Building Australia’s hydrogen industry

By Dennis R Van Puyvelde – dvanpuyvelde@energynetworks.com.au

A new plan by the Australian Government outlines options for hydrogen infrastructure development between now and 2050 to meet the emerging hydrogen economy opportunities to serve the domestic and export sectors. It’s a welcome and necessary move to identify Infrastructure needs to support an essential element to deliver net zero. Now we need a renewable gas target to help us deliver. We shed some light on the National Hydrogen Infrastructure Assessment.

It is important to understand and plan the infrastructure required to ensure Australia can successfully develop a globally competitive hydrogen industry. The National Hydrogen Infrastructure Assessment (i) (NHIA) – released in April 2023 – provides a plan of hydrogen infrastructure investment for the next 20 years.

Strategic and timely investment in Australia’s supply chain infrastructure will underpin the rapid scale up of a competitive hydrogen industry required over the next decade to secure our position as a major global hydrogen player (NHIA, pg 1)

It’s a good plan, as we detail below. But we also need a mechanism via policies like a renewable gas target to help incentivise the investment needed to deliver our infrastructure needs. Reaching our net zero targets depends on it.

Hydrogen demand scenarios

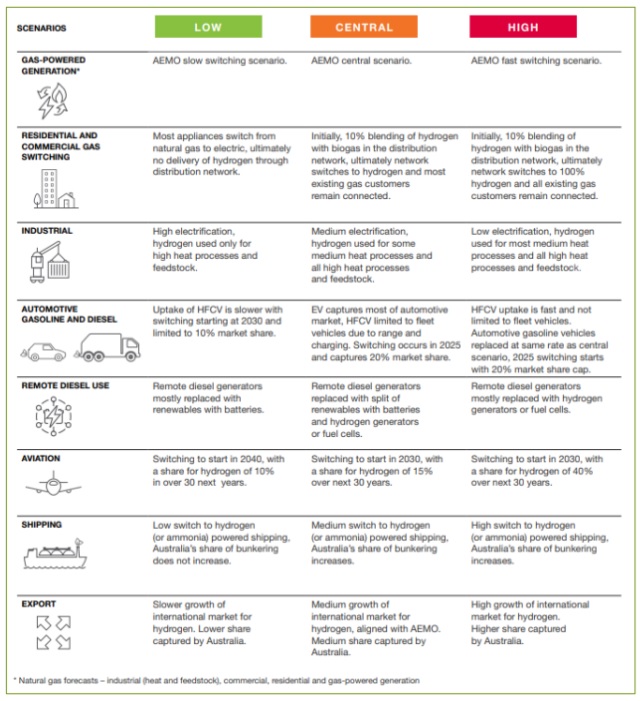

The infrastructure assessment is based on lowest cost hydrogen supply chains covering hydrogen demand scenarios for the next 30 years. Low, central and high demand scenarios cover three components:

- Switching from existing gas, oil or coal use to hydrogen;

- New domestic hydrogen uses; and

- Hydrogen export.

Environmental and social considerations are also included in determining the supply chains.

Figure 1: Assumptions summary of hydrogen demand scenarios (Source: NHIA, Figure 2.3.2)

The hydrogen demand in the model is based on the hubs initially identified in the 2019 National Hydrogen Strategy, which includes both domestic nodes and potential new export nodes. It is interesting to note that the modelling includes both Melbourne and Canberra as domestic nodes that can be supplied with hydrogen using national infrastructure. At the same time, those local governments are limiting access to renewable gas options by only considering local production of renewable gas (ii) or transitioning away from gas overall (iii).

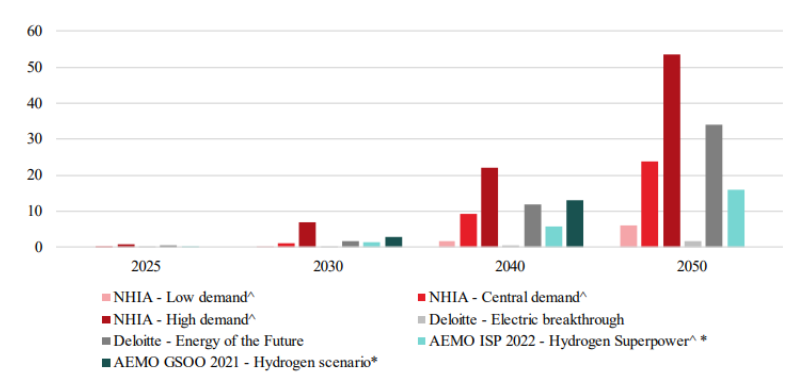

The results show a wide range in hydrogen demand, starting from a low base of 69 kt in 2025 but reaching a potential of 6 to 54 million tonnes of hydrogen (720 to 6,480 PJ) (iv).

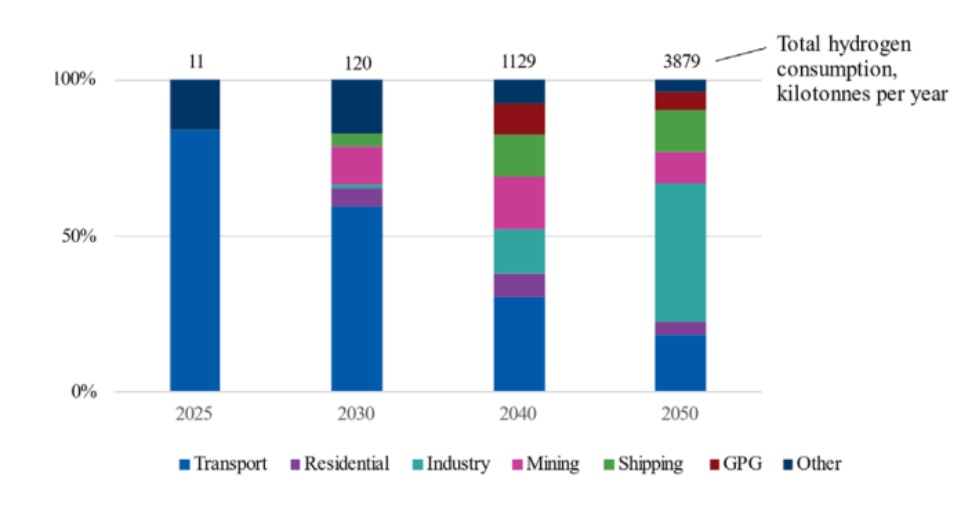

Figure 2: Hydrogen consumption of modelled scenarios (Source NHIA, Figure 2.3.3).

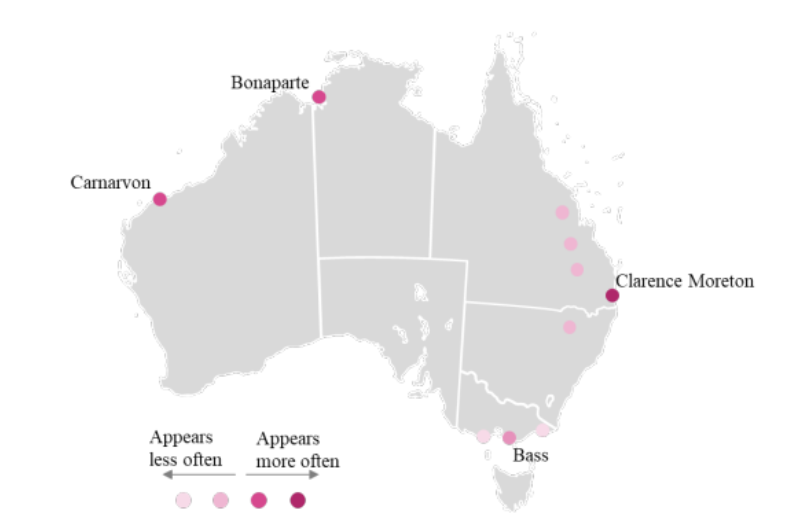

Hydrogen is assumed to be produced with low emissions, via either renewable electricity or via converting natural gas to hydrogen with carbon capture and storage. The model determines the lowest cost of hydrogen supply. The locations for blue hydrogen are limited to regions with strong geological storage opportunities. This seems particularly favoured for areas in Queensland and the Northern Territory.

Figure 3: Preferred blue hydrogen locations (Source: NHIA, Figure 3.4.4).

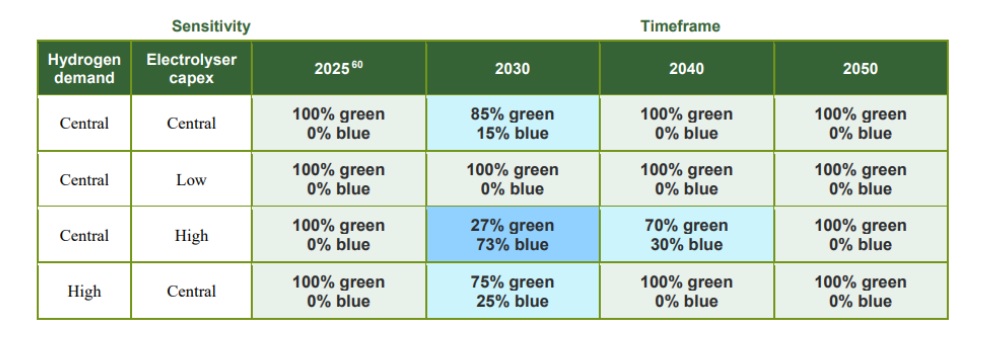

There is an overall trend that sees green hydrogen playing a larger role in the production of hydrogen with blue hydrogen only appearing to have a role in the medium term. The modelling shows that all the hydrogen produced in 2025 will be green hydrogen, possibly due to its ability to produce smaller volumes of hydrogen, and once again by 2040 and 2050 as a reflection of ongoing cost reductions of green hydrogen.

Figure 4: Modelled hydrogen production pathway by different scenarios (Source: NHIA, Table 3.2).

Whole of systems infrastructure requirements

Priority infrastructure requirements are identified nationally and more specifically for each state. These requirements are based on the:

- Hydrogen demand by locations,

- Hydrogen production technology costs,

- Potential storage opportunities, and

- Transport pathways.

The priorities below are whole of country priorities. The hydrogen industry cuts across electricity, gas and transport, as well as exports, where a whole of energy system approach is needed. Some of these requirements require planning of Renewable Energy Zones, which is also a major feature of AEMO’s Integrated System Plan, or infrastructure corridors for transmission lines and pipelines, which also draw on existing gas pipeline corridors.

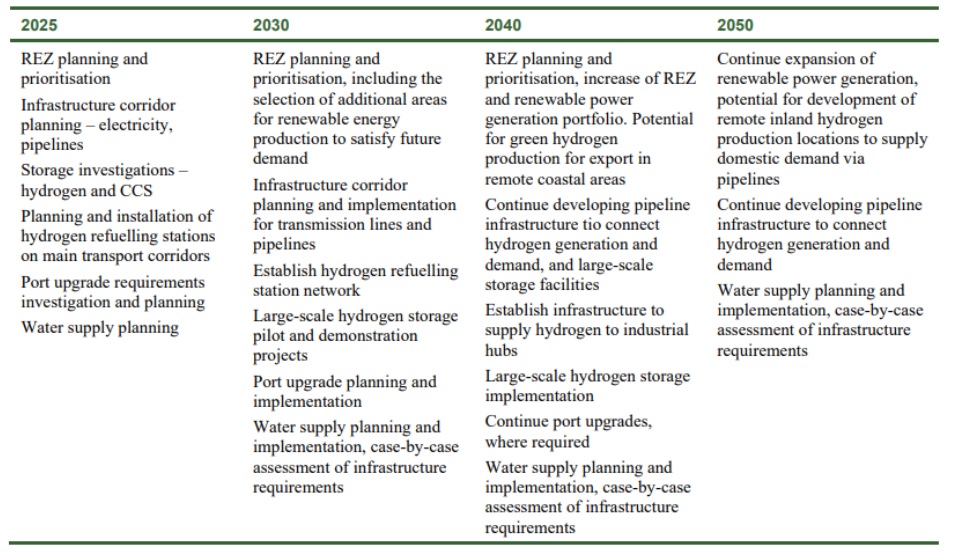

Figure 5: Australia wide hydrogen infrastructure requirements (Source: NHIA, Pg 6 ).

The development of infrastructure is graphically represented in the plan, and illustrated below for Western Australia. The demand for hydrogen in WA grows as follows:

- In 2025, most of the hydrogen demand in the state will be directed towards the transport sector,

- By 2030, transport will still be the dominant sector but hydrogen will also be adopted in mining and in gas distribution networks.

- By 2050, half of all the hydrogen demand will be used by industry.

Figure 6: Hydrogen consumption in WA by end sector (Source: NHIA, Figure 4.6.2).

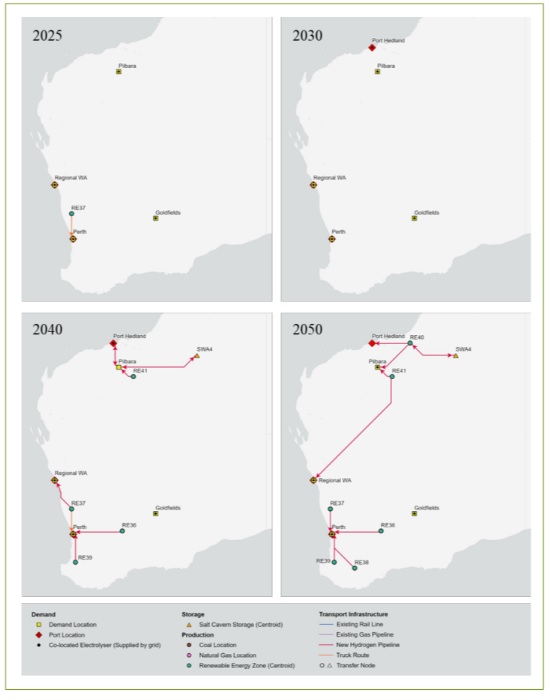

Infrastructure planning illustrates how the hydrogen infrastructure will need to evolve over time. In 2025, for example, there is only a small role for hydrogen expected for transport in Perth and this will mainly be supplied by a trucking route. Moving towards 2040, the Pilbara develops as a demand source for hydrogen and sees new pipelines being built to salt storage caverns. Thousands of kilometres of hydrogen pipelines are needed by 2050 to meet the growing demand in the state. Some of these transport options could repurpose existing infrastructure.

Figure 7: Hydrogen infrastructure plan for Western Australia (Source: NHIA, Figure 4.6.1).

Developing the business case

The NHIA is an excellent report that outlines the infrastructure requirements for the emerging hydrogen industry. While the plan makes demand projections of hydrogen, it does not provide any greater certainty of making this demand a commercial reality.

There are many demonstration projects and initiatives underway to develop the hydrogen economy but market development of hydrogen remains a key gap that requires supportive policies, in the form of a renewable gas target or contract for difference.

ENDNOTES

(i) https://www.dcceew.gov.au/energy/publications/national-hydrogen-infrastructure-assessment

(ii) E.g. Both the Victorian and ACT Governments have only considered locally sourced renewable gases within their modelling work, and explicitly excluded the role of pipelines to bring in gas from distant places, as happens at the moment, especially in the ACT which produces no natural gas of its own.

(iii) The ACT has adopted a strategic direction to electrify the services provided by the natural gas network.

(iv) Using a hydrogen conversion factor of 120 MJ/ kg