Mind the Gap: Navigating a customer focused transition

Transforming the energy system to net-zero emissions requires a build out of critical infrastructure and many billions of dollars of capital. These costs all flow through to customers in one way or another. It is important to consider how the costs of the transition will likely manifest for customers in the prices and bills they pay throughout the transition, while also factoring in the long-term value customers receive from these investments and the enormous costs of inaction. This can help governments and market bodies develop and implement policies that are clear eyed in how they impact customers today and into the future.

Energy Networks Australia has worked with consultants Dynamic Analysis to take a closer look at some of the factors that might influence customer prices over the long term. You can find the report here.

First, a word of caution – no modelling can predict the future. The mechanics of a model are always a crude simplification of the real world, further limited by imperfect assumptions and inputs. A few important notes on this model:

- For wholesale market modelling we used the publicly available outputs from Endgame Economics. Importantly, the numbers we used were produced after the invasion of Ukraine by Russia and subsequent gas shortages, but before the gas price cap was introduced.

- For distribution network costs, ENA created a post-tax revenue model (PTRM) using existing and proposed revenue settings and then made some informed assumptions on expenditure and key regulatory settings out to 2050.

- For transmission assets we created a PTRM and escalated it using the Integrated System Plan (ISP) step change scenario and state government plans as the guide.

- Some assumptions were made for retail and other costs. For example, it is assumed traditional retail costs would reduce slightly (with greater economies of scale) and new services, such as aggregation and the provision of system security services, would develop over time.

The ISP step change scenario heavily informed the inputs and assumptions for this modelling. This modelling will therefore not predict the future in many of the same ways that the ISP model does not predict the future.

Headline results

One thing that modelling is good at is highlighting trends or relationships between things. A few such insights jump out of this analysis:

- Customer prices and bills will go up (which we are experiencing now) before they come down

- Electric vehicles (EVs) will significantly reduce customer bills, most dramatically for EV owners, but also for non-EV owners

- Poorly managed EVs or consumer energy resources (CER) would result in fewer savings for customers over the long-term.

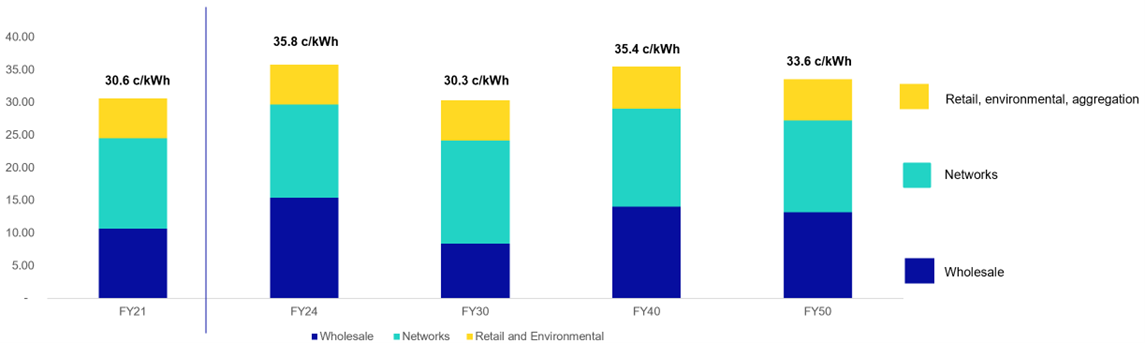

Customer prices will go down in the long-term

The report indicates that customer prices and bills will go up before they come down. The 2023 mid-year price increases are largely due to the delayed financial fallout from high gas prices. We caution against relying on the prices shown here for 2024 because these are driven largely by wholesale market modelling conducted before the gas price cap was introduced.

Prices in the medium term should normalise before rising towards 2040 due to:

- Increased wholesale costs to firm renewable energy supply as coal exits

- Increased network costs due to input costs rising with inflation and also due to increased replacement and augmentation investment to keep the lights on and to transform networks to facilitate the energy system transition to net-zero emissions.

Over the longer-term prices begin to come down again due to reduced network prices.

Figure 1 – Electricity prices – c/kWh for typical Australian household (real $2023)

The wholesale component appears to be the most volatile over time, reflecting that this is a competitive market where prices are set at the margins. It is also the component most likely to be different in terms of real world outcomes because, as we have experienced in recent years, unforeseen events can quickly impact wholesale market outcomes. The network component is more stable, yet clear trends are observable over time.

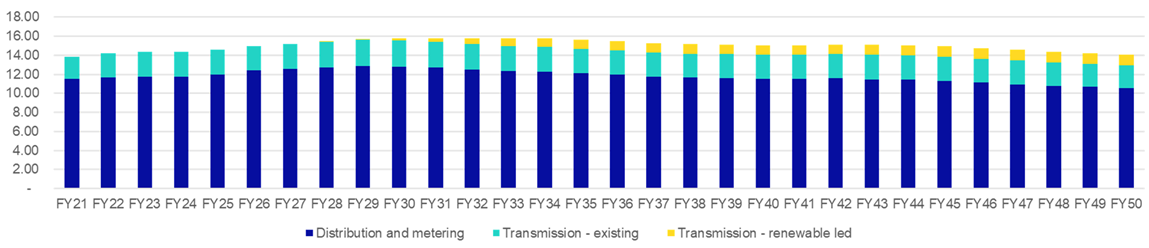

Figure 2 – Network component of electricity prices – c/kWh for typical Australian household (real $2023)

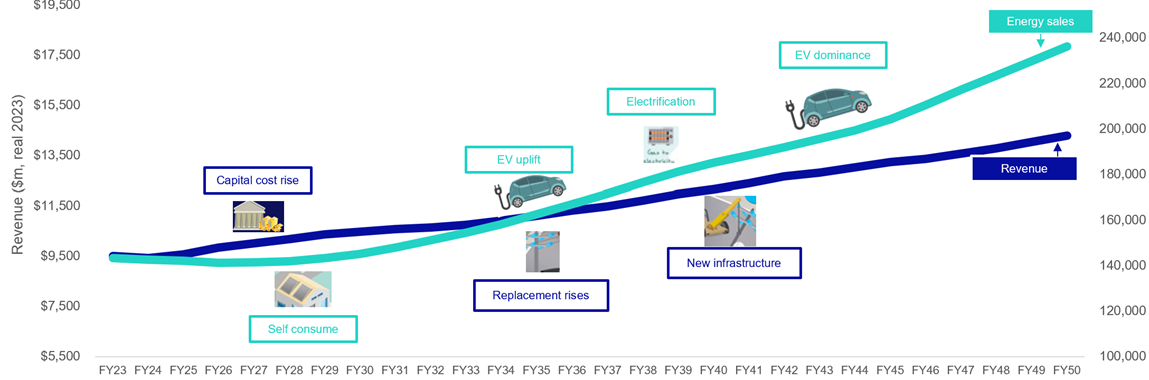

The dynamics at play for network prices are important to delve into. A key relationship is between revenue, consumption and price. Networks are largely made up of fixed costs. When these costs (networks’ revenues) are spread across lower levels of consumption, prices will be higher. When consumption increases relative to costs, network prices go down.

Our modelling outcomes show that in the short to medium term network revenues rise steadily due to the factors noted above, but at the same time energy consumption from the grid is suppressed as customers continue to install rooftop solar PV. Network prices accordingly increase. Over time, the electrification of transportation, and to a lesser degree of gas appliances,[1] drives a significant increase in electricity consumption, reducing network prices.

Figure 3 illustrates this dynamic. When the dark blue line is higher than the turquoise line, network prices are rising. When it is lower, network prices are falling.

Figure 3 – Total revenue ($m, real 2023) and energy consumption (GWh)

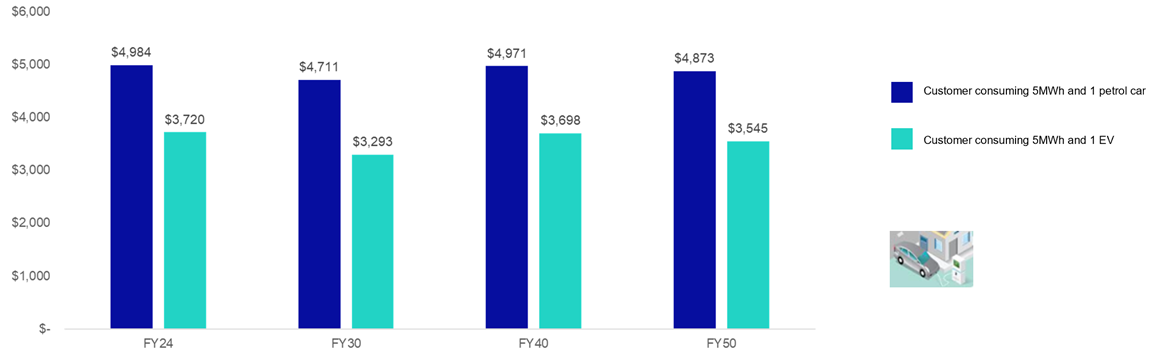

EVs will reduce customer energy bills

EVs will significantly reduce customers’ energy bills. The most significant savings will be on total energy bills (electricity and transport) for EV owners. When a customer driving around 13,000km a year gets an EV, they will, by 2050, save more than $1000 a year (about $100 per 1000 km).

The dynamics noted above, where higher energy volumes reduce network prices, will also mean that customers without EVs will start to see savings. These savings are closer to $100 per year.

The impact of EVs on bill savings could be even greater than is shown in this analysis. We included the very conservative assumption that new EV load would have the same profile as existing load. If EV charging can be better integrated, by soaking up solar and adding less to peak demand, the savings to customers will be higher.

Figure 4 – Annual transport and electricity costs for an Australian household consuming 5MW – petrol vs EV car ($, real 2023)

Poorly integrated EVs or CER will cost us more

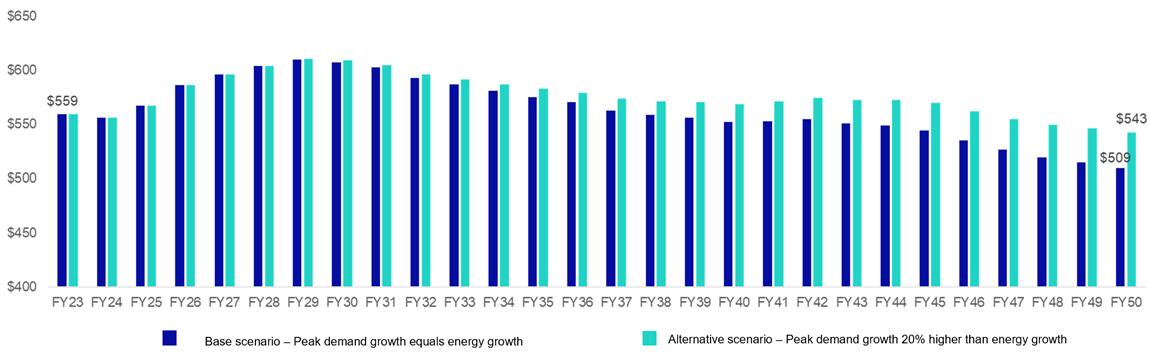

Another key relationship influencing long-term network prices is between peak demand, which generally drives fixed asset costs, and consumption. Where new consumption is poorly coordinated it adds more to network costs and limits the effect described above of increased consumption reducing prices.

Poorly integrated EVs or consumer energy resources (CER) would therefore result in smaller savings for customers over the long term. Our modelling finds that the network component of a customer’s bill (for a customer without an EV) will be around $35 higher in 2050 if EV charging is poorly coordinated.

Figure 5 – Network bill for customer consuming 5MW (base and alternative scenario) – weighted by customer size

This sensitivity analysis tested a scenario with higher peak demand growth caused by EVs than the assumed base case. A similar pattern would emerge for poorly controlled CER or poorly integrated load growth from the electrification of domestic gas use. It highlights the importance of prioritising the electrification of flexible load such as EVs that can ‘fill in the gaps’ and improve network utilisation without driving significant additional network cost.

Similar implications are also likely in wholesale market costs – which we did not investigate in this sensitivity analysis – where flexible new load can help soak up excess solar. Conversely, inflexible new load could drive higher wholesale market costs due to the increased need for firming at times of peak demand or during periods with low renewable resource availability.

Final thoughts

A clear understanding of the prices and costs that customers face throughout the energy transition should inform how we best target policy settings and government interventions. It could help, for example, to inform the best timing and approach to reducing customer costs through allocations made under the Rewiring the Nation fund.

An important additional context is the role of investment in facilitating the societal transition to net-zero emissions. In the energy system, investment is needed now to ensure the reliability and security of the system as it evolves and transforms. The costs of delay are well recognised. It is critical to ensure that value for customers is at the forefront of decisions, policy and otherwise, through the transition. It is also critical to ensure that we continue to meet the needs of customers today, while safeguarding future generations’ interests.

[1] The level of domestic gas use assumed to electrify is consistent with the ISP step change scenario assumptions, and we note there is a high degree of uncertainty on any forecasts or assumptions for the electrification (and timing of electrification) of gas use.