Energy goes digital: smart investments to save money

As the Australian Energy Regulator (AER) undertakes a review into how it assesses network expenditure on information and communication technologies (ICT), it is timely to consider what benefits these investments provide for customers.

The AER’s review is about ensuring ‘energy consumers pay no more than necessary for the safe and reliable distribution of electricity’. This is an objective the network sector shares.

One crucial way this is and will continue to be achieved is through investment in digital technologies.

As growing amounts of solar and storage are integrated with the electricity network, ICT projects will increasingly underpin and enable critical grid access, reliability and service outcomes for customers.

Technology enables businesses to improve operational efficiency and asset utilisation which lowers costs for customers – for example through automation or demand response solutions. These can include allowing networks access to household solar and storage devices, for example, to harness stored energy at times of peak demand. Such innovation can avoid the more expensive alternative of upgrading the network (which results in higher network costs and higher bills for customers).

ICT investment also ensures safety, reliability and compliance obligations – such as cyber security requirements and maintaining voltage constraints and system strength – can continue to be met.

In Victoria, where smart meters are ubiquitous, networks have access to timely data that provides valuable visibility of voltage fluctuations to individual premises. This enables interventions to be made to fix faults before they result in damage to appliances, cause local power outages or safety issues for customers.

Better network monitoring also enables visibility of network operations, so outages can be detected in real time with greater accuracy and crews dispatched as quickly as possible – reducing the amount of time customers are without power.

Importantly, ICT investment satisfies customer expectations about the type of services distribution companies should facilitate in the modern age. These services include ensuring customers can get maximum benefit from their distributed energy resource (DER) investments – for example by enabling peer-to-peer trading, offering network support services and ensuring solar PV systems can export to the grid.

Some other innovative, cost-saving uses for ICT that networks are trialling include using drones to inspect pole tops rather than walking the line and looking from the ground and also to carry wires across rivers or flood areas where access is otherwise impossible.

Putting ICT expenditure in context

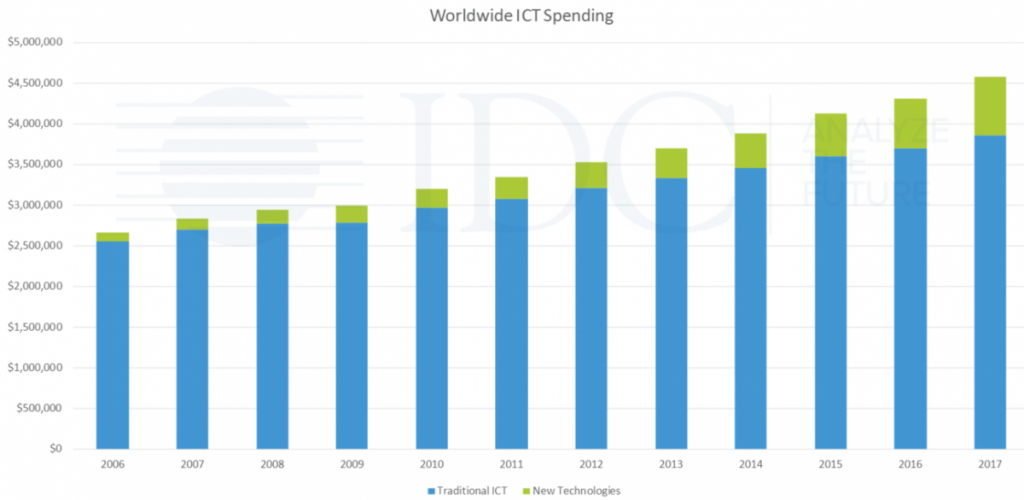

The AER reports network spending on ICT grew by between 27-28 per cent in real terms or 52 per cent in nominal terms between 2009 and 2017.

This historical expenditure is consistent with the global trend.

The International Data Centre (IDC) reports that in 2009, worldwide ICT expenditure was $3 trillion. By 2017, it was just under $4.6 trillion, an increase of around 53 per cent in nominal terms.

Figure 1: Network ICT expenditure increases are in line with global growth in in ICT spending[1]

Note:

|

Like the rest of the world, networks are embracing new technologies and becoming more digitised. Just as residential homes now have more devices and subscribe to more monthly internet-based service offerings than in 2009, so to do businesses.

Investment has expanded in portable hardware (iPads, laptops and mobile phones), software is moving from outright purchasing to a subscription-based business model and cloud-based platforms are slowly becoming the norm.

This transition to improve efficiency may increase some costs in the short-term as applications are migrated one at a time. This means that the new platform is initially under-utilised while costs are being incurred for those applications that have yet to be migrated. Over time, however, the new platforms can deliver better services for customers at lower cost.

Networks recognise that many software vendors will soon cease to offer on-site solutions and support, making migration to the cloud necessary.

The figure above also highlights that new technologies (like real-time analytics, machine learning, control systems and automation etc.) represent a growing proportion of ICT spend.

ICT expenditure forecasts

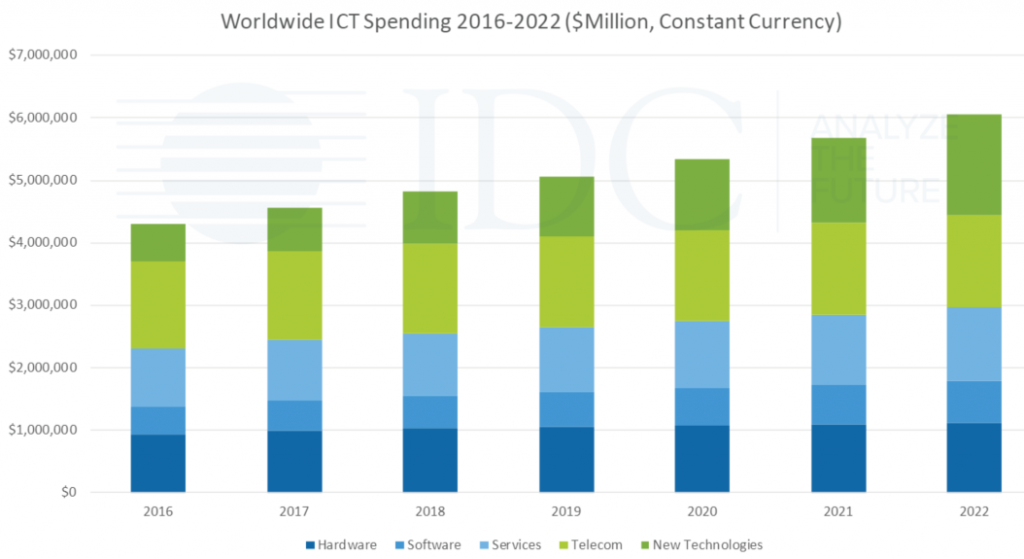

Unlike traditional ICT spend, which is forecast to broadly track GDP growth over the next decade, the IDC expects the growth in ICT spend related to new technologies to continue (see figure below).

Figure 2: Spend on new ICT technologies is forecast to grow significantly[2]

The IDC expects traditional tech spending to remain a stable share of overall business and consumer spending with:

- Software being the major contributor to improved productivity and the driver of most of the economic benefit of ICT spending

- Cost savings generated by cloud and automation being diverted towards new technologies such as AI, robotics and augmented reality/virtual reality

- Next-gen security related to new technologies also continuing to drive significant growth

- The integration of new digital strategies with existing operations and metrics (the digital transformation) also driving significant expenditure.[3]

ICT is key to improving networks utilisation and facilitating the transformation to accommodate growing DER and other new technologies. This new ICT expenditure will bring efficiencies that will lower customer bills, ensure licence and compliance obligations can be met and ensure the network remains valuable to customers.

Digitalisation of energy – smart investment to save money

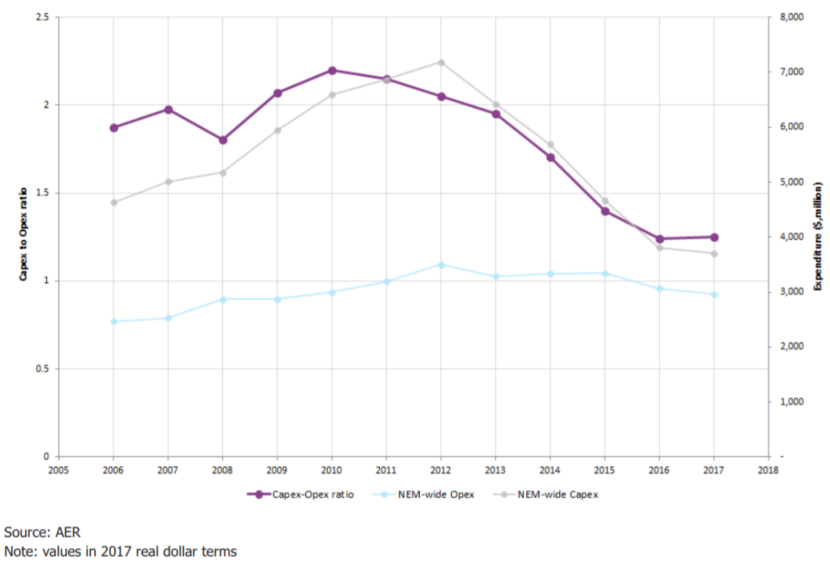

While network ICT expenditure has grown, there has been a significant decline in total network expenditure since 2011-12. This has been driven by a reduction in network augmentation and replacement infrastructure.

So, while networks may have invested more in ICT – $150 million since 2009 – it is worth noting that this is more than offset by a decrease in total expenditure over that

Figure 3: Combined distribution networks operating expenditure and capital expenditure and associated ratio[4]

John Pierce, Chair of the Australian Energy Market Commission, highlighted reform to support the digitalisation of energy as one of the AEMC’s top five priorities last week in his speech to Australian Energy Week[5].

The AEMC’s objective is to help customers take advantage of emerging technologies to support enabling them to better manage their energy use. “These smart technologies mean households and businesses can take advantage of things like demand response and that means the power system can avoid the cost of more resources to service peaks in electricity demand for only a few hours of the year,” Mr Pierce said.

This focus on the value of ICT is welcome and necessary, as is an understanding that efficient investment in this area will save money. Restricting expenditure on new technologies and innovation will only lead to higher prices in the long term.

Energy Networks Australia’s response to the AER Consultation Paper on ICT Expenditure Assessment is available here.

[1] Global ICT Spending 2007-17 ($3.8T in 2017), International Data Centre https://www.idc.com/promo/global-ict-spending/overview

[2] ICT Spending Forecast, 2018-22 forecast, International Data Centre https://www.idc.com/promo/global-ict-spending/forecast

[3] ibid

[4] Economic Regulatory Framework Review, Promoting Efficient Investment in the Grid of the Future, Australian Energy Market Commission, July 2018, Figure 3.12, p. 50