Multiplying uncertainties: Nailing the problems with RAB multiples

In economics, Goodhart’s law is typically expressed as ‘when a measure becomes a target, it ceases to be a good measure’. Originally formulated by British economist Charles Goodhart, this law points to the ways over-reliance on a single measure can lead decision-makers badly astray.

How to side-step the ‘one giant nail’ problem?

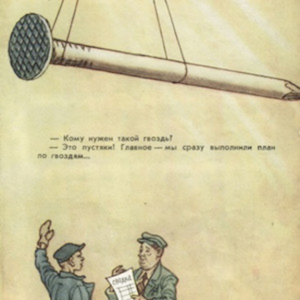

Using the wrong measure compounds the problem. This issue is best highlighted in a famous Soviet cartoon of a manager of a nail factory being awarded the Order of Lenin for exceeding his tonnage quota for nail production.

Rather than going to the trouble of producing millions of nails, the tonnage quota had instead resulted in the production of one giant, and obviously useless, nail.[1] Perhaps less apocryphal were the similar complaints by Soviet Premier Nikita Khrushchev of state factory-made chandeliers produced to fulfil quotas that were so heavy that the ceilings they were attached to would cave in.

The implication is that caution should be applied when a single measure or number is presented as being informative of wider or complex phenomena.

With a recent round of media and reporting on the possible regulatory asset base (RAB) multiples for energy infrastructure implied by transactions in process or prospect, this point appears more relevant than ever.

What is a RAB multiple?

A ‘RAB multiple’ is the equity value of a regulatory firm, divided by its regulatory asset base.

Under a set of strict laboratory-like conditions never met in the real world, it is possible algebraically to show that in theory a RAB multiple ‘should’ equal around 1.0. [2] That is, at least, if certain parts of any incentive-based regulatory framework are entirely ignored.

For regulated firms, this theoretical benchmark is essentially the equivalent of the wider corporate finance principle that the value of a firm is equal to the present value of future cashflows, or that the market value of firms should closely match their ‘book’ value.

Theory, meet markets – does a RAB multiple actually count what counts?

The problems arise when seeking to use RAB multiples to inform future decisions in any specific way.

RAB multiples provide an easy, available metric or heuristic for considering and comparing specific transactions close in time. However, they are a flawed measuring rod for much more complicated and broader public policy questions, such as whether the ‘right’ regulatory rate of return for network investments has been set.

Some of the complications that set in when seeking to use the metric to draw any specific conclusions are:

- How to account for unregulated activities – There are few transactions which are not affected by valuation assumptions around other unregulated business operations of the firm, leading to problems in seeking to differentiate between a successful purchaser’s valuation of the regulated and unregulated segments.

In much commentary on RAB multiples, there is no discernible attempt to even conduct this separation. Recent transactions have included sizeable unregulated components, and potentially large growth options.

- The cause of any multiples greater than one are inherently unclear – A RAB multiple above one may indicate expectations around other firm cashflows that have no relationship to the regulatory rate of return, leading to a lack of ability to draw any definitive conclusions from any particular transaction multiple.

- Equity stakes in firms can have different value to different potential buyers – By definition, a winning bid for a stake of firm equity will go to those that value it most highly. This can introduce other reasons why an algebraic answer might break down in real markets.

Purchasers might be willing to pay – quite rationally – a premium for significant control of a firm or believe that they can capture operational efficiencies higher than those implied in current market prices. Finally, an unlucky purchaser could even be subject to the well-documented ‘winners curse’ phenomenon.

- The equivalent metric does not hold for firms or the market as a whole – A glaring issue with the use of multiples is that the value of firms in competitive markets do not follow any type of equivalent rule.

As an example, the average ratio of market valuation to book value across the US share market is currently around 2, higher than RAB multiples sometimes held as evidence of the potential sufficiency or generosity of existing regulatory returns. This finding is consistent with the theory of why firms exist – i.e. to productively grow and add value to assets on the balance sheet, and the long-standing findings that there is no theoretical reason to expect a firm to trade at a multiple of 1.

The tight theoretical restrictions that are required to be satisfied prior to drawing robust conclusions from either individual or trends in RAB multiples are well document in a number of papers such as this one and further discussed by the Australian Energy Regulator here.

Multiples and changing market conditions

A final difficulty with the value of RAB multiples is they represent irregular snapshots in time of a specific purchaser’s valuation of a firm. This can be a product of market conditions which can change or evaporate rapidly.

The pattern of RAB multiples over time suggests it is driven more by broader market conditions and investor sentiment, exemplified by the average multiple falling sharply during the Global Financial Crisis, just when one might have expected it to hold stable or rise.[3]

An Infrastructure Partnerships Australia Infrastructure Investment Report released last month further highlights this issue of market-wide conditions. It found that COVID-19 impacted market conditions had instigated a ‘flight to safety’ and an uptick in investor preference for regulated assets.

Yet this move was the reverse of that observed in past surveys, and investor sector participants in the report queried if it would be a sustained trend. Plainly then, any RAB transaction multiples occurring in one set of unusual conditions is unlikely to be a safe basis for regulatory settings impacting investments a decade or so ahead.

Avoiding Goodhart’s law and the 1000-pound nail

Positively, the Australian Energy Regulator has in the past clearly accepted that due to the types of problems described above, RAB multiples cannot be currently used to reliably determine the adequacy of the rate of return.

It is commonly said that if your only tool is a hammer, everything looks like a nail.

As infrastructure transactions and equity markets continue their winding journey forward, prudence would suggest a high degree of caution about any reliance on a single, flawed and partial measure, to help us guide critical decisions affecting the lives of Australian businesses and consumers in the decades ahead.

[1] Roberts, P. C ‘My time with Soviet Economics’ in The Independent Review, Vol.VII, Fall 2002

[2] Dr Daryl Biggar Understanding the role of RAB multiples in Regulatory processes, 20 February 2018

[3] Dr Ross Barry, The Split Cost of Capital, Report to the Queensland Competition Authority, 7 November 2013, p.8