Maintaining a strong heartbeat in the transitioning power system

In June, Transgrid released its System Security Roadmap, which outlines the challenges of moving the electricity system to net zero and managing energy reliability, security of supply and power system operability. Managing the grid as aged generators retire and are replaced by intermittent and geographically diverse renewable generators will not be without its trials. The power system that will soon see periods of up to 100% instantaneous renewables is a more complex grid. Read on to find out more about Transgrid’s Roadmap and the three critical pillars of the electricity system transformation.

Over the next decade, around 7GW or 80 per cent of NSW’s coal generation capacity will retire from the power system. If anything, coal retirements are accelerating as they age and have reduced profitability. By 2050, NSW will need to have built 50GW of large-scale renewable generation to replace exiting coal.

The new renewable generation will be geographically dispersed and therefore needs new or upgraded transmission infrastructure to connect to the power system. The ageing coal generators also provide system security services that help the grid remain stable and able to ride through disturbances such as peak times or lulls in renewable generation. These security services must be replaced to enable more renewable generation on the system and lower wholesale energy prices. As the power systems move to net zero, the system will need to operate at 100 per cent instantaneous renewable generation, which is already increasing power system security.

These three pillars as indicated below form the basis of Transgrid’s System Security Roadmap.

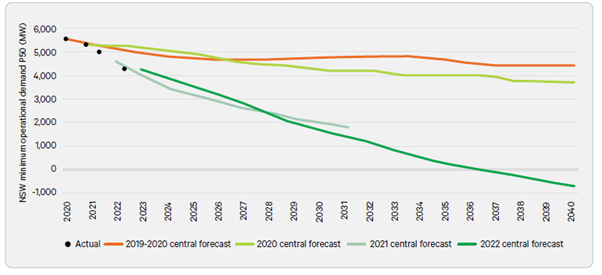

Over the next decade, rooftop solar is expected to grow, reaching 13GW installed capacity in NSW. The minimum demand in the middle of the day is expected to reduce over the next 15 years, with rooftop solar meeting all the state’s electricity needs for short periods in the middle of the day, as seenin Fig 1 below. This creates huge swings in the power system that need to be managed on both the low voltage network and the high voltage networks.

Fig 1 Forecast minimum operational demand in NSW continues to reduce[1]

Pillar 1 – maintaining reliability

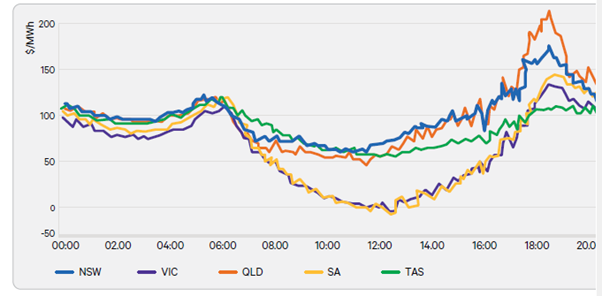

As more renewable generators are connected onto the NSW energy grid, there is more congestion within NSW and on the interconnectors to other states. Some congestion is good: however, it also means the lower cost renewable energy is not able to be dispatched without more transmission or unlocking other non-thermal system constraints.

Fig 2 below indicates the price separation that is appearing across the states between those with higher levels of renewables compared to other states.

Fig 2 Average NEM prices by state in Q1 2023[2]

A comprehensive plan has been developed to strengthen the backbone transmission system, as indicated in Fig 3. Delivering this new energy superhighway allows more renewable energy to be connected and more firm dispatchable energy (e.g. from Snowy 2.0) to cater for times when the sun isn’t shining, and the wind isn’t blowing.

Fig 3 Key NSW Transmission infrastructure development projects[3]

AEMO noted in the 2022 ISP that every $1 spent on transmission delivers $2 of benefits for consumers. These projects are estimated to cost around $14b and must be supported by a mixture of debt and equity. To support this investment without government support, investors will need certainty that these significant projects will be financeable before they commit financially and reputationally to the projects.

Australian networks are procuring in constrained global supply chains as other countries also seek to move to net zero. Transgrid has been exploring ways to mitigate risk in this market, including through negotiations with international suppliers for transformers and reactors.

It isn’t just about traditional transmission infrastructure, though. Transgrid are also looking at battery energy storage to meet demand and reactive power support devices, special protection schemes etc.

Pillar 2 – Managing system security with reducing synchronous generation

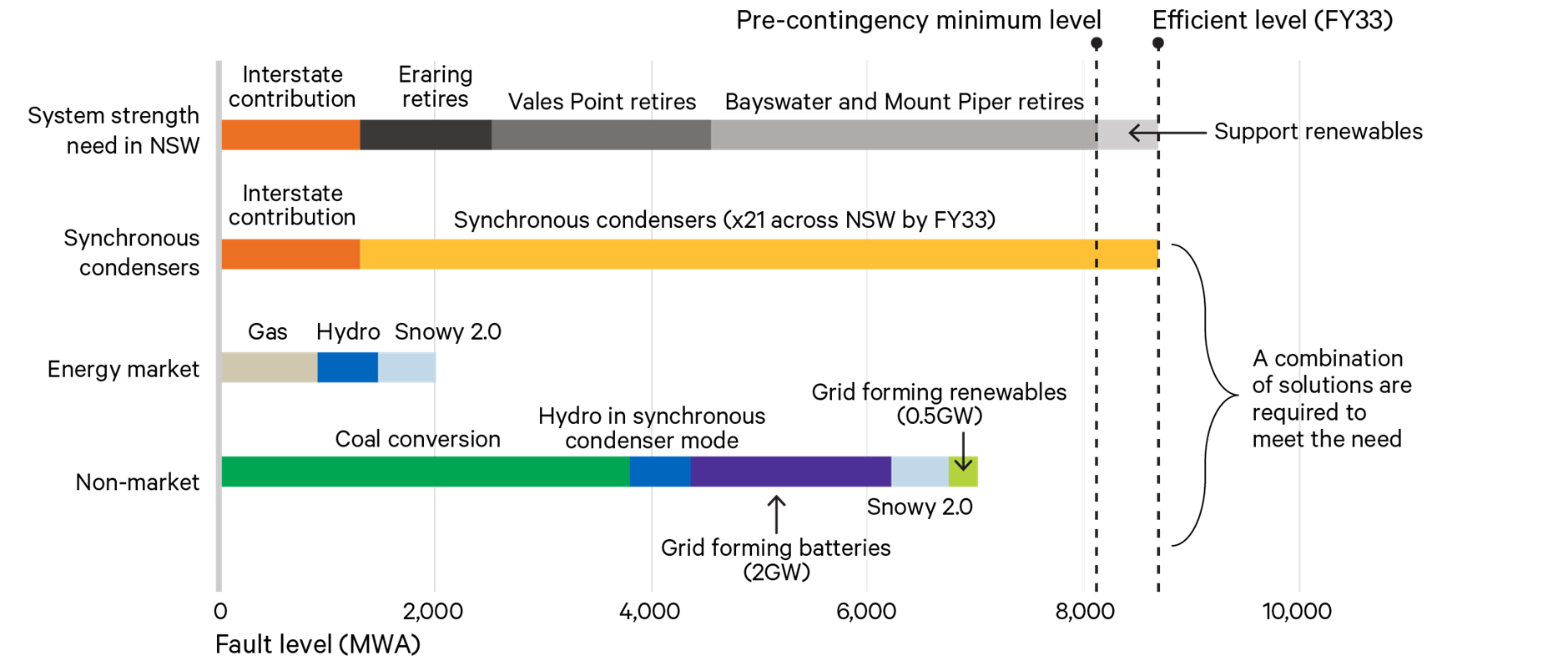

Coal and gas generation provide system strength and inertia and help the power system to ride through disturbances such as extreme weather events. Hydro generators also provide system strength and may have the capability to operate in synchronous mode. To maintain a stable power system, seven coal-generating units (or equivalent) need to be online in NSW. As these synchronous generators operate less and retire, the essential system services need to be replaced by other means.

From 2 December 2025, the national electricity rules place obligations on ‘System Strength Service Providers’ like Transgrid to ensure system strength at efficient levels keeps the power system safe and secure, and unlock more renewable generation capacity. Transgrid is currently considering all options for system strength provision including from existing synchronous generators, generators that can operate or convert to operate in synchronous mode, synchronous condensers and other solutions such as batteries with grid forming inverters, as shown in Figure 4.

Transgrid expect to need to the equivalent of 21 synchronous condensers over the next 10 years. The regulatory investment processes will assess all the options available and the best mix of solutions for the lowest cost.

Fig 4 Possible solutions available to meet minimum post-contingency fault level requirements at the Newcastle system strength node as coal generators retire.[4]

South Australia is already pushing these boundaries. Detailed analysis has been undertaken on the ability to reduce the number of gas-fired generators to operate the power system securely – 4 generators has been reduced to 2 and more recently 1. AEMO is not yet confident to operate a state with no synchronous generators operating but the option will continue to be reviewed.

In assessing solutions, synchronous condensers can also provide voltage stability and for minimal additional cost, inertia services. AEMC is currently considering the approach for future provision of inertia but also how to operate the electricity market reasonably co-optimised with these other essential services.

Pillar 3 – Planning and operating a far more complex grid

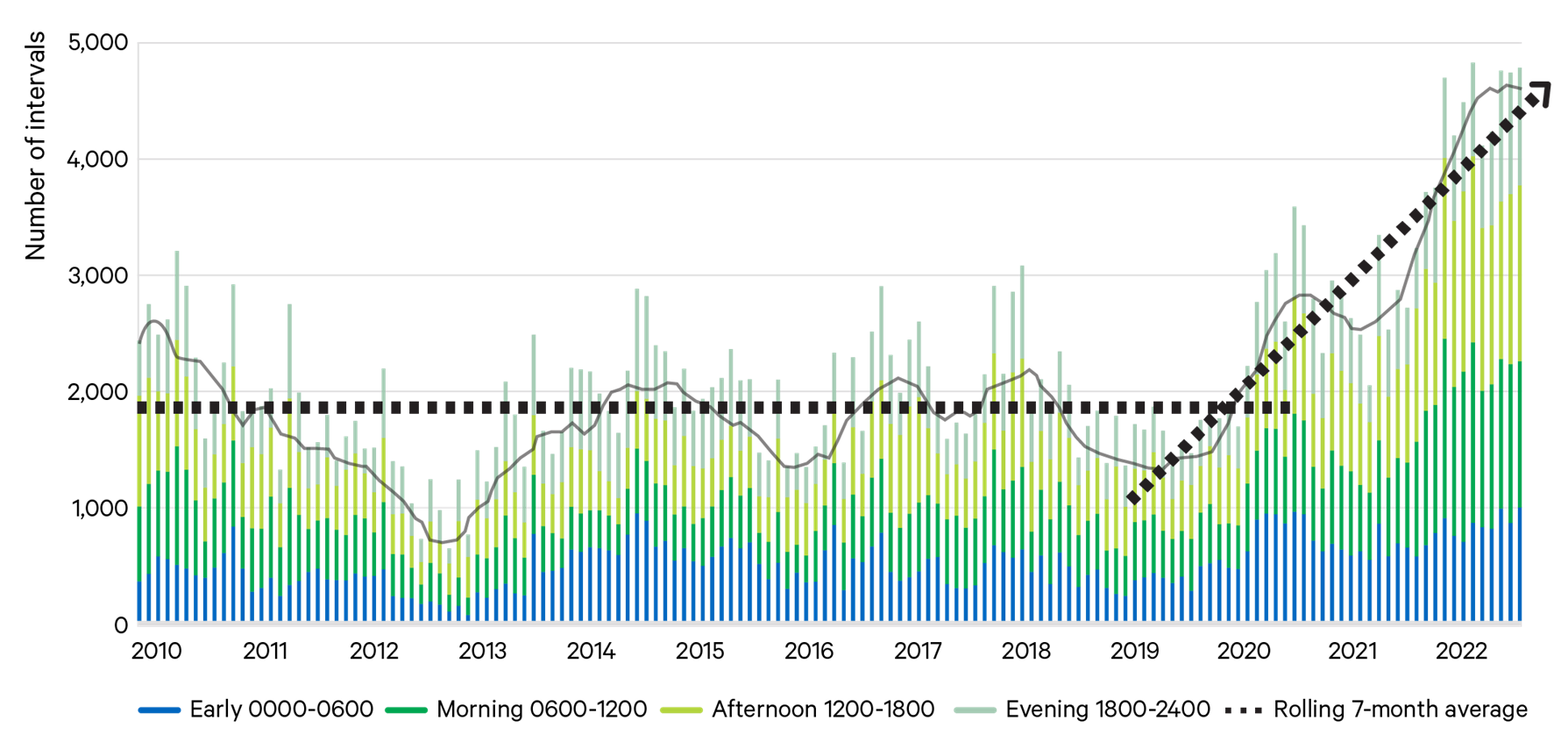

As noted earlier in this article, the largest, uncontrolled generation could come from the distribution network during the day; with cloud cover, this could be significantly reduced and, at night won’t be generating. The same happens with grid-scale solar generation and wind; it is intermittent. The system will be more dynamic and closer to the edge of the secure operating envelope. This adds to the complexity for the network control room and planners both at Transgrid and at AEMO. It is not a future problem but a trend that can already be seen since 2020.

Fig 5 Operating intervals (5-minute granularity) per month when at least one credible contingency on the NSW transmission system would have resulted in a violation of the power system technical envelope, with a simplified trend overlayed[5]

There is a need to uplift resourcing and skills, plus the tools to better plan this more dynamic and unpredictable grid.

The increased levels of smaller, dispersed renewable generators mean more connections need to be managed, more monitoring and alarming equipment as well as significantly more generator control rooms and new staff. This all needs to be managed to operate a secure power system year-round and maintain the system securely while allowing network outages for maintenance and to bring on new transmission.

It will also need increased modelling and analysis to support the short-term and longer-term system planning.

It will no doubt be a bumpy road ahead; it is becoming increasingly complex to put these jigsaw pieces together and manage an evolving dynamic and unpredictable system in real-time. Electricity is an essential service; transmission is an important enabler of the transition and we have to keep the essential heart beating.

[1] Transgrid System Security Roadmap Fig 7, page 4

[2] Ibid, Fig 14, page 11, sourced from AEMO, 2023, Quarterly Energy Dynamics

[3] Ibid, Fig 15, page 13

[4] Ibid, Fig 23, page 23

[5] Ibid, Fig 28, page 29