ESB’s crystal ball: the Post 2025 Energy Market

Grand designs are seldom easy to execute, and energy market designs are no different. There can be no more challenging task than designing potential new models for the National Electricity Market during significant technology change and a transition already well underway. Against this backdrop, the Energy Security Board (ESB) recently released the next chapter in its ongoing review of Post-2025 Market Design.

Just like many building projects, timeline risks and unexpected interventions of good and bad fortune challenge the most carefully laid plans. The ESB review is due to provide advice to the Energy Council on a ‘next generation’ of market design, to take effect from the middle of the next decade.

Scope of the market design review

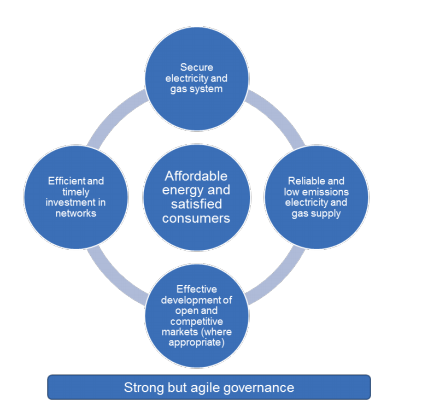

Market design, in this context, is intended to cover a far-reaching set of energy policy issues – from how security of supply is maintained, to how the energy market operates to deliver services to customers day to day.

To help focus its efforts, the Energy Security Board has identified five key challenges facing the Australian energy system

- Driving innovation to benefit the consumer;

- Investment signals to ensure reliability;

- Distributed energy resource integration into the electricity market;

- System security services and resilience; and

- Integration of variable renewable energy into the power system.

As the review defines its own shape, it has developed assessment criteria or potential market designs and reforms. These start with traditional concepts of efficiency and consumer benefit, but also extend to more than a dozen possibly over-lapping considerations. These include that any redesigns be robust to future government policy interventions, which can at times be difficult to predict, let alone model.

Figure 1. Strategic Energy Plan Outcomes, ESB Post 2025 Market Design Issues Paper

Designing a house for changing needs

And there lies the challenge for the review. Governments are unlikely to stand still while the review proceeds, even in the absence of alternately negative and spiking prices that have been a recent feature of wholesale markets.

The review is prudently taking a spread of market scenarios into account, based on those set out in the Australian Energy Market Operators’ recent Integrated System Plan. The project sees the review developing two market designs for testing by the end of this year.

From early 2020 these two models will be detailed and tested, leading to recommendations and then possible energy legislation and rule changes through 2021.

Given the breadth of issues under review, there is the potential for some of these options for market designs to look fundamentally different to the National Electricity Market as it operates today. Potential key issues could be whether ‘energy-only’ wholesale markets, supplemented by current policy initiatives, will be enough to bring forward required new investment in firming generation or alternatives.

Investability – the foundations of a good plan

This raises what will be a central issue for a broad market design review to contend with.

How do we ensure the overall investability of the framework for the major capital requirements likely to be required to upgrade, modernise and optimise operation of the grid for customers?

This is an issue that stretches from generation, to the networks that connect generation and distribute the power, right to the everyday customer considering investing in solar, batteries and an electric vehicle.

The Australian Energy Market Operator estimates potential medium-term investment and upgrade needs in transmission will run into the billions. It will therefore be critical that these investments, which will deliver services for decades, have a stable and efficient investment recovery framework.

This priority is reinforced by the review’s early scope discussions. In these there was a focus on including market design options with more a centralised planning approach than the default ‘apply competition and ask questions later’ approach we have had. Management of these issues over the medium term is all complicated by the fact that governance of the market itself is out of scope.

From blueprints to breaking ground

As the review heads towards its alternative market designs, a critical success factor will be its capacity to bring energy consumers and market participants along the reform journey. Australia’s changing energy market has not lacked for blueprints. Rather, a growing set of previous reviews have been partially implemented, largely ignored or quietly super-ceded by new processes.

The test for the post 2025 review will be a challenging one – will we eventually move beyond the design phase to the build, with all parties in agreement on the outcome desired?

You can read more about the Energy Security Board’s post 2025 review here.