Health of the NEM: the patient is in a serious condition, but improving

As we kick-off a new year that promises to bring significant reform in the energy sector, it is important to check in on the National Electricity Market (NEM) to see if it is keeping up with the rapid pace of change.

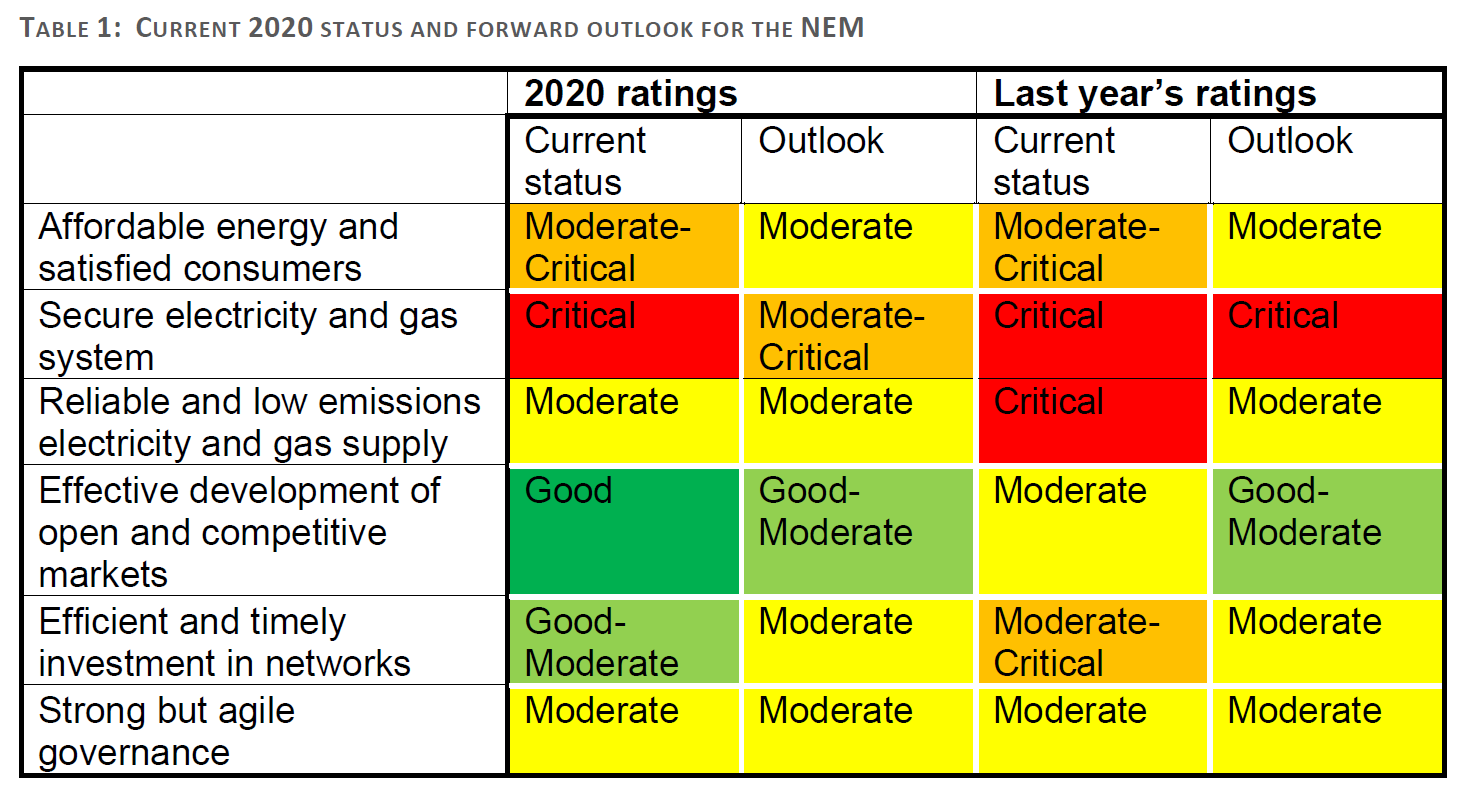

The Energy Security Board (ESB) recently published its fourth annual report on the health of the NEM. This assessment considers the progress of the NEM against the six objectives outlined in COAG’s Strategic Energy Plan. For each objective, the current status and the outlook is assessed using a rating scale as follows: good, good-moderate, moderate, moderate-critical and critical.

Affordability and consumer satisfaction

Affordability is rated ‘critical’ with the outlook rated slightly more positive as ‘moderate’. The outlook signals a need for investment in dispatchable generation and transmission to integrate more renewables into the grid.

While wholesale prices have fallen, COVID-19 has increased the financial pressure on household and business consumers. Consequently, the number of vulnerable customers has increased, and they are at greater risk of being exposed to any gaps in the consumer protection framework.

In terms of demand management, a survey conducted by Energy Consumers Australia (ECA)[1] showed that about 25-30 per cent of households and small businesses would require an incentive to reduce their energy use during very hot days. This signals the need to ensure that market arrangements and regulatory frameworks support the use of new technologies and empower customers to manage their demand through distributed energy resources (DER) and energy efficiency solutions.

Secure electricity system

System security remains the most critical issue due to the increased penetration of variable renewable energy (VRE) and DER reducing the incentive for traditional synchronous generators to remain online. This can be seen with the increased need for AEMO to intervene in the market for system security purposes – as evidenced by the 258 directions issued to participants in 2019-20.

The outlook is rated as ‘moderate-critical’, with the ESB Post-2025 market design initiative on establishing an essential system services market aimed at addressing these security challenges.

With the recent floods in south-east Queensland and the bushfires in 2019/20, it is vital to consider the impact of extreme weather events. The CSIRO Electricity Sector Climate Information project is key to improving the reliability and resilience of the NEM as it will provide the sector with high-quality climate projections and facilitate better long-term network planning.

A reliable and low-emissions electricity supply

The current status rating for reliability has improved from ‘critical’ to ‘moderate’, which the ESB says is due to AEMO’s Interim Reliability Reserve[2].

The outlook rating remains ‘moderate’, due to the uncertainty around the timing of the exit of coal- fired power stations.

In 2020, the emissions across the NEM were 25 per cent below 2005 levels. This downward trend is expected to continue with emissions to reach 40-58 per cent below 2005 levels by 2030. This is primarily due to the rapid uptake of renewables and the gradual exit of emissions-intensive thermal generation (brown-coal).

Open and competitive markets

The current status rating has improved to ‘good’, indicating that competitive markets are delivering positive outcomes for customers. The outlook rating remains ‘good-moderate’ due to risks associated with the demand and supply of coal and gas and uncertainty around the timing of exit of existing assets.

Notably, spot prices have lowered to levels not seen since 2015 which is indicative of competition in the wholesale market. It is expected that large-scale renewable generators and rooftop PV will keep prices subdued at least during high generation periods.

The cost of new technology is falling but the uncertainty in innovation investment is likely to have increased. A COVID-19 induced economic downturn is forcing investors to seek safe and low-risk investments.

Efficient and timely investment in networks

The current status rating is ‘good-moderate’ with critical ISP (Integrated system plan) projects on track, although the current Transgrid/ElectraNet financeability rule change proposals could, if rejected by the AEMC, disrupt recent progress.

The outlook rating remains ‘moderate’ due to challenges associated with transmission network investment which is critical for the continued uptake of VRE. Also, the need for significant investment in distribution networks is essential to support the integration of increasing levels of rooftop solar and residential batteries.

The ESB reports that incentive-based regulation is resulting in positive outcomes for customers due to networks improving operational efficiency and reducing capital expenditure[3].

Strong but agile governance

The status of governance within the NEM remains unchanged from 2019[4] as ‘moderate’, but with stronger conviction. The outlook is also rated ‘moderate’, with some governance changes for example, the future of the ESB – considered challenging and posing some risks.

The lack of strategic direction at a national level has increased uncertainty and dampened investor confidence. This has resulted in the deferral of investment in new generation and increased the reliability and security risks across the electricity market. Recent “going it alone” policies from multiple states have added to this challenge.

The ESB recommends the NEM rules, and their processes are thoroughly reviewed once the pace of change within the sector becomes more manageable. Not sure when that will be.

Overall, the NEM is progressing well but security and reliability challenges remain. The overall ratings are shown in the table below:

Like every sector participant, we’ll have to wait and see whether these challenges are adequately addressed by the significant market re-design proposed through the ESB Post-2025 project[5] and associated reforms.

[1] ECA, Energy Consumer Sentiment Survey June 2020

[2] Interim Reliability Measures | COAG Energy Council (coagenergycouncil.gov.au)

[3] ENA, Rewarding Performance – How customers benefit from incentive-based regulation (2019)

[4] COAG Energy Council, Health of the National Electricity Market (2019)

[5] Energy Security Board | Post 2025 electricity market design project (aemc.gov.au)