to accept market risk. It positions Australia’s energy system to take full advantage of new technologies competing on a level playing field with investments proceeding on a commercial basis.

[3] Tracking Clean Energy Progress 2016 – Energy Technology Perspectives 2016 Excerpt IEA Input to the Clean Energy Ministerial

[5] Australian Energy Market Operator- South Australian Fuel and Technology Report March 2017. See Tables 22, 23 and 24.

[6] AEMO noted that the cost of pumped hydro would be significantly variable depending on the scale and size of the project and other factors such as proximity to power lines.