Productivity gains deliver for customers

Electricity network productivity is shining among the backdrop of stagnating productivity performance in the broader economy, with networks continuing to deliver better performance for their customers.

The Australian Energy Regulator’s recently published 2019 Annual Benchmarking Reports reveal average productivity improvements of one per cent for distributors and an impressive 2.2 per cent for transmission networks over the past year.

The productivity of distribution businesses is on the rise for a third consecutive year, while transmission businesses notched up a 7.5 per cent productivity increase across two years. Productivity increases are great for customers. Better productivity means doing more with less. More services are being provided at a lower cost, which means lower bills.

Consecutive year on year increases reflect networks’ ongoing work to deliver greater value for customers and the benefits of incentive-based regulation. This regime is delivering more than $6 billion to Australian network customers.

What is economic benchmarking and why does it matter?

Economic benchmarking is when the inputs and outputs of a business are tracked across time to see how efficient the business is operating relative to the previous year, other businesses or other industries.

The results are important for customers, networks and regulators because making sure every dollar spent on the network is spent wisely leads to better business performance and more value for customers.

The reports take the capital assets owned by networks and the year’s operating expenditure as inputs and determine how well they have been used by networks to produce a set of defined outputs, based on measures such as:

- customer numbers

- the length of cables

- the highest or ‘peak’ demand recorded on a network

- total energy delivered; and

- minutes off supply due to network events (network reliability).

A measured productivity increase simply means that more outputs were delivered with the same amount of inputs, or that the same amount of outputs were delivered at a lower cost.

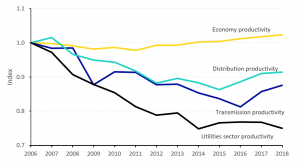

Networks outpacing economy-wide productivity gains

Network productivity increases comfortably outpaced productivity growth across the wider economy, with Australia posting slower economic growth than expected in 2018 and the broader utilities sector performing poorly in relative terms. If you take the electricity, gas, water and waste services sectors as one benchmark for utilities, it’s no small feat that networks continued to exceed challenging targets and realised stronger productivity improvements over more than a decade.

Figure 1 – Industry productivity over time

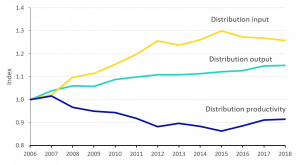

Figure 2 – Electricity distribution productivity

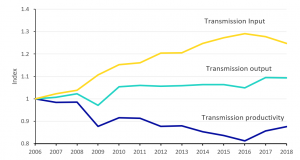

Figure 3 – Electricity transmission productivity

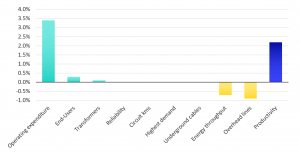

Operating expenditures efficiency leading improvements

Reductions in operating expenditures across the sector are the main driver of increasing network productivity. These reductions reflect clear incentives and actions to lower costs, innovation in service delivery and savings from some industry consolidation.

Distribution networks are also handling the challenge of a growing customer base and consequent pressures on demand, infrastructure requirements and operating expenditures. Australia’s third hottest year on record contributed to lower reliability levels in 2018, with some areas of the country recording their hottest on record. This contributed in some cases in lower outputs, though these were fully offset by operating expenditure efficiencies.

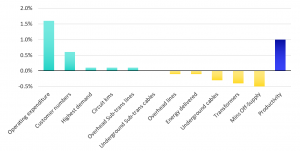

Figure 4 – Electricity distribution input and output contributions to annual productivity change

Large reductions in operating expenditures drove substantial increases in transmission network productivity, only being partially slowed by increases in required infrastructure and declining energy throughput.

Figure 5 – Electricity distribution input and output contributions to annual productivity change

The percentage contributions charted above are the contributions to total factor productivity and don’t represent actual changes in variables. Actual reductions in operating expenditure were much larger.

At an industry level, distribution operating expenditure productivity individually increased by 4.5 per cent while transmission operating expenditure productivity rose a remarkable 13.2 per cent.

The challenge ahead

Productivity assessed by these traditional metrics is useful. However, many of the outputs were designed around simple measures of the physical extent of a one-way network. This fact partially obscures the scale of change underway to evolve to a two-way network. The Australian Energy Regulator (AER) has acknowledged that the impact of distributed energy resources like solar and batteries on benchmarking – and their implications for targeted outputs – should be reviewed in the near future[i]

The key finding of the report is that networks are reducing costs and as a direct result, network charges are coming down for customers. The results are promising for further reductions in future, however, some cost reductions need to be viewed with a cautious eye.

It is important to continue to reward cost reductions and seek to replicate the forces of competitive markets on regulated businesses. Yet in an era of growing customer service expectations, expanding regulatory obligations and challenging cost outlooks for some inputs, it remains an open question whether so strong an upward trajectory of industry-wide productivity can be sustained indefinitely.

For each dollar reduction in operating expenditure, there is a corresponding fall in benefits that the expenditure provided. The challenge for networks, regulators and policymakers is to make sure that the expenditure reductions don’t unintentionally result in a net reduction in customer outcomes.

In part, this reinforces the need for networks to continue to engage with customers about the types and levels of services they most value and for regulators to enable this conversation. It also emphasises the importance of foundational market-wide processes such as establishing values for customer reliability. Getting the balance right for customers between value, price and reliability demands nothing less.

[i] Australian Energy Regulator, Annual Benchmarking Report – Electricity distribution network service providers (2019) p. 43.