Changing the rate of return ‘road rules’ at peak hour

As focus intensifies on energy prices, attention naturally falls on the rate of return allowed to gas and electricity network businesses. The Australian Energy Regulator has the challenging task of driving the next rate of return guideline within existing rules with one eye to what the future rules may look like. Are we in for a smooth ride, or are there hazards ahead?

Changing the rate of return ‘road rules’

When Sweden decided to change which side of the road 1.5 million cars could drive on, it closed its roads for five hours and made the official switch from the early morning on 3 September 1967. Despite intense community-wide preparations, 157 minor accidents still ensued.

Figure 1. Kungsgatan, Stockholm – the day Sweden switched sides of the road, 1967.

This year, Australian energy regulation is facing a task arguably as complex, but with potentially longer-term impact.

Governments are set to decide a new framework for Australia’s energy regulators to make decisions on the allowed return gas and electricity network businesses can earn on their pole, wire and pipeline investments. All this is happening while the Australian Energy Regulator (AER) proceeds to make this very same decision – which could be equated with deciding new road rules at peak hour.

The rate of return and the AER’s review of the existing rate of return guideline is arguably one of the most significant long-term decisions made in regulatory framework. It has the single largest impact on revenue and therefore prices paid by customers. It is the ultimate trade-off between the short-term interests of consumers – lower prices – and their long-term interest – reliable and sustainable energy supplies.

Over the guideline’s expected four-year term, it will govern the allowed level of return on capital reflected in every network charge. Directly and indirectly, it will affect network revenues of more than $20 billion and potentially apply to network determinations until 2027 – nine years into the future.

Role of appropriate guidance in customer outcomes

The potential new shape of the rate of return framework is set out in exposure legislation released by the COAG Energy Council in March. Energy network businesses have welcomed the development of a binding guideline framework, but raised significant concerns about aspects of the proposed approach. The proposal is to remove almost all substantive guidance from the framework that supports existing decisions. From a network sector perspective, the proposed changes would introduce a level of discretion that is detrimental to regulatory certainty, stability, accountability and ultimately the long-term interests of customers by increasing financiers’ view of the sector’s risk.

While it is proposed to retain the existing high-level requirement for a regulator to consider the broad law objectives and principles on rate of return issues, this won’t be sufficient to stop a perception of higher risk. The guidance these provisions give is indefinite and potentially capable of supporting a wide range of future ‘road rules’, including major departures from approaches contemplated under the existing rules.

Such avoidable uncertainty will ultimately increase financing costs and potentially impact on network investments underpinning customer outcomes over the long-term. For this reason, networks and investor stakeholders are signalling to COAG Energy Council that more work is needed on the proposed legislative approach and networks have proposed an alternative, more balanced, principles-based approach.

Meanwhile…on the road to a new guideline

Amid this debate on the role of guidance, the Australian Energy Regulator has had the challenging task of applying the current rules to develop its next rate of return guideline, with one eye to what the future rules might look like.

The 2018 guideline is the third guideline review process that the AER has delivered, and has been used to trial a range of new consultative steps and collaborative approaches. The regulator has so far convened two expert round-table sessions, working on establishing areas of commonality and difference between rate of return experts nominated by the regulator and stakeholders. Following the expected release of a draft guideline in late June, an independent review panel will be asked to consider and test the guideline’s approach.

A further innovation has been a structured dialogue process between Energy Network Australia and representatives of the AER Consumer Reference Group, building understanding between perspectives and reaching shared positions on decision transparency and how some technical aspects of the AER’s current approach to implementing the cost of equity could evolve. This has enabled network business representatives to hear first-hand perspectives from consumer groups, a process supplemented by a range of networks engaging with their own customers on their expectations and priorities for the review.

Network businesses understand energy prices are a concern to customers This has driven networks to support a guideline that is capable of acceptance to all and which delivers outcomes that are in the long-term interests of customers. This includes ensuring that network businesses are able to achieve a reasonable, predictable and sustainable return on investment.

Reviewing the journey so far…

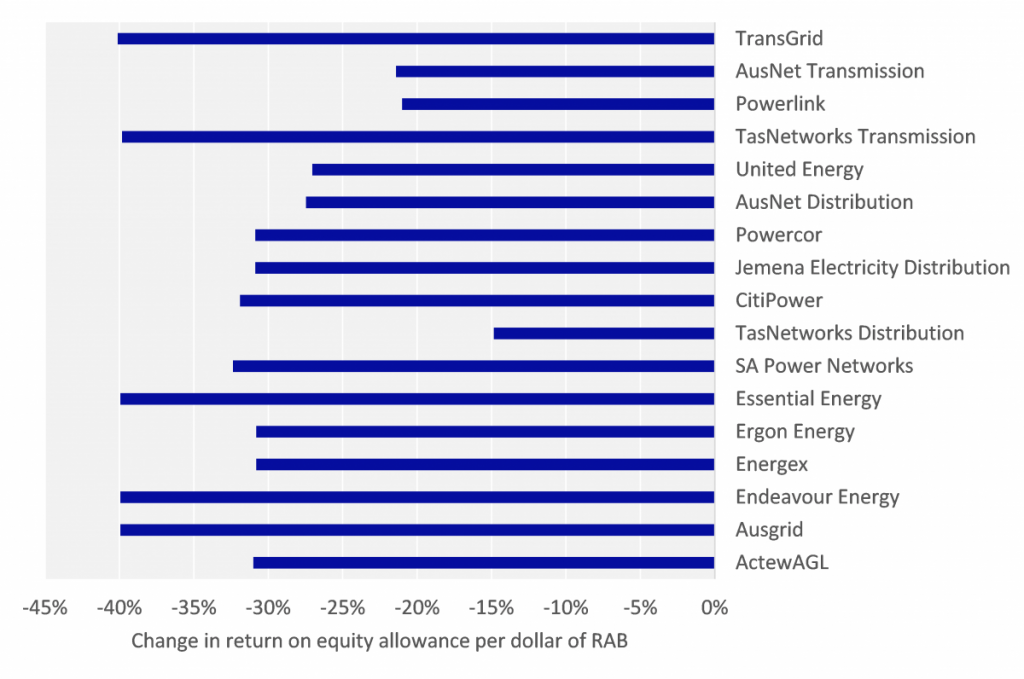

The guideline process is occurring in the context of significant reductions made in the 2013 guideline, which had the effect of lowering allowed returns. As an example, allowed returns on equity have fallen by an average of more than 30 per cent relative to each dollar of past investment and current overall allowed rates of return are at their lowest levels since 2006.

Figure 2 – Change in return on equity allowance per dollar of RAB in decisions made since 2013.

These falls have been a contributor to downward movements in network charges over the past five years.

As we go about our everyday life, agreed road rules are likely the most important common societal understanding for personal and community safety.

In trying to reach a balanced and appropriate set of future guidance on rate of return decisions, at the same time as reviewing the current guideline, the Australian energy community is also embarking on a critical shared project, with long-term consequences for customers, energy-intensive businesses and future investment.

As in Sweden, we should look both ways, step cautiously and opt for carefully planned change wherever justified, mindful of all risks and wary of unintended consequences.

Please follow these links for Energy Networks Australia’s responses to the COAG Energy Council on the proposed rate of return binding guideline legislation and the AER’s recent Discussion Papers. Further information on Energy Networks Australia’s stakeholder engagement in the rate of return guideline review can be accessed here.