Victoria revs up its REZ ambitions – but how will it work?

What does the Victorian Government plan entail?

On February 18, the Victorian Government released a Directions Paper[1], the Victorian Renewable Energy Zones Development Plan, for consultation. The Victorian Government is committed to developing renewable energy zones and connecting more renewable projects in Victoria in a timely manner. Its objective is to reduce the risks to the generation projects and deliver affordability and reliability. The directions paper proposes adding a further 10GW of new renewable capacity, taking the total capacity across the Victorian REZs to 16GW.

The directions paper covers three key areas:

- Initial network investments that could be delivered immediately – this plan has been developed by AEMO and the Victorian Government

- Establishment of VicGrid to actively plan and develop Victoria’s REZs

- An implementation plan will be released later to outline how Victoria will plan, develop and invest in Victorian REZs

Each of these key elements is described in more detail below, but first, why does Victoria need the plan?

Why does Victoria need the plan?

While Victoria is certainly not the largest state in Australia, moving energy from one end to the other can be herculean task.

The introduction of the REZs will enable a clear pathway toward a renewable energy grid and encourage forward planning for efficient and effective generation and transmission.

As we have seen in Texas this week – a patchwork quilt approach to infrastructure planning will serve no one. This Victorian Government REZ directions paper plans to have governments, networks, generators and customers all on the same page.

This plan builds on (and will likely utilise) the powers under the NEVA (National Electricity (Vic) Amendment Bill 2020) that already allow a more streamlined and broader benefits test[2] to get developments moving.

Initial network investments that could be delivered immediately

The 20/21 Vic Government budget includes $540million to be made available over four years for investment in network solutions in REZs. Any project considered for this funding will have to prove its worth and show value for money for the taxpayer.

The projects considered in the Stage 1 Plan are for immediate progress to deliver short term grid remediation solutions by 2025. These minor projects will cost around $129m-352m.

A further set of stage 1 projects to upgrade some transmission lines will cost between $147m-$343m and may be the subject of the Victorian broader cost benefit test under the NEVA.

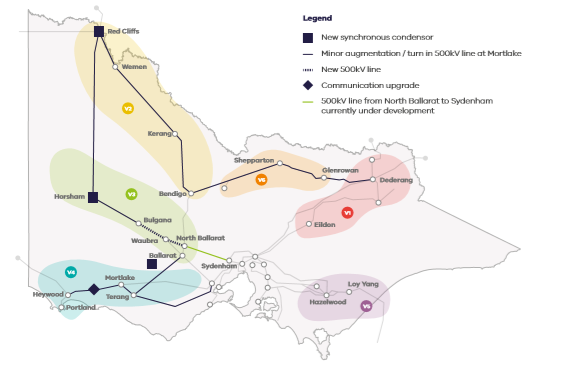

As indicated in Fig 1, the REZ zones depicted cover large areas and much of the backbone of the Victorian transmission system and depict the stage 1 projects. These projects will impact the existing network owned by the Victorian transmission business, AusNet Services.

Fig 1 – Victorian REZ zones overlaid with the immediate network solutions[3]

The Stage 2 projects require further technical analysis, assessment of the costs and benefits and consideration of funding and business models, including how other RIT-T (Regulatory Investment Test Transmission) projects such as VNI West progress. These projects also include consideration of battery energy storage projects which may allow some degree of firming of energy in Victoria. While the directions paper highlights the list of projects is not exhaustive, it’s a pretty long list and is expected to cost between $4b and $9.4 billion with a range of early developments delivered in two to four years while others could take up to seven years.

Similar to the Victorian plan with six renewable energy zones, the NSW legislation declares five REZs with a new Energy Corporation to plan the more than 11GW of renewables. The NSW legislation establishes a Consumer Trustee who, like the VicGrid entity, must develop and update an infrastructure plan every two years. However, the Consumer Trustee also develops a risk management framework approved by a regulator. The NSW legislation enables certain aspects of the NER (National Electricity Rules) to be bypassed like the NEVA. NSW projects are subject to a Transmission Efficiency Test and there are checks and balances afforded by some level of regulatory oversight. The NSW legislation goes a step further with the establishment of a financial trustee and a scheme financial vehicle.

Establishment of VicGrid to actively plan and develop Victoria’s REZs

The Victorian Government intends to establish VicGrid by mid-2021 and is considering the precise form, function, and powers it will have, including its role in the Victorian Transmission Planning framework. The new entity will be responsible for the future development and possibly delivery of these projects. VicGrid will not only consider appropriate funding and delivery models but actively consider cost recovery and ownership of these assets.

Role and powers of VicGrid could include;

- Broadly planning, developing and delivering timely and coordinated transmission, generation and firming projects in REZ areas

- Facilitating delivery of renewable projects in the REZ areas, including funding support

- Leading community engagement and benefit sharing from REZ development

- Supporting state and regional economic development opportunities

- Identifying and applying appropriate procurement, cost recovery and co-funding approaches

This new role also has some similarities to the ESB’s proposed REZ Coordinator to facilitate the coordination of ISP and regulated REZs in the national rules.

AEMO is currently the jurisdictional planner in Victoria but there has been speculation for years that it may be better if this role was transferred to AusNet. The creation of VicGrid certainly complicates this, it could be that VicGrid takes a focus on renewable energy zones only.

An implementation plan will be released later to outline how Victoria will plan, develop and invest in Victorian REZs

By end of May 2021 the priority network projects financed through the REZ fund will be announced.

By July 2021 the government will establish VicGrid to deliver the REZs and will also release the REZ Implementation plan, the framework for funding and investment and ongoing work to update and deliver it. Busy times ahead for investors.

If states invest heavily in REZs, improvements in NEM interconnection may well be displaced. AEMO’s national integrated system plan considers a broad range of scenarios and risks in the transition to develop the least cost approach to take the NEM forward. If states continue to go their own way, it does beg the question the exact role of the ISP and why consumers are ultimately paying about $15million per year for the privilege of a well-considered, robust national plan.

[1] https://www.energy.vic.gov.au/__data/assets/pdf_file/0016/512422/DELWP-REZ-Development-Plan-Directions-paper.pdf

[2] https://www.energynetworks.com.au/news/energy-insider/2020-energy-insider/transmission-troubles-will-vicxit-fix-it/

[3] https://www.energy.vic.gov.au/__data/assets/pdf_file/0016/512422/DELWP-REZ-Development-Plan-Directions-paper.pdf, pg. 11